At the turn of the year, we were focused on the major political and economic events that we thought would shape the weather for investors in 2020: the next stage of the UK’s exit from the European Union; the upcoming US presidential election in November; and the planned stepping down of Angela Merkel as Chancellor of Germany after 15 years as the pre-eminent politician in Europe, to name but a few.

As we have always said, a few weeks can change the perspective of the central events to consider when managing clients’ portfolios. This dictum has never proved more true than in the current extraordinary circumstances and the continuing battle against coronavirus.

Where are we today?

The backdrop as we entered 2020 was of all risk assets, be they equities, bond markets or property at elevated valuations that were overdue a retracement. After 10 years of a bull market, investors had become increasingly complacent with valuations stretched in large part because of an unprecedented level of support from central banks in the form of quantitative easing and record low interest rates.

While the extent of the crisis that coronavirus has wrought, both from a health perspective but also economically, wasn’t anticipated. Western economies and equity markets were in a poor position to weather any economic shock.

Record low interest rates across Japan, Europe, the UK and US have left central bankers with nowhere to go with regard to monetary policy. There has been no normalisation of interest rates in the UK at all, with base rates remaining at 1% or below for the last 11 years. Conventional theory would suggest a cut in the region of 4% to interest rates would be required to stimulate the economy after such an economic shock. Evidently, without pondering the realm of negative interest rates, not something that is possible with base rates at 0.75%, as they were in January and February this year.

What is the likely policy response?

We would expect a global wave of quantitative easing (or money printing to give it its more common name) to an extent never seen before together with a widescale fiscal response from governments across the world. These policies will likely have to last for years.

It is conceivable that central banks across the world will be required to step in and part fund major Western economies for the next decade. The previous global experience of quantitative easing from 2009 onwards (where the UK printed £375 Billion and the US $3 Trillion), ended up supporting the balance sheets of large investment banks and inflating the value of assets from government bonds to equities, but crucially did not really filter down to the average man or woman on the street.

The challenge in 2020 and onwards is for politicians and central bankers to direct this support to the ordinary economy. A task that is easier said than done.

The beginnings of the response have already been seen. Policy makers globally have acted in a fast and coordinated way to show markets they really will do ‘whatever it takes’ and have backed this up with tangible action (Bank of England £200 billion QE programme, European Central Bank 750 billion Euro programme and the US Federal Reserve effectively announcing unlimited QE). This has driven risk assets to rebound about halfway from their late-March lows.

Despite all the uncertainty, there is a great deal to be optimistic about. Tilney has been investing money for clients since 1836. In the last 180 years, the world has encountered many challenges. In the 20th Century alone, the world was faced with two world wars and a Great Depression but still benefited from the greatest creation of wealth in history. Human drive, ingenuity and the advances in technology find a way.

In the fullness of time, when we defeat COVID-19, the world will present us with very different investing conditions. Investors will have to be nimble but also have a firm grasp on the long-term trends that will drive returns and create wealth for clients. As one of the largest and best resourced investment management businesses in the UK, we believe we are well positioned to get those decisions right.

To summarise, key considerations are:

- Lower global growth due to structural challenges – higher levels of debt and challenging demographics in the Western world

- The conflict between inflation and deflation

- Lack of appeal of traditional safe havens – cash and conventional bonds

- Active management – an essential component of our approach

By Maria Municchi, Multi Asset Fund Manager, M&G Investments

The last few weeks brought about enormous changes to our society, to our personal lives and to the economic environment as we know it. The spreading of a deadly virus across the world prompted many governments to put out unprecedented restrictions on businesses and the wider population, while at the same time trying to support their economies via aggressive monetary and fiscal policies.

Financial markets have responded aggressively, selling off across risky assets and offering little shelter from volatility. Businesses with a strong ESG framework have not been immune from the sell off, as illustrated by the performance of MSCI World ESG leaders versus MSCI World.

This is not surprising given that the recent market moves have been driven by panic and fear of the unknown, and in those situations we rarely see investors differentiating between companies on the basis of their financial or ESG quality. But what can we say about the more lasting impacts of the virus, both on global economies and for ESG investors?

The economy

It is reasonable to believe that the impact of COVID-19 will be temporary: if the measures being implemented slow the transmission rate and eventually defeat the virus, if new drugs currently being trialled are found to be effective in lowering the mortality rate, or if a new vaccine is created in the next 12 to 18 months. Meanwhile, governments will have to support society and the economic system that sustain it.

Today, governments are (in the majority of cases) acting to support liquidity to the system and are doing it in ways that in the past have been considered to be unconventional. Even in the depth of the global financial crisis, the idea of ‘helicopter money’ was never implemented but today the US is planning to distribute cash directly into individuals’ bank accounts, and only recently, South Korea announced a voucher scheme to make direct payments to households.

Longer term, these shifts could mark a longer lasting shift in perspectives over the range of policy actions available to governments, for implications for global economies. Paying attention to these developments are likely to be far more important than focusing on near term macro data, much of which cannot be interpreted through the same analytical lens as previous downturns.

Looking longer term: The UN Sustainable Development Goals

Much of the emphasis behind ESG investing is driven by a desire to look beyond the short-term results that dominate market commentary and frequently.

Paying attention to issues like quarterly GDP, monthly inflation rates, or weekly market returns can be important, but also distract us from thinking longer term. Perhaps a period in which such data provides even less insight into the genuine underlying picture for the global economy will serve to recalibrate time horizons.

From this point of view, the UN Sustainable Development Goals provide a good framework for determining what should be at the forefront of the political, social and economic long-term agenda.

