By Jerry Wharton, CEO, Church House Investment Management

There have been significant losses for some bond investors so far this year and we have been asked how we have protected our holdings from the worst of the volatility in the Church House Tenax Absolute Return Strategies Fund.

We have always been very proactive about protecting our holdings, either through curve positioning (duration), credit quality, or explicit interest rate hedges. This has enabled us to embrace higher yields whilst avoiding the risks to capital values.

Government benchmark yields have indeed risen sharply and holders of too much duration have certainly paid the price. Bear in mind though the opportunities that this readjustment has created.

Only a few months ago, the short end of the Gilt curve was almost negative, now we have two-year Gilts offering a mighty 1.6%. Not that attractive in itself, but when you add a credit spread on top, you are now able to access a fair yield on a total return basis.

There are now a number of quality bonds, issued last year when yields were low, that are trading well below par. Remember that bonds are redeemed at par, 100p. A good example is a green bond issued by Berkeley Homes last year. The proceeds of this issue can only be used for the construction of new housing stock that qualifies for the highest rating of EPC (Energy Performance Certificate). These bonds are currently trading at 87 offering a yield to redemption in nine years’ time of over 4%. Given the current risk-free rate of return, this is a wonderful opportunity.

Another fine example is a sustainable bond from Tesco (well ahead on reducing their carbon footprint since 2015). These five-year instruments are investment grade and pay a coupon of 1.875%. We can buy them at around 93, which therefore gives us a yield of 3%.

The other weapon we have is using AAA-rated floating rate notes. These tend to be of the highest quality, mostly covered bonds secured by residential mortgage loans with loans-to-value of about 45%. The coupons of these bonds refix on a quarterly basis using a spread above SONIA (the LIBOR replacement) and therefore the capital value of these bonds actually increases as interest rates rise, providing a hedge against rising inflation.

At the end of Q1 this year, the Tenax Fund had 34% invested in Sterling corporate bonds with duration of 4.4 and an average yield to redemption of 3.75%. A further 37% was invested in AAA floating rate notes, providing a hedge against inflation, a higher return than cash, and helping to dampen volatility across the fund.

In conclusion, there is no need to sit there and take all the medicine in the way that some bond investors have. Whilst it is not possible to have completely mitigated the downside, we have contained it through judicious curve positioning and interest rate hedges. The opportunities now abound for achieving a decent yield from fixed or floating bonds.

Find out more about Church House Investment Management.

Dynamic Planner, today announces the appointment of Christophe Ponette as Managing Director for Europe to lead the company’s EU expansion. Christophe was previously the MD of Avaloq, the European Banking and Wealth Technology Provider for Benelux, speaks multiple languages and has over 25 years’ experience working in sales and management positions in European markets including The Netherlands, Switzerland, France, Luxembourg and Belgium.

His appointment follows an extensive, two-year exploratory process which has looked intensively at the needs of European financial services firms, asset managers and clients as a result of MiFIDII, IDD and the growth in risk-based investing.

Christophe will work in collaboration with Simon Colboc who has joined Dynamic Planner in a non-executive capacity. Simon has 25 years’ experience in Financial Services, including executive positions at Fortis, BNP Paribas and Prudential Plc. He heads up FECIF’s work on pan-European pensions and runs the Financial Services Practice of Paris-based firm CMI Strategies.

Dynamic Planner has signed an agreement with The European Federation of Financial Advisers and Financial Intermediaries (FECIF) an independent and non-profit-making organisation exclusively at the service of its financial adviser and intermediary members, who are from the 27 EU countries plus the UK and Switzerland; it is the only European body representing European financial advisers and intermediaries. FECIF is based in Brussels, at the heart of Europe and will be working with Dynamic Planner to identify and introduce potential partners.

Dynamic Planner has already completed the localisation of its risk and sustainability profiling instruments for France, Germany, Italy, Spain and Belgium working with in-country experts and financial advisers to ensure they adapt to local requirements. Dynamic Planner will localise its full functionality including: reviews, goal based cash flow planning and suitability reporting to provide its one financial planning system to European clients.

Ben Goss, CEO, Dynamic Planner said: “Backed by almost two decades of experience of Dynamic Planner in the UK, we are now taking our leading financial planning system to the Continent. Europe is in the foothills of an enormous shift in the way that advisers help households manage their finances and prepare for retirement in terms of the investment risk they need to take and the regulation that they face. The market feedback we have had is that we can help financial services firms successfully meet these challenges as we do in the UK.

