By Maria Municchi, Fund Manager, Sustainable Multi Asset Fund Range, M&G Investments

Sustainable investment approaches look to the future, by investing responsibly and supporting the environment and society. So sustainable investment strategies should aim to achieve objectives that include meeting financial goals, as well as preserving our planet’s resources, recovering its climate and making life better, more equal and inclusive.

A multi asset approach to sustainable investing allows investors to make use of a diverse range of asset types to achieve their objectives. Diversification offers investors the opportunity to spread their risk, with the intention of avoiding concentration in one or a few themes or assets classes that might introduce unwanted volatility in their returns. These are likely to include traditional asset classes of equities, bonds and cash, but also may now incorporate such things as infrastructure, green bonds, social bonds and speciality funds.

Equities within a sustainable strategy provide an ownership stake in businesses that are following a sustainable business model or are transitioning towards one.

Bonds, or fixed income securities, represent a way of lending to companies that take a responsible approach, or even directly to fund specific projects or initiatives that aim to make a positive difference, often from supranational entities. We also include buying bonds issued by governments in our sustainable strategies, as governments around the world will typically use the bulk of their income, be they tax revenues or bond proceeds, for the good of their society.

This may be in the form of providing education, welfare payments, healthcare or public pensions. Of course, any government may undertake practices that some find unpalatable, and we will refrain from holding their bonds where we believe the negatives sufficiently outweigh the positives.

The pressing challenges facing environments and society know few borders and investors have extended their scope worldwide, so taking a global approach is a necessity in our view. In our sustainable strategies, we aim to find value opportunities that we believe are attractive, wherever they may arise.

The techniques and tools applied in investing sustainably continue to evolve. What may have previously amounted to simply excluding investments in certain sectors has developed into more sophisticated approaches. These approaches may require greater and more detailed analysis on the work companies are doing to meet their sustainability objectives, as well as identifying and measuring their achievements. This may involve extensive resources, which may only be available to the larger organisations.

As the spectrum of sustainable investing has developed, we have incorporated additional features to existing first stage exclusions on such factors as adherence with United Nations Global Compact Principles, as well as sector and industry exclusions. Considerations of how a potential investment may be judged on its environmental, social and governance (ESG) behaviours and contributions have now been integrated into our investment process. We believe that adopting a positive ESG-tilt approach, by looking to focus on investing in entities that have more positive ESG characteristics compared to their peers, should form a core element of how we build portfolios of sustainable assets.

To achieve this, we believe it is appropriate to use the access we typically have, as large-scale investors, to the management and ownership of companies, to engage with them to gain clearer insights into the sustainability of their business plans and processes. Engagement can help clarify investor understanding, encourage greater transparency and identify tools to measure progress towards sustainable objectives. Beyond that, we also seek to incorporate investments that actively aim and intend to make a positive impact on some of the world’s pressing environmental and social challenges.

Across the investment world demand for sustainable or responsible investment products is growing and even gaining momentum. Individual savers and institutional investors alike have recognised that investing to sustain the planet’s resources, improve its social well-being and look to the world’s future, can go hand in hand with seeking to achieve financial security and M&G feels equally strongly about that and have been developing processes and products to help meet those goals.

Sustainable multi asset investing at M&G

We understand that while investors may have objectives relating to a sustainable future that are similar, their expectations for financial returns and their tolerance for risk may differ.

To meet that demand, M&G has launched a new range of sustainable multi asset funds, which we believe can satisfy these alternative appetites. Spread across cautious, balanced and growth profiles, these actively-managed, risk-targeted solutions combine strategic and dynamic asset allocation decisions originating from our long-standing Multi Asset team, invested in assets that incorporate positive ESG-tilt and positive impact characteristics.

All those decisions are encompassed with an overarching climate focus, which concentrates on carbon intensity and climate adaptability, which we believe is crucial to achieving a more sustainable global economy.

The value of a fund’s assets will go down as well as up. This will cause the value of your investment to fall as well as rise and you may get back less than you originally invested. The views expressed in this document should not be taken as a recommendation, advice or forecast.

For financial advisers only. Not for onward distribution. No other persons should rely on any information contained within. This financial promotion is issued by M&G Securities Limited which is authorised and regulated by the Financial Conduct Authority in the UK and provides ISAs and other investment products. The company’s registered office is 10 Fenchurch Avenue, London EC3M 5AG. Registered in England and Wales. Registered Number 90776.

On 1 February 2021, the FCA’s ‘investment pathways’ were introduced and while consequences are keenest, in this context, for non-advised investors, advice firms and their clients too are not unaffected.

This regulatory development can be spun as a risk to firms potentially losing valuable new business. Or an opportunity for firms to separate themselves and showcase the value of their service.

What are ‘investment pathways’?

To recap, why has the FCA introduced ‘investment pathways’? In short, post-2015 and pension freedoms, the regulator is worried people will lose out on income in retirement through a marriage of poor decisions – i.e. holding cash – and lack of access to investments.

Cue ‘investment pathways’ to give individuals in pension drawdown access to simple, good-value investments broadly matching income goals. People entering drawdown or transferring to a drawdown account will now have three options:

- Choose ‘investment pathways’

- Choose their own investments

- Stick with investments they already have

If they pick ‘investment pathways’, pension providers must now offer customers four new options, designed around four, broad retirement income objectives:

- I have no plans to touch my money in the next 5yr

- I plan to use my money to set up a guaranteed income (annuity) within the next 5yr

- I plan to start taking my money as a long-term income within the next 5yr

- I plan to take out all my money within the next 5yr

Pension providers will offer investors a single investment solution, depending on which pathway they choose. Okay. But how does this affect advice firms and their loyal clients?

Implications for advice firms

First, providers must offer options to both advised and non-advised customers, so clients of advice firms will be aware. Second and perhaps more important, non-advised options with a 75bps anchor may well become a ‘standard’ against which regulated advice is measured.

When advising clients on drawdown investments, advisers should include consideration of pathway investments (similar to RU64 rules when recommending a personal rather than a stakeholder pension). By implication, this means they will have to outline why their recommended solution is more suitable than the pathway fund the client could have chosen.

In addition, if the adviser did not give the client a personal recommendation on the transaction to move into drawdown within the last year, the client must be taken through the ‘investment pathways’ process.

How then can firms demonstrate the higher value of the service they deliver? There are instinctively two key ways: more fully measure a client’s risk profile; and the suitability of the investment solution.

Client risk profiling

Leaving aside the risk of investment solutions being offered to people with no true account of their risk profile being taken into consideration, advisers can go further by properly assessing what we can term a client’s ‘withdrawal risk profile’.

