Simplified decision making and compliance

Dynamic Planner Insights provides you enhanced information to meet your regulatory, compliance and business needs.

Request DemoData driven decisions

Financial advice firms are increasingly data driven. To thrive they need actionable information to better understand their customers, optimise their operations and make informed decisions about target markets and business efficiencies.

Analysing information about advice processes at scale, whether for compliance purposes or internal decision making, is only possible with a consistent source of data. The Dynamic Planner platform is a perfect source for this information.

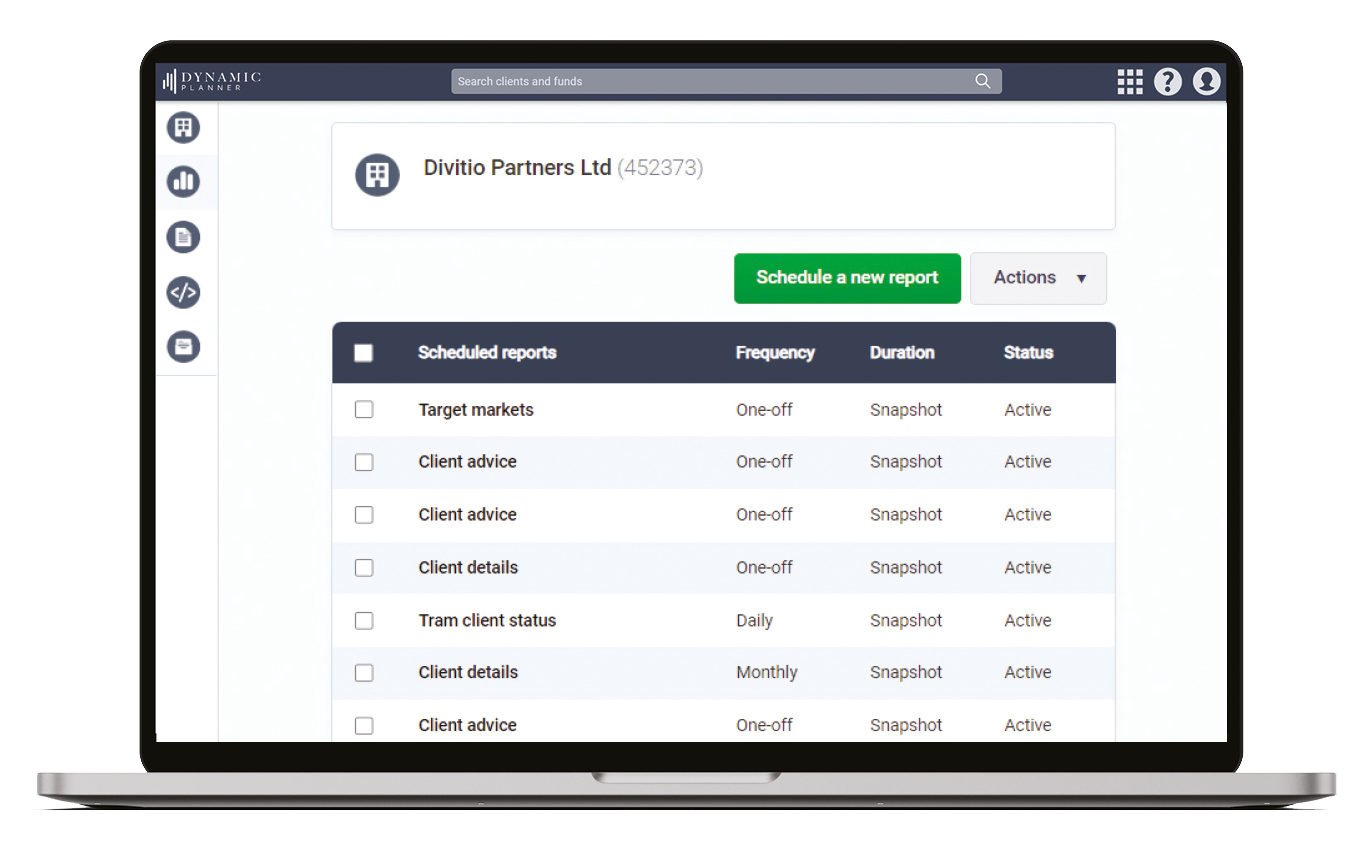

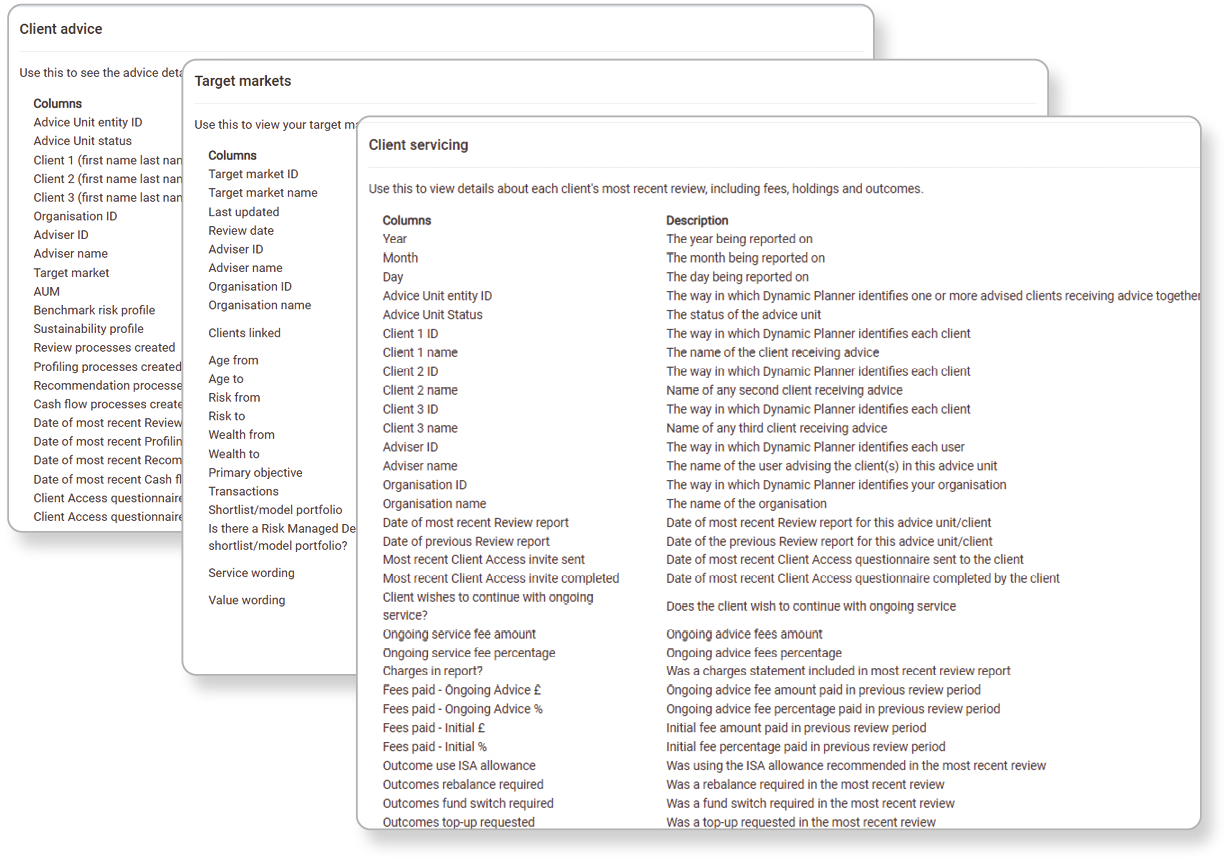

As a result, we have invested in building a new Insights module which will provide enhanced information to meet this need. This powerful reporting delivers regularly scheduled data on client demographics, profiling, target markets, advice processes and client interactions through our platform and mobile app, Tram.

Your firm’s data at your fingertips

- Platform usage (e.g. track number of users, completed annual reviews)

- Entered data (e.g. view client lists and other inputs)

- Analysis (e.g. assess client risk and sustainability profiles)

- Outputs (e.g. annual review outcomes)

- Client activity (e.g. monitor interactions in Tram)

- Client servicing (helping you fulfil the FCA’s ongoing service requirements)

Stay ahead with regularly scheduled MI from Dynamic Planner

Insights are available as one-off requests or scheduled monthly updates, giving you a continually updated view of your firm’s activity. This includes advice processes undertaken by advisers and support staff, as well as detailed breakdowns of your target markets, your clients and their usage of our client-facing mobile app, Tram.

We also provide data specifically designed to meet your regulatory and compliance needs, including client servicing – evidencing the nature and completion of the ongoing advice being delievered by your firm.

Next steps…

Investment Risk Profiling

Investment Risk Targeting

Risk Managed Decumulation

DFM / MPS Reporting