The coronavirus pandemic – with enormous speed and significance – has impacted almost every aspect of our lives in the UK in recent days and weeks.

Early last week, huge numbers of us began working from home indefinitely, against the broader backdrop of being increasingly told to avoid trips outside and contact with others. The magnitude of everything currently happening may only really resonate further down the line, once we have had time to absorb this experience of Covid-19.

In the more immediate term, life and work, of course, must continue as best it can. There is solace and reassurance, in a sense, that we are all in a similar boat, right now. We are all sharing and experiencing the same circumstances and problems.

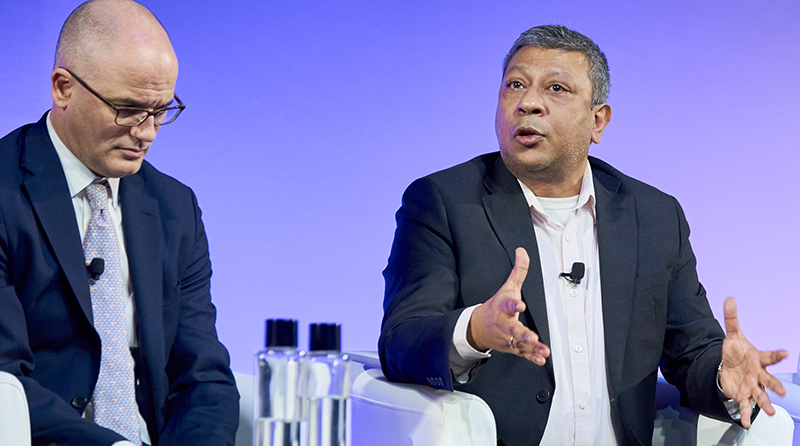

What has been the initial impact on one financial advice firm, FB Wealth Management in North East Lincolnshire? Here, Tom Saleh [pictured below speaking at our 2020 Manchester Conference], an adviser with FB Wealth, kindly takes the time to share his thoughts and experience of all of this.

Please note: the current Covid-19 crisis is, of course, fast-moving on many levels. All Tom’s comments were correct and given in good faith at the time of interview [19 March].

How is the crisis disrupting you and your firm?

I am proud to say that the disruption at our firm has been minimal. We all have the capability to work from home thanks to our remote desktop set-up. The only real problem we are facing is how to handle the post that comes into the office daily, although this can be resolved quite easily. The other major change in how we are working is a shift away from face-to-face meetings, which we have decided to stop almost entirely – to an internet-based approach through conference or video calling. The clients I have corresponded with have been very happy to communicate through these means and I get the impression that once we have overcome the pandemic, we will be seeing clients more regularly virtually.

Have you ever experienced anything like this before?

Never – the current situation is unprecedented in many ways. It is entirely unique and nothing like the financial crash of 2008. We are still unsure exactly how this will affect markets going forward, which companies are going to fail as a result and more worryingly, how long the virus will continue to spread before it is controlled.

What conversations have you been having with clients, worried about their portfolio?

Fortunately, we have been on the front foot with clients, sending them regular updates over the last three weeks since the coronavirus pandemic began to evolve rapidly. This, coupled with telephone conversations and the loss depreciation reports we have been sending out, has kept clients reliably informed. The media has also played a part in this, as it’s hard to get away from any market news on new channels at the moment – so, unlike the crash of 2008, clients understand the reasons behind the significant falls over the past few weeks and are likely to be aware as soon as we are.

How is Dynamic Planner helping your firm, at the moment?

We are trying to continue business as normal, albeit not necessarily in the office or face-to-face with clients. Dynamic Planner embraces technology, so we can still access the features we use day-to-day as normal. We can still conduct annual reviews over the phone, using Dynamic Planner’s client report pack, which saves sending numerous documents to clients, which can be difficult to talk through. The reports in Dynamic Planner are so clear and easy for clients to follow.

Read our market commentary from Chris Jones, Proposition Director and Abhi Chatterjee, Chief Investment Strategist here

It is at times like this that you realise the importance of being able to buy things.

There was a time in the past where it was easy to do so – but now that it’s suddenly more difficult, you wish you had stockpiled when you had the opportunity.

We didn’t know that all of this was going to happen, of course, but you do know that one day you will retire and roughly when that date will be. You aren’t now going to suddenly start stockpiling items for your retirement, because you don’t know what things you might need. However, you can stockpile the ability and resources, through money and equity, to buy things in future.

The good news is that right now the cost of equity has gone down, so now is a great time to set aside any spare cash you have for the future. It is also an opportunity to rethink how much you are currently setting aside each month, when you perhaps have more, for a time when you know that you will have less. Chris Jones, Proposition Director

The precipitous fall in equity markets and bond yields have thrown many portfolios off their strategic benchmarks, becoming underweight in equities and overweight in bonds. This has been followed by correlations turning positive, with a co-ordinated fall in equities and bond prices.

Valuations have been forgotten during this period of panic, much as they were amid the euphoria of valuation highs, which saw equity markets reach multi-year highs. Unprecedented support and targeted fiscal stimulus from governments and central banks seem to have little effect on sentiment, which fluctuates between panic and doom.

The credit markets remain a worry, in that the cash flow transfer mechanism may have a thrombosis, leading to defaults.

IG spreads widened 150bps and High Yield widened 400bps. The High Yield sector remains on edge as the capacity for repayment of these companies, fuelled by cheap money become suspect, with the energy, retail, aviation and tourism sectors being a particular concern.