Put simply, most accumulating clients require as much capital as possible, while clients in decumulation face more complex challenges, like income, timescale and sequencing risk.

Clients drawing down a fixed amount each month face additional risk when markets drop suddenly, particularly if that fall happens early in their retirement when the value of their portfolio is greatest. Each withdrawal taken in the aftermath of that loss, steepens the decline in value of their portfolio and reduces any ability to financially recover.

In accumulation, portfolio value only mattered at a client’s annual review. In decumulation, it matters every month when units are sold to provide income and therefore the volatility of unit price needs to be micro-managed much more, on a monthly not an annual basis.

Creating a proper retirement income plan, in tandem with a risk-based cash flow planning tool, will enable firms and their clients to map out future spending and levels of income over the full course of retirement and its different demands. What must a client spend? And what could they spend ideally if they are able to? Capacity for loss is key here.

Decumulation funds

Advisers can further demonstrate their value by adopting a more personal, client-centric approach and devising a true investment strategy for decumulation. In particular, Risk Managed Decumulation funds, which manage risk on a monthly basis and mitigate sequencing risk. The results can be startling.

In short, a client’s portfolio can last longer in retirement and which client wouldn’t want that outcome?

In conclusion

Ultimately, the FCA’s new ‘investment pathways’ initiative will provide people with access to simple investment solutions and lower the number holding cash long-term.

Meantime, advice firms can view this intervention as an opportunity to demonstrate the value of financial advice. Yes, ‘pathways’ here can help; but deciding which product is most efficient to withdraw from; visiting tax implications of decisions; adjusting to changing markets and changing personal circumstances all demand a skilled adviser, who can carefully analyse and recommend the best solution for the client.

Want to see what Dynamic Planner can do for you? Request a demo

By Brooks Macdonald

Over the past two decades, several major global events – including most recently the coronavirus pandemic – have prompted investors to flee financial markets, but data shows this could have been a mistake. When it comes to achieving long-term financial goals, investing – and remaining invested – tends to be the better option.

COVID-19 has had tragic consequences, with the loss of human life at the forefront of people’s minds. The outbreak has seen widespread changes in human behaviour, with lockdowns and social distancing changing the way millions of us now live and work. This has had a dramatic knock-on economic impact with stock markets behaving in an extremely volatile manner at the start of 2020, creating a great deal of worry for investors.

Amidst heightened volatility, it is understandable that many are concerned about the impact on the value of their investments. But, while sharp declines in markets can naturally be disconcerting, if you want to give your investments the best chance of earning a long-term return, then it’s a good idea to practice the art of patience.

When markets fall and fear dominates, it can be difficult to resist the temptation to sell out of the financial markets and switch to cash, with the idea of reinvesting in the future when feeling more positive about market prospects – trying to ‘time the market’. But this is a strategy that carries with it the risk of missing out on some of the best days of market performance. And this could have a devastating impact on long-term returns.

Remaining invested may be an emotional rollercoaster during times of market stress, but research shows time and again that this is the best investment approach over the long term. For example, one study of US equity mutual fund investors showed that their tendency to try and time the market was a key driver of their underperformance (Dalbar, 2019)1.

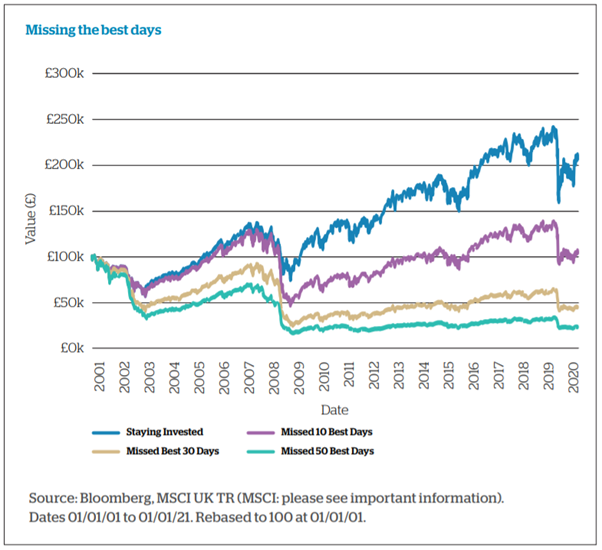

Despite temptations to switch into cash, data shows that missing out on just the 10 best market performing days can have a big impact on long-term returns. The chart on the next page shows UK equity market performance over 20 years. Staying fully invested during the ups and downs of that period has resulted in an initial £100,000 portfolio having an ending value of £207,000, compared to £104,000 for those that missed the 10 best days.

One of the most common reasons investors lose money is when they try to time the market. People try to avoid the worst days of the stock market by cashing out and then re-investing when they think the market is going to pick up.

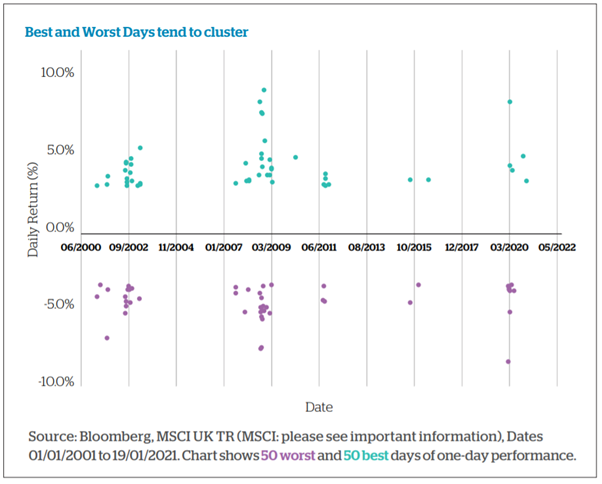

However, as the chart below shows, the best and worst days of the stock market are actually much closer than you would think. Try to miss the lows and you’ll probably miss the highs too because the best and worst days tend to cluster together.

Simulated past performance is not a reliable indicator of future results

Simulated past performance is not a reliable indicator of future results

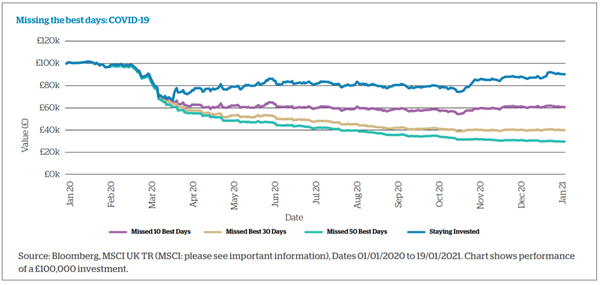

What has been the experience during COVID-19?