Focusing on those longer term goals can lead to a better outcome for stakeholders in society. It is also the case the dealing with the coronavirus and its impact may accelerate moves to tackle some of these long-term issues, with potential impacts on the prospects for related companies.

These pressures being faced by society and governments at present may come to bear on three of the goals in particular: number 3 (‘Health and Well-Being’), number 8 (‘Decent Work and Economic Growth’), and number 12 (‘Responsible Consumption and Production’).

UN Sustainable Development Goal Number 3: Good Health and Wellbeing

Before the pandemic crisis hit, the health system in many countries was already operating close to its full capacity, both in terms of infrastructure and personnel. While widespread access to healthcare has never been more important. Public and private spending will need to contribute to rebuild capacity and make it more adequate to current demographics. This could support companies operating in the health sector like medical equipment producers, diagnostic, health insurer and others.

UN Sustainable Development Goal Number 8: Decent Work and Economic Growth

Today more than ever, we realise the importance of social safety nets and emergency liquidity measures for businesses. It is by supporting business and employers in this difficult time that we protect future economic growth. Governments and central banks spent the last few weeks trying to identify the most efficient measure to do so, including less conventional ones.

UN Sustainable Development Goal Number 9: Industry Innovation and Infrastructure

The last few weeks have changed the way many of us work, shop and communicate. The role of technology and infrastructure have been critical in how we have dealt with the virus.

The ability to communicate and coordinate action, the ability to work from home and deliver essential goods and services, and the ability to shift economic activity from areas that are shut down to those in need of extra resource are all areas that we would have been unlikely to have managed in the same way even ten years ago.

These developments are indicative of very rapid change. Many of us are likely to maintain some of those new habits in the future, boosting internet usage, and the need for fast and efficient networks (like 5G). Innovative telecommunication business and IT specialists are likely to continue benefiting from this trend.

UN Sustainable Development Goal Number 15: Life on Land

Currently, there is still no certainty on how exactly this specific coronavirus transmitted from animals to humans. However, the destruction of natural ecosystems and related challenges to biodiversity are likely to have played an important role in generating transmission across different animal species and eventually to humans. Maintaining the delicate balance betweenhuman beings and nature will continue to play a key role in the years ahead in protecting society from further pandemics and I expect public and private entities to boost the efforts in this area.

UN Sustainable Development Goal Number 16: Peace, Justice, and Strong Institutions

The current status also reminded us of the important role of institutions in our society, from looking after our health to enabling our economy to thrive. While the recent rise of populism had challenged the role of our institutions, the levels of intervention, coordination and cooperation needed today remind us of the importance of strong institutions.

In this context, it will be interesting to see the impact this historic moment will have on the European Union. On one had it offers the possibility of the co-ordinated fiscal activity that some have been crying out for. On the other, steps to close borders and limit movement have been taken on a seemingly unilateral basis (at least temporarily), in opposition to the ethos of the European project. On the face of such a huge test, will Europe become more united or will coronavirus mark the end of the Union?

Conclusion

Heightened volatility naturally tempts us to think short-term. And yet there is scope to believe that some of the challenges that we are facing today could well prompt a refocusing of attention to those goals that are important for the longer term.

While the narrative and price action of the last few weeks might seem far removed from the long-term themes of sustainability and ESG considerations, it may well be the case that such themes become even more relevant today. Rather than something that should be put on hold, considering today’s challenges from an ESG perspective could well provide us with a framework to identify future investment opportunities, while making our society and economy more resilient.

By Abhi Chatterjee, Chief Investment Strategist

In the last six weeks, I have seen more from my home office desk than all the time I have previously spent in my career on trading desks. To recap, what have we witnessed?

- The single largest day increase in VIX since 1990

- Two of the largest daily falls in the S&P 500 since 1927

- Central banks committing larger amounts of money to targeted relief than during the crisis of 2008

- And people ready to pay others $38 to hold a barrel of oil

Given stringent social distancing policies have been largely in place, a sharp decline in economic activity has already occurred, as shown by PMI numbers plummeting to unforeseen lows.

It is expected that we will see a deep recession in the Western, as well as Emerging economies. The question now though still remains, ‘How long will the recession last and what will the long-term impacts of the coronavirus pandemic be?’

Answers are currently only speculation, as details of how and when lockdown measures precisely will be eased are only just emerging – and, of course, there is also the real threat and future concern that there will be a second, significant spike of infections.

Extrapolation of data from past recessions are unlikely to help. All we know is that pent-up domestic demand should come back online, once social distancing measures gradually begin to be rolled back, but economic growth may still be sluggish due to an equally gradual growth in international trade and investment.

Following the pandemic’s outbreak, central banks globally have unleashed a flood of fiscal policies to help the private sector and the cornerstone of all developed economies. In a concerted action across the board, central banks in developed countries have assured individuals as well as corporations that no measure is big enough for them to use in these times.

Central bank rates are at all-time lows; asset purchase programmes are worth billions and involve buying up of below investment grade debt and asset-backed securities; and governments effectively are providing loan guarantees to mortgages providers, banks and the like.

It appears Western governments have opened their balance sheets for households and the private sector, in order to stave off bankruptcies and large-scale lay-offs. Credit is the fuel which businesses run on and the availability of credit will determine which parts of the economic anatomy remain unaffected by all this.

However, credit perpetuates on the optimism of growth – the promise of an increase in activity resulting in repayment. Without growth, be it sustained or otherwise, we face a self-reinforcing cycle of diminished confidence, bankruptcies and lay-offs. Thus, the over-leveraged world, which gorged itself on debt in a low interest environment, looks on with mounting concern and interest – if you pardon the pun.