Though many feel embattled and with parallels being drawn between now and wartime, one needs to be aware that the ‘foundations of production’ – capital, labour and land – are all intact and this is primarily a supply side slowdown as opposed to a demand-side one. The taps of production can be turned on easily. Abhi Chatterjee, Chief Investment Strategist

Read how one advice firm is managing the impact of Covid 19 and self-isolation here

Working remotely has, today, suddenly shifted from a nice-to-know option for many of us – to an essential choice we are nearly all having to make.

But what about the technology and devices you are using? Do they work as smoothly outside the comfort of the office? If, for whatever reason, they don’t and you hit an issue, you need support you can trust.

But will anyone be available to pick up the telephone and tackle your issue? You might prefer to send a short email, but who is monitoring the inbox at the other end – and how long will it take to receive a response?

At Dynamic Planner, we have long understood and appreciated the real value and the simple reassurance great customer support provides our 7,000-plus users and clients with. As a result, we have a dedicated and experienced Client Success team waiting to answer your call or email, Monday to Friday and immediately pick up your problem and find a solution.

That last paragraph, of course, is our words, which we deeply believe in – but below is what three of our clients had to say when asked what they thought of the support they receive from our Client Success team.

What do 3 of our users have to say?

Dean Mullaly, of London firm Mark Dean Wealth Management, said: “We love the support you get at Dynamic Planner. You can call the Client Success team up; they don’t try and get you off the phone; they login and share the screen; and they stay on the line with you, right until the end to ensure you have resolved your issue.

“It’s really, really good. For me, this is Dynamic Planner’s biggest selling point.”

David Owen, of Lifetime Connect, based in St Albans, said: “The people on Dynamic Planner’s Client Success team are brilliant and are masters at using Dynamic Planner. The customer support you receive as a result is fantastic. We really like it and have nothing but high praise for it.”

Serena van der Meulen, of Serena Van Der Meulen Associates in South Yorkshire, said: “I frequently request the help of the Client Success team at Dynamic Planner. The service and support they provide is excellent – couldn’t be more helpful.”

Of course, if you are not accustomed to working remotely, it can be disruptive, particularly initially. It’s like starting a new job, in a sense. A new setting and environment; a new view out of the window; new sounds; and new distractions.

But the familiarity of a friendly voice can quickly make you feel at home and settle into your new office. That reassurance that you are not alone and isolated and that help is out there, as soon as you need it, is invaluable.

David Owen continued of the Dynamic Planner Client Success team: “Everyone is very knowledgeable and what we particularly like is, you call up, they ask you where you are in the system and what you are currently doing. Then they say, ‘Okay. Hit that and you’re good to go’. It’s brilliant and stops you sitting there staring at a screen for two hours trying to work it out.”

Serena van der Meulen said: “The value they add makes Dynamic Planner much more attractive as a proposition to an adviser. You know that once you pass them a question it will be dealt with. This is rare in our industry.”

- If you would like to find out how Dynamic Planner can help support your firm’s financial planning and advice service, Request A Demo with one of our experienced Business Consultants today

When you see empty shelves in the supermarkets and people panic buying on TV, you can’t stop feeling that you are going to miss out – even though all the experts tell you that you won’t.

In much the same way with investment portfolios and despite the fact that we knew that we were taking an agreed level of risk, we still feel a little panicky and have an urge to sell. This makes our role in rationalising and reassuring all the more important.

It is not untypical at Dynamic Planner for us to field calls or challenges that our return assumptions are too conservative and that the risks that we expect had gone away. Of course, Dynamic Planner’s risk and return assumptions cater for markets events like we have been experiencing in March and which remain entirely correct and valid.

As you may very well know, at Dynamic Planner we efficiently and effectively assess the risk of any combination of asset classes – and in the case of Dynamic Planner risk profiled solutions, any combination of investment instrument or holding.

Fund managers are all different and will be using their own mandates, capability, and expertise to try and deliver the best return for the risk taken, pretty much in real-time. They will be issuing their own communications about recent market events and what they intend to do, and that will be informative for you and for your clients invested in those funds.

The markets themselves – how are they being impacted? Equity markets, especially developed markets, are down approximately by 10%. From a peak last month on 19 February, the drops can be read below:

| Index Name | Peak to Trough Loss | 5% Annual Loss (Expected) |

| S&P 500 | – 17.395% | – 24.02% |

| FTSE 500 | – 20.00% | – 24.31% |

| Euro Stoxx 50 | – 23.44% | – 31.56% |

The move, also, in the FTSE 100 can be seen above – and these are big moves, especially over so short a period. For context, the last such moves were witnessed in H2 2018, but they happened over almost six months.

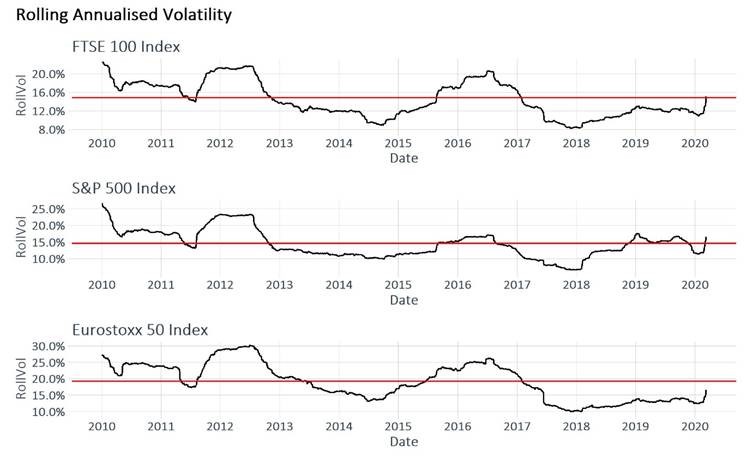

In terms of our modelling at Dynamic Planner, we remain quite confident. We use long-term models for our volatility estimation – and we have been criticised for high numbers here. The three graphs below show that even with these vehement moves, the ‘realised’ rolling volatility on these benchmark indices over the last 10 years have just started approaching the long-run numbers.

