Dynamic Planner, the UK’s leading digital financial planning and advice platform, has boosted its data analytics offering with two Data Engineer appointments.

Saranya Vadrevu and Rohan Nandi have joined Dynamic Planner’s Data and Analytics Team led by Business Intelligence Manager, Abhishek Vethanayagam. Together they will drive data-led decision making and provide advanced analytics solutions across strategic initiatives. Saranya will lead the development of data services for advice firms, and Rohan will lead the development of data services for asset managers.

Abhishek Vethanayagam, Business Intelligence Manager at Dynamic Planner said: “With a wealth of experience in data engineering, machine learning, and prescriptive analytics, Saranya and Rohan will enable Dynamic Planner to harness the power of data to support strategic decision-making, optimise processes and drive business growth through the development of data services for the industry.

“This year will see us supporting advice firms and asset managers with key Business Intelligence and Management Information, as well as beginning to explore how AI can be incorporated to drive innovation. Rohan and Saranya will play a key role in this and I look forward to moving our plans forward with them.”

Dynamic Planner, the UK’s leading risk based financial planning system has opened registrations for its 12th annual Conference on 5th March at 22 Bishopsgate in the City of London.

This year’s ‘Scaling Success’ themed event, will see hundreds of financial planning professionals attend to hear how they can scale advice businesses through leading, end-to-end technology; scale client data through innovative, integrated systems of record; and scale loyal client bases with good outcomes running through their core.

CEO Ben Goss will provide his annual keynote which will reveal exclusive announcements and the latest news from Dynamic Planner. Delegates will also take away unique and valuable insights from exclusive speakers, as well as from the UK’s leading Chief Investment Officers, analysing today’s outlook for global markets and investment portfolios on the 2024 CIO panel.

Yasmina Siadatan, Chief Revenue Officer at Dynamic Planner said: “Join us at our not-to-be-missed 12th annual Conference for 2024, once again in the heart of City. Come and experience the power of the financial planning community and explore how together we can scale success for your clients, for you and for your business.

“Anyone who has attended in the past knows that our annual Conference always promises to be a fantastic occasion. We look forward to welcoming clients and prospective clients to our Scaling Success themed event on Tuesday 5th March.”

Delegates can register here. Anyone unable to travel to the event can join as a virtual conference delegate, live streaming keynotes and all Main Stage sessions in broadcast-quality. Dynamic Planner’s 2024 Conference agenda can be found here.

Dynamic Planner, the UK’s leading digital financial planning and advice platform, has launched a pioneering approach to single strategy fund mapping.

Available from today, Dynamic Planner’s Single Strategy Mapped Service is designed to assist the advice industry in making the most accurately informed decisions when it comes to single strategy fund selection. The Single Strategy Mapped Service takes single strategy fund selection to the next level, giving advice firms the ability to create diversified portfolios with far greater accuracy, and clearer, more representative risk look-through to ensure suitability.

Through the precise mapping of instrument-level holdings data against Dynamic Planner’s risk factors and Asset Risk Model, Single Strategy Mapped Service provides greater accuracy and efficiency in the use of single strategy funds, and for the first time, with the same rigour as multi asset solutions.

Dynamic Planner achieves this by sourcing single strategy fund holding data directly from fund providers, rather than via third parties at broad asset allocation level, which enables a level of granularity not previously possible. In addition, with the increasing responsibility assigned to fund managers and how their funds are used through regulation such as Consumer Duty and PROD, Dynamic Planner is also able to support the different asset management models that are emerging as a result.

Chris Jones, Chief Proposition Officer at Dynamic Planner said: “As financial markets have evolved and become more complex, we have ensured that we accurately analyse the underlying holdings of the solutions that we risk profile and map them to our risk factors within our trusted Asset Risk Model. Dynamic Planner users who also build advised portfolios have asked for the same level of granularity and we are pleased to be able to support them with the Single Strategy Mapped Service.

“The new service will provide them with a level of granularity not previously possible, greater efficiency and accuracy, and all within one system with a consistent level of risk throughout. However you organise your business and decide to meet the needs of your clients Dynamic Planner can support you.