The policies enacted now by public institutions face the ultimate dilemma and balancing act: the creeping devastation of a stagnant economy or a terrible human cost.

Abhi Chatterjee is Chief Investment Strategist at Dynamic Planner and helps lead its expert, in-house team of analysts, who each quarter risk profile the 1,400+ investments currently available in Dynamic Planner – to research and recommend to clients of financial advice firms.

Speak with a consultant to find out how Dynamic Planner fund research can help your firm

[vc_row type=”in_container” full_screen_row_position=”middle” column_margin=”default” column_direction=”default” column_direction_tablet=”default” column_direction_phone=”default” scene_position=”center” text_color=”dark” text_align=”left” row_border_radius=”none” row_border_radius_applies=”bg” overlay_strength=”0.3″ gradient_direction=”left_to_right” shape_divider_position=”bottom” bg_image_animation=”none”][vc_column column_padding=”no-extra-padding” column_padding_tablet=”inherit” column_padding_phone=”inherit” column_padding_position=”all” background_color_opacity=”1″ background_hover_color_opacity=”1″ column_shadow=”none” column_border_radius=”none” column_link_target=”_self” gradient_direction=”left_to_right” overlay_strength=”0.3″ width=”1/1″ tablet_width_inherit=”default” tablet_text_alignment=”default” phone_text_alignment=”default” column_border_width=”none” column_border_style=”solid” bg_image_animation=”none”][vc_column_text]

By Amanda Tovey, Investment Director at Whitechurch Securities

Life pre the COVID-19 outbreak now seems a distant memory. Over the past few weeks, the priority of people, companies and governments around the world has been how to get through the crisis with minimal loss of life and economic damage. As time moves on, attention is now turning to what will a post-COVID world look like?

Prior to the outbreak, climate change was high on the agenda as governments struggled to meet the goals set out in the Paris climate agreement. Figures show that in 2018 the atmospheric concentration of CO2 and other greenhouse gases once again reached new highs. However, since the global lockdowns began, there has been a notable change in air quality around the world as we have seen pollution levels drop, albeit temporarily as transportation and industry have ground to a halt.

We are now seeing some governments, particularly in Europe, start to put stipulations in place for companies receiving bailouts, which mean they must become more environmentally friendly in order to receive money, suggesting climate change will continue to be top of the agenda for many as we move forward.

Many companies have been keen to show they have acted in a socially responsible way throughout this crisis. This has been seen in a variety of ways – from companies taking ventilator designs ‘off patent’ and sharing with other companies to increase production, to companies providing discounts or priority service to frontline workers.

It has also been reflected in the way companies have treated staff during the crisis – i.e. have they done their best to keep them safe and where possible keep them employed? Companies which have acted responsibly will have helped their brand in the long-term and may see financial benefit from their actions as the economy reopens.

What does this mean for Socially Responsible Investing?

Pre-COVID-19, we were seeing a substantial increase in investor interest towards Socially Responsible Investment [SRI] options. We believe this will continue moving forward and investment opportunities will increase as governments and companies look to align themselves further with the United Nations Sustainable Development Goals [SDG].

The UN SDG’s have been designed to drive change globally and cover a range of environmental and social issues. Many SRI and impact funds look to map to these goals as a way of measuring the positive impact they are having.

As behavioural and consumption patterns change – such as increased working from home, a shift towards online communication, increased focus on healthcare and the security and sustainability of global supply chains, alongside a transition to a low carbon economy – this all creates opportunity as many new technologies, industries and products need funding in order to meet the challenge. Many SRI funds have for a long time been focused on investing in the best companies in these areas.

[/vc_column_text][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row type=”in_container” full_screen_row_position=”middle” column_margin=”default” column_direction=”default” column_direction_tablet=”default” column_direction_phone=”default” scene_position=”center” text_color=”dark” text_align=”left” row_border_radius=”none” row_border_radius_applies=”bg” overlay_strength=”0.3″ gradient_direction=”left_to_right” shape_divider_position=”bottom” bg_image_animation=”none”][vc_column column_padding=”no-extra-padding” column_padding_tablet=”inherit” column_padding_phone=”inherit” column_padding_position=”all” background_color_opacity=”1″ background_hover_color_opacity=”1″ column_shadow=”none” column_border_radius=”none” column_link_target=”_self” gradient_direction=”left_to_right” overlay_strength=”0.3″ width=”1/2″ tablet_width_inherit=”default” tablet_text_alignment=”default” phone_text_alignment=”default” column_border_width=”none” column_border_style=”solid” bg_image_animation=”none”][image_with_animation image_url=”9523″ animation=”Fade In” hover_animation=”none” alignment=”” border_radius=”none” box_shadow=”none” image_loading=”default” max_width=”100%” max_width_mobile=”default”][/vc_column][vc_column column_padding=”padding-5-percent” column_padding_tablet=”inherit” column_padding_phone=”inherit” column_padding_position=”top-bottom” background_color_opacity=”1″ background_hover_color_opacity=”1″ column_shadow=”none” column_border_radius=”none” column_link_target=”_self” gradient_direction=”left_to_right” overlay_strength=”0.3″ width=”1/2″ tablet_width_inherit=”default” tablet_text_alignment=”default” phone_text_alignment=”default” column_border_width=”none” column_border_style=”solid” bg_image_animation=”none”][vc_column_text]

Positive impact, positive returns

There is growing evidence to suggest that companies who have high standards in the areas of Environmental, Social and Governance perform better overall. Implementing better practices in these areas can make businesses more efficient and mitigate risks of operational shortfalls and reputational damage.