“This is a natural progression for Dynamic Planner and an incredibly exciting time for us as both a team and a business. We have already learnt a great deal from our engagements with European partners, advisers and experts about how financial advice is given in different countries, for example in the area of sustainability, and much of this will be beneficial for our overall product for our UK clients too.

“Our mission is to help firms match people to suitable portfolios through engaging financial planning and we believe there is a huge opportunity to contribute the expertise and one financial planning system technology we offer in the EU.”

As part of the exploratory process, Dynamic Planner’s Head of Psychology and Behavioural Insights Dr Louis Williams, conducted a large-scale country specific and analysis study of a cross section of the populations in France, Germany, Italy, Belgium and Spain to understand attitude to risk (ATR) and views on sustainability to assist in the creation of bespoke psychometric questionnaires for each territory. Local financial advisers reviewed translations and provided their views on the question set and framework.

Key differences between the five European countries and UK population include:

ATR Profiling:

- Belgium and Germany have significantly higher average levels of risk tolerance in regard to investments compared to France, Italy and Spain;

- All European countries appear to be more risk averse than the UK population;

- Significantly more Europeans from all five countries were a risk profile 2 (4.49%- 7.54%) and 3 (11.52%-18.87%) and fewer a risk profile 5 (14.75% – 18.62%);

- Significantly fewer UK respondents were a risk profile 1 (0.23%), 2 (0.74%), 3 (3.55%) and 4 (14.09%), and more a risk profile 5 (31.23%), 6 (27.19%) and 7 (16.7%).

Sustainability:

- French respondents have significantly higher average scores when measuring the importance of sustainability in comparison to Germany, Italy, Spain and Belgium;

- More European respondents view sustainability as of higher importance than UK counterparts;

- Significantly fewer respondents from France, Germany, Italy and Spain (10.69% – 14.76%) have a low importance sustainability profile. The UK have significantly more within this profile (27.67%);

- Significantly fewer respondents from the UK consider sustainability to be of high (8.24%) and very high importance (3.8%).

Christophe Ponette, Managing Director, Europe, Dynamic Planner said: “We have undertaken extensive country specific research to enable us to understand what is needed and begin to adapt what we offer to each market. This has already informed the design of a range of country specific, multi-language risk profiling and sustainability questionnaires. This insight has also highlighted a need for more education around financial risk and this is central to what we do at Dynamic Planner.

“Large organisations in Europe face many challenges – ageing populations; low savings rates and clients with assets held across different institutions. Above all there is a need to create a culture of investment, improving the overall customer experience and establishing a better and more efficient integration of the financial planning process. We believe Dynamic Planner can provide the answer to these challenges.”

By Sam Liddle, Sales Director, Church House Investment Management

As rising inflation continues to grip markets, investors are looking for ways to protect their portfolios against the potentially damaging effects.

Whether inflation this time around is a short-term issue or something we all need to get used to the foreseeable future, its effect on cumulative returns can be long lasting if or when interest rates continue to rise in line with inflation.

Multi-asset investors, some with cash plus targets, face a dilemma in this scenario – how to beat inflation yet remain true to their investment process.

Do they simply move further up the risk scale increasing the potential of heavy losses if markets go against them? Do they buy ‘expensive defensives’, and at what cost? Do they move to cash or worse, negative-yielding bonds? What about derivatives – can asset managers justify and explain that position to investors who want to understand exactly where and how their cash is invested?

It could be that the investment instruments and tactics that portfolio managers employ to navigate through the potentially rough seas ahead will make all the difference.

No frills to avoid thrills and spills

Take, for example, the humble Floating Rate Note (FRN). “What on earth is a Floating Rate Note?” I hear you ask.

FRNs are debt instruments, typically issued by financial institutions, supranationals (e.g. the European Investment Bank) and governments, and, as the name implies, FRNs differ from other fixed income securities by having a variable (floating) coupon rate.

The coupon on a FRN is re-set every quarter to a specified level over the reference rate such as SONIA (Sterling Overnight Interest Average). When interest rates rise, SONIA, in turn, ratchets up and consequently, the coupons on FRNs increase.

Simply put, as interest rates rise, so does the coupon on FRNs.