“From a PROD and Consumer Duty perspective the Single Strategy Mapped Service also enables the fund manager to more simply and clearly communicate whether a fund is intended to be distributed as a solution or part of a portfolio.

“Recent geopolitical events have raised the awareness and importance of things such as duration, cap size and location within a traditional asset class not only amongst our users but also their clients. We hear that being able to view and discuss this using Dynamic Planner has been very helpful with solutions and we are pleased to support single strategy funds in the same way.”

Key Benefits of Single Strategy Mapped Service

- Holdings are mapped precisely against Dynamic Planner’s 72 asset classes.

- Advisers can select from a larger universe of funds with increased confidence.

- Advisers can create diversified portfolios from single strategy funds with greater accuracy and clearer, more representative risk look-through.

- Instrument-level holdings data within Dynamic Planner, all within one system with a consistent level of risk.

The Single Strategy Mapped Service is part of the research journey in Dynamic Planner which continuously evolves to support the needs of users and now includes:

- Target Market Tool including advisers cost and service

- Platform and Product Target Market Statements and Value Statements

- Full SIPPS included

- Enhanced Risk Reports

- Underlying holdings for appropriate Multi-Asset Funds

- Research Reports

- Research reports including ESG for MPS

- DFM MPS Performance

Not a Dynamic Planner user? Schedule a free no-obligation demo with a business consultant and experience the full functionality of Dynamic Planner.

A new low code integration platform now enables your firm to integrate Dynamic Planner with other systems you use to manage your client relationships. Compared to Open API, low code integration provides an even simpler way to integrate technology, managing much of the complexity of mapping your client data.

What does it do?

Initially, Dynamic Planner’s low code integration enables you to create or update client [and their partner’s] details in Dynamic Planner. For example, if you have a CRM system which isn’t integrated to Dynamic Planner, we hope this provides a straightforward way of sending client details to Dynamic Planner, without having to invest too much time building an integration.

Specifically, the integration will check and allow you to match the incoming client details to your clients which already exist in Dynamic Planner, minimising duplication and ensuring Dynamic Planner remains a clean and reliable system of record for your firm. After first creating or matching a client, subsequent information received about that client will be treated as an update, without needing to match again.

What’s the difference between low code and Open API?

Dynamic Planner’s low code integration is built on top of its Open API, extending it to enable users and firms to build integrations with the system faster.

The Open API provides a lower level of control and access to a wider range of data items in Dynamic Planner. However, to create an integration, the system on the other side of the integration has more to do, other than sending data over. The shape of the data in the other system will likely be different to what is required in Dynamic Planner, so mapping will be required.

How does it work?

We’ve deliberately designed Dynamic Planner’s low code integration to have a simple interface. To create or update a client [and if appropriate, their partner] using it, you are presented with a simple set of options:

- Login to Dynamic Planner [if you don’t already have an active session]

- Confirm your organisation [helpful if you work across advisers / teams)

- If it’s the first time Dynamic Planner has seen this client ID, you’ll see potential client matches

- If the client is new, you see the data you’re set to add to Dynamic Planner

- If the client exists, you see how updated data will update details already in Dynamic Planner

- Once import is complete, you’ll be directed to Dynamic Planner and the respective client’s dashboard, where you can continue working

How do we imagine this being used?

Dynamic Planner already has deep integrations with intelliflo office, Iress Xplan and Time4Advice CURO. But there are lots of CRMs out there. Dynamic Planner’s low code integration offers a simple way for firms who use them to begin integrating with Dynamic Planner – without having to invest so much time and effort. As always with integrations, the possibilities are endless. We’re excited to see how Dynamic Planner’s user community adopts and adapts this ability.

Need deeper integration?

We’ve intentionally kept the low code integration simple, to make the ingestion of client data quicker and simpler. If you want to import arrangements, and incomes and expenditures, Dynamic Planner’s Open API is a more traditional RESTful API which makes more data available. However, you will have to write more code to manage the more sophisticated processes.

What’s next?

