We are in the middle of a synchronized downturn. Analysis of the quarter or quarter change in GDP globally and in the US makes grim reading – worse than anything observed in the past.

Partially, this is due to the global reduction in activity through lockdown restrictions to mobility. Yet, if equities were to be considered as a barometer for future global activity, this would appear to be the shortest recession in history.

We can spotlight the performance of the S&P 500 Index. From being down approximately 30%, the market crossed its previous peak of 3389 on 18 August 2020. And with the backdrop of increasing infections globally, especially in the United States, and the upcoming presidential election in November. Analysis shows a real disconnect between the financial assets and the real-world economy. In addition, the stocks on NASDAQ, primarily small tech companies, have recovered an eye-watering 78%, after a drop of 28%.

In response to the Covid-19 crisis, central governments across the globe have unveiled massive fiscal and stimulus packages to help sustain their economies, especially from threats to the labour market.

The scale of stimulus has even dwarfed those created during the global financial crisis 2008. The stimulus packages in United States amount to approximately 13% of GDP, with the UK at 5% of GDP. The comparable figures in 2008 were 5.9% and 1.5% respectively.

A consistent concern expressed at this tidal flow of liquidity being provided is what happens in the wash. The bull run in equities and the compression of yields of corporate bonds is often attributed to the stimulus provided by central banks along with lower interest rates, which can be considered as a form of stimulus as well. Post the implementation of the emergency measures since March 2020, we see the same pattern re-occur, albeit on steroids.

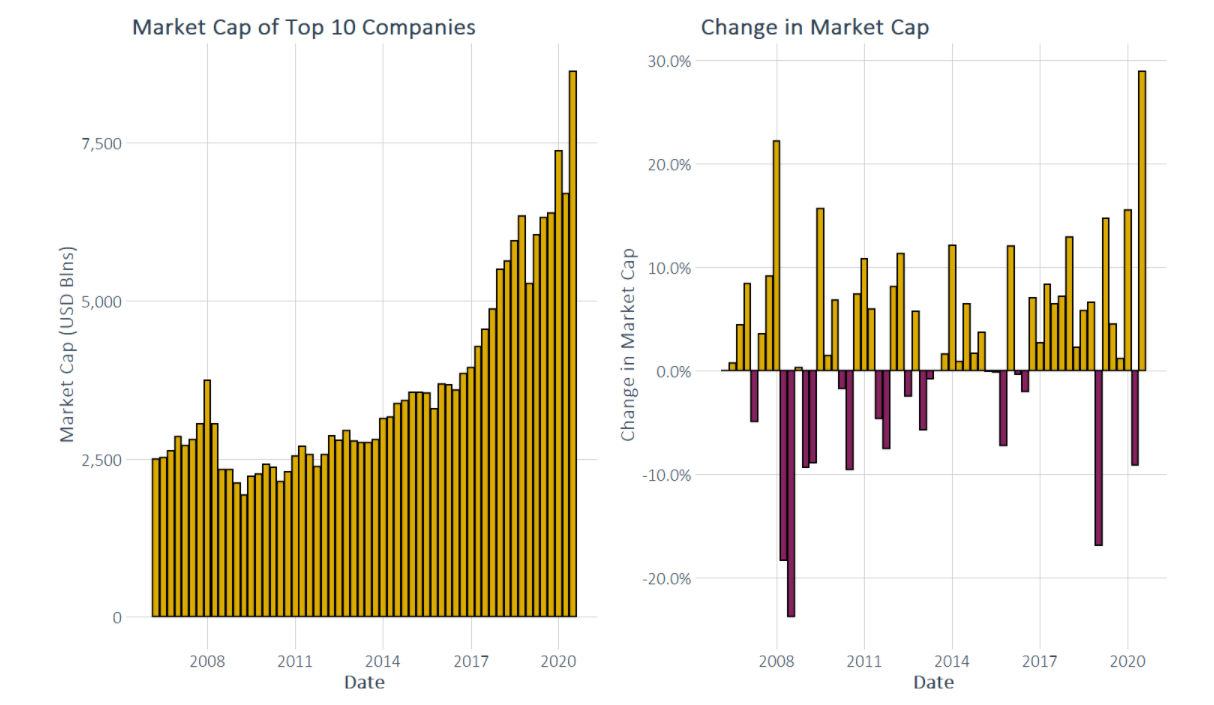

The market participants have been especially selective. Consider [above] a chart of the 10 largest companies in the world and their market capitalisation as well as the change quarter on quarter. It is incredible to note that capitalisation of the top 10 companies is the highest that it has ever been and up almost 30% from the previous quarter. While it is understandable that after a severe shock to markets, there is generally a rebound in the valuations, in 2020 even compared to previous crises, the change in value appears egregious.

The market participants have been especially selective. Consider [above] a chart of the 10 largest companies in the world and their market capitalisation as well as the change quarter on quarter. It is incredible to note that capitalisation of the top 10 companies is the highest that it has ever been and up almost 30% from the previous quarter. While it is understandable that after a severe shock to markets, there is generally a rebound in the valuations, in 2020 even compared to previous crises, the change in value appears egregious.