The speed at which the market entered ‘bear’ territory (typically a 20% decline) in response to the coronavirus outbreak, was the fastest in history. However, just 12 months on, markets are hitting all-time highs as they price in a post-COVID-19 environment.

We have also seen the clustering of best and worst days of market performance play out in response to the pandemic. More specifically, the moves in the US equity markets on 24 March 2020 and 12 March 2020 were the best and worst (respectively) since October 2008. This is also true of European and UK equity markets which had daily returns in the top five days on record on 24 March 2020.

Over 2020, missing the best days during the market volatility and subsequent upturn would have had a large impact on the returns generated, when compared with remaining invested throughout.

Simulated past performance is not a reliable indicator of future results

Simulated past performance is not a reliable indicator of future results

With the benefit of hindsight, we are now fully aware of the global impact of COVID-19, and the rapidity in which it has hit equity markets. While markets rivalled the speed of the virus in trying to price-in the near-term damage, we expected they would also be swift to act when a tipping-point was seen to be close-at-hand. This expectation was played out in the market recovery over 2020 and continues into 2021.

If you try to time the market, there is a significant risk that you will miss the best days of performance. Yes, the journey may not be smooth – as with all investing, values can go down as well as up and neither is guaranteed – but the long-term returns support the case for looking past the short-term news flow and remaining invested, even during volatile times.

Please get in touch with your Brooks Macdonald representative or send us an email at info@brooksmacdonald.com to find out how we can help guide your investment journey. We would be delighted to hear from you!

Important Information

Investors should be aware that the price of investments and the income from them can go down as well as up and that neither is guaranteed. Past performance is not a reliable indicator of future results. Investors may not get back the amount invested. Changes in rates of exchange may have an adverse effect on the value, price or income of an investment. Investors should be aware of the additional risks associated with funds investing in emerging or developing markets.

The information in this document does not constitute advice or a recommendation and you should not make any investment decisions on the basis of it. This document is for the information of the recipient only and should not be reproduced, copied or made available to others.

Brooks Macdonald is a trading name of Brooks Macdonald Group plc used by various companies in the Brooks Macdonald group of companies.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

Brooks Macdonald Asset Management Limited is regulated by the Financial Conduct Authority. Registered in England No 3417519. Registered office: 21 Lombard Street, London EC3V 9AH.

Brooks Macdonald Asset Management (International) Limited is licensed and regulated by the Guernsey Financial Services Commission. Its Jersey Branch is licensed and regulated by the Jersey Financial Services Commission. Brooks Macdonald Asset Management (International) Limited is an authorised Financial Services Provider, regulated by the South African Financial Sector Conduct Authority. Registered in Guernsey No 47575. Registered office: First Floor, Royal Chambers, St. Julian’s Avenue, St. Peter Port, Guernsey GY1 2HH

By Sanlam

The operational benefits of having an advisory firm’s investment proposition run by a third-party investment manager are increasingly well understood. Typically, this means using a discretionary investment manager to run a discretionary model portfolio. These operational benefits include:

- All clients achieve the changes in their portfolio at the same time, meaning they all get the same price for their investments

- All clients are treated consistently and fairly

- Important changes to asset allocation and investments can be made in timely fashion, avoiding some of the worst that markets can throw at us and taking advantage of investment opportunities

- The administrative goose chase of getting client affirmation to portfolio changes is removed and client contact for the adviser can concentrate on advice and building relationships, not administration

- Removes ‘key person risk’ in advisory business, where a small number of people are responsible for the investment research and maintenance of portfolios

Despite these benefits, some IFAs are reluctant to outsource. This hesitancy seems to stem from a perception that outsourcing leads to a loss of control and an emotional attachment to a traditional advisory approach that seems to work.

Let us take these two in turns – loss of control.

Even in an advisory proposition, the IFA isn’t the investment manager. He or she is already outsourcing to fund managers, but deciding to keep all the administration hassle of moving funds around. This isn’t control, it is a comfortable familiarity that is of little benefit to clients and does nothing to add value to an IFA business, perhaps quite the opposite.

We need only ask firms interested in acquiring IFA businesses – they much prefer a tightly controlled streamlined centralised investment proposition managed by an investment manager and this is reflected in the sale price.

The other aspect of control is client ownership. Using a DFM on a wrap platform does not threaten the IFA’s position. Indeed, DFMs have no sight of any underlying client data. This is a red herring.

Attachment to sticking to what has worked in the past is a barrier for some advisory firms taking the outsourcing step. That’s a bit like saying you quite like riding a horse and it works and ignoring the opportunity to drive a car instead even though it would get you to your destination more quickly and efficiently. There are even research companies out there supplying advisers, at a cost, to encourage them to keep riding the horse in the hope they don’t notice the car is a better option.

Clients value the advice and reassurance advisers give them. Achieving a client’s lifestyle objective is very powerful. This is what clients value and pay for, not portfolio administration.

Developments in outsourcing also mean that advisers will be pleased with how this option is evolving. At Sanlam, we find that advisers are particularly interested in developing a wealth proposition that supports their overall client proposition and brand. Done carefully, this is a more sophisticated approach to outsourcing and can reinforce the loyalty to the IFA’s brand.

www.sanlam.co.uk/financial-advisers

Sanlam is a trading name of Sanlam Private Investments (UK) Limited (registered in England and Wales 2041819; registered office: 24 Monument Street London EC3R 8AJ). Authorised and regulated by the Financial Conduct Authority. The value of investments, and the income from them, may fall as well as rise and are not guaranteed. Investors may not get back the original amount invested.

- Whole of market MSCI ESG fund research now available in Dynamic Planner to help advisers match people to sustainable portfolios

- Helping advisers solve the ‘mystery’ of sustainable investing and ensure clients fully understand both ESG risk and opportunity

3 February 2021: Advisers using Dynamic Planner now have whole of market MSCI ESG fund research at their fingertips, enabling them to help clients invest more sustainably through accurately matching their ESG preferences to ESG researched investment solutions.

Launching today, Dynamic Planner Sustainable Investing insight harnesses MSCI’s global market leading research widely used by institutional investors. Advisers now have instant access to comprehensive research across 36 key ESG issues for 36,000+ funds derived from the analysis of over 8,500 companies and more than 680,000 equity and fixed income securities globally. Crucially the research is objective, uniform and analysed at individual holding not fund level.