Over time, at Dynamic Planner, we plan to expand the low code integration to enable more data to be pushed into Dynamic Planner, and allow different planning processes to be launched automatically.

If you would like to make use of Dynamic Planner’s low code integration, reach out to the team and email us at Integrations@DynamicPlanner.com . We will be happy to support you and provide more details.

It is that time of the year when we, as market watchers, pull out our crystal balls. Just as we dust ourselves off from the past year, we look to the one ahead, either with anticipation or trepidation.

Taking a moment to look back, it has been an extraordinary year – from the tremendous gains from a handful of stocks to a synchronous increase in interest rates from Central Banks to whiplash from the bond markets. Given that towards the beginning of the year recession was the only alternative, most investors have been surprised by the resilience of developed market economies, despite persistent inflation, but buoyed by better-than-expected unemployment numbers and wage growth.

Although the cost-of-living crisis continued apace, consumers, so far, have been surprisingly resilient in the face of sustained pressure on household finances from inflation and high interest rates. This has flowed through the developed market economies, especially in the US, leading to stellar growth, with the Eurozone and UK lagging behind. Though we near the end of the year with thoughts of a well-engineered ‘soft landing’ by central banks, the situation remains far from clear – with numerous alternatives to be considered.

From a macro-economic perspective, we now enter a period of change. Since 1980 till last year, we have been in a world where interest rates have declined. More so, since the Financial Crisis of 2008, we have been through a period of low economic volatility, low inflation and low rates but high realised returns. There now appears to be a change in the wind.

We are at levels of interest rates last seen before the financial crisis, but even more challenging has been the speed with which Central Banks have ratcheted up rates. Naturally, this has caused volatility in markets – but what has been unnatural has been the fact that while volatility in equity markets has dropped, fixed income volatility has remained elevated as can be seen in Figure 1. This has wreaked havoc with low-risk portfolios which have been, traditionally, heavy in fixed income. If there is one certainty that we can speak about, it is that volatility will be our constant companion for the coming year. Were it to be constant, volatility in and as of itself would not pose a problem – it is expected that the volatility of volatility will be high, creating peaks and troughs in volatility levels.

Although inflation has declined over the recent past, the effect of the change in monetary policy is yet to be fully understood. Milton Friedman said monetary policy acts with ‘long and variable lags’. The economic resilience of the past year can partially be attributed to savings of households from the different pandemic related stimuli, as well as widening government deficits. As the level of savings decline, faced with the real reduction in disposable income (Figure 2) from the cost-of-living issues, one can expect a deterioration in consumer demand, resulting in lower growth.

This can already be seen feeding into consumer and business confidence, which are considered lead indicators of economic activity. High interest rates also affect corporates. Taking advantage of the low interest rates, most corporates increased the amount and maturity of their borrowings. This can be observed from credit spreads, which have not followed their usual widening pattern, following interest rate increases. As a result, the corporate default environment has been very benign. However, when time comes for refinancing, these companies may be faced with an increased cost of capital, which may materially alter the corporate bond market. It has only been about three quarters where the high base rates have had an opportunity to reset and have impacted company cash flows. This has resulted in a reduction of free cash flows for numerous business which have borrowings which are not aligned to maturity structure of their assets, be it tangible or non-tangible. The need for refinancing capital may make some capital structures put in place inappropriate and unreliable.

One may look back at equity markets globally and would be hard pressed to complain. However, one takeaway has been that diversification did not pay – Figure 3 shows a wide disparity between Growth and Value stocks. An equally weighted holding in the ‘Magnificent Seven’ stocks doubled in value over the recent year, while the S&P 500 gained circa 20%. This has resulted in the weight of these stocks in the S&P Index to be around 29%.

In relative terms, while growth assets did very well, defensive assets like bonds lagged. While this is not abnormal in late cycle dynamics, the egregiousness of outperformance is. This is not expected to continue going forward as cyclical pains appear to have been delayed and not eliminated outright – a typical scenario where the can has been kicked firmly down the road. While valuations in Large Cap equities appear to be stretched, the same cannot be said for Mid or Small Cap stocks. These stocks are typically more influenced by local economies rather than the more global Large Cap stocks and as a result, seem to have factored in the recession probabilities to a larger extent. As a result, one could possibly expect a rotation into stocks lower down the capitalisation ladder – which may expose portfolios to greater drawdown risks as liquidity gradually dwindles in these markets, as fiscal tightening takes hold.