They are therefore negatively correlated to, or provide a hedge against, a rise in interest rates, and unlike derivative hedging and structured products, the FRN hedge costs little.

Gilts and other debt instruments, such as investment grade and high yield corporate bonds are positively correlated to interest rate movements so will fall in value when interest rates rise.

For this reason, FRNs make up a significant component of the investment grade bond market and tend to be in high demand when interest rates are expected to increase.

For Absolute Return strategies, aiming for positive returns in excess of cash, FRNs provide a useful hedge against rising interest rates and help moderate volatility. They are also fully liquid so when volatility increases in other asset classes, creating mispricing, fund managers are able to sell FRNs to exploit those opportunities.

After decades of falling interest rates in the UK, the direction of travel might have changed, and rates have started to rise. James Mahon and Jerry Wharton, co-managers of our own Church House Tenax Absolute Return Strategies Fund are clearly placing a lot of faith in FRNs with a 38.3% allocation.

If rates now rise faster and further than most investors and commentators expect, gilts and corporate bonds will become more volatile – FRNs on the other hand will, much like the tortoise in Aesop’s fable, quietly and surreptitiously win the race against the inflation hare.

Advisers looking for risk rated investing solutions for their clients, can benefit from the revamped RSMR Responsible Managed Portfolio Service (MPS) now available through Dynamic Planner.

The newly launched RSMR Responsible Growth Portfolio means that advisers can now take advantage of four risk profiled portfolios in the RSMR Responsible MPS that is risk rated on Dynamic Planner: Responsible Cautious, Responsible Balanced, Responsible Growth and Responsible Dynamic. This new range of portfolios joins the RSMR Rfolios range of eight funds which has now been added to Dynamic Planner, having been launched in 2015.

RSMR Head of Managed Portfolio Services, Stewart Smith, said: “We have taken the opportunity to broaden our offering in the responsible investing area through the launch of the Responsible Growth Portfolio. Alongside our well-established RSMR Rfolios range, we offer advisers four RSMR Responsible portfolios, risk profiled by Dynamic Planner within risk levels 4, 5, 6 and 7.”

Yasmina Siadatan, Sales & Marketing Director, Dynamic Planner said: “We are passionate about broadening out the range of risk rated funds with a focus on responsible investing to give advisers even greater choice within this area for their clients. We welcome the MPS Range from RSMR to Dynamic Planner. Continuing to expand the risk rated responsible fund universe in Dynamic Planner enables advisers to give clients increased opportunity to use their investments to deliver financial returns for the risk they are willing and able to take, alongside ensuring sustainability preferences are matched.”

What is RSMR’s approach to ESG?

Like all of us, we are deeply disturbed by what is happening in Ukraine. While it may not be equal to that, we fully understand your clients will have concerns right now.

We want to provide you with reassurance and information below regarding our model and processes, which you can share when speaking with your clients about their investments. If you have further questions or concerns, please do not hesitate to contact the Dynamic Planner Client Success team in the usual way.

Capital Market Assumptions and benchmark asset allocations

Dynamic Planner provides forward-looking, ex-Ante assumptions for real returns, volatility, correlations and covariances, and associated calculations such as 95% VaR. They are calculated objectively through proven, statistical models using many decades of data – and rigidly reviewed, monitored and governed to ensure discipline and objectivity.

In Dynamic Planner, you can accurately risk profile any combination of assets. So, however you choose to position yourself tactically, over or underweight to our benchmark, you can understand the risk and expected return.

At times like this, there will no doubt be assets, countries and companies that will do better or worse. This could also change quite quickly. Ultimately, in the medium to long-term, this will mean a change to the constituents and weighting or ranking of the indices that define the assets within our Capital Market Assumptions.

If you want your firm’s or your clients’ investments to react to these changes, then you would need to rely upon a professional fund manager to do that effectively on your behalf. We would therefore, as we always do, encourage the use of the appropriate Risk Target Managed [RTM], Risk Managed Decumulation [RMD] and Risk Profiled solutions in Dynamic Planner.

Risk characteristics within Risk Profiled solutions

Dynamic Planner is unique in the way that it calculates the risk profile of solutions, especially RTM and RMD. We insist that asset managers provide us with the underlying holdings and their weights throughout the review period, including specific stock and derivatives. We calculate the solution’s risk profile using the correlations and covariances of all those underlying instruments.