Dynamic Planner Sustainable Investing insight will enable advisers to ensure their clients fully understand both the ESG opportunities and risk that their investments present, as well as helping to support advisers in fully meeting the fast-evolving regulatory requirements. Powering Dynamic Planner Sustainable Investing insight using global leader MSCI’s unrivalled research and data builds on the collaboration between Dynamic Planner and MSCI in 2019 which saw the launch of the Dynamic Planner Indexes.

Developed in consultation with asset managers, financial planners and their clients, this is the first stage of Dynamic Planner’s Sustainable investing capability to be unveiled. Further announcements will follow on the next stages including Dynamic Planner’s Sustainable Investing questionnaire and further fund research and analysis functionality. Developments will be made in tandem with the market and regulatory environment evolving. Dynamic Planner Sustainable Investing insight is available without additional charge to all Dynamic Planner users.

Ben Goss, CEO Dynamic Planner said:

“Dynamic Planner cares passionately about using business as a force for good. Today’s launch means we can help advice firms deliver more deeply valuable and bespoke financial plans in line with clients ESG preferences, an ever-growing concern.

“The rise of sustainable investing has been one of the most important developments in our industry for decades – evolving from being driven by institutional investors to being led by something of an investor revolution and momentum is building. We believe it is right that suitability and sustainability should go hand in hand, and advisers now need the tools to help facilitate great conversations with their clients about both the investment risks and opportunities driven by global environmental and social challenges.

“Our powerful partnership with MSCI, world leaders in this area, means we are uniquely positioned to harness their whole of market ESG research and literally put the all-important objective data at the fingertips of advisers within Dynamic Planner. In the complex world of sustainability that can often be smoke and mirrors, this insight will provide advice firms with a clear, objective view of a fund’s ESG characteristics undertaken in an objective bottom-up way.

“This is just the beginning of our great ambition to support our industry in this complex and ever evolving space, and as the market and regulatory environment continue to evolve more announcements will follow.”

Jim Henning, Head of Investment Services at Dynamic Planner, said:

“Sustainable investing has long been a part of institutional investing and it is no secret that it is an area of investment that is rapidly changing and moving mainstream. Last year the UK saw significant inflows into sustainable investment solutions – astounding resilience in the face of widespread market volatility caused by COVID-19.

“The direction of travel is clear. And at Dynamic Planner it is an area we have been working on for some time. We have approached this in a careful and considered way to ensure we get it right given the complexities and speed of change, consulting with advisers on finding the ideal solution to what is a fast moving, evolving target, and especially so from a regulatory perspective.

“Core to our proposition is helping advisers have good, objective conversations around sustainable investing as part of their suitability conversation and ultimately in supporting them in accurately matching ESG fund preferences to end fund solutions. What we have produced is an extension of our suitability process with the extra ‘s’ of sustainability. Advisers will now be able to match client preferences with in-depth research and fully understand the risk of what they are holding, all in one place.”

Dynamic Planner Sustainable Investment insight

- Approx 80% of Dynamic Planner’s risk profiled funds covered

- MSCI will update reports each quarter, for ongoing suitability

- MSCI ESG Fund Ratings from AAA (leader) to CCC (laggard)

- MSCI score each fund from 0-10 on ‘ESG Quality’

- Funds ranked against peers from 0-100 percentile

By Daniel Needham, Global Chief Investment Officer, Morningstar

Key Takeaways

- Active management may not be in decline, rather the type of active management is changing to benefit active asset allocation. This presents investment opportunities for long-term asset allocators.

- Research shows that investors need to not only be active to outperform; they need to be patient.

- Long-term investing can be psychologically challenging, so it’s important investors have an adviser to keep their focus on what really matters.

All Investing is Active Investing

The move to passive investing has been a powerful trend, but to date has focused on security selection. In this context, passive refers to the replication of a market capitalisation-weighted index, while active may describe everything else. The same principle may apply to asset allocation, with passive classically defined as holding the entire investable market in proportion to the abundance of each part.

Clearly, few, if any, investors proportionally own every investable asset.1 Therefore, almost every investor is active on some level. Furthermore, replicating an equity index such as the FTSE 100 is therefore not strictly ‘passive’ since trading is required to match the constituents of the index.2 In this sense, the connection between ‘buy and hold investing’ and ‘passive investing’ can be misleading.

When we look at how assets are invested through more accurate definitions, we believe the share of actively managed assets hasn’t declined as much as shifted from security-selection to asset allocation.

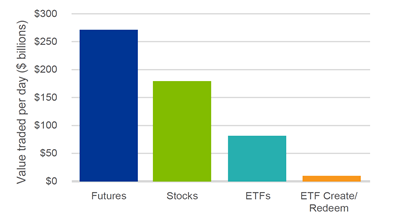

That is, those buying exchange-traded funds (ETFs) aren’t buying them for keeps. They’re using them to express an active investment decision (sometimes to meet a client need) and often trading them frequently, invalidating the term ‘passive’.

Exhibit 1 ETFs are Traded Frequently, Supporting Active Asset Allocation

Source: Blackrock, Index Investing Supports Vibrant Capital Markets, October 2017. Bloomberg, KCG Market Commentary: ETF Insights (Feb 8, 2017)

On balance, this shift in active management increases the opportunity to outperform, we believe, for investment managers who are able to take broader views on asset classes, sectors, industries, and other characteristics. In turn, this may increase the opportunity for investors who are patient.

Shorter Time Horizons Hurt Investors

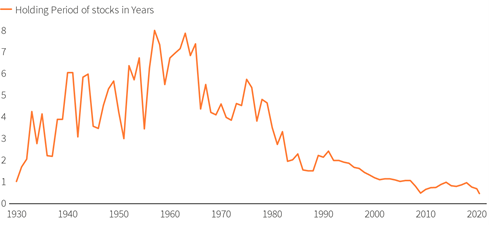

Time horizon turns out to be critical for taking advantage of investment opportunities for truly active management and receiving the benefits of compound interest—benefits that are hard to overestimate.3 Yet, this observation contrasts with the fact that average holding periods continue to fall. Holding periods have arguably been shortened by the rise of passive management, which appears to be a contradiction given passive funds’ low turnover rates.