China, which has recently been the driver of global economic growth, has been impacted by structural issues stemming from the real estate sector. The sector has been a driver of growth in China, with it accounting for almost half the local government revenues. The recent well documented wobbles in the sector exposed the reliance of China’s financial and government sectors on real estate and its associated infrastructure development. The administration has ruled out blanket bailouts in favour of ‘remodelling’ the debt-stricken sector to further extend support to the ‘stronger’ developers whose bankruptcies could trigger wider financial contagion by encouraging bank lending, bond issuance and equity financing. The overall aim is to reduce the reliance on this sector, while maintaining a sizeable presence.

One must remember that China is a developing economy in transition from a primarily export and manufacturing oriented one to a consumer driven one. This transition is not easy given the trade restrictions in place from developed economies and the simmering tensions between itself and the developed world, primarily led by the US. If the transition is well managed and the market stabilizes, the economy will continue to grow and fuel global growth, but the path may be painful for all involved.

To cap it all, geopolitical risk is back on the horizon. While the Ukrainian war rumbles on, the Middle East is embroiled in further violence. While Europe has more or less weaned itself off Russian gas, uncertainty in the biggest oil producing region could risk creating stickier inflation through higher oil prices and potentially weighing on global asset prices. This would have a greater impact on Europe rather than US, given the latter has a larger domestic production base. Upcoming elections in the US, UK and India also creates an overhang of possibilities of global tension and uncertainty, already exacerbated in a polarised world.

To conclude, two words would define the outlook for the coming year – ‘cautious’ and ‘selective’. To give a twist to the old adage, if we manage to take care of the risks, the returns will take care of themselves. A successful navigation of the upcoming year will depend on how cautious we are in our approach and how selective we are of the risks we include within our allocations. It is clearly a case of keeping dry powder, which will be instrumental in taking advantage of material opportunities which will definitely arise once the markets readjust to the new regime.

Hear more from Abhi Chatterjee, on the Chief Investment Officer Panel, at March’s Dynamic Planner Conference.

In what has been a challenging year from both an economic and regulatory perspective, resilient advice firms are embracing change and looking to the future, reveals new research from Dynamic Planner, the UK’s leading risk based financial planning system.

Published today, Dynamic Planner’s third annual Spotlight Report ‘Resilient and Embracing Opportunity: The financial advice landscape in 2023’, has found that while regulation was cited by 1 in 4 as being the no 1. headache for 2023, firms have shown their mettle, with 9 out of 10 confident they have met the key outcomes of Consumer Duty despite the significant challenges it presented.

Technology has been a key enabler, with 85% of the group, drawn from one of the largest advice communities in the UK – the 6,950 users of Dynamic Planner – saying it has improved their ability to serve clients, and close to three-quarters believing it is also helping them to meet regulatory requirements.

Yasmina Siadatan, Chief Revenue Officer at Dynamic Planner said: “The financial advice industry has embraced technology and its ability to help firms meet regulatory requirements, whilst unlocking productivity gains and deepening client relationships. Advisers were faced with a significant test this year in the form of Consumer Duty – but despite the challenges, the mood is one of resilience and looking to the future.”

Overall, the picture that emerges from this year’s survey is of a thriving industry. Firms continue to increase adviser numbers, and the vast majority of advice professionals are serving more clients than they were three years ago. However, 2023 undeniably brought challenges in the form of a more difficult economic environment and a major regulatory deadline. As a result, the picture is more nuanced than it was in 2022.

Key findings for 2023 include:

- Advisers are happy in their roles and would overwhelmingly recommend careers in the industry to others, 9 out of 10 under 30’s would recommend financial advice as a career.

- 70% of advisers are servicing more clients than they were three years ago.

- 41% are using apps or tools to conduct risk profiling.