We hold a database of more than 40,000 instruments and continually review their risk characteristics relative to 72 asset class indices, considering a wide range of potential factors, depending on the nature of the instrument. Dynamic Planner’s Asset Risk team have been considering these risk factors and how they may change the risk factors of certain instruments in light of the crisis in Ukraine, sanctions and market closures.

The Solutions Risk team are using these live risk factors of the underlying instruments within any solution to calculate its risk profile, as well as engaging with asset managers as to whether and how they may be reacting within their mandate to meet a solution’s objectives.

MSCI ESG ratings

We have always known that this is an emotive, complex and evolving issue that we do not have the in-house expertise or resource to fully understand or monitor at an investment instrument level. We rely upon ESG research from MSCI, respected pioneers in this space. Currently, we only make the MSCI ESG fund reports available to Dynamic Planner users, but we do have the full MSCI stock holdings level data available to us.

We have engaged with MSCI and they have said that, owing to the unprecedented nature of the current crisis, and the severe economic pressures facing Russian listed companies, they have implemented a series of ESG ratings downgrades with immediate effect. MSCI will continue to assess these companies’ ratings on an ongoing basis.

They have applied an ESG ratings ceiling of ‘B’ for all Russian companies within their coverage. Companies that were already ‘B’ or ‘CCC’, retain that rating, but all others have been downgraded to this ‘Laggard’ status.

Within MSCI’s corporate governance methodology, Russian companies will see the application of a ‘Very severe’ assessment on the ‘Other high impact governance events’ key metric. Additionally, Russian state-owned enterprises will see the application of a ‘Severe’ flag on the ‘Financing difficulties’ key metric, owing to their additional risk and exposure to sanctions, export restrictions, and removal of access to international financing channels.

MSCI have also downgraded the ESG government rating for Russia from BBB to B (equivalent to ‘Laggard’ status).

At a multi-asset fund solution level, which are very diversified by nature, it is unlikely that such actions of Russian companies or state will have turned the dial on their overall MSCI ratings yet. However, for those relying upon Dynamic Planner and MSCI data, recent actions are being proactively picked up within the assessment of their ESG risks.

If you have any further concerns about market conditions and your customers, please get in touch with the Client Success team.

Dynamic Planner has launched Client Access, a customer focused and interactive technology designed to help advisers drive deeper client engagement and relationships in the new flexible hybrid world of financial advice.

Now available to Dynamic Planner users, Dynamic Planner Client Access empowers clients to complete the psychometric risk and sustainability profiling questionnaires remotely, enriching the process of data capture. Fully interactive, clients benefit from simple language and short videos to clearly communicate key messages and guide them at every step. It is mobile friendly with screens optimised for all devices, with the look and feel fully configurable to a firm’s branding.

Yasmina Siadatan, Sales & Marketing Director at Dynamic Planner said: “While remote advice is here to stay, it can be a challenge for advisers to make the process engaging and easy to understand for clients, as well as build deep relationships which ultimately result in better outcomes. Dynamic Planner Client Access gives advisers that fundamental piece of the hybrid advice puzzle, whilst enhancing their whole experience in an interactive and efficient way.

“We believe it will be fundamental in supporting hybrid advice as demand grows even more, with the ability for advice firms to engage successfully on a remote basis with clients a major step along this path. Advisers will be able to improve outcomes through better informed conversations with clients, whilst at a business level, the increased efficiency of the process will enable firms to increase capacity in their business.”

Advisers can choose which questionnaires clients receive, and once captured, the information flows seamlessly back into Dynamic Planner to support the profiling, cash flow and review processes. With automatic notification that the process is complete, and any inconsistencies in answers flagged, Dynamic Planner Client Access increases the efficiency of advice firms and enables them to focus on more important things such as having good conversations with clients.

Client Access is available now in Dynamic Planner; see for yourself

Dynamic Planner is today trusted by thousands of UK financial advisers, helping them engagingly match their clients with suitable investment portfolios. The award-winning software is constantly evolving to reflect latest regulation and how businesses in the profession work.

What is it like helping make that happen, as members of Dynamic Planner’s growing Product, Development and Test teams? What is a typical day like? What is the culture like? What do people like about working at Dynamic Planner? To give you some insight and to help mark International Women’s Day 2022 [Tuesday 8 March], three team members share their experience.

Claire, Senior Product Owner

When did you join Dynamic Planner?

November 2019.