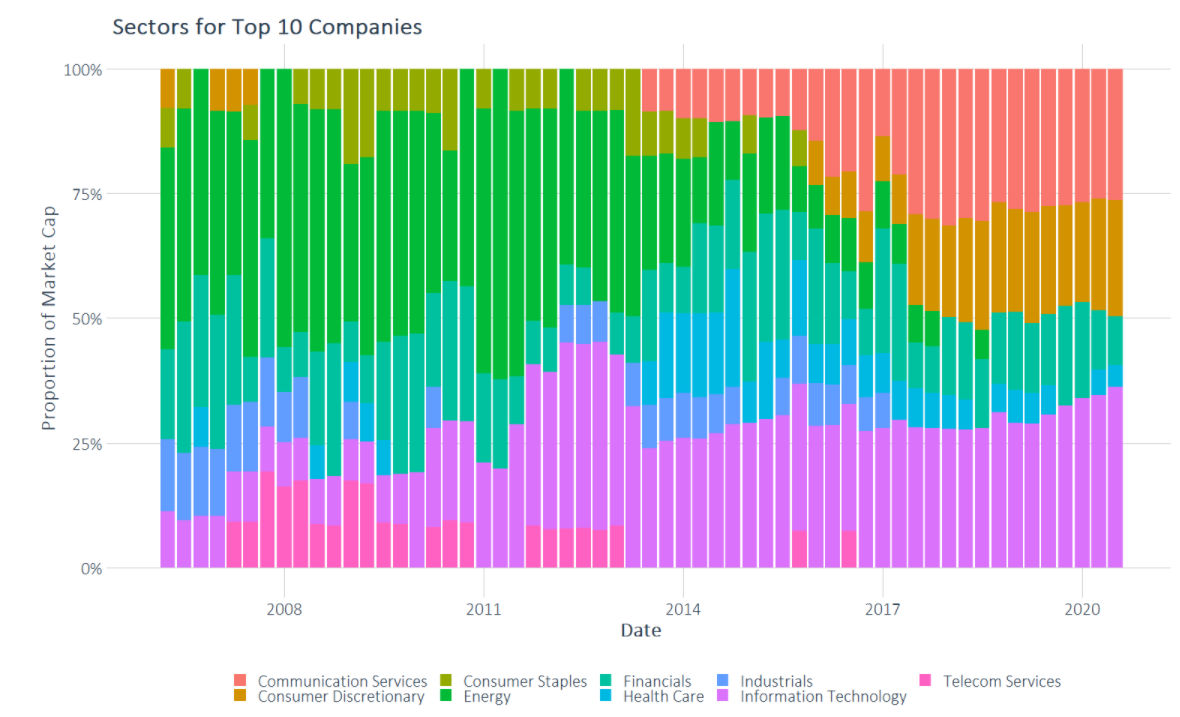

In addition, we can look at the composition of these 10 companies [above]. Since the time we have collected this data, which starts from Q2 2006, the companies have been composed of seven GICS sectors whereas as of Q2 2020, it composed of four sectors.

In addition, we can look at the composition of these 10 companies [above]. Since the time we have collected this data, which starts from Q2 2006, the companies have been composed of seven GICS sectors whereas as of Q2 2020, it composed of four sectors.

Out of the 10 companies, seven of them are technology enabled and include the likes of Facebook, Apple, Google, Microsoft and Amazon. The non-tech companies include Berkshire Hathaway, Visa and Johnson & Johnson.

Like any crisis, the Covid-19 pandemic has been a catalyst for change, being referred to even as the ‘Great Acceleration’. While it is immediate in some areas, as in the change in consumer behaviour and adoption of e-commerce, in others we may not see the impact in a few years.

What all economic participants realise and agree on is that there is no going back to pre-Covid in terms of business models, as well as consumer preferences and behaviours. What we do expect to see are the following:

- Shift to value and essentials. This, being a social crisis, affects the real economy more than previous crises. Uncertainty about prospects and health concerns, has shifted focus to being mindful of spending and researching brand and product choices before buying

- Increased and persistent utilisation of digital channels. Becoming a requirement due to restricted mobility, this is a trend which appears to have been adopted the most by consumers. The growth has been across the board for all kinds of products and across all age groups.

- Decreasing brand loyalty. Due to supply chain disruptions for certain products and brands, consumers could not find their preferred products at their preferred retailer. This has had an impact on brand loyalty through brand switches, with value, availability and quality being the main drivers.

- A home-based economy. Consumers have increased their consumption of in-home offerings across all sectors. This is not linked to easing of government restrictions, rather than waiting on guidance from medical authorities.

Given these changes, it is only logical and natural that companies which have already adopted such consumer preferences, within their business processes or have changed rapidly to do so, have benefited.

But, as we saw in the lead up to the dot-com bubble in the 1990s – a period of massive growth in the use and adoption of the internet – any company which purports to do business online or related to e-commerce, cloud computing or disruptive growth has seen huge uptake, resulting in near-egregious valuations.

So, when we look at headlines blaring about the peaks made by S&P 500, one tends to forget that it’s mainly the tech-driven companies which have been bought – even over bought maybe. As with any such exuberance with the advent of the new, there is always a dampener as business models get fixed into place. Winners and losers among the adopters will arise, leading to a shake-up in markets.

Looking forward, we expect to see some volatility coming through in markets, as investors rationalise and reassess. But this only serves to separate the wheat from the chaff – leading to the re-establishment of new order.

As investors, we need to be wary and congnizant of these changes and constantly re-assess the relative risks that arise. It is tempting and often simpler to go with the flow. But not jumping the FOMO bandwagon could possibly be the way forward.

Learn more about Dynamic Planner’s benchmark asset allocation.

10 September 2020: Dynamic Planner has confirmed the dates for its Digital Autumn 2020 Training Academies. Following the success of its Spring 2020 Training Academies, which were rapidly moved online in response to this year’s Covid-19 crisis and lockdown, these latest events will also be staged virtually.

The first of the events will take place on 29 September, with the last held on 12 November. There will be 15 virtual events, spanning five weeks and five different topics, aligned to the most pressing demands of financial planning and advice today. Events are free to attend and are open to all advice firm professionals. They will be CPD-qualifying and focused solely on attendees’ learning and education.

Yasmina Siadatan, Sales & Marketing Director, Dynamic Planner said: “While we may not be able to meet in large groups in person, it hasn’t stopped us running our ever popular Training Academies – and this time around we will be doing things a little bit differently! Each week, our Academies will shine a light on a single topic: risk profiling, great client outcomes, assessing target markets, cash flow and finally the client journey A-Z.

“Advisers can join us each week to hear about all five topics or pick and choose as they wish. As ever, we will have leading asset manager partners joining us, who will share with delegates their expert insight and analysis of the latest market news and developments.”