- Almost two thirds of respondents from larger firms expect to actively grow their business over the next five years. They are the most likely to have expanded over the past three years and are the most bullish about the future.

- Smaller firms are the most likely to have reduced adviser numbers, and close to a third of those in single-adviser firms are looking to retire or sell up. As a result, the consolidation trend in the industry looks set to continue apace.

- By age some differences emerge. Those in their mid-careers, who have the benefit of experience but also years ahead to ride out the challenges, are particularly likely to recommend careers in the advice industry to others. They are embracing the opportunities ahead by adopting new technologies and serving younger clients.

- Advisers aged 55 and over are most likely to have reduced their client load over the past three years, while more than 70% of advisers aged 60 and over expect to retire or sell their businesses in the next five years.

- Advice is in high demand, with 1 in 2 firms seeing an increase in new client enquiries over the past three years.

- However, firms continue to identify significant barriers to serving lower-value clients. Time is cited as the biggest obstacle by two thirds (66%) of firms, followed by profitability (64%) and regulation (37%). Around 1 in 10 (11%) feel lack of demand is an issue.

- For those firms requiring a minimum level of investable assets, the most common threshold is £100,000.

Yasmina Siadatan continued: “Overall, despite the economic environment and regulatory shift, the mood is positive, and some of the challenges may be easing as 2023 draws to a close. Although Consumer Duty implementation has not been easy with firms viewing regulation as their biggest headache – they also are confident they have got it right.

“Firms are making significant productivity gains through the use of apps, tools and other new technologies, allowing advisers to service more clients more efficiently. As these efficiencies grow, firms could unlock the ability to service lower-value clients – something they currently identify as too time-consuming for the profits available.”

Download the full Spotlight report.

By Newton Investment Management

Against a backdrop of volatility and macroeconomic uncertainty, investors might be wary about the future. Here, Newton multi-asset chief investment officer Mitesh Sheth and FutureLegacy portfolio manager Lale Akoner outline what they think makes a robust multi-asset portfolio in the current environment.

We have entered a market regime characterised by deglobalisation, decarbonisation and divergence, which requires an active, dynamic and sustainable approach to portfolio management, according to Newton multi-asset chief investment officer Mitesh Sheth and FutureLegacy portfolio manager Lale Akoner.

“We believe this next decade will be unlike anything we have lived through before,” says Sheth. “We cannot just rely on historical models and data, or experience alone to navigate this volatile regime.”

Sheth thinks volatility in markets has led investors to be nervous about saving for the future.

“People want their investments to keep pace with inflation, they want to remain resilient through this market volatility and leave a legacy, not just for their own kids but for all our futures on this planet,” he adds.

He argues in this environment it is important for investment management to draw heavily on multiple research inputs across asset classes. At Newton these include quantitative, fundamental, and sustainability research and even investigative journalism.

On a thematic level, Newton’s research considers the macro themes of big government, China’s influence, financialisation and the great power competition; and micro themes of the internet of things, smart everything, tectonic shifts, picture of health and natural capital.

Sheth says bringing this all together enables the investment process to be ‘joined up, agile and able to spot opportunities others miss – now and in the future’.

Dynamic and active

Other important factors in the current environment, Sheth adds, include being directly invested and actively managed.

“At a time of great divergence, we believe passive strategies may struggle to deliver positive real returns,” he says.

Akoner concurs that as capital becomes limited, talented active managers have a higher chance of outperforming benchmarks. She notes 2022 was the first year since 2009 that most active asset managers of equity mutual funds were able to outperform the S&P 500 index .

“This is because liquidity is getting scarce and the dispersion between stocks and sectors is increasing, leading to a boarder opportunity set for active managers,” she adds.

Tactical overlay

In terms of portfolio construction, Akoner argues tactical asset allocation, using a derivative overlay, is fundamental to navigating the current market volatility.

“We look at things like liquidity indicators, positioning and flow indicators as well as spreads data to see if there is any froth in the market,” she says. “We can use futures, forwards, and physical securities to navigate the environment tactically.”