As can be seen above, the FTSE 100, after a 20% loss, has just reached the levels of expected volatility after facing placid conditions since 2016. In short, conditions like these explain why our volatility numbers are higher, because they incorporate dramatic moves as part and parcel of an investment cycle.

From our perspective, you can be reassured you that you can stand by the risk and the return you have led your clients to expect – and that unless there has been a change in the client’s circumstances, they should stay invested.

Remember – just because you could not see the risks, that didn’t mean that they weren’t there. And just because you haven’t had the returns today, that doesn’t mean you won’t get them tomorrow.

For more information on how Dynamic Planner can help your firm, book a demo with one of our team.

This month, we can announce a new feature within the client review process to help you and your firm in more turbulent market times.

We have updated our review report template to provide space for your firm’s own market commentary. This provides you with space in the report to outline prevailing market conditions for your clients.

Whilst we’re in the midst of market instability, due to the coronavirus outbreak, this is another way in which Dynamic Planner can help your clients understand and rationalise the potential impact on their portfolio and long-term objectives.

You can enter your firm’s market commentary within the ‘Paragraph Library’ administration feature. Once provided, the content will appear in the review report in the Appendices. And as with other sections of the review report, you can optionally include or exclude the content on a client by client basis, to ensure you provide content that is relevant and interesting for the individual client.

Take a look in ‘Help’ for more detailed instructions on how to set default content for the review report.

We hope you find the enhancements a useful addition to Dynamic Planner. As always, your feedback as clients is vital to helping us continue to improve and enhance the Dynamic Planner service for you and your firm.

Please do leave any feedback you have, however small, in the feedback portal. We do read it all! Thank you.

And as ever, you can contact our Client Success team – on 0333 6000 500 or support@dynamicplanner.com – with any other queries or issues you have.

The Chief Investment Officer Panel – where leading UK fund managers debate the big issues of the day – is always a real draw at Dynamic Planner’s Annual Conference.

This year was certainly no different. On 5 February, fittingly amidst the history and heritage of the IET in London, six CIO’s, or their equivalents, gathered on stage in the Kelvin Lecture Theatre for 60 minutes of insight, debate, opinion and humour – all masterfully chaired by the inimitable Simon Jack, Dynamic Planner’s Conference host again in 2020.

But which industry issues grabbed the spotlight and gaze of such a knowledgeable panel? Risk today and what we can expect from global markets in 2020 kicked proceedings off before the discussion turned to encapsulate a myriad of issues and subjects currently dominating conversations.

Climate change and its increasing impact on investing; the coronavirus; the fallout from Woodford; asset allocation or stock picking – which is more important? Are Apple and Google just too big for their boots today? How do asset managers self-police to avoid another Woodford? And, finally, what one thing keeps them awake at night?

Answering the questions were: Abhi Chatterjee, Chief Investment Strategist at Dynamic Planner; Chris Forgan, Portfolio Manager with Fidelity International; Chris Jeffery, Strategist – Asset Allocation at Legal & General Investment Management; Hector Kilpatrick, CIO at Cornelian Asset Managers; John Ricciardi, Lead Manager & Head of Global Asset Allocation with Merian Global Investors; and Rupert Rucker, Head of Income Solutions at Schroders.

Below is what they said.

Risk-on, or risk-off in 2020?

Rupert Rucker [Schroders]: “Risk-on still, despite the coronavirus in China. That means at Schroders that we’re overweight with equities in a multi asset portfolio – and we still think there’s an upside in markets, particularly outside the US.”

John Ricciardi [Merian Global Investors]: “Risk-on, has it has been for the last couple of quarters. Maximum equities; minimum bonds. Underweight in major markets, compared to emerging markets. And within major markets, underweight US, overweight in Europe.”

Simon Jack: “When you talk about ‘maximum equities’, what kind of allocation are you talking about?”

John Ricciardi: “We can take at Merian a 50 per cent world equity allocation and 50 per cent global bond allocation as standard – and from there we work on the allocation to earn our ‘value add’ for investors. We can go as high as 80 per cent in equities.”

Hector Kilpatrick [Cornelian Asset Managers]: “Risk-on and currently overweight in equities compared to our standard position at Cornelian. But we are very short on risk in credit and government bonds, in particular.”

Abhi Chatterjee [Dynamic Planner]: “We don’t worry about risk being on or off, at Dynamic Planner we just worry about risk all the time! [Laughter.] In our asset allocations currently, we are tending to hold more cash and less bonds, but we balance it out.”

Chris Forgan [Fidelity International]: “Currently at Fidelity, we are modestly risk-off and mostly underweight in equities as a result.”

2020: A ‘very different’ beast to 2019

John Ricciardi: “We think 2020 is going to be very different to last year, which had very little chance for economic growth or a rise in earnings, which is how 2019 turned out when the US Federal Reserve cut interest rates from 3% to 1.5%. This year is very different: there is very little chance we will see lower interest rates; more chance they will be higher.”

Chris Forgan: “Expectation of an economic upswing in 2020 has been fairly tentative until perhaps the last few weeks, which is why we have been a touch more cautious. Structurally, we have tilted away from the US and more towards the Far East and Asia.”

Simon Jack: “In the search for yield, where does that take you?”

Rupert Rucker: “In 2020, returns are not going to be as high, so the income part of any investment then becomes much more important, particularly the dividend. Extracting that will be a big part of the total return – but that has been the case historically anyway.”