There is evidence to suggest that during the Q1 sell-off, some ESG and SRI funds outperformed, helped by the strong ESG focus and investment into companies which were not as badly affected by the economic shutdown and in some cases benefited through the provision of solutions to the problems faced, as per themes above.[/vc_column_text][/vc_column][/vc_row][vc_row type=”in_container” full_screen_row_position=”middle” column_margin=”default” column_direction=”default” column_direction_tablet=”default” column_direction_phone=”default” scene_position=”center” text_color=”dark” text_align=”left” row_border_radius=”none” row_border_radius_applies=”bg” overlay_strength=”0.3″ gradient_direction=”left_to_right” shape_divider_position=”bottom” bg_image_animation=”none”][vc_column column_padding=”no-extra-padding” column_padding_tablet=”inherit” column_padding_phone=”inherit” column_padding_position=”all” background_color_opacity=”1″ background_hover_color_opacity=”1″ column_shadow=”none” column_border_radius=”none” column_link_target=”_self” gradient_direction=”left_to_right” overlay_strength=”0.3″ width=”1/1″ tablet_width_inherit=”default” tablet_text_alignment=”default” phone_text_alignment=”default” column_border_width=”none” column_border_style=”solid” bg_image_animation=”none”][vc_column_text]

Why talk to clients about Socially Responsible Investing?

Many of us would like to be able to reflect our personal values in our investments, but have been held back in the past due to lack of choice and perceived poor performance of funds in the ethical space.

Historically, ethical or SRI has been about excluding stocks in sectors such as tobacco, gambling and defence. These exclusions have in the past led to some periods of underperformance from ethical funds when areas such as tobacco outperformed.

Over the past few years this part of the investment market has changed dramatically and we are seeing a rapid increase in the number of clients interested in this space. Amendments to Mifid ll, expected to come into force soon, will mean advisers will need to be more proactive with customers in relation to SRI considerations by asking them about their preferences.

What we can offer at Whitechurch Securities?

We offer ethical income and growth orientated portfolios in a range of risk levels from £3,000 upwards, available directly and on a number of platforms. For clients with more bespoke needs, including CGT management or particular ethical requirements, we can tailor individual portfolios (investment from £250,000).

For more articles and information including our Socially Responsible Investment Guide, or to find out how we can help you and your clients, please visit our website – www.whitechurch.co.uk – or contact a member of our Business Development Team on 0117 4521207 or at DFM@whitechurch.co.uk[/vc_column_text][/vc_column][/vc_row]

By Abhi Chatterjee, Chief Investment Strategist

The ‘Corona Crash’

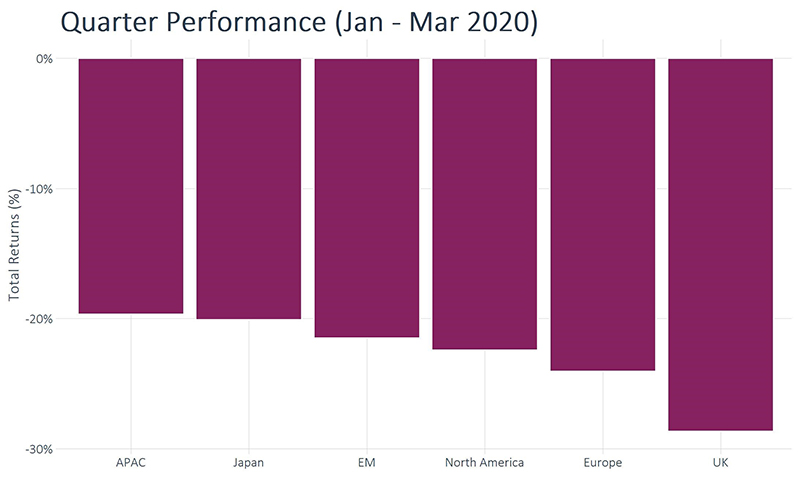

The Covid-19 outbreak triggered a geo-economic panic, resulting in an unprecedented spike in global equity market volatility, with severe declines exceeding 20% and extreme daily swings on a scale comparable to the financial crash of 2008.

Thus, we dramatically marked the end of a remarkably resilient equity bull market, that had begun back in March 2009. The moves largely occurred in late-February and March as numerous countries went into lockdown in response to the pandemic, bringing economic activity to a virtual standstill globally.

Meanwhile, government bond yields and prices were incredibly volatile. Yields first hit extreme lows on heightened fear, but then rose, as panicked investors sold off liquid assets indiscriminately, in order to raise cash. High yield credit was hardest hit given this dramatic spike in risk aversion, with the rout most evident in sectors perceived as most vulnerable, such as those related to travel and retail, as well as energy, given the price of Brent crude plummeted to its lowest level since 2003.

In emerging markets, the heaviest falls were suffered by local currency denominated bonds. There were double-digit declines, in some cases of around 20%, linked to issuance in currencies perceived as more sensitive to the economic growth shutdown, falling oil prices, and those with more market liquidity.

