JIM HENNING, Head of Investment Services at Dynamic Planner, shines a revealing light on risk and volatility and the starkly different impacts they can have on a client’s portfolio in accumulation, as opposed to decumulation. Here, Jim contrasts the conflicting experiences of pound cost averaging and pound cost ravaging and what they mean for your clients

When elevated market volatility occurs, this typically coincides with an unexpected economic or geo-political event. Needless to say, 2020 is certainly a year that will forever be an infamous example.

It also serves as a reminder of the important challenge for advisers in helping clients navigate market ups and downs to ensure they remain on track. However, depending on the life phase of the client, periods of volatility can be more friend than foe and this is where it’s important to distinguish between the potential impact of pound cost ‘averaging’ and ‘ravaging’ when constructing suitable portfolios.

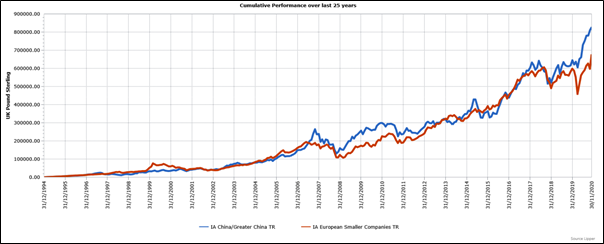

When it comes to an ‘averaging’ example, let us consider a typical client, approximately 25 years from retirement, saving monthly into an employer sponsored DC pension scheme. With the benefit of perfect hindsight, the two best IA fund sectors over the last 25-year period would have been China / Greater China and European Smaller Companies and both you would fully expect to experience considerable periods of volatility.

Investors who were fully prepared for the ride via monthly contributions would have benefited both from their long-term structural growth, but also during the periods of market falls, would have accumulated units at considerably cheaper levels. This is a very effective and automatic process to help smooth out the volatility over the investor journey to planned retirement.

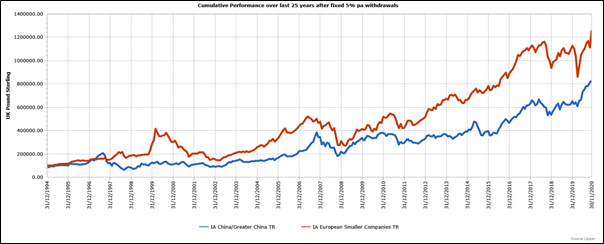

While clearly few would consider investing in such funds in isolation, or continue to hold them closer to retirement, they are wholly unsuitable for funding income in retirement. It’s worthwhile though just taking a moment to remind ourselves why not, by looking at the impact of pound cost ‘ravaging’ in this scenario, given a fixed, 5% per annum level of withdrawal on a monthly basis over 25 years.

The difference between these two fund sectors has been significant. During the accumulation phase, the more volatile sequence of returns from China funds would have generated a 22% higher return. Conversely, the ravaging impact of taking fixed withdrawals when there is higher volatility can be seen with European Smaller Companies instead outperforming China by 52%.

Let’s take a look at more sensible multi-asset strategies instead and what would have happened using the Dynamic Planner risk adjusted benchmarks 4 and 9, over the last 10-year period as an example.

| Accumulation phase | Decumulation phase (assuming 5% per annum fixed withdrawals) |

| Dynamic Planner Risk Profile 9 outperformed by 9% | Dynamic Planner Risk Profile 4 outperformed by 12% |

Diversification across assets and region within the two above benchmarks has significantly reduced the level of volatility and hence the divergence of outcomes, compared to the initial example we saw.

Using different strategies to improve the likelihood of capital sustainability may include building a centralised retirement process around natural yield funds for more wealthy clients, to a combination of cash and decumulation solutions for the less so.

Controlling short-term volatility is the most important risk to mitigate where clients are taking fixed monthly withdrawals from their variable savings pots. None of this is simple and hence opportunities to improve research, efficiency and scalability need to be considered.

Actively planning for a sustainable retirement is of vital importance and where the benefits of using robust cash flow planning tools comes into their own.

At Dynamic Planner, we ensure consistent calibration of customer risk to end investment recommendation, by fully integrating our client risk assessment and cash flow modelling tools to a dedicated new Risk Managed Decumulation fund service.

For the latter, this combines the highest level of conviction from asset managers to control monthly volatility of their packaged multi-asset solutions within the service alongside independent and granular, monthly oversight and consultancy services from Dynamic Planner.

How can Risk Managed Decumulation funds help my clients? Find out.