Hector Kilpatrick: “At Cornelian, we are currently overweight in equities, but not hugely. We are concerned that any economic upswing is not going to come through as people are perhaps hoping for.”

Abhi Chatterjee: “We are very low on illiquid assets currently. We just don’t want to get heavily into physical property, which can get locked up, so to speak. We also feel there are pockets in markets where people have overbought, like fixed income or high yield bonds.”

What has the fallout been from the Woodford scandal?

Simon Jack: “Woodford was a moment when fund managers were not covered in glory and has shone a light on an issue like illiquidity. Are you mindful of that now?”

John Ricciardi: “There are approaches here, if you’re not looking at particularly stock picking – it depends upon where your ‘value add’ comes from as a manager. You can structure portfolios and we’ve done it at Merian for five or six cycles where we’re holding for example 600 stocks and the average capitalisation is £100bn.

“That gives you massive liquidity, but that’s not your ‘value add’ – that comes from going up or down the risk scale and from making the kind of bets we’ve already talked about, like being underweight in the US.”

Rupert Rucker: “The problems which came last year with Woodford came from the distrust they engendered. One thing fund managers need to do, of course, is control capacity. That is an internal discipline that must take place to cap the amount of assets a fund can manage, according to the daily liquidity. But all of the funds the people on this panel manage are all controlled by capacity and third-party risk so that we can control that liquidity.”

Abhi Chatterjee: “Illiquidity risk is like any other type of risk – there are two sides to the coin. During the accumulation phase of a portfolio, a bit of illiquidity premium helps add to the return. However, during decumulation and when you’re selling down units within that portfolio, that’s when it becomes a problem.”

What’s more important: Asset allocation or stock picking?

Rupert Rucker: “If a manager is providing an outcome, which is difficult to deliver – e.g. an income outcome or a volatility outcome – that takes asset allocation to deliver and fund managers charge fees for that expertise and skill. In terms of stock picking, if you’re looking to deliver anything over the markets, you have to pick the right stocks. But fund managers, without doubt, have to deliver both, because they charge fees.”

John Ricciardi: “If you look at the numbers historically, for example in the US, around 70 per cent of returns was really dependent upon how much risk a manager took from year to year. Another 20 per cent comes from choice or asset allocation and how a manager engenders risk – i.e. in bonds, in equities, derivatives. Of the remaining 10 per cent, five of that comes from stock picking or manager picking – and the final five per cent is random.

“So if you quote a stat that 90 per cent of fund managers underperform markets, you’re really looking at that five per cent and that ‘value add’ that managers can add if they know how to arrange risk – i.e. when to take risk and achieve returns and when not to take risk.

“If you want to beat the markets, you need some kind of active information and you need to see if a manager can bring that information to bear through asset allocation and through risk. As we’ve said already today, ‘How does your manager bring ‘value add’ to a portfolio, so that you can measure it?”

Simon Jack: “Abhi, at Dynamic Planner, how do you check that a fund is doing what it says on the tin?”

Abhi Chatterjee: “We look each quarter at a fund’s assets, holding by holding to calculate its risk profile. If a manager’s fund changes risk profile, we can then have a conversation with them to look at that. That is fund risk profiling. In risk target managed funds, the manager cannot go outside the respective risk profile’s boundaries. They are committed to a fund’s risk profiles.

“We can also measure a fund against our MSCI benchmark asset allocations, which we know the risk of. If a fund is able to outperform the Dynamic Planner benchmark for its risk profile, good for the manager.”

Are corporate giants like Apple and Google today simply too big for markets?

Simon Jack: “Today, when you consider giants like Apple and Google etc. it feels that any retraction in those stocks puts markets in trouble. Is that not the case?”

Chris Jeffery [Legal & General Investment Management]: “Yes, you’re worried that you haven’t got many eggs in many baskets, which is entirely reasonable. Of course, managers will look at total returns and how much of that comes from perhaps only a handful of stocks, like it hasn’t before at any point historically. So, yes, it is very hard not to worry at a global level about risk coming from that tech sector.”

Simon Jack: “How do you kick your funds’ own tyres, so to speak, when it comes to risk and self-police?”

Hector Kilpatrick: “If you’re considering an asset allocation movement that comes with a significant risk, you check that and ensure it remains within the parameters that you have set yourself.”

John Ricciardi: “At Merian, we set ourselves maximums and minimums for holding different percentages of assets. We also do high intensity modelling to help us and which map economic growth, for example, to equity markets; and map inflation to bond markets; and map liquidity and economic policy to currencies.

“That modelling gives us likely outcomes for the next six to eight weeks for different asset classes. For example, in 2018, before the September, October and November drop in markets, we went all the way down the risk scale to maximum equity in bonds.”

Rupert Rucker: “At Schroders, our products are designed for the long-term and are consistent with the investment journey an advice firm has bought into with their clients’ capital, to deliver the outcome they want. The biggest risk is that the fund manager doesn’t do that and that instead they change their process in a way no one could anticipate.”

Simon Jack: “That was so on message. Three points to Gryffindor!” [Laughter.]

Chris Forgan: “I would echo all the thoughts we have just heard and add that all the fund managers here tackle risk on a daily basis and the potential impact of changing portfolios. One key point, which is often underestimated, is that statistics don’t always capture everything going on in a portfolio – unless protection is there.”

How is the issue of climate change today affecting how portfolios are managed?

Chris Jeffery: “I think there is a ladder of appetite for this and at L&G, as a result we offer people a ladder of options that look at different things like corporate governance, for example and something like sustainability. But we have to be quite careful here. There isn’t a ‘one size fits all’ solution.”