Exhibit 2 The Reduction in Holding Period

Source: NYSE, Refinitiv. Note: Holding periods measured by value of stocks divided by turnover. https://www.reuters.com/article/us-health-coronavirus-short-termism-anal/buy-sell-repeat-no-room-for-hold-in-whipsawing-markets-idUSKBN24Z0XZ

If index-tracking holdings aren’t frequently buying and selling stocks, how could they contribute to shortening horizons? Because they themselves are being bought and sold. With the rise of lower-cost investment vehicles that can be traded like individual stocks, ETF volumes have risen to meaningful proportions of the market activity relative to their size. Still, it has been estimated that only about 10% of ETF volumes leads directly to the creation/redemption of shares.4 Despite this, it does appear that this turnover and activity impacts the underlying securities5, with higher volatility and turnover for stocks included within ETFs amplified by arbitrage activity—often impacting sectors, countries, industries, styles, or themes.6

This presents an opportunity, through active asset allocation of sectors, industries, and countries across equity markets, and for bottom-up investors that can take more active risk by including focused exposure to these areas. While the game may be getting harder in the more narrowly defined subsectors, it may be an opening for those with a long time horizon and a high active share.

By Definition, You Must Do Something Different to Outperform

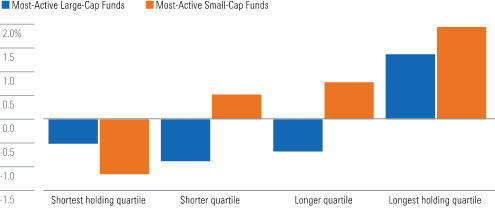

According to Sir John Templeton, one of the great investors of the 20th century, it’s impossible to produce superior performance unless you do something different from the majority. Academics call this ‘active share’, which is loosely defined as how different an investment strategy is from its benchmark. High active share should not be interpreted as having a higher likelihood of outperformance on its own. Like all things, one should be cautious in drawing conclusions from a single metric. On this point, author and academic Martijn Cremers7 identified that funds with high active share and low turnover tended to do better on average. This makes sense to us.

Exhibit 3 More-Active Strategies Held for the Long Run Tend to Outperform

Source: Cremers, M. 2016. “Active Share and the Three Pillars of Active Management: Skill, Conviction and Opportunity.” See online appendix at https://papers.ssm.com/sol3/papers.cfm?abstract_id-2891047

In our opinion, while certain strategies with lower active share and higher turnover can and do outperform, for fundamental investors time horizon seems to be the road less traveled. This concept of patient capital has been described as time horizon arbitrage and is tied to the idea of limits to arbitrage. In other words, patient investors may reap rewards—these rewards are available to any investor, but in practice go to only those who do what it takes.

Arbitrage Comes in Different Forms, Including Time Horizon

Arbitrage typically refers to different prices set for the same asset, a condition that generally requires not enough market participants seeing the big picture. The astute investor can buy at the lower price and sell at the higher one, keeping the difference.

Once, arbitrage involved buying something (gold, for example) at a lower price in one port, and sailing it to another port to sell at a higher price. With a large enough spread (and trustworthy enough sailors), anyone could take advantage of the price difference, but of course not everyone did.

Time horizon arbitrage is the idea that many investors are so focused on the short term, with lots of competition for investment results, that they don’t see the big picture, in this case the value of the investment for a long-term owner. Whether due to incentives or to psychology or career risk,8 there’s a reluctance to extend one’s horizon. With all the focus on winning over the short-term, this reduces the competition for information that is only relevant over the long term.

While there are no doubt opportunities over short horizons for talented investors and traders, as the time horizon extends, competition appears to decline. The desire or need for quick results is the siren song for most investors. This presents an arbitrage opportunity for those willing to tie themselves to the mast and wait patiently for potential returns.

Bringing It All Together

While headlines decry the decline of active management, we may be seeing a change of active management from purely security selection to active asset allocation. This utilises portfolios of stocks, principally ETFs, rather than the underlying stocks themselves. The rise of passive management may imply less activity and longer holding periods. However, the opposite may be occurring.

With the rise of active asset allocation through ETF trading, we see an opportunity for asset managers willing to be different, taking a long-term view. As the security selection asset manager universe shortens their time horizon and increase their activities, the opportunities may well be in doing the opposite—fishing where the fishermen aren’t9 – reinforcing one of the few durable investment advantages, a long-term investment horizon.

We think this changing nature of active management is therefore an opportunity and an advantage for us at Morningstar Investment Management. Our investment process is designed to opportunistically buy assets and patiently hold them until they appreciate. At times this means that we are well out of step with markets as we wait for prices to return to their long-term fair values, but we believe that we will significantly help investors meet their goals in the long run.

Of course, we can’t do this without their help. Changing strategies midstream can destroy value for investors because it often means selling low and buying high—something commonly referred to as ‘chasing returns’.

Financial advisers can help clients stay the course by reminding them of the big picture and keeping their focus on the long term.

References:

[1] https://www.nytimes.com/2015/10/25/magazine/should-you-be-allowed-to-invest-in-a-lawsuit.html

[2] “Being passive” is in fact still an active choice. As Lasse Pederson pointed out, even “passive” managers of indexes are required to trade[1] due to buy-backs, dividends, re-constitutions and corporate actions, often with active investors on the other side. This isn’t talked about often but could be argued as a potential source of alpha. https://www.tandfonline.com/doi/full/10.2469/faj.v74.n1.4

[3] Albert Einstein supposedly said that compound interest was the eighth wonder of the world, and even modest returns compounded over very long time periods turn into large sums. Legendary investor Warren Buffett said his life has been the product of compound interest.

[4] In the BlackRock’s October 2017 Viewpoint, they point out that the average creation/redemption was 11% of secondary daily ETF flow and 5% of all US stock trading.

[5] https://www.troweprice.com/content/dam/ide/articles/pdfs/2019/q3/the-revenge-of-the-stock-pickers.pdf

[6] This potentially increases non-fundamental information and reducing efficiency. The more trading of baskets of stocks via ETFs, the more this can impact prices of the underlying basket of stocks. https://www.nber.org/system/files/working_papers/w20071/w20071.pdf

[7] Who coauthored a 2009 paper that introduced the active share concept, and identified in a 2016 paper the relationship between active share and holding periods.

[8] The challenge is that most arbitrageurs manage other people’s money, and the fund manager may be fired before their long-term investments deliver results. The irony of the lack of competition for long-term investment ideas due to the institutional limits to arbitrage is that the benefits of compounding returns is best over very long horizons.

[9] An expression that’s a clever contrarian twist on Charlie Munger’s advice to fish where the fish are, borrowed from Jeremy Hosking, an outstanding investor of the eponymous Hosking Partners LLP.