In terms of long-term positioning, Akoner says the portfolios are overweight in healthcare and utilities while underweight in consumer discretionary and energy. When it comes to fixed income, portfolios are underweight duration relative to the benchmark.

“We think market is incorrect in pricing quick Fed cuts,” she adds. “We think especially the ample amount of Treasury issuance could contribute to the peak rate environment in the short term. When those rates start to come down, we could go neutral and move long equity futures.”

Sustainability

With decarbonisation also being a key facet of the new market regime, Akoner says it is important for an investment process to support the transition to a low carbon economy. This, she adds, means adopting an investment process that incorporates red lines for excluding certain companies. The FutureLegacy team then look for three buckets of investment opportunities:

- Solution providers – companies solving problems on sustainability through products and solutions. For example, heating, ventilation and air conditioning (HVAC) businesses

- Balanced stakeholders – companies with sustainable internal processes. For example, companies best in class for governance or high standards on human capital management

- Transition – companies at the start of their sustainability journey but showing a credible commitment to a transition business model

Akoner notes sustainable strategies in the wider industry have tended to have a growth bias, because they consist to a large degree of technology companies which can have lower carbon emissions. However, she argues quality is the primary factor the team look for which could then result in a stock being either value or growth.

Please feel free to contact us if you would like more information on the FutureLegacy range.

The value of investments can fall. Investors may not get back the amount invested.

For Professional Clients only. This is a financial promotion.

Any views and opinions are those of the investment manager, unless otherwise noted. This is not investment research or a research recommendation for regulatory purposes.

For further information visit the BNY Mellon Investment Management website: http://www.bnymellonim.com.

Dynamic Planner, the UK’s leading digital financial planning and advice platform, has analysed the data* of almost 17,500 advised investors views on the importance of sustainability.

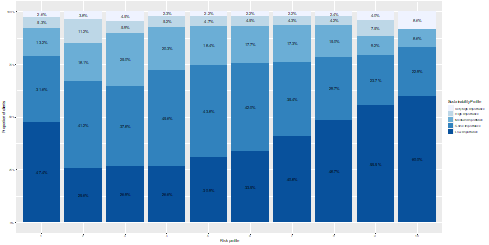

As COP 28 gets underway, Dynamic Planner has found that while investing sustainably remains an important factor, as willingness to take risk increases the importance of sustainability reduces. The analysis showed that of those investors in risk profile 10, Dynamic Planner’s highest risk level, 6 out of 10 viewed sustainability as of low importance **

Chart showing the relationship between an investors risk (1-10) and sustainability (low to very high profiles)

Dynamic Planner also found that a larger proportion of men (39%) than women (26%) view sustainability as something of low importance, while (32%) of women view sustainability as of medium to very high importance compared to men (21%).

The stereotype that younger clients have a greater preference for sustainable investments due to supposedly being more values-driven and having a greater desire to seek investments that align with their views were not borne out in the analysis, with no apparent differences across any of the age groups.