Find out more on our dedicated Training Academy page

Louis Williams – Head of Psychology & Behavioural Insights at Dynamic Planner – analyses the risk profiling process, from start to finish, for your clients. He considers: why are risk profiling questionnaires psychometric? What does psychometric mean?

What are the alternatives for financial advice firms? What are the pitfalls to avoid? And how did Dynamic Planner and Henley Business School successfully navigate those dangers when they created their attitude to risk questionnaire? You can also view our recorded webinar where Louis discusses this, “Why use psychometric risk profiling anyway?” here.

Why do financial advice firms risk profile clients?

First, FCA rules state that firms must and are obliged to understand more about their clients’ investment objectives and risk tolerance, so that they can make them the most suitable recommendations, based on that understanding.

This understanding enables advisers to help the client achieve their objectives and, vice-versa, it helps the client understand the financial planning and advice process more clearly and brings them more into that process. That, in turn, deepens the relationship between the adviser and the client and facilitates fruitful conversations here.

How do advice firms risk profile clients?

The most common approach currently is by a risk questionnaire and ultimately matching clients with investments based upon an agreed risk profile. Clients complete questionnaires, each answer within the questionnaire is scored and those scores are aggregated, resulting in a final score from one to 10, for example, where one represents the lowest level for risk tolerance and 10 the highest level.

Why are risk questionnaires psychometric? And what does psychometric mean?

It is easy to think it is simply about the end product, so to speak, and the measurement of someone’s personality or attitude. But psychometric is also about the process of creating a tool to measure someone in this way. How does the tool interpret and achieve that final measure? Psychometrics therefore are about understanding the tool itself and testing if it is valid and reliable.

Attitude to risk is often stated as a psychological trait, but I would argue it is more complex than that.

If the former were true, our attitude to risk would be identical in different scenarios – for example, by taking a ride on a rollercoaster. But in that example I know my attitude to risk is very different compared to my attitude to risk concerning my finances. Therefore, attitude to risk is not that simple and as a result, we need to ensure that we create a tool for measuring what we want it to measure: specifically, someone’s attitude to risk concerning their pensions and investments.

Are there alternatives to risk questionnaires?

There are other methods which purport to be more objective than risk questionnaires, because, for example, they are founded on measuring someone’s experience or past behaviour in this context. But that doesn’t necessarily mean they are more valid.

One alternative is the Multiple Price List method, where clients are given choices and they make decisions until a tipping point is reached regarding their risk tolerance.

This method can be problematic because of something called extreme aversion bias, where the client continually opts for the safe, middle option. One example here might be going to the cinema and choosing a regular bucket of popcorn, avoiding choosing the small or large bucket. In that way, the client here is not fully considering the consequences of their choices. It could also be argued that the Multiple Price List method does not measure a client’s capacity for risk.

Are there other alternatives to consider?

Yes. One is a financial anamnesis, similar to how a doctor would look at a patient’s background and family history to discover more about them. But of course, this method can be unreliable when the aim is to understand more about the individual client, not their family or any stereotypes.

We can, of course, look at the individual’s investment experience, and Dynamic Planner’s risk questionnaires do consider this as part of a complete, holistic approach. On its own, though, this has problems, because what if the individual has never invested before?

A final alternative we can consider for the moment is a goals-based method – a top-down approach which looks at the risk required to ultimately achieve the returns a client desires to reach their final investment objective. But this avoids a conversation about an individual’s attitude to risk and is again arguably incomplete.

Do psychometric questionnaires have limitations?

In short, yes. A client’s answers can be flawed, but that then can fall back to the adviser to ensure that the client is fully engaged with and fully understands the process and questions.

On another side of the coin, we can acknowledge that the tool itself we are using has flaws, which is what happened in 2017 when Dynamic Planner first partnered with the University of Reading and Henley Business School to create a new and better tool here – a tool which was not only arguably better, but had purpose, as we have seen, behind the design.

What are the potential pitfalls to using a psychometric questionnaire?

- A questionnaire might not have been built with psychometric testing theory

- The terminology in questions might be very complex – or assume prior investment or mathematical knowledge

- Questions might overlap and repeat themselves in some way, which can be frustrating for the respondent and invite problems, because the client naturally answers differently, assuming each question aims to elicit a fresh response

- Finally, a question set might not capture and measure multiple dimensions of risk and ignore, in particular, the importance of emotions here. How does someone feel about risk?

How can you combat any questionnaire flaws?

First, we need to think about the questions themselves and how they are constructed. Are they open or closed questions, for example? Further, what does each question measure and how do we measure someone’s response? What different options or rankings do we give an individual for their response?

We also need to think about the number of questions we include and reach a balance, between a suitably holistic understanding of a client’s complete attitude and emotions, but avoiding fatigue setting in when someone is completing the questionnaire.

Furthermore, what is arguably vital is striking a balance between using the same response options for questions and the direction of phrasing in each question.

It is usual to have responses ranging from ‘strongly agree’ to ‘strongly disagree’ throughout. However, are questions phrased in different directions, so it effectively engages the client and avoids encouraging an individual to disengage and click ‘strongly agree’ each time?

The questions themselves must be direct and tailored to measure someone’s risk tolerance regarding their finances. However, we need to be careful that they are not so specific that they question the individual about actual investment choices, like the Multiple Price List method. Therefore, we need to avoid hypothetical questions, any ambiguity and also double-barrelled questions, which demand the client tries to answer two questions in one, which of course could prove very problematic.

Once we have our final set of questions, we of course have to test it, which was something Henley Business School and Dynamic Planner realised was vital when they designed their risk questionnaire in 2017 before its launch in early 2018.

To test it, we can use pilot studies and / or focus groups to discover potential flaws in the questions; examine their validity; and also consider any ethical issues perhaps not previously considered.

We can also test engagement here. How long does it typically take a respondent to complete the questionnaire? Are they just ‘straight lining’ and clicking the middle option, as we have seen, for each answer? We can also gauge if questions are eliciting an appropriate range of responses – and if people understand questions and are therefore answering them how we would want.