John Ricciardi: “Ultimately, it is a client’s money which is being invested by a manager and it has to be run in the way that the client wants. There is lots to consider. Is a firm which attracts investment just trying to be passive and trying to do no harm – or is it taking active measures to have a positive impact for such considerations?

“At Merian, we have an entire team looking at risk like this and who analyse information available on every company and every country in the world, which measures things like governance and like social. Ultimately, they will reach different scores for different funds.”

Abhi Chatterjee: “At Dynamic Planner, we’re getting a lot of requests about how a fund scores here. It is a difficult thing to measure, but we can see demand is there and it is only growing. It is up to us to provide advice firms with the right tools.”

Hector Kilpatrick: “With the best of intentions, everyone sets the bar differently, so the labels the industry currently uses here are inconsistent.”

Chris Forgan: “I think it’s about appreciating what specific issue a client has and then designing a product to provide a solution, rather than choosing one already out there but which is very broad and generic in how it meets a requirement.”

The coronavirus – at what point do you start taking real notice of it?

Chris Jeffery: “You have to be very, very cautious I think, because if a fund manager pretends to understand virology as well as he understands markets, he would probably be lying. The honest answer is we don’t know what is going to happen and my advice would be, ‘Don’t pretend to know the answer here’.”

John Ricciardi: “I think you have to manage something like this in terms of probability, because you get external shocks to the system. You can’t just run for the hills here, in terms of being defensive, because then what if you miss out on the recovery and the returns you are aiming to deliver to your clients?”

What one thing keeps you awake at night?

Rupert Rucker: “The lack of trust currently in the industry and another Woodford happening.”

Chris Jeffery: “Aside from my two-year-old daughter, latent inflation. It’s not here today, but we are constantly watching to see if it is going to return.”

Chris Forgan: “Credit risk.”

Abhi Chatterjee: “Again, inflation and credit risk.”

Hector Kilpatrick: “Extraordinary monetary policy becoming normal monetary policy. I think that’s very dangerous. Also, I think we could be sleepwalking into a debt trap, but that’s maybe for another day.”

John Ricciardi: “I’m worried about China’s large, important economy having a dictatorship on technology to control its population and what that means for humanity.”

For more information on how Dynamic Planner can help your firm, book a demo with one of our team.

Dynamic Planner Investment Committee – Q1 2020 Update

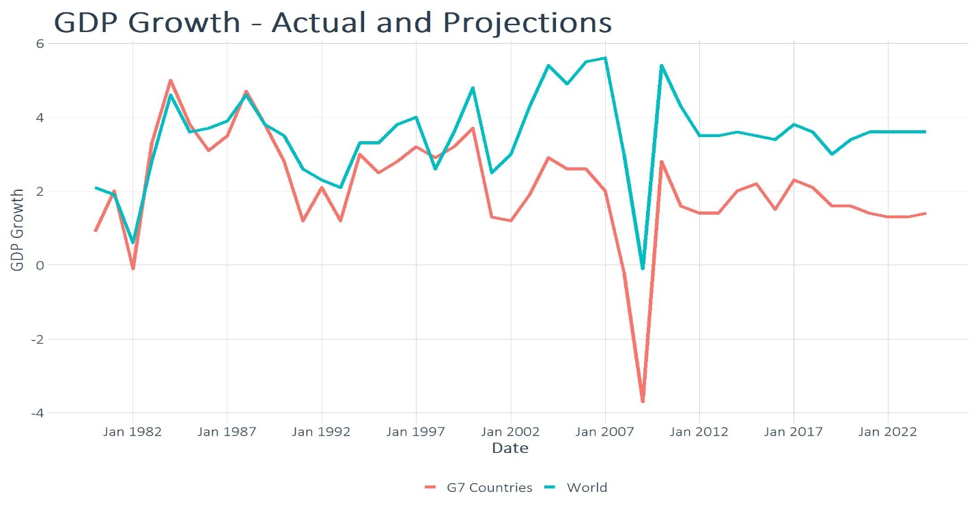

Global growth levels were muted for 2019, but forecasts are for a modest pick-up in 2020 for the G7 economies.

The US still stands out among the advanced economies, given the current full employment and strong retail sales growth. With 2020 being an election year, there have been hints from the Federal Reserve of letting the economy ‘run hot’ rather than raise rates again. The previous three rate cuts had certainly improved market sentiment over 2019, but further cuts this year are being viewed as unlikely.

The Euro Zone (mainly Germany) is re-adjusting to weaker demand globally and has seen consumer confidence fall, resulting in muted growth.

Emerging markets and the Asia Pacific region still remain the powerhouse of global growth, but structurally we expect this to temper, especially in China, because of the growing trend to repatriate manufacturing back onshore by the developed economies as a result of technological advances. The spread of the coronavirus is also a growing existential threat to the expected growth levels in China as well as to the wider global economy.

In the UK, we have finally got closure over the Brexit divorce and the resulting ‘Boris bounce’ in consumer confidence after the resounding general election result in December. However, several big challenges await during the future UK – EU trade relationship negotiations this year.

We are expecting generally muted growth in 2020, with focus mainly centred on the impact on world trade negotiations and the potential lowering of tariffs, rather than further monetary policy initiatives. While talks between the two largest global economies, China and the US, will continue to hold centre stage, we could see more fiscal stimulus measures elsewhere to revive economic growth fortunes, particularly in Japan, UK and Europe.

The US, as we have already mentioned, still stands out among advanced economies, but expansionary monetary policy may have less than expected impact on growth at current levels of employment and consumer confidence. The growth rate in China will continue to slow.

Inflation will remain subdued, in spite of continuing loose monetary policy across the globe.