For further information on how Morningstar Investment Management can support your clients and practice:

Call

0203 107 2930

Email

UKManagedPortfolios@morningstar.com

funds@morningstar.co.uk

Visit

www.morningstarportfolios.co.uk

www.morningstarfunds.co.uk

www.morningstarinsights.co.uk

About Morningstar Multi-Asset Funds

Now available on a range of platforms, the Morningstar Multi-Asset Fund Range is a series of multi-asset funds that offer investors a choice of three different risk levels with equity exposure ranges of 30-50%, 50-70%, and 70-90% complemented by lower risk and diversifying investments:

- CG Morningstar Multi Asset 40 Fund

- CG Morningstar Multi Asset 60 Fund

- CG Morningstar Multi Asset 80 Fund

The funds predominantly invest in a blend of low-cost passive funds, looking to lower the cost for investors by comparing the ongoing charges figure (OCF) of these funds to the others in relevant Investment Association sectors, but will also have flexibility to target high-conviction active funds. They are designed for U.K. investors seeking capital growth and some capital preservation over the medium- to long-term within a risk-managed framework.

About Morningstar Managed Portfolios

Morningstar Managed Portfolios are designed to support investor needs as determined by our risk profiling process. Our Active, Passive, Income, Real return, Governed, ESG and International portfolios are built using our approach to valuation-driven asset allocation and portfolio construction, which is informed by manager research from Morningstar’s global analysts. All portfolios are fully supported with ongoing risk management and reporting capabilities. Morningstar Managed Portfolios are intended to help advisers offer their clients efficient and cost-effective investment choices delivered through a wide selection of platforms.

Since its original publication, this piece may have been edited to reflect the regulatory requirements of regions outside of the country it was originally published in.

About the Morningstar Investment Management Group

Morningstar’s Investment Management group, through its investment advisory units, creates investment solutions that combine award-winning research and global resources with proprietary Morningstar data. Morningstar’s Investment Management group provides comprehensive retirement, investment advisory, and portfolio management services for financial institutions, plan sponsors, and advisers around the world.

Morningstar’s Investment Management group comprises Morningstar Inc.’s registered entities worldwide including: Morningstar Investment Management LLC; Morningstar Investment Management Europe Limited; Morningstar Investment Management South Africa (Pty) Ltd; Morningstar Investment Consulting France; Ibbotson Associates Japan, Inc; Morningstar Investment Adviser India Private Limited; Morningstar Investment Management Asia Ltd; Morningstar Investment Services LLC; Morningstar Associates, Inc.; and Morningstar Investment Management Australia Ltd.

About Morningstar, Inc.

Morningstar, Inc. is a leading provider of independent investment research in North America, Europe, Australia, and Asia. The company offers an extensive line of products and services for individual investors, financial advisors, asset managers, retirement plan providers and sponsors, and institutional investors in the private capital markets. Morningstar provides data and research insights on a wide range of investment offerings, including managed investment products, publicly listed companies, private capital markets, and real-time global market data. The company has operations in 27 countries.

Important Information

The opinions, information, data, and analyses presented herein do not constitute investment advice; are provided as of the date written; and are subject to change without notice. Every effort has been made to ensure the accuracy of the information provided, but Morningstar makes no warranty, express or implied regarding such information. The information presented herein will be deemed to be superseded by any subsequent versions of this document. Except as otherwise required by law, Morningstar, Inc or its subsidiaries shall not be responsible for any trading decisions, damages or losses resulting from, or related to, the information, data, analyses or opinions or their use. Past performance is not a guide to future returns. The value of investments may go down as well as up and an investor may not get back the amount invested. Reference to any specific security is not a recommendation to buy or sell that security. There is no guarantee that a diversified portfolio will enhance overall returns or will outperform a non-diversified portfolio. Neither diversification nor asset allocation ensure a profit or guarantee against loss. It is important to note that investments in securities involve risk, including as a result of market and general economic conditions, and will not always be profitable. Indexes are unmanaged and not available for direct investment.

This commentary may contain certain forward-looking statements. We use words such as “expects”, “anticipates”, “believes”, “estimates”, “forecasts”, and similar expressions to identify forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason.

The Report and its contents are not directed to, or intended for distribution to or use by, any person or entity who is not a citizen or resident of or located in any locality, state, country or other jurisdiction listed below. This includes where such distribution, publication, availability or use would be contrary to law or regulation or which would subject Morningstar or its subsidiaries or affiliates to any registration or licensing requirements in such jurisdiction.

For Recipients in Europe: The Report is distributed by Morningstar Investment Management Europe Limited, which is authorised and regulated by the Financial Conduct Authority to provide services to Professional clients. Registered Address: 1 Oliver’s Yard, 55-71 City Road, London, EC1Y 1HQ

For Recipients in Dubai: The Report is distributed by Morningstar Investment Management Europe Limited Dubai Representative Office which is regulated by the DFSA as a Representative Office.

For Recipients in South Africa: The Report is distributed by Morningstar Investment Management South Africa (Pty) Limited, which is an authorized financial services provider (FSP 45679), regulated by the Financial Sector Conduct Authority.

A schooling in psychology drives LOUIS WILLIAMS – Head of Psychology & Behavioural Insights at Dynamic Planner – to question what we know about your clients, people who invest. By learning more, he believes we can help them weather financial crises better in future

We know, according to research, that someone’s emotional state can strongly influence financial decisions they make. I want to explore how individual differences make investors more susceptible to either positive or negative emotions.

In that light, I have been looking closely at an individual’s emotional resilience or stability and their subsequent ability or strategy for regulating their emotions during difficult market periods.

Mind the behaviour gap

We might find that an individual or client has an attitude behaviour gap, whereby they are broadly risk tolerant, but during difficult market periods they are prone to panic and disinvesting from their current position. That gap manifests when risk becomes reality and they experience actual losses in their portfolio.

Ultimately, what I am trying to do, through my work at Dynamic Planner, is reduce this potential gap.

To do this, I have taken a step back and looked at psychology theory from the 1980s and ‘90s. For example, the theory of planned behaviour first proposed by Icek Ajzen in 1985, which shows how our attitudes influence our behaviour. Alongside that, all of us are also impacted by social pressure from family and friends or, in this context, from a financial adviser. Does such pressure lead us to behave in a certain way or not?

We can further consider what is called perceived behavioural control – an individual’s self-efficacy – or, in more layman terms, our ability to believe in ourselves in different situations. Does an individual feel confident managing their finances? The answer to that question of course can impact actual behaviour.

For example, if an individual has very low confidence in their ability to manage their finances, they may not act at all in a given situation or act contrary to what would be expected by an adviser in respect of their agreed attitude to risk.

In another way, we can look at this using the example of someone trying to quit smoking. They may know it’s an expensive habit and one they don’t enjoy anymore. Social and peer pressure comes into play here too. However, if an individual has very low belief in their ability to successfully quit, that then can significantly influence how someone will ultimately behave and in this example whether or not they actually stop smoking.