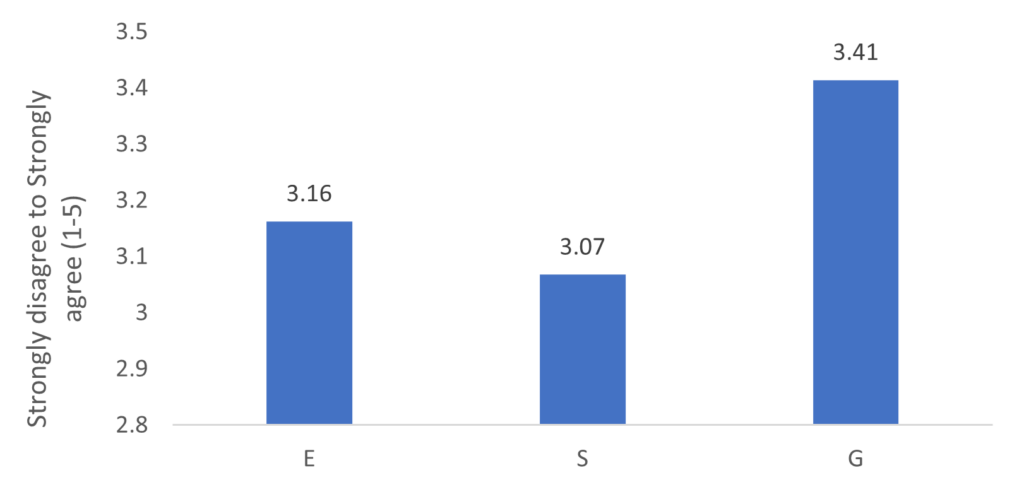

In terms of which aspect of sustainability is held in highest regard, more investors said the ‘G’ of ESG is a priority as it means investments help companies treat all stakeholders fairly. Even a proportion of around 70% of investors who consider sustainability to be of low or some importance, agree with this statement, 17% and 51% respectively. Surprisingly fewer placed as much importance on ‘E’ – that investments help to improve the environment. The ‘S’ – that their investments should help improve people’s living conditions was the lowest priority of the three ESG factors. However, of those who view sustainability as of high and very high importance, a higher percentage strongly agreed that it is priority to help improve the environment, compared to improving living conditions and treating stakeholders fairly.

Chart showing importance placed on ESG statements

Louis Williams, Head of Psychology and Behavioural Insights at Dynamic Planner, said: “Our analysis paints a nuanced picture of attitudes towards investing sustainably and ESG factors. Events like COP28 which bring the world together to focus on issues such as climate action have ensured that many people understand the importance of acting in a sustainable way. However, using the power of their investments to shape the world for the better is perhaps limited for some due to the greater focus on trying to achieve a better return.

“We have found those investors who are more comfortable with increased financial risk are prepared to invest in market opportunities that go beyond the realms of companies that act in a sustainable or ESG risk managed way. This may be because climate change and risks of stranded assets have not yet been properly understood or their appetite for not missing out on certain market sector returns is still the overriding motivation. There also may well be some investors who want their fund managers to engage (by remaining invested) to bring about change.”

* Research has been undertaken using data from Dynamic Planner’s sustainability questionnaire, an industry first when it was launched in 2021 and created by the team behind the UK’s leading risk profiling process. A client’s sustainability preference is profiled on a scale, like their attitude to risk, providing you with a foundation for a conversation and enabling you to match it with solutions with ESG ratings available to research in Dynamic Planner.

Dynamic Planner also offers clients access to independent and whole of market ESG research of more than 32,000 funds. Guard against greenwashing and trust that the research is objective and is rigorously completed by a 200-strong team of analysts at MSCI, a world leader in the field which has been doing it longer than anyone else.

** Risk Profile 10 – Likely to contain very-high-risk investments such as emerging market shares and a small amount in high-risk investments such as shares in UK and overseas developed markets.

By Minerva Fund Management Solutions

For a number of years, financial advisory firms have operated in an environment that is ever changing and bringing increased challenges to their business model. One challenge is managing a range of client portfolios across a range of clients and asset classes.

As a financial advisory firm, it is an expectation that the suite of products offered will be broad, flexible and potentially encompass a range of investment options that meets a varied set of client needs, particularly for firms holding themselves out as independent.

PROD has resulted in financial advisory firms offering their clients solutions based on client lifecycles (the ‘target market’), that can contain a variety of investment solutions including active, passive, blended options, bespoke investment management and the ability to meet a client’s ESG preferences.

Needless to say, Consumer Duty is a piece of FCA regulation that brings another challenge, which requires a financial advisory firm to scrutinise their business and formally document how they meet the four client outcomes, taking into consideration a number of requirements such as client needs and the associated costs aligned to a level of service or tariff that represents fair value.

This has led financial advisory firms to explore opportunities to simplify their processes, and one opportunity that is generating more interest is unitising existing client investment solutions within their Centralised Investment Proposition (CIP).

The rationale for this is due to a variety of reasons, so there is no ‘one size fits all’ approach but to give you an example; under the Consumer Duty, good client outcomes for all clients is one of the core principles, if a financial advisory firm is managing a CIP across multiple platforms and each platform trades with a different modus operandi, then investment outcomes will inevitably be varied across their client base. Firms will need to think through the implications of this under their Consumer Duty procedures.