The current macroeconomic backdrop all points to a continued ‘Risk On’ approach throughout 2020, but with levels of negative yielding debt estimated at $12 trillion (albeit down from its peak of $17 trillion), as a result of ultra-loose central bank monetary policy, there are many reasons to remain aware of the downside risks should policy or external events suddenly change

The degree of the impact of the coronavirus on global growth is still difficult to predict at this stage and also, we have the US presidential race this year, so one can expect President Trump will be doing all he can to get re-elected.

As a result, the Dynamic Planner Investment Committee felt at this time no changes to the current risk profile asset allocations were warranted and the strategic theme of maintaining a globally diversified portfolio with reducing exposure to bond duration continues.

Find out more about Dynamic Planner fund research

Annual suitability reviews for clients are today being delivered by advice firms against a backdrop of greater fee transparency and more volatile markets than was typical in the long bull run following the global financial crisis.

As a result, firms have come under pressure to deliver reviews – very often representing their core income – efficiently and in a way in which demonstrates the real value they add for their clients. But what is the answer?

How does your firm go from unstructured and unrepeatable reviews for clients, to a happy opposite and structured and repeatable? How do you go from time-consuming to time-saving reviews? And how do you move from frustrating, multiple data points stored manually to just one, which is cloud-based?

Here, representatives from three advice firms together discuss and talk candidly about how Dynamic Planner has helped transform the way they approach and deliver annual reviews for clients; the challenges they faced during initial adoption; and the eye-opening time-savings they have successfully made once they overcame them.

Below is what they said.

What was your firm’s review process for clients prior to adopting Dynamic Planner?

Adviser Susan Hill, of Susan Hill Financial Planning in Hertfordshire, said: “Before, I had a template for annual reviews in the form of a Word document, which was time consuming. Then, MiFID II came in and you had to include so much more information for a client review. It was dragging me down and it was hard work.”

Adviser Neil Gilbourne, of Nottinghamshire firm 3R Financial Services: “Technically, it was just chaos before! We had no definitive structure; nothing was repeatable; and we had so many data points. It was really just a mess and when you actually sat back and looked at it, annual reviews were accounting for 60 per cent of turnover for the firm.

“Thankfully, we came to Dynamic Planner’s Conference in 2019, when their new annual review process and report was announced, and we haven’t looked back.”

Compliance Manager Clare Edes, of Skerritts Chartered Financial Planners, which has offices in London and East and West Sussex, said: “Before, all of our advisers had their own review process, which meant that all of the admin team had to know all those different review processes if they were going to effectively support them. With MiFID II coming in, we weren’t sure we were able to carry on in that way.”

How has the Dynamic Planner Review been adopted at your firm?

Clare Edes said: “It has allowed our admin team to do more work around client reviews. Before, it wasn’t cost effective for us to do that, because they had to learn lots of different processes. Using Dynamic Planner, they can enter a lot of the information for a review and the adviser can then login themselves and review it and make any amendments. It’s a lot easier than having lots of different emails being sent.”

Neil Gilbourne said of his firm’s adoption: “It makes the whole process of completing a review for a client very easy. As the adviser, you can personalise wording within the report, so it includes different wording around how risk has been discussed and what the client is trying to achieve etc. That information can then be sent back to the admin team to include within the final report.”

Neil added: “Everything is repeatable, quick and easy – and every client receives the same service, whatever the size of their portfolio. That doesn’t matter. From a compliance and suitability of advice perspective, Dynamic Planner is absolutely brilliant.”

Susan Hill happily discovered that there were added benefits to adopting Dynamic Planner she hadn’t envisaged.

She explained: “The report allows me to include all of my charges for a client and in some cases, it made me realise that I wasn’t getting paid enough for the work I was doing. It opened my eyes and highlighted clients which weren’t profitable for the business.

“What ultimately Dynamic Planner does is allow me to give a good service for clients, who don’t need much ongoing service and then free me up for those clients I really should be working harder for, because both I and they can see how much I’m charging.”

Neil Gilbourne agreed: “That’s exactly right. It allows you to save time doing normal, everyday things and then spend that time on more complex cases. The report itself is completely flexible and allows you to include as much or as little portfolio analysis as you want. You can then tailor it to the individual client.”

Susan Hill: “If there are graphs included within the report template I don’t like, I just take them out – so I really make it my own. A lot of clients aren’t bothered about lots of graphs. What they really want to know is, ‘Has the value of my portfolio changed? How much have I made? And how much has it cost me in fees?’

“Dynamic Planner’s Client Review has revolutionised my service for clients. I’m really proud of what we’re doing now.”

Is Dynamic Planner’s Client Review saving your firm time?

Neil Gilbourne: “Too much time is the short answer to how much time it was taking us to complete reviews before. Now it really is the click of a button to bring all things like funds through – nice and easy – and it might take them 10 minutes to prepare a simple review for a client. If it’s more complicated, it’s still no more than half an hour.”

Susan Hill: “Previously, it was taking me about six hours start to complete a review for a client. Using Dynamic Planner, I have now reduced that to four hours per review. That amounts to 200 hours a year, with 100 clients. That’s quite a few weeks of saving for me and is really good. I can get on with other things.”

What has feedback been like from clients who have received the review reports?

Neil Gilbourne said: “The feedback we’ve had is that clients can see the value in what we’re doing for them, because the reports show if they’re on track with their objectives and ultimately, what they are trying to achieve and do with their money. It’s clear and up front. There are no smoke and mirrors. It’s great. Every client I have given the report to has commented upon it – and it’s only been positive.”

Susan Hill: “The reports produced create an audit trail and they create a record for the client to show what you have achieved each year. It ticks all the boxes.”

Clare Edes: “The report demonstrates everything you have done for a client in one document, which is brilliant. Clients like it – and the report is not full of technical jargon. It’s really easy to read and facilitates that conversation between adviser and client, without bombarding the client with pages of documentation all over the place.”