Confidence is key for your clients

Studies already completed have looked at financial self-efficacy and they revealed that people with low levels of this were most negatively affected during extreme periods of market volatility. That is what we might expect.

Having confidence in our ability, in all area of our lives, can make us more resilient when we face adversity, thereby allowing us to better manage stress and our emotions. Naturally, in this context, financial advice firms want to have resilient clients.

When I first began working with Dynamic Planner, in autumn 2019, I discovered that while psychology has broader measures of an individual’s resilience, there is no explicit measure of an individual’s financial resilience. That’s important. We arguably need one, because measuring resilience can be very domain specific. For example, my resilience regarding a health issue could be very different in comparison to my resilience regarding my finances.

What is resilience?

It is of course our ability to bounce back following a difficult period, but it also reveals our ability to adapt in the face of adversity.

In 2019, the French professor Dr Fanny Salignac created a model which looked at financial resilience and identified four key influences: an individual’s economic resources, their social connections, support network and lastly, financial knowledge. I would argue Salignac’s model fails to encompass an individual’s personality traits and qualities. Indeed, their experimental results show that optimism was a good indicator of whether someone would be financially resilient, yet was not used to inform their financial resilience model.

I have conducted some research myself to explore this issue by using hypothetical scenarios to test someone’s financial resilience. Serendipitously, after I had begun this research, we experienced a real-life market crash in February 2020 at the beginning of the Covid-19 crisis. I was therefore further able to look at results of people who completed the survey before February and or after. I also wanted to study the benefits potentially of an individual having worked with a financial adviser previously.

2020 Dynamic Planner study

The survey questioned different things. For example, we asked someone what their response would be to their portfolio suddenly falling in value by 20%. We also asked them how they would feel in that scenario.

Broadly speaking, we found that people who had worked previously with a financial adviser were more comfortable with taking risk. Interestingly, this group was also generally more resilient. Demographic variables – for example, males, who have been found historically to be more comfortable with risk – could in part explain such results, but when we controlled such variables more tightly, these trends were still apparent.

When it came to studying the results of people surveyed before the real-life crash in February and afterwards, we found that people afterwards experienced more negative emotions, like distress, anxiety and guilt. Those people also had lower levels of financial self-efficacy.

Again, people who had previously worked with a financial adviser were more optimistic and less concerned about the hypothetical scenarios, than those who had not. Interestingly, we also found that of the people who had worked previously with a financial adviser – who completed the survey both before and after February – the post-February group were most optimistic, suggesting that after experiencing the ‘real life’ adversity of last year’s crash, that core message from their adviser of staying invested resonated more strongly during the hypothetical scenarios.

Regarding low levels of financial self-efficacy, someone worrying about running out of money in retirement, for example, can be a good predictor of negative reactions to periods of adversity. In contrast, individuals with high levels of financial self-efficacy are more likely to be resilient, optimistic and to stay invested.

When it comes to personality traits, introverts, for example, are more likely to disinvest during a difficult period and are more susceptible to herding behaviour, following the crowd. Individuals with less emotional stability are more likely to base decisions on much more recent events or experiences, or are more likely to avoid reaching a decision altogether.

How can we improve clients’ financial self-efficacy?

First, set realistic goals with a client and start by working with them on smaller tasks. For example, cash flow planning may be useful to help clients achieve modest successes and therefore feel more confident when it comes to tackling the bigger picture regarding their overall finances.

Second, as their adviser, you can celebrate these successes and thereby help build a client’s confidence, like a coach. The relationship here and trust within it naturally is key. A client may well look to their adviser as a financial role model. Communication is crucial, with the adviser providing relevant information and collateral for their client to read and engage with; and they can speak regularly with their client.

Finally, an adviser can consider their client’s emotions and help decide when they are best suited, or ill-suited, to make an important decision. Can a client be encouraged to reappraise their position more positively, if they are experiencing negative emotions?

Ultimately, the end goal is a confident client and a resilient one in terms of managing their finances.

“Using Dynamic Planner Cash flow, you don’t just have to tell a client why you think something’s not a good idea – you can show them.” What does one firm think?

JIM HENNING, Head of Investment Services at Dynamic Planner, shines a revealing light on risk and volatility and the starkly different impacts they can have on a client’s portfolio in accumulation, as opposed to decumulation. Here, Jim contrasts the conflicting experiences of pound cost averaging and pound cost ravaging and what they mean for your clients

When elevated market volatility occurs, this typically coincides with an unexpected economic or geo-political event. Needless to say, 2020 is certainly a year that will forever be an infamous example.

It also serves as a reminder of the important challenge for advisers in helping clients navigate market ups and downs to ensure they remain on track. However, depending on the life phase of the client, periods of volatility can be more friend than foe and this is where it’s important to distinguish between the potential impact of pound cost ‘averaging’ and ‘ravaging’ when constructing suitable portfolios.

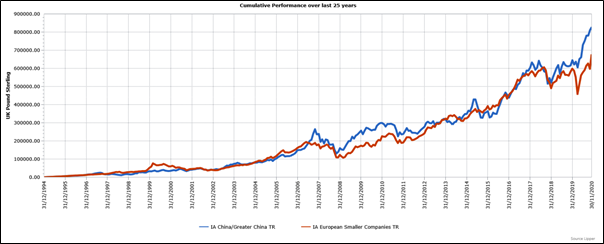

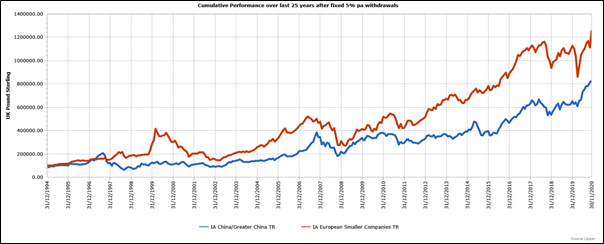

When it comes to an ‘averaging’ example, let us consider a typical client, approximately 25 years from retirement, saving monthly into an employer sponsored DC pension scheme. With the benefit of perfect hindsight, the two best IA fund sectors over the last 25-year period would have been China / Greater China and European Smaller Companies and both you would fully expect to experience considerable periods of volatility.

Investors who were fully prepared for the ride via monthly contributions would have benefited both from their long-term structural growth, but also during the periods of market falls, would have accumulated units at considerably cheaper levels. This is a very effective and automatic process to help smooth out the volatility over the investor journey to planned retirement.