Maintaining essential checks and balances

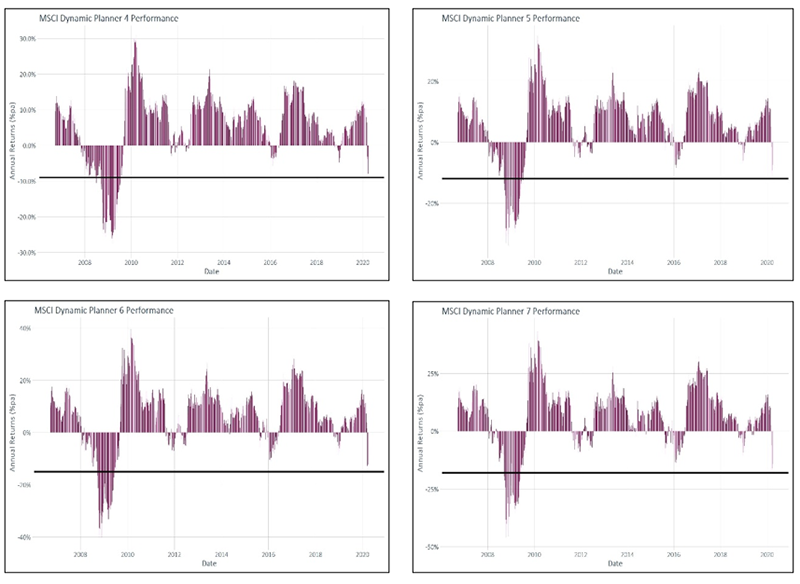

The committee reviewed the performance of the current benchmark asset allocations, which have proven so resilient during this and other periods of extreme market volatility, with none breaching their defined, 95% value at risk limits over the quarter.

The above charts show the rolling, 12-month index returns for risk profiles 4, 5, 6 and 7 updated each month.

The horizontal lines are the respective, 95% value at risk limits for each.

The key role of the Investment Committee [IC] is to ensure that prudent checks and balances are in place, so the integrity of Dynamic Planner’s forward-looking asset and risk model is maintained. During the meeting, the IC carefully considered what could be learned from recent events and whether its current process in forecasting asset class growth and volatility remained appropriate if we are witnessing a significant macro-economic regime change in the making.

Given these extreme market swings and the current uncertainty, as to how long the global lockdown measures will remain in place, after much discussion, the IC agreed that now was not the time to make any changes to its long-term growth forecasts or strategic asset allocation benchmarks. There are just too many unknowns presently over the scale of the economic impact and recovery trajectory, the downstream implications of the huge fiscal and monetary stimulus measures on growth, inflation and interest rates and the likelihood of a viable vaccine becoming widely available.

The current process used for volatility forecasting involves detailed analysis and interpretation of data trends from both a long and short-term perspective. This requires striking a careful balance with the data inputs to the model. The danger of giving too much credence to short-term noise is the potential for overshooting of data in times of extreme market anxiety, potentially leading to significant misalignment in the forecasts generated.

Conversely, the process needs to be sufficiently sensitive to detect emerging changes in how asset classes are expected to behave and their impact on future volatility and correlations over the longer term. For this particular quarter, given the extent of recent extreme data outliers, the IC agreed that their use would be inappropriate on this occasion. Therefore, the longer term data trends for volatility and correlations were used for the Q2 2020 volatility and correlation assumption setting. The data derived from the shorter term modelling techniques were not included.

The IC also noted that post-Brexit negotiations between the UK and the EU were still ongoing, but no significant breakthroughs before the end of the December transition period that could have any bearing on the model assumptions have yet to be announced.

Summary of Investment Committee Q2 2020 decisions:

- No changes to strategic asset allocations

- Previous quarter’s growth forecasts remain unchanged for Q2 2020

- Forecasts for volatility and correlations were based solely on the long-term data modelling approach for this quarter

Disclaimers

You should not rely on this information in making an investment decision and it does not constitute a recommendation or advice in the selection of a specific investment or class of investments.

It is estimated that roughly one in three of us globally are currently living in lockdown, to varying degrees, against the backdrop of the ongoing coronavirus crisis.

Here in the UK, we are now entering week seven or week eight for many of us, since the first announcement from government on 16 March to, if possible, begin working from home for the foreseeable future.

Of course, debate has now shifted and increasingly so to how social distancing and other lockdown restrictions will gradually be lifted. This is perhaps not the time or indeed the platform to enter that critical discussion, which will impact all of us.

However, we have garnered anecdotal opinion from six members of the Dynamic Planner user community, who have been kind enough to share their thoughts on what the lasting changes from lockdown might be – in financial services, more broadly in the world of work and in society itself. This is what they said.

Nathan Lewis – Client Relationship Manager, Logic Wealth Planning

It is actually a good test to see how good our systems are – and it may mean in future that more remote working takes place.

Serena van der Meulen – Financial adviser, Van der Meulen Associates Ltd

I think people who have avoided technology in the past are more likely to embrace it now. And people hopefully will have their priorities more grounded and appreciate the importance of health, of family and of having quality-time. I know people who before the crisis worked an 80-hour week in the office. Now they have time at home to spend with their children.

Hopefully, people will now know their neighbours a lot better, in communities, which I think is really important. Local businesses and shops are thriving in many ways, as people appreciate the value of a good local butchers or greengrocers and how they have really been coming through for people. I hope that continues going forward.

Dmitry Morgan – Financial adviser, Morgan Financial

Personally, I do not think there will be a lasting impact from this. Yes, there will be a different approach to meetings, being out in public and the work ethos for a time – but people will quickly forget this crisis when managing their day-to-day lives. It may be six months or two years hence, but business and interpersonal relationships will go back to normal.

David Owen – Wealth Director, Lifetime Connect

I’m an optimist, so I’d like to say, ‘Yes, there will be a positive and lasting impact’. However, we are a funny species, humans, so I do have a horrible feeling that we will go back to driving 2hr to attend a 1hr meeting and then 2hr back. Hopefully, that won’t happen as much in future – and we will say, ‘All that driving about was crazy; we were polluting the planet; and it was unnecessary. Look at how much better off financially we are by not paying so much for petrol each month?’