What were the challenges at your firm to adopting Dynamic Planner’s Client Review?

Neil Gilbourne said: “It’s never easy to get a bunch of advisers and admin staff to take something new on board. People fear change. Yes, there were teething problems after we initially adopted it, but once we had got over those small niggles, it was easy – really easy for us, as a firm, to adopt an approach to annual reviews which is the same every time.

“What that means as a firm is you have a sustainable business model going forward, demonstrating why recommendations are right for the client, which the regulator will look at. It allows you to demonstrate your firm’s value for clients and, for your own part as an adviser, you know you’re looking after people. It gives you conviction, in the reports and evidence you produce, that what you’re doing is right.”

Does Dynamic Planner encourage greater collaboration between teams at your firm?

Clare Edes said: “Adopting Dynamic Planner has allowed our admin team to do more work around annual client reviews. Before, it wasn’t cost effective for us to do that, because they had to learn lots of different processes. Using Dynamic Planner, they can enter a lot of the information for a review and the adviser can then login themselves and review it and make any amendments. It’s a lot easier than having lots of different emails being sent all over our system.

“Resources are now being shared and as a process it’s a lot easier to manage, because Dynamic Planner is cloud-based. If you were working in Word, there would be lots of different versions of reports going around and that might result in the wrong version going out to the client.”

“Ultimately, Dynamic Planner allows our admin team to take a much more leading role in producing documents relevant for a client review, allowing advisers to have time to do things like tax planning for a client – and to sit with clients and discuss their review.”

Want to find out more and how Dynamic Planner can help support your firm? Request A Demo today.

The FCA’s Debbie Gupta delivered an impassioned and heartfelt keynote at the climax of Dynamic Planner’s 2020 Annual Conference, at the IET in London.

The industry regulator’s Director of Life Insurance and Financial Advice Supervision presented to delegates for approximately 20 minutes before opening things up and taking questions from the audience.

Debbie was relaxed on stage; she understood the day-to-day problems and frustrations faced by advice firms; and she spoke candidly, intelligently and maturely in a compelling conclusion to what was a great occasion.

Much of the discussion returned to the critical issue for firms’ clients of pension transfers and ensuring a suitable income in retirement – and a retirement today which is more demanding and complex perhaps than for people of previous generations.

“Consumers are increasingly facing uncertainty about later life – changes to their health and their life expectancy,” Debbie told delegates in London. “We are living and working for longer, and we have to really think carefully about how we provide ourselves with an income later in life.”

She continued: “With the arrival of pension freedoms, consumers are having to make a series of increasingly complex decisions – and how do you make good decisions alongside a drive forward in technology and changing expectations?”

Debbie powerfully outlined and described how, for most people, the point when they retire is the key financial moment in their life – and naturally the moment when suitable professional financial advice is most valuable to them.

She said: “A pension, of course, is typically a person’s biggest asset, representing for them a relatively enormous amount of money. But managing that money is not easy, which is why what advice firms do is so critical and becoming ever more important.

“How do firms best ‘know their clients’? Firms who succeed here realise how critical a customer fact find is and demonstrate evidence supporting it. However, not all firms do that and we are still seeing DB transfer advice where they have not recorded, for example, other pension details, state pension details or indeed what a client’s expected income might be in retirement.

“The best firms capture this information, they contextualise and they tell a client’s story – and they demonstrate evidence why advice given is suitable.”

Speaking in the IET’s Kelvin Lecture Theatre, Debbie continued: “Seeing firms really transform their relationships with clients and evidencing clearly how they have done so – that’s, at the FCA, what we want to see going forward.

“While it’s not an FCA requirement, one way we’ve seen firms transform how they approach fact finds is by recording interactions with clients, which are often the most robust evidence a firm has, for example, in the event of a complaint. Recordings help firms hear the client’s voice and the context of their language and phrasing.”

There was a wonderful hush in the day’s final session at the IET on 5 February – a clear and very real sense in the theatre that it we were all sat in privileged seats to hear, first-hand, thoughts from a key figure from the regulator. Debbie herself treated the stage and audience with enormous respect. It was great to see and to experience.

The Director of Life Insurance and Financial Advice Supervision urged representatives of advice firms present to not be afraid of challenging their clients, when they fear a stated aim or desire is not ultimately in their best interests.

She said: “We see many examples of firms detailing what a client wants in fact finds, but do they also consider what that client really needs? Because many client ‘wants’ are based on flawed assumptions or a lack of understanding of potential risks – for example, the future impact of inflation.

“Establishing income needs in retirement is critical and challenging a client’s misconceptions is where a firm can add real value. Advice firms are the experts here.”

Writing in Dynamic Planner’s 2020 London Conference Magazine, which all delegates received upon arrival, Debbie underlined: “The biggest challenge for firms is to ensure through evidence that they really do know their client. Good financial advice focuses on what clients really need to achieve.

“What singles out good firms is the evidence they retain to demonstrate that they have thoroughly assessed their client’s needs and objectives. They have gone beyond the words and actively listened to what is being said; they have taken a holistic view of the client’s needs; and, where appropriate, they have educated the client or challenged them when it is clear that their wishes are not in line with their needs.”

“Every bit of advice, whether initial or ongoing, relates to a unique individual and advice should be personalised to reflect this. The more your fact find records everything relevant and the more specific it is – the easier it will be to evidence the suitability of your advice.”

Later, during open questions and answers from the audience, the Dynamic Planner 2020 Conference host Simon Jack pointedly asked Debbie, ‘Were pension freedoms a mistake?’