While clearly few would consider investing in such funds in isolation, or continue to hold them closer to retirement, they are wholly unsuitable for funding income in retirement. It’s worthwhile though just taking a moment to remind ourselves why not, by looking at the impact of pound cost ‘ravaging’ in this scenario, given a fixed, 5% per annum level of withdrawal on a monthly basis over 25 years.

The difference between these two fund sectors has been significant. During the accumulation phase, the more volatile sequence of returns from China funds would have generated a 22% higher return. Conversely, the ravaging impact of taking fixed withdrawals when there is higher volatility can be seen with European Smaller Companies instead outperforming China by 52%.

Let’s take a look at more sensible multi-asset strategies instead and what would have happened using the Dynamic Planner risk adjusted benchmarks 4 and 9, over the last 10-year period as an example.

| Accumulation phase | Decumulation phase (assuming 5% per annum fixed withdrawals) |

| Dynamic Planner Risk Profile 9 outperformed by 9% | Dynamic Planner Risk Profile 4 outperformed by 12% |

Diversification across assets and region within the two above benchmarks has significantly reduced the level of volatility and hence the divergence of outcomes, compared to the initial example we saw.

Using different strategies to improve the likelihood of capital sustainability may include building a centralised retirement process around natural yield funds for more wealthy clients, to a combination of cash and decumulation solutions for the less so.

Controlling short-term volatility is the most important risk to mitigate where clients are taking fixed monthly withdrawals from their variable savings pots. None of this is simple and hence opportunities to improve research, efficiency and scalability need to be considered.

Actively planning for a sustainable retirement is of vital importance and where the benefits of using robust cash flow planning tools comes into their own.

At Dynamic Planner, we ensure consistent calibration of customer risk to end investment recommendation, by fully integrating our client risk assessment and cash flow modelling tools to a dedicated new Risk Managed Decumulation fund service.

For the latter, this combines the highest level of conviction from asset managers to control monthly volatility of their packaged multi-asset solutions within the service alongside independent and granular, monthly oversight and consultancy services from Dynamic Planner.

How can Risk Managed Decumulation funds help my clients? Find out.

By Chris Jones, Proposition Director

Last year’s crisis vindicated a ‘stay invested’ message to clients and once again underlined the value of diversification through multi-asset investing. Having said that, we have all seen since the social and economic uncertainty which has continued to drive increased volatility in markets.

As we become increasingly accustomed to the new normal, multi-asset investors are all facing rebalancing responsibilities and many are facing tactical and active management decisions. How those decisions are made and how and when the instruments are bought or sold is quite different, depending on the type of solution. I am not talking active versus passive; I am talking about collectives versus discretionary portfolios versus advised portfolios in a post-MIFID II world.

It is entirely possible to build an identical portfolio in a collective (e.g. OEIC), a discretionary managed portfolio or an advised portfolio and therefore it is easy to find or build either to be compatible with your client’s risk profile.

It is what happens afterwards that is quite different. The obvious differences are:

- The way your portfolio is reported to the client

- The way charges are disclosed

- The breadth of assets available

- The way assets are taxed

- The speed in which the investment manager or adviser can act

At Dynamic Planner, we are agnostic and enable advice firms to select compatible solutions for their clients in any structure safely and efficiently. However, for advised portfolios it is important that you use Dynamic Planner’s Client Review and Recommendation functionality to help you comply with post-MIFID II regulation.

If in Dynamic Planner you select a risk targeted, risk profiled or Risk Managed Decumulation fund, you can rely on the asset manager to rebalance and make buy / hold / sell decisions in line with regulations. However, if you are rebalancing an advised portfolio, then that responsibility is the advice firm’s and Dynamic Planner now enables the required suitability assessment and report to be produced quickly and easily before any transaction to trade instruments is made.

We know from our research, which shows that approximately 70% of platforms provide auto-rebalancing ability, but what you cannot do is rely solely upon that without meeting the responsibilities which came into force at the start of 2018.

COBS 9A.3.2, COBS 9A.2.18 and in particular COBS 9A.2.23,54(1) states: “Where investment advice or portfolio management services are provided in whole or in part through an automated or semi-automated system, the responsibility to undertake the suitability assessment shall lie with the investment firm providing the service and shall not be reduced by the use of an electronic system in making the personal recommendation or decision to trade.”

These responsibilities and a more complex and uncertain economic outlook have seen an increased use by advisers of risk targeted, risk profiled and Risk Managed Decumulation funds in Dynamic Planner, alongside collectives and discretionary managed portfolio services. All of these are supported by our Client Review and Recommendation functionality.

Now, more than ever, it is about knowing your tools and choosing the right tool for the right job.

Find out more about Dynamic Planner’s new Recommendation reports.

Dynamic Planner has announced details for its ninth ‘Transform the Way Clients See You’ Annual Conference, which is set to be delivered remotely, into the homes of attendees on Wednesday 10 March: 11am-4pm. Dynamic Planner’s previous eight conferences have centred on connection and community, and with these human needs now greater than ever and 2020 shifting the way the industry and beyond communicate, this year’s conference will be like no other.

In an inspiring day of insight, attendees can look forward to networking opportunities, sessions with leading asset managers and a fascinating CIO Panel debate. Keynotes will include: ‘How you can save hours of time streamlined within PROD rules’; ‘How has integrated cash flow modelling reduced the cost to serve for the many?’; and ‘The roaring 2020s and heralding of ESG – The future is upon us’. Dynamic Planner CEO Ben Goss will also reveal the latest Dynamic Planner innovations.

Yasmina Siadatan, Sales and Marketing Director at Dynamic Planner said:

“Last year shifted the way we communicate. Never again will we take for granted roundtable discussion, speed networking, or revolutionary stage design with that unforgettable keynote. While we may feel a sense of nostalgia for the way we used to engage as an industry, it doesn’t mean we need to forget knock-out events altogether.

“Our Annual Conference has been the go-to in person event for the last few years and we will deliver the go-to virtual industry event of 2021, the Dynamic Planner 9th Annual Conference hosted by BBC Business Editor Simon Jack.

“We will bring together advisers, paraplanners, administrators, asset managers, journalists, influencers and a host of other guests and VIPs into one digital environment to network, discuss, debate and unpick the most pressing issues we all today face. It’s a not to be missed event. Come and connect live with the industry, we all need and deserve it. You are very welcome to join us.”

Dynamic Planner’s ninth Annual Conference will take place on Wednesday 10th March: 11am-4pm. Attendees should register early to be on the first come first served list for lunch which will be delivered in line with Dynamic Planner’s sustainable credentials with as little environmental impact as possible.