After initial testing, it is then possible to compile all your pilot data and run analyses to highlight if any questions are effectively redundant or if there are inconsistencies in what we, holistically, are asking respondents. Does that make our question set weaker, as a whole?

How did Dynamic Planner and Henley Business School create its risk questionnaire in 2017?

First, as we have seen, they asked, ‘What are we measuring here?’ Answer: attitude to risk, which they broke down into three elements based on academic theory – attitude to risk concerning financial gains which can be made, concerning losses and concerning the context in which a decision is made. How do those different components frame someone’s attitude to risk?

They therefore considered what are termed drivers, constrainers and enablers in relation to an individual’s motivation to either take risk or feel inhibited when taking risk.

Henley Business School and Dynamic Planner also considered different types of attitude structures and how an individual adopts them to evaluate a product or a concept. What are attitudes based on – logic, emotions or on observations or interactions they have experienced?

The final questionnaire created in 2017 encompasses all these multiple dimensions regarding an individual’s attitude to risk. It was then robustly tested using a large population set. Focus groups were also used to help test what advice firms and their clients see when they begin the risk profiling process in Dynamic Planner today.

Hear more from Louis Williams, Head of Psychology & Behavioural Insights, in this webinar recording: “why use psychometric risk profiling anyway”.

If you are not already a Dynamic Planner user – and would like to find out more about how we can help you and your firm – please get in touch.

By the Fidelity Multi Asset Income Team – Eugene Philalithis, George Efstathopoulos & Chris Forgan

We are yet to see this extent of recovery in fundamentals for equities and dividend payments, and while earnings have generally been better than expected across regions and sectors, there is the risk that they could stall from here.

In contrast to equities, the rally in credit markets has a healthier spread, where the narrowly led nature of the equity market indicates fragility, acutely seen for US equities.

It’s no secret that both equity and credit markets have seen a strong recovery after the aggressive sell-off to their March lows, and the bleak economic data that followed. We have seen a liquidity-driven rally through which credit especially has staged an impressive recovery.

Against this backdrop, we have maintained our bias for credit risk over equity risk and continue to focus on assets further up in the capital structure for income security and capital preservation. In particular, high yield bonds and emerging market debt (EMD) in hard currency are two key areas of conviction that we have been adding to over recent months.

Regionally, we see Asia as favourable compared to other regions – both under the base case scenario and in terms of the upside / downside ratio, although we are starting to become more constructive on other regions. Valuations also continue to be attractive given spreads remaining high versus their historical ranges, and importantly, the boosting of yields supports income sustainability.

Within high yield, our preference for Asian high yield has persisted over recent months due to a number of factors including Asian companies having reduced debt on their balance sheets, supportive funding conditions. The domestic focused nature of the Asia high yield universe also offers some insulation against any sustained trade war resurgence.

However, we are now moving towards a more constructive view on US and European high yield, which we think offer a more attractive risk-reward against their respective equities. The fundamental outlook for EMD has improved with the re-opening of the world’s major economies, upward oil price trend and the scale of IMF support. We therefore continue to rotate from EMD local currency to hard currency due to its attractive valuations, defensiveness relative to local currency EMD, and more upside participation in oil markets.

Of course, inherent risks remain within credit – particularly amongst the most challenged emerging market issuers, which have a lack of fiscal headroom to continue quantitative easing over a prolonged period – and so when we evaluate credit asset classes, the downside scenarios are interrogated closely.

Overall, after a strong rally, our preference for credit over equity risk is still intact. However, a more finely tuned credit asset allocation is needed as the risk-return asymmetry is more attractive in certain areas of credit than others. We believe that a multi asset approach that can allocate flexibly across the spectrum of income paying assets, and navigate the caution required around various credit assets, makes our income-focused strategies well positioned to deliver on their objectives.

Important information

This information is for investment professionals only and should not be relied upon by private investors. The value of investments (and the income from them) can go down as well as up and you may not get back the amount invested. Past performance is not a reliable indicator of future returns. Investors should note that the views expressed may no longer be current and may have already been acted upon. The Fidelity Multi Asset Income funds take their annual management charge and expenses from your clients’ capital and not from the income generated by the fund. This means that any capital growth in the fund will be reduced by the charge. The capital may reduce over time if the fund’s growth does not compensate for it. The Fidelity Multi Asset funds use financial derivative instruments for investment purposes, which may expose the fund to a higher degree of risk and can cause investments to experience larger than average price fluctuations. The value of bonds is influenced by movements in interest rates and bond yields. If interest rates and so bond yields rise, bond prices tend to fall, and vice versa. The price of bonds with a longer lifetime until maturity is generally more sensitive to interest rate movements than those with a shorter lifetime to maturity. The risk of default is based on the issuer’s ability to make interest payments and to repay the loan at maturity. Default risk may therefore vary between different government issuers as well as between different corporate issuers. Sub-investment grade bonds are considered riskier bonds. They have an increased risk of default which could affect both income and the capital value of the fund investing in them. Changes in currency exchange rates may affect the value of investments in overseas markets. Investments in emerging markets can be more volatile than other more developed markets. Investments should be made on the basis of the current prospectus, which is available along with the Key Investor Information Document, current annual and semi-annual reports free of charge on request by calling 0800 368 1732. Issued by Financial Administration Services Limited, authorised and regulated by the Financial Conduct Authority. Fidelity, Fidelity International, the Fidelity International logo and F symbol are trademarks of FIL Limited. UKM0820/32078/SSO/NA

A client whose financial adviser had relied upon performance scenarios required in a Key Information Document (KID) at the start of this year, may have been unprepared for this year’s coronavirus crisis.

The same could also potentially be said if their adviser relied upon past performance of an IA sector to highlight potential returns in future – or made simplifying assumptions like ‘market recovers within 1yr’.

Such techniques are employed by advisers while, of greater concern, the performance scenario approach required in KID’s – which already applies to Packaged Retail Investment and Insurance-Based Products (PRIIPs) – is expected to be applied to all UCITs funds from the end of 2021.