A unitised fund solution can enable a financial advisory firm and its clients to access the same investment solution and have similar investment outcomes. In addition, there are a number of other factors that could lead a financial advisory firm to consider unitisation as an option for their business. It has the potential to provide:

- Greater transparency in terms of cost, performance, and volatility

- All client portfolios with access to the same investment strategy at the same cost, regardless of their asset value

- More efficient and lower cost portfolio rebalancing

- An additional layer of governance and investment oversight, through the ACD and the fund’s Depositary

- Access to a greater asset universe

- Scalability of client solutions and investment proposition

- Different tax treatment – a fund will be taxed differently from an MPS

In addition to the above, in our view, a unitised fund solution may help a financial advisory firm satisfy two of the four outcomes under Consumer Duty, namely Products and Services and Price and Value. This is because under the Consumer Duty, products that already comply with the Product Governance Rules in PROD and the Collective Investment Scheme Assessment of Value Rules in COLL, can satisfy these two Consumer Duty Outcomes. As a result, the use of FCA regulated unitised funds could achieve these two outcomes.

So, there are a number of fundamentals as to why a financial advisory firm could consider this option to augment their CIP. However, before a financial advisory firm reaches a conclusion that a unitised offering is a good move for their business, there are other factors that need to be considered before they can press the start button.

As a starting point, a financial advisory firm will need to compare a client’s current proposition with the potential unitised investment offering. Prior to undertaking this comparison, there is perhaps a perception that a fund offering may increase the ongoing charges figure (‘OCF’). However, this is not always the case and before making this assumption, it is always worth having an in-depth discussion with potential providers. Of course, one key factor in an overall OCF is fund size, and in our experience, making a unitised solution as part of a CIP viable requires AuM of at least £50m per fund.

Another aspect to consider is client reporting. A client using a Model Portfolio Service for example, can have the added benefit of a client viewing individual holdings in a quarterly valuation and take comfort their portfolio is diversified; compared to a unitised solution with just one or two fund holdings. Having said that, there are technology solutions that are available and will offer a ‘look through’ service.

In essence, there is no overriding rationale as to why a financial advisory firm should, or should not, offer a unitised investment solution to their clients. The most optimal outcome will, of course depend on their business model, client requirements and what is most suitable for their clients.

Find out more. Contact Mark Catmull, Sales and Marketing Director, Minerva Fund Management Solutions.

Dynamic Planner, the UK’s leading risk based financial planning system, is now risk profiling the world’s oldest collective investment fund, F&C Investment Trust. Launched in 1868, F&C Investment Trust Plc is managed by Columbia Threadneedle Investments with Head of Asset Allocation (EMEA), Paul Niven, being the Trust’s Fund Manager. It is a constituent of the FTSE 100 index managing over £5bn in assets1.

Chris Jones, Chief Proposition Officer at Dynamic Planner, said: “We are delighted to welcome F&C Investment Trust to Dynamic Planner. When it comes to investment trusts, F&C is a household name, and having launched in 1868, it is the oldest collective investment.

“In recent years we have seen profound changes, both in the way advice is given and how technology is helping to power advice. If a 157 year old Investment Trust can embrace technology, then so can you. In a client focused world, understanding the client outcome that a solution can deliver is more important than its structure, and appropriately including Investment Trusts enables advisers to maintain a consistency of approach when assessing suitable investment solutions.”

Steve Armitage, Co-Head of UK Wholesale Distribution at Columbia Threadneedle Investments, added: “We are delighted F&C Investment Trust has been added to the suite of investment solutions being risk profiled by Dynamic Planner. Through our longstanding partnership with Dynamic Planner, advisers are now able to select portfolios that are aligned to their clients’ individual risk requirements from across our range of Multi Asset solutions, including our low cost, active CT Universal MAP range, our risk targeted CT MM Lifestyle range and now F&C Investment Trust.”

1 Total assets as at 31.08.2023 of £5.4bn – source: F&C Investment Trust & Global Trusts (fandc.com)