She answered: “It is a difficult question to answer here on this stage and you can see why pension freedoms, of themselves, were good and well intentioned – but in almost all cases, transferring out of a DB scheme is not in the best interests of the client.”

During her talk, Debbie continually reminded the audience that the person on the street, the clients of advice firms, was very firmly always forefront of the FCA’s thinking and policy.

She said: “It is easy to leave a talk like this and think it is all doom and gloom. I want to reposition that thinking, because the regulator is in a unique and privileged position to see what ‘really good’ looks like within the industry and also understand that there is really bad practice going on as well.”

She continued: “The FCA is here to serve the public interest – a remit which comes with both a great deal of responsibility and a huge challenge. It is often said that the FCA is slow to act – but I would say instead that we’re thoughtful, deliberate and careful. That is absolutely the right way to respond to those challenges. I know that can feel frustrating sometimes, but it’s important that we take care in how we work and that firms have time to respond and engage with us.

“Our focus on consumers is unwavering and we are increasingly focusing our efforts on the financial advice sector.”

In a final question, in the interview which appeared concurrently in the 2020 Dynamic Planner London Conference Magazine, Debbie was asked, ‘What is the best piece of advice you have ever received?’

She said: “Keep asking yourself, ‘What is the problem I am trying to solve?’ because sometimes it’s easy to get lost in the complexity of the challenge. It’s so simple it’s almost silly, but staying focused on the big picture is the best way of making sure you’re headed in the right direction – especially when you can’t see through to the other side.”

Where does the value in adopting Dynamic Planner lie for your firm? Find out at Dynamic Planner’s 2020 events

We’ve had a great start to the new year with our Annual Conferences in Manchester and London and multiple product announcements to keep us busy!

Alongside developing all these new services, we’re continuing to develop and evolve our current features. One common theme across all new areas of Dynamic Planner is the quality and presentation of the reports it enables you to generate.

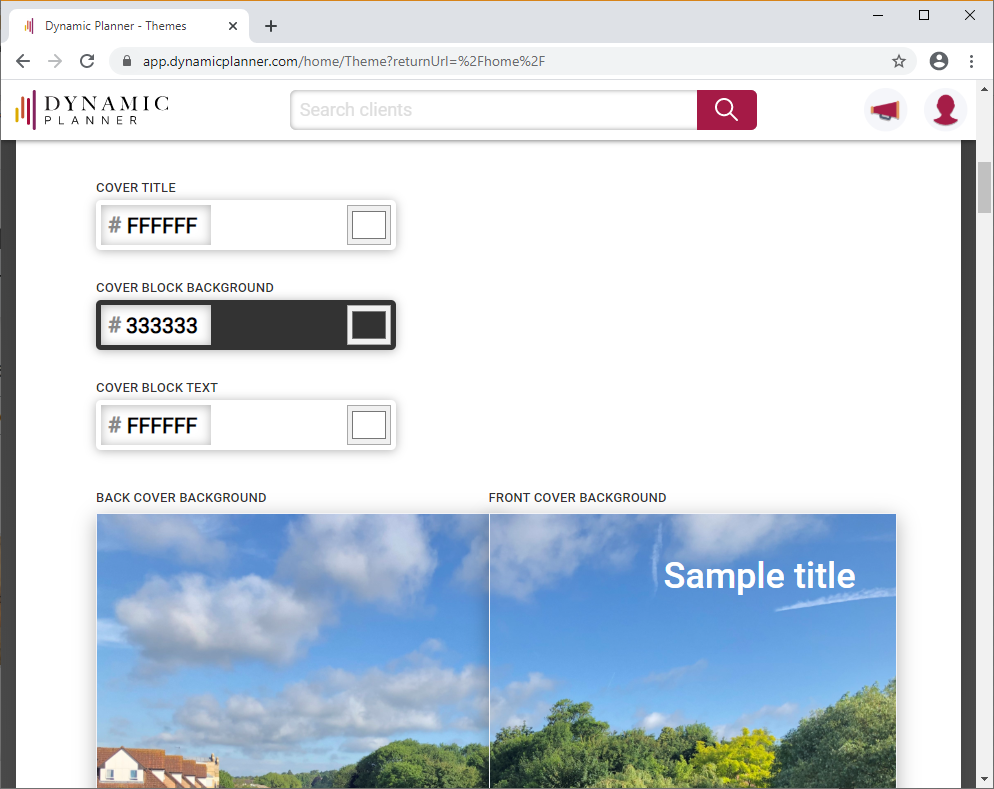

We’ve had some great feedback about the new client review and risk profiling reports, and the ease with which you can apply your own logo and imagery. However, a common request from users has been to provide more flexibility in the colours used.

So, we’re pleased to announce that the theme editor has been updated to provide you with extra control over the colours used throughout reports. You can find the theme editor in the top right menu once you’ve logged into Dynamic Planner.

What you’ll see is the ability to clone one of the default themes (e.g. ‘Countryside’) from which you can then apply your own images and colours. We hope this unleashes a new wave of creativity among you!

Late last year, we held a competition to find the best use among our clients of the report theme editor. You didn’t let us down. We were spoilt for choice with lots of great use of really striking and thoughtful imagery used throughout reports. There could only, however, be one winner unfortunately – of a £250 Amazon voucher, which went to Terry Shatwell of Lifetime Financial Solutions. Congratulations Terry.

We hope you find the enhancements a useful addition to Dynamic Planner. As always, your feedback as clients is vital to helping us continue to improve and enhance the Dynamic Planner service for you. Please leave any feedback you have, however small, in the feedback portal. We do read it all!

As ever, you can always contact our Client Success team on 0333 6000 500 or support@dynamicplanner.com with any other queries or issues you have. Thank you.