The 2020 coronavirus crisis will cast a spotlight on the use of historically based performance statistics as a guide to future risks and returns.

Problems with historic performance

For fund managers, the Summary Risk Indicator (SRI) required in a KID and the associated performance indicators are calculated using five-year historic performance data as the key determinant.

While the SRI requires the use of value-at-risk analysis, taking into consideration a probabilistic distribution of potential returns and losses, the dispersion of returns during this year’s crisis underlines how sweeping a categorisation this is and why it is problematic to prepare clients for their investment journey using it.

Reviewing the range of UCITs funds, which have their current risk indicator score calculated at 3 (from a maximum range of 7), yields an array of 16 IA sectors with well over 200 primary funds – equity, mixed asset or bond-oriented, with the latter including local currency emerging market debt funds.

The situation worsens when reviewing the forward-looking performance scenarios required on a KID. Looking at a popular, volatility managed, multi-asset fund with an SRI of 3 out of 7, an ‘Unfavourable’ outcome reveals the investor might be expected to only lose 1.48% after a four years and further, can expect to enjoy a positive return over the holding period of seven years of 1.18%.

‘Moderate’ and ‘Favourable’ forecasts, meanwhile, project persuasive growth figures over these time frames.

The classic criticism of this approach is well documented and arguably well deserved. As Deloitte has put it previously: “For many funds, bullish market conditions in recent years may result in overly optimistic projections. Trends may be exaggerated in case they are projected over long investment horizons, as very positive past performance is assumed to continue indefinitely and the potential cyclical nature of markets is not taken into account.”

Crises like 2020 can happen

For investment advisers, reliance upon historic IA sectors performance to explain potential risks and returns does not work either. The range of outcomes in a single fund sector is often so wide as to be meaningless in terms of expectation setting for a client’s portfolio.

Assuming a sector’s performance history will continue to repeat itself is of course simply wrong. Adopting this approach, for example, at the beginning of this year would have believed a crisis like Covid-19 could not happen.

Relying on deterministic projections to help clients plan for the future and risk match portfolios only introduces more limitations – and even if they are married with ‘market crash’ and recovery assumptions, because these ‘crashes’ too rely in main on historical data.

The emergence of contemporary asset allocation-driven portfolio construction and financial planning tools echoes thinking that, according to research, more than 90% of the variability of returns of a typical portfolio is explained by asset allocation.

A progressive, more robust answer

Progressive models, in comparison, adopt a combination of historical inputs – returns, volatility and asset class correlations – alongside inputs reflecting prevailing conditions, like inflation, bond yield spreads and forward-looking expectations for global growth and dividend pay-outs.

These inputs are then fed into an asset model, which assumes a distribution of returns, the extremes of which may not have been experienced yet and can only be seen in ‘tail risk’ events.

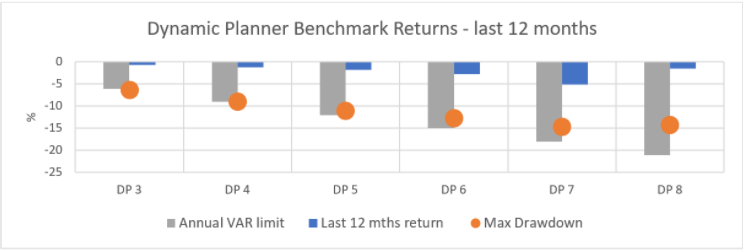

Our experience at Dynamic Planner, so far in 2020, is that this provides a more robust approach for managers and advisers to construct and plan portfolios. The graph below shows the observed performance of the Dynamic Planner – MSCI benchmarks over the last year, against their expected value at risk (calculated at a 95% confidence limit) alongside the maximum drawdown experienced.

This value at risk statistic is used with the client during the risk profiling process, so the adviser can be sure it is a consistent basis for matching the portfolio and there is no risk of ‘miscalibration’, as the FCA describes it.

The use of asset allocation-driven, forward-looking models, to assess potential returns and losses for clients, has been growing rapidly since 2008 and the global financial crisis. They represent not just an improved mechanism for projecting and for setting investor expectations, but also for matching them to investments that are more likely to perform within these expectations in a way that is fair, clear and not misleading.

They greatly improve upon historical or deterministic models and mean clients sat with their advisers don’t look back in anger while planning a bright future.

Dynamic Planner has expanded its fund risk profiling service to include investment trusts. Broadening the range of investment vehicles analysed by Dynamic Planner, the first trust to be risk profiled is the Seneca Global Income & Growth Trust plc, assigned a Dynamic Planner Risk Profile 7 (on a 1-10 scale).

To date, Dynamic Planner risk profiles more than 1400 model portfolios and open-ended funds and plans to increase the number of investment trusts analysed. Financial advisers will then be able to apply the same approach to assessing the suitability of different solutions – whether an OEIC or investment trust.

Dynamic Planner Proposition Director Chris Jones said: “Trusts are the vehicle of choice for many investors and while choice is all important, we believe it’s vital to maintain a consistency of approach when assessing suitable investment solutions.

“For more than 17 years, we have helped thousands of advisers understand the risk profile of thousands of model portfolios and open-ended funds. We can apply this same model to assess the risk profile of investment trusts, because we analyse all risk characteristics of underlying holdings.”

Chris continued: “We are delighted to welcome the Seneca Global Income & Growth Trust plc to Dynamic Planner. We have conducted in-depth analysis of the underlying holdings of the Trust, looking back over several months. By utilising our in-house research, which now spans over 25,000 individual securities, we calibrated the Trust’s holdings to our latest capital market assumptions, enabling us to assess its expected volatility journey.

“This process includes the evaluation of gearing on individual holdings and this was also carefully considered at the wrapper level for the Seneca Global Income & Growth Trust plc.”

David Thomas is Chief Executive of Seneca Investment Managers Ltd and the Trust’s investment manager.