Hopefully, financial advisers will embrace this change and carry on holding client meetings remotely in future and once we start to get up to speed and move away from things like having to have wet signatures, for example, we can be in a position to work more effectively.

Lee Waters – Chief Executive, Barwells Wealth

I think the crisis has and perhaps will move a lot of the boundaries with regards to people working from home. Firms, perhaps, have been in two camps prior to this: one camp embraced working from home and members of their team hot desking years ago, while the other is more traditional where everyone comes in each morning at 9am and works until 5.30pm when they go home.

I think moving forward, firms probably will be more relaxed about people working from home, because they realise the impact isn’t as detrimental as what they thought it might have been.

Lee Whiteside – Financial adviser, Plan4Life

[During lockdown] I’ve completed my first meetings with new clients I had never met before, by video conference. I used Zoom. You can share documents with the client and do pretty much everything you can face-to-face, except get a physical signature, of course. I think we just have to adapt, don’t we? We haven’t had a choice at the moment.

I risk profiled the client and have done everything I wanted with her, and at the point of sale – a full fact-find; we talked about pension switches; and I quickly followed up with a recommendation to move an old pension she has got. It’s actually easier, in one way and a really good of working, and you do start to think, ‘Hang on a minute, why don’t I run my business like this all the time?’

Older clients, of course, might well prefer to see you face-to-face – and younger people might feel like that too. But when things do go back to normal, I definitely need to consider if this is a new process I need to integrate into my business more permanently.

Read how different advice firms have managed this year during the crisis here

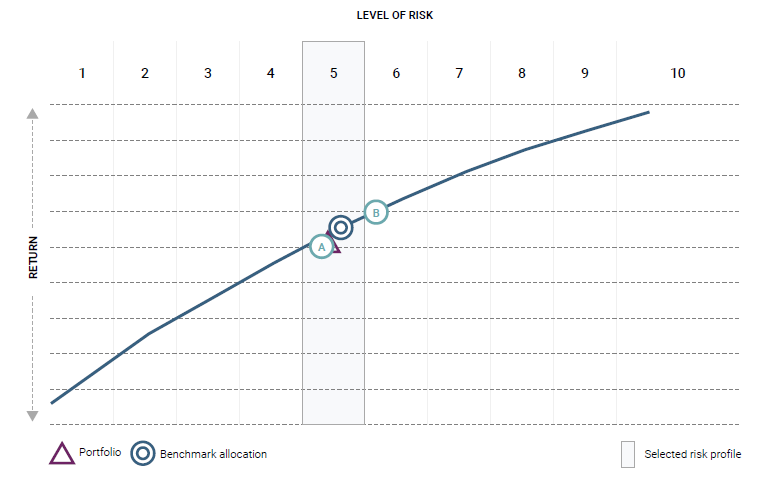

Accurately risk profiling your clients and subsequently matching them with suitable investments has arguably never been in sharper focus than it is today.

Financial markets dropped more dramatically, by broadly 25%, than ever before from 16-19 March this year. Of course, as a result, it is vital, amid such volatility, for a client’s portfolio to be at a risk that they are willing and able to take.

Matching people with suitable portfolios sits at the very heart, at Dynamic Planner, of what we enable advice firms to do – quickly and accurately allowing you and your firm to revisit the risk profile of a client and their portfolio to check if anything has changed during times of extreme market turbulence, which we experienced in March.

Dynamic Planner enables you and your firm to securely email clients an invite to complete the risk profiling questionnaires remotely – questionnaires which comprehensively include capacity for loss and investor experience, safely ensuring both those key aspects are consistently being covered from a regulatory and best practice perspective.

Further, Dynamic Planner is a cloud-based financial planning system, which can easily be screen shared during a remote meeting via video chat platforms like Zoom, which have become synonymous with communications during the crisis and beyond.

How do five advice firms risk profile their clients in Dynamic Planner in this climate? Where is the real value, on different levels, in it for them?

David Owen – Wealth Director, Lifetime Connect

“The risk profiling tool in Dynamic Planner is incredibly powerful. To be able to recheck, at the moment, their attitude to risk and capacity for loss is great. You can have the conversation with the client, ‘You’re coming out as a risk profile 7, but can you really afford to be? From what you’re telling me, it appears you can; or you can’t’. You can then take an action.

“Using something like Zoom, you can go through the risk questionnaire with a client and share your screen and analysis like the ‘efficient frontier’ to check that they are comfortable. It’s absolutely brilliant.

An efficient frontier

“Once upon a time with technology, you had to complete a load of training before you started using it. That idea can still be anchored in people’s minds. But if you think of things like Zoom, you don’t really need training. They’re intuitive to use, aren’t they? It’s more about curiosity now. If you’re curious, you will use technology – and Dynamic Planner falls into that camp, I think – it’s very easy to screen share; it’s very easy to navigate; you can’t really go wrong.”

Neil Gilbourne – Financial adviser, 3R Financial Services

“We first started using Dynamic Planner to help us manage risk. That was the driver. The client risk profiling process was the reason why and it’s worked for us ever since. We wanted to demonstrate for all our clients that we were measuring accurately their attitude to risk. It’s peace of mind for us that we are clearly demonstrating that we are providing ongoing advice for clients – and if the regulator came to us and asked, ‘How is that advice suitable?’ We can demonstrate that and say, ‘Yes, it is’.”

Clare Edes – Compliance Manager, Skerritts Chartered Financial Planners

“We first started using Dynamic Planner because we wanted to add another layer of compliance to our processes, so that we knew what a risk score looked like for a client and we knew, as a firm, what then we were working towards. Our Investments Team can then run model portfolios and funds based on a target risk score.