He said: “We were keen to have this analysis undertaken, since Dynamic Planner has provided formal risk profiling oversight of our similar open-ended multi-asset funds for a number of years. We are very comfortable with their rigorous process and saw no reason to exclude the Trust, just because it was closed-ended, given its inherent multi-asset diversification and the tight Board control over the level of gearing applied to the underlying assets.”

Nick Britton – Head of Intermediary Communications at the AIC [The Association of Investment Companies] – said: “As part of our ongoing education programme, we’ve trained thousands of financial advisers about investment trusts and we’re keen to break down barriers to their wider use wherever possible.

“One of these barriers has been the lack of availability of risk profiling for investment trusts, which many advisers have told us is essential to their research process. This news from Dynamic Planner is an encouraging sign that one more barrier to investment trust use is on the way to being removed, smoothing the path to wider adoption of trusts among advisers.”

Find out more about Dynamic Planner fund research

Looking back over the first half of the year, January seems to be a completely different era. In between, an unprecedented health crisis has uprooted medical care, financial markets and the prospects for the global economy. In spite of the sharp rebound in markets, allocators are still reeling from the vehemence of the sell-off.

As economic numbers are now released, the severity of the downturn becomes slowly apparent, with further contractions expected for the rest of the year. Repeat lockdowns and voluntary social distancing, as well as uncertainty around re-opening, continues to negatively impact economic activity. Consumer confidence remains the priority for the post-lockdown world.

While unemployment has been kept in check with financial support from governments, as these policies stand to run off, as surely they will, uncertainty about jobs could delay consumption, leading to further decline in activity and a vicious cycle of defaults and further unemployment. These could possibly freeze up financial conditions, exposing vulnerabilities of already over-indebted households and corporates.

Though we have witnessed a sharp rebound in risk assets, we do wonder whether the market is pricing in a quicker recovery than what the ground reality is telling us. Analysis shows that the S&P 500 Index and Consumer Confidence has historically trended together, but recently there has been a decoupling, with a parting of ways for the two.

S&P 500 / Consumer confidence

As we look forward, what started feeling like a macro shock has slowly started to morph into a macro regime change. Government borrowing across the developed economies have reached eye watering levels, the proceeds being used to buying back government and for the first time, corporate debt, both investment grade and high yield.

Corporates themselves are going through an identity crisis, with business models and profitability coming under pressure from changing consumer preferences. Usage in public transport and workplaces have been way below baseline, with residential numbers higher than baseline in spite of re-opening. Thus, sectors like retail, energy and commercial property come under pressure.

Google UK mobility data

Even as business activity restarts, heightened health and safety concerns will continue to slow progress. It is likely that the recession we are in will be long and drawn out. Thus, with this context in mind, valuations of equities and fixed income, especially credit, appear to be stretched.

If markets were being irrational before the crisis, it looks to continue being irrational for some time to come. In fact, John Maynard Keynes’ pithy comment comes immediately to mind, ‘The markets can remain irrational longer than you can remain solvent’. In times like these, portfolio risk comes to the fore for our allocations and client solutions.

To achieve investment goals and meet the needs of clients, we need to stay invested, as the alternative would be inherently unproductive. Without risk, we would not have a return. Thus, we need to focus on putting together a portfolio of ‘desirable’ risks – risks which can be mitigated if the need arises, like the risk arising out of investments like equities and fixed income.

Risks like liquidity are the undesirable ones as there is nothing one can do if no one wants to buy illiquid holdings. Focusing on risk in this way helps us achieve our objectives, while keeping our powder dry to take opportunities as and when they arise, which they certainly will.

Clients in decumulation – What is the best defence against market volatility?

[vc_row type=”in_container” full_screen_row_position=”middle” column_margin=”default” column_direction=”default” column_direction_tablet=”default” column_direction_phone=”default” scene_position=”center” text_color=”dark” text_align=”left” row_border_radius=”none” row_border_radius_applies=”bg” overlay_strength=”0.3″ gradient_direction=”left_to_right” shape_divider_position=”bottom” bg_image_animation=”none”][vc_column column_padding=”no-extra-padding” column_padding_tablet=”inherit” column_padding_phone=”inherit” column_padding_position=”all” background_color_opacity=”1″ background_hover_color_opacity=”1″ column_shadow=”none” column_border_radius=”none” column_link_target=”_self” gradient_direction=”left_to_right” overlay_strength=”0.3″ width=”1/1″ tablet_width_inherit=”default” tablet_text_alignment=”default” phone_text_alignment=”default” column_border_width=”none” column_border_style=”solid” bg_image_animation=”none”][vc_column_text]Whether you feel good, bad or indifferent about it – video chat on platforms like Zoom very quickly became synonymous with wider events this year.

Media advertising soon caught up and the distinctive images were everywhere. That trend has inevitably crossed over into professional walks of life, including of course financial services.

Indeed, four in 10 industry professionals say they are now using video chat to help conduct new business at their firm. The finding is part of a June 2020 survey we conducted of a cross-section of Dynamic Planner users, responding to questions concerning new business they had conducted – with new and with existing clients – in four months from February to May this year.

Video chat was one of two key ways firms engaged with clients, in a first meeting for new business, with 40% revealing they used it. Respondents added that clients were comfortable with the platform, through using it socially in lockdown and said that the time savings professionally, through not having to travel to client homes for meetings, were huge.

One person wrote:

“Video conferencing has meant we can speak with a client in Belfast, Devon and Essex in the same day. Face-to-face would have taken a week.”

The most popular way to host a first meeting with clients this year, at 44%, was a telephone conversation, while 10% said they used email. Prior to a meeting, just over half, 51%, said telephone was how they initially communicated with a client – with a quarter, 25%, using email and 17% employing video chat in that scenario.

In an interview in late-March, Lee Whiteside, an adviser in the North West, revealed he first started using Zoom – in combination with Dynamic Planner – this year once lockdown began.

He said of the platform:

“You can share documents with the client and do pretty much everything you can face-to-face… and at the point of sale. It’s actually easier, in one way and a really good of working. You do start to think, ‘Why don’t I run my business like this all the time?’”

David Owen, of Lifetime Connect in Hertfordshire, commented in April:

“Hopefully, some advisers will embrace this change and carry on holding client meetings remotely in future. And once we start to get up to speed and move away from things like wet signatures, for example, we can be in a position to work more effectively.”

June’s survey of Dynamic Planner users ran to 21 questions and covered multiple issues around new business for firms.

Concerning barriers to new business, 42% answered that they were already running at capacity at their firm, while 20%, one in five, said they did not have time to pursue new business. 22% added that opportunities for new business were simply not there and 12% said they could not recruit enough people to meet the demand.

Compared to Q4 2019, the survey questioned, ‘How is your level of new business in 2020?’ 46%, nearly half, said their level of new business was lower, while a third, 33%, said it was the same and just over a fifth, 21%, said it had been higher this year.

Time, or a lack of it – despite us being more time-rich in many ways, working from home in lockdown – was a recurring issue.

The survey asked, ‘How much time does your new business process take, from initial contact to completion?’ Less than 3% said it was faster this year, while 38% revealed it was slower and 60% said it was the same. When asked to elaborate, ‘Why?’, respondents described delays with post and providers; collaboration among colleagues, hampered by people working in isolation remotely; and a lack of support from admin team members, who had been furloughed.

‘Why were clients and prospects getting in touch?’ Understandably, the top reason at 23% was market volatility, followed on 19% by a desire to get finances and life in order – and on 18% by income in retirement. 14% said that lockdown had given them time to really look at their finances, while 10% said lockdown had made them re-evaluate and had triggered their inquiry.

Lee Whiteside continued in March:

“Clients, of course, are worried at the moment. We’re seeing pretty significant losses, even in quite low risk portfolios. There’s no point avoiding client phone calls. It’s about reiterating messages and revisiting client objectives. It’s a reassurance piece as much as anything.”

Nick Ryan, with Yellow Bear Financial Consultancy in Buckinghamshire, said earlier this year:

“Of course, I’m not happy about the situation as their adviser and they’re not happy as clients. But I am pleased with how people have reacted – I don’t think I actually could have asked for a better reaction. Hopefully, that was down to the preparation work we have together done in readiness for this type of market fall-off.”

David Owen added of the crisis’ impact:

“Rather than disrupted, I would say it has actually enabled us as a business. We’ve not hit the pause button, we’ve carried on – just with a different rhythm and routine.”

What did our survey reveal? ‘10 learnings from advice firms successfully generating new business in the pandemic’. Download your copy of our guide here.[/vc_column_text][/vc_column][/vc_row]

By Sam Liddle, Sales Director, Church House Investment Management

If you’re a young person, with no job and little prospects, then Rishi Sunak’s recent jobs announcement would have given you cause for hope for the future. But it was less positive for committed savers, with retirement on the horizon, and recent retirees wondering what income to draw from a ravaged portfolio.

If anything, the Chancellor’s summer statement was notable for not axing the triple lock that supports rising state pension payments. What’s more, the demographic picture is getting less helpful, as populations grow older.

The latest EU projections say that by 2100 there’ll be less than two working people to fund every retiree. That’s a far cry from the current three workers to one retiree. Given that 2020’s markets have been unhelpful to those near or in retirement, now is probably a helpful time to offer the reminder that income can be generated from a bottomed-out market.

Readers will no doubt be aware of the risk / reward dynamic. In bull markets, investment strategies pile into risk assets to capture these market gains. And this works very well. Until it doesn’t. As all-too-many retirees find, risk assets can quickly turn into huge liabilities.

This is something we saw almost universally when Covid-19 drove economies into lockdown and stopped history’s longest bull market in its tracks earlier this year. Stock markets were decimated, unemployment rates soared, and central bank support once again slipped into unprecedented territory. Value was wiped from almost every investment strategy, but those with the highest risk allocations were left the worst-affected.

For younger investors, investments are not typically their primary source of income, and they have time on their side. The same cannot usually be said for retirees who rely (or plan to rely) almost entirely on their investments for income – and this need doesn’t disappear just because markets are crashing.

Unfortunately, this can give rise to a well-known and potentially serious issue called ‘sequencing risk’ – also known more colloquially as ‘pound-cost ravaging’. For retirees wanting to draw income from their portfolio in falling markets can leave capital depleted and, in turn, future income permanently lower.

After all, while a 10% loss in any one year would require an 11% gain to break even, a 30% loss requires a rise of 43% to break even. Relatively short-term losses can have a lasting impact, and drawdowns only emphasise this.

The result? Either those affected ultimately accept a reduced level of income, or their pension pot will deplete further and further until a return to its initial value becomes virtually impossible to achieve. Put another way – it is the effect of compound interest in reverse.

With Covid-19 wiping hundreds of billions off pension pots across the UK, pound cost ravaging is a harsh reality that many will now be facing. So, how can retirees minimise the long-term impact of wider market performance?

To start, the investment performance of a fund relative to another should take a back seat. After all, funds posting large gains could indicate a higher proportion of holdings in risk assets and equally huge losses could follow when markets turn against them. Instead, a much more important consideration is whether the product can provide for their retirement goals consistently.

This will almost always involve providing income and preserving capital as much as possible in all market conditions. This is where multi-asset and, more specifically, absolute return funds come to the fore.

They have often been misunderstood with investors relying on performance tables to determine their investment strategy. However, the very nature of well-managed absolute return is to smooth returns and limit losses rather than ride the rollercoaster at the mercy of single asset movements.

With careful investment across asset classes, it is possible to target a 3% to 4% annual income drawdown with capital remaining largely intact over the longer term and with the income growing in line with inflation.

It also helps to have a clear focus when managing these funds. Do the fund managers themselves invest in their own strategies? Do their families? For example, our own fund, the Church House Tenax Absolute Return Strategies fund was launched in 2007 borne out of a single client’s priority to protect the value of his capital and take a consistent income. They’re still invested today. As are the fund’s managers.