“Dynamic Planner covers risk mapping and what a portfolio looks like at a given level of risk. It also asks clients questions concerning their capacity for loss, which means we’re covering more in a client fact find. Previously, there wasn’t a set trigger point to spark those questions and conversations.”

Lee Waters – Chief Executive, Barwells Wealth Independent Financial Planning

“The fact that Dynamic Planner is cloud-based is extremely helpful. Everybody at your firm can login as though they were in the office. We can also still send risk questionnaires out to clients and overall [during lockdown], I don’t think there has been any disruption to how we use Dynamic Planner.

“We have been able to use it to help reassure clients that their risk profile isn’t changing, because the way people answer the risk questionnaires varies depending upon how they are feeling emotionally at that time. If you gave someone the risk questionnaires a year ago and you gave them, them today, they would come out more cautiously, because of what has happened. It is about that conversation and saying to the client, ‘Are external events driving any change in attitude to risk or is it something more fundamental?’

“If there are changes to how much risk the client wants to take, we can use Dynamic Planner to map where they are now and where they need to be in future.”

Lee Whiteside – Financial adviser, Plan4Life

“I completed my first meeting with a new client by video conference during the lockdown. I used Zoom. You can share documents and do pretty much everything you can face-to-face. I risk profiled the client and have done everything I wanted with her, and at the point of sale – a full fact-find; we talked about pension switches; and I will quickly follow up with a recommendation to move an old pension she has got.

“It’s actually easier, in one way and you do start to think, ‘Hang on a minute, why don’t I run my business like this all the time?’”

Want to see how your firm can benefit from our risk profiling process? Talk to one of our consultants.

By Chris Jones, Proposition Director

In a capitalist free-market society, I have a choice to use the fruits of my labour to buy things from a company or buy parts of a company. But, because I am human I rarely think about it and invariably spend more on buying things because I get immediate gratification.

The practical impacts of COVID 19 have brought this subconscious decision more to the front of our minds.

Firstly, the connection between what we do as consumers, and how that impacts us as investors has some clearer examples; we aren’t flying and therefore airline stock is going down, but on the other hand, we are using Amazon and Zoom and they are going up. Our relationship with supermarkets is confused as is the share price.

Secondly, my preference for immediate gratification is being curbed by the lockdown and social distancing. I look at my online banking and the previously dominant entries from coffee shops, bars, restaurants, and travel have vanished. If you are fortunate not to have had a cut in your income then you will see an unusual monthly surplus.

Finally, ‘rainy days’ do happen; our certainty about the world has taken a hit; we didn’t see this coming; we can’t see how this will play out; and can’t foresee which companies will be needed and thus successful when we need to spend our investments.

DIY investing no longer seems so easy and the value of expert financial planners and asset managers is easier to see.

People who are experiencing this may therefore benefit from not only staying invested but also diverting the money they are not spending into increased or even new regular savings. Modern ISAs, GIAs and pensions are no longer rigid commitments, so you can always stop this when the pubs open again. The choice is always there but current circumstances are weighted towards bargain investments rather than bargain stores or happy hour.

Have a look at our Content Hub, where we have written a guide on the value of remaining invested that you can use with your clients.

This year and particularly since mid-March, the whole financial services industry and indeed world has changed in ways few of us could have imagined.

The provision of financial advice has always been a very sociable and personal service. Many times in discussions with Dynamic Planner users over the years, I have been told that firms’ clients value time spent with their adviser and those meetings, whether held at the client’s home or at a firm’s office, form a key part of the service and value advisers deliver to their clients.

Given the current need for working remotely and of course providing and delivering financial advice at a distance, below is a rundown of five ways in which Dynamic Planner can help you right now.

1. Risk Profile Client Invites

For several years now, Dynamic Planner has provided advice firms with the ability to send risk profiling questionnaires to clients for completion remotely prior to a meeting. Clients answer them via dedicated, client-facing screens, which are optimised for use across devices, including mobile. It’s no surprise that this feature is being used now more than ever in 2020.

2. Beautiful digital reports

Within the latest version of Dynamic Planner, you and colleagues can download high quality risk profiling and client review reports, which can easily be personalised with your firm’s logo, own imagery and colours. Final reports can be downloaded as PDFs for easy sharing.

In addition, we have launched a Content Hub on our website providing you and your with freely available material you can download and share with your clients, to help reassure them at this time. Literature available to download includes, ‘The value of remaining invested over time’, ‘The value of a relevant benchmark to measure fund and portfolio performance’ and ‘Checklist: Key things to remember for low, medium and high risk profile clients’.

3. My Planning client portal

If you are looking for a way to share reports you have created within Dynamic Planner, in a secure way with clients, then look no further than My Planning – Dynamic Planner’s client portal. It gives your clients an overview of their wealth, alongside the ability for you and your firm to share documents and minimise the need to send documents via email.

4. Easy to use screens, maximised for client interaction

The use of remote video calling and screensharing technology has boomed over the past few weeks, with Microsoft Teams and Zoom being two of the most widely used platforms and both reporting a huge increase in demand for their platforms.

We have heard from existing Dynamic Planner users how over the past few years the use of technology within the client meeting has become increasingly prevalent and this of course applies remotely as well as physically.

As such, while our users are predominantly financial advisers, paraplanners or other office staff, we design all new features with a view that the client will be sitting there in the meeting and viewing. This leads us to question the importance of every piece of data or analysis shown on screen and how that content is presented. Ultimately, it results in a slicker service for all – so Dynamic Planner’s Client Review process is perfectly suited to being used remotely via screensharing, providing you and your firm’s clients with full interactivity and richness of analysis to support the conversation.

5. Access anywhere, anytime

Finally, Dynamic Planner is a web-based service, with nothing more than a modern web browser required to quickly access – and no obscure software or device requirements. With the latest version of Dynamic Planner, you can even conduct a client review from your mobile phone.

Like many businesses, at Dynamic Planner we have had to rapidly ready our staff to work remotely. This involves ensuring everyone on the team has access to the equipment and software they need to continue to perform their role remotely.

We hope that helps with ways in which Dynamic Planner can support you through this time.

If you have any more questions, please do get in touch. We’re fully operational throughout the current lockdown.

By Sam Liddle, Sales Director, Church House Investment Management

When it comes to retirement, the needs of Britain’s savers are defined by factors such as goals, wealth and personal circumstances. However, for the most part, these investors require financial solutions that can support their income, grow in line with inflation and leave a pot of money for their family to inherit.

Since the introduction of pension freedoms in 2015, targeted absolute return funds have become an increasingly popular option for those entering the decumulation phase of their financial lives. Given what the funds were established to offer, this is not surprising with low interest rates and against a low-return backdrop in annuities and other traditional retirement solutions.

Indeed, Dynamic Planner has just announced the launch of its Risk Managed Decumulation service, comprising 11 funds such as Church House Tenax Absolute Return Strategies – the key attraction being the low volatility of returns, which permits regular withdrawals of capital and income with little risk of reducing the value of capital invested.

In its purest form, the absolute return approach suits the needs of many retirees perfectly. It should provide consistent, smooth returns that can be top sliced, without diminishing principal investment against any backdrop. However, the reality is quite different. In recent years, the sector has come under much pressure as many constituents have fallen short of their goals.

As defined by the Investment Association, absolute return funds are managed principally to deliver positive returns in any market condition, often expressed in terms such as ‘cash plus’. The products are not benchmarked against a specific sector or index and must clearly state the period over which they intend to deliver their target return – a rolling timeframe that cannot exceed three years.

Problems are likely to arise in any sector whose definitions contain vagaries, let alone a sector whose underlying funds invest across many different assets and geographies. Capital preservation, rather than ‘cash plus’, should be at the heart of any absolute return fund.

It’s no secret that after years of quantitative easing, many investors have been drawn higher and higher up the risk scale in search of income and / or growth. Therefore, potentially subjecting investors to major and unexpected losses. The pursuit of growth while disregarding capital preservation seems like a reckless strategy.

Some assets look uniquely vulnerable in certain environments and investors have to ensure that their absolute return fund is going to protect them in all market conditions, not just the benign ones. They should not be seduced by low volatility into thinking that capital preservation is easy.

Given the shrinking pool of income-generating options in traditional asset classes, the enhanced versatility offered by absolute return funds, when applied with caution, is key to providing the sort of consistent, low volatility returns required for decumulation.

In recent years, many absolute return products at the more aggressive end of the sector have begun to take on increasing levels of risk to achieve their objectives against a backdrop of broadly rising markets. This has led some to shoot the lights out in one year before crashing just as heavily in another when markets change.

For retirees wanting to draw income from their portfolio, such volatility can become a real issue due to something known as ‘sequencing risk’ – also known more colloquially as ‘pound cost ravaging’. These terms describe the process by which taking income from portfolios in falling markets can leave capital depleted and, in turn, income permanently lower. After all, while a 10% loss in any one year would require an 11% gain to break even, a 30% loss requires a rise of 43% to break even. Relatively short-term losses can have a lasting impact and drawdowns only emphasise this.

The graph above shows the difference in portfolio value over time for the benchmarks, Dynamic Planner Risk Profile 8 and Risk Profile 4, as well as the Church House Tenax Absolute Return Strategies Fund, itself rated a Risk Profile 4 as a decumulation vehicle. The chart assumes a 4% annual drawdown scenario.

The difference is immediately apparent and it’s clear that a lower volatility of returns is preferable for a drawdown vehicle.

Broadly speaking, an absolute return fund which delivers volatile returns, risks undermining the purpose of absolute return investing. It is therefore imperative that investors do the research needed to identify the products in the sector most likely to provide smooth returns. These are the products that start from a base of capital preservation rather than ‘cash plus’; and those which have historically delivered a smooth path of growth and consistent income across market cycles, rather than a volatile growth curve inappropriate for retirees looking for consistency in returns.

There are several ways that this can be done:

By checking timeframe: The shorter the period the manager has given themselves to meet their goal, the less scope they have for volatile returns and the less likely they are to take on excessive risk.

By checking performance: In cases where funds have been running for long enough, check every possible rolling period to see if it met its goals. Likewise, check performance over annual periods. If outperformance is remarkable in one year, then consider this a red flag. The same degree of underperformance could follow in another 12 months.

By checking maximum drawdown over a certain period: This is an excellent way of assessing the amount that would have been lost if an investor had sold at the worst time. The lower the figure, the better.

Absolute return funds adhering to the core, original principles of the concept are actually an ideal option for retirees looking for a consistent annual income while minimising the risk that they will deplete capital over time.

In the recent market sell-off, the reputation of absolute return funds has been restored somewhat following a few difficult years, during which a number of the larger funds produced disappointing results. However, investors in the sector should be looking carefully at a manager’s definition of absolute return, what they are trying to achieve, as well as historic performance, drawdown, volatility and the type of risks they are taking.

For the record, the Church House definition of the absolute return objective is the delivery of positive returns in excess of cash plus fees over rolling 12-month periods. We view an objective of cash plus 3% or plus 5% over longer periods as ‘targeted return’ for which a higher level of risk is required than for absolute return.