This is a really effective stabiliser as just about every decision made on the fund is made through the lens of this investor and that of our families and own retirement pots. Prevailing market conditions have exposed many investment funds and, in so doing, have sadly had a devastating effect on retirement pots. We must start to learn from these times. By keeping volatility to a minimum throughout market cycles, a much greater emphasis can be placed on overall capital preservation relative to peer funds that sacrifice ultra-low risk for a shot at greater returns.

Of course, well-run multi-asset absolute return funds tend not to participate in the entirety of the upside when wider markets are booming, but that doesn’t matter. When the tide changes, their ongoing provision of ‘cash plus’ returns and capital preservation (or at least minimal losses relative to the markets in which they invest) will look a whole lot more appealing to a retirement investor than a blown-out account.

Building a retirement pot should be a marathon not a sprint.

Find out more about Dynamic Planner Risk Managed Decumulation funds – designed for your clients making regular withdrawals, typically in retirement

We have all been grateful for a little help at some point this year. Whether it has been an understanding boss, or a driver delivering your weekly food shop – it has been very welcome.

We have also been happy to help others and it has felt good to give back, even in only a small way, when we have had the chance.

At Dynamic Planner, we have heard stories of advisers and firms extending that spirit and sense of community to clients – speaking to them at the start to lockdown, so that they can hear a friendly voice; or helping them get their head around Zoom, so that they can ‘meet’ with friends and family.

We spoke to people from 10 different advice firms this year, who have all adopted Dynamic Planner within their financial planning process and we asked them, ‘How has its technology helped you most this year?’ Below, is what they said.

1. Financial plan with your clients in real-time

“I started using Dynamic Planner’s Client Review at the start of 2020 and it has changed everything for me. It’s just brilliant. It makes my life so much easier, because now I can sit and go through everything with the client in real time, whereas before I was having to give my paraplanners so much paper work after a meeting for them to input.

“I now sit with the client and say, ‘This is where you are now. This is what your portfolio was worth a year ago. This is what you’ve done in the last 12 months. And this is what it’s worth today’. We can recheck their attitude to risk and the whole process becomes much more interactive.”

Louise Jones, Ivor Jones & Co

“The great thing about Dynamic Planner is it’s very easy to screenshare; it’s very easy to navigate; you can’t really go wrong; and the Client Review report – you can’t really undersell it. It allows advisers to articulate to clients their value, in a stylish way that appears like it has been completed by a team of 10 people, who worked for hours to create it.

“To be able to create a presentable report for a client, in a relatively short period of time; to share it with them via your screen; then to give the client the context and financial planning tips is brilliant.”

David Owen, Lifetime Connect

2. Improve your clients’ understanding of risk within their portfolio

“At the end of the day, everybody knows their investments are going to go up and that they are going to go down. But what is key is that it is communicated in a manner and in language that the client clearly understands. As an adviser, it is my job to do that and that’s what Dynamic Planner’s Client Review report allows us to do.”

Neil Gilbourne, 3R Financial Services

“It is up to the adviser to explain risk – because there is risk in everything the client does. Even in an old-fashioned risk profile 1, ‘Under the bed’ there is the risk of theft and of inflation. That is where Dynamic Planner helps us so much, in pictures and words, to explain that.”

Kevin Walsh, Home & Finance Ltd

“Where Dynamic Planner has been brilliant this year is if you are rebalancing a portfolio for a client. You can show them where their portfolio or where a fund sits on the ‘Efficient frontier’, in relation to the risk and return of the benchmark asset allocation for each risk profile. That can be a really important visual for a client.”

Serena van der Meulen, Van der Meulen Associates

3. Enable your clients to complete risk questionnaires on their own remotely

“Dynamic Planner has helped even more during lockdown this year. We’ve been able to send clients a link to complete their attitude to risk, prior to a meeting and people have had time on their hands, so they have been getting on with it. I sent one link out and it came back within five minutes.”

Susan Hill, Susan Hill Financial Planning

“That completely changes the conversation and allows you to go to that meeting with a risk profile report and talk it through with the client and ask them, ‘Are you comfortable with that level of risk?’

“It brings the whole conversation alive and makes it feel more real for the client, because they can see with their investments at a risk level, ‘Plan for this’, ‘Be prepared for this’ and ‘Be pleasantly surprised by this’. The client can see, ‘Okay, I’ve got £100,000. How is that going to perform at a risk profile 7, or a risk profile 4?’ It’s been really good.”

Jack Igglesden, Radcliffe & Co

4. Enable easy collaboration among colleagues and teams

“Using Dynamic Planner, advisers can complete reviews themselves or ask for help from Admin – who, in that instance, can produce the main part of the report before an adviser amends, where necessary.

“Working in that framework makes the process easier and, from a compliance perspective, we know reviews are covering everything necessary. It stops us having 11 different processes for 11 different advisers, which is difficult to monitor.

“Introducing change always has its challenges and if you try to introduce too much, you can get less buy-in. At any firm, you will always get early adopters of something new and others who will follow at the end. But once you have introduced change and people become used to a new process, it no longer becomes an issue. Dynamic Planner is easy to use and it doesn’t require a huge amount of training, because it is so user friendly.”

Clare Edes, Skerritts Chartered Financial Planners

5. Increase your firm’s capacity to service more clients

“I completed a review for a client the other day in about 20 minutes. Obviously, nothing much was required – and if a review is more complex, it will of course need more time. But what Dynamic Planner has allowed me to do is review around 100 to 120 clients each year and have greater capacity, definitely. The report itself is nicely presented; it keeps MiFID happy; and it’s extremely quick to produce.”

Nick Ryan, Yellow Bear Financial Consultancy

6. Match your clients with suitable investment portfolios

“It is about reassuring clients that they remain on the right track, with regards to risk and if there are changes to how much risk they want to take in future, we can use Dynamic Planner to map where they are now and where they need to be in future.”

Lee Waters, Barwells Wealth

If you are not already a Dynamic Planner user – and would like to find out more about how we can help you and your firm – please get in touch.