Describe a typical day for you.

In the morning, I usually enjoy a quieter hour of focus before more people start to come online and meetings begin. A typical day could involve a design meeting with other members of the Product team; research calls with existing clients; technical meetings with our developers; and stakeholder discussions for various projects. Aside from meetings, I can often be found creating prototype wireframes, working through analysis, and documenting designs by writing user stories and flow charts, for example. I also regularly help our Client Success team with any product queries they have.

What do you like about working at Dynamic Planner?

I never feel like I am a number on a spreadsheet. Instead, I feel like a valued member of the team. I love being able to work flexibly, insofar as I start my working day at 8am. I’m a morning person and this really suits me. Whilst we all work remotely the majority of the time, I like the way we are kept connected and updated with regular company meetings. And it’s also always fun to anticipate what each month’s payday treat will be!

Nethra, Senior Software Developer

When did you join Dynamic Planner?

April 2020.

Describe a typical day for you.

My day starts with a meeting with my team, discussing what was done the previous day and the pending tasks. Then, the whole day is spent on coding and technical discussions, alongside occasional scrum meetings.

What do you like about working at Dynamic Planner?

Dynamic Planner is a place that continually demands excellence, while still allowing you to experience a healthy and positive work environment.

Tara, Senior Test Analyst

When did you join Dynamic Planner?

September 2020.

Describe a typical day for you.

As a QA Tester, I start my day off checking my messages, reviewing test runs and checking anything urgent that needs dealing with from a quality perspective. After catching up with the team, I’ll usually start working on testing tickets and working with the Developers and Product Owners / Managers to make sure we are all on the same page with what needs to be delivered. Then, I work on designing and creating solid automation, reviewing code and generally working with the QA and wider teams as needed. Each day is different.

What do you like about working at Dynamic Planner?

I like the flexible working and the team dynamics. With flexible working, I can choose to go into the office or work remotely. Also, I’m able to work around my life more than in previous jobs. If I need a slightly longer lunch one day, I’m not chained to my desk. It’s just about being respectful to your team and not taking advantage. In terms of team dynamics, I always feel free to express myself with ideas or suggestions. Everyone is friendly and approachable.

Visit our careers page to view our latest vacancies

The team at Dynamic Planner have grown rapidly during Covid, meaning many members began roles in varying levels of lockdown in the UK. However, the award-winning firm’s commitment to remote and hybrid working has helped new starters hit the ground running in the field of financial planning technology.

Thomas Pegg’s dream of being a commercial pilot was thwarted by a medical condition. But software testing appealed to his love for the technical side of flying. He retrained and took a role as a test analyst for a political party before joining Dynamic Planner in July 2021.

How has the transition been from your old role to new?

I think I’ve had a steeper learning curve than some of my colleagues, in that I was in politics for seven years and financial technology, or fintech, is a completely new world for me. The biggest challenge has been understanding the business, how it operates. But I was given lots of time and support, and it wasn’t long before I was getting stuck in.

What do you do on a day-to-day basis?

I do some manual testing, but most of the day is spent writing automation. That was one of the key things I was looking for from a new role – the opportunity to develop my test automation skills. It’s important because it’s helping safeguard the quality of the product. When there are software updates, we know that the core features are always going to be robust, because we have that automation in place.

Working in tech wasn’t your original career plan. How do you feel about it now?

The possibilities of what you can do with tech are endless – from the strides forward in AI to new uses in the medical profession. Fintech is an industry that’s great if you want to be challenged and stretched, and the career paths can be very rewarding. It’s exciting to be able to contribute to advances happening.

Visit our careers page to view our latest vacancies

By Wayne Bishop, King and Shaxson Asset Management

King and Shaxson Asset Management’s sole focus is managing ESG and Impact portfolios. We have been doing so since 2002, long before the terms were first coined.

In the years leading up to the pandemic, interest and assets under management in ESG and Impact products had been growing at a rapid pace. This was fuelled by relative outperformance and client interest; the pandemic’s arrival then provided a perfect catalyst.

The reflation trade in 2021 led to a reversal in this relative outperformance for the first time in 11 years, presenting a window for opponents to criticise ESG and Impact. In particular, they took aim at funds’ exposure to the technology sector. Increased retail interest has added a number of new considerations and risks to the financial adviser’s process. In this article we seek to explain the main risks and considerations advisers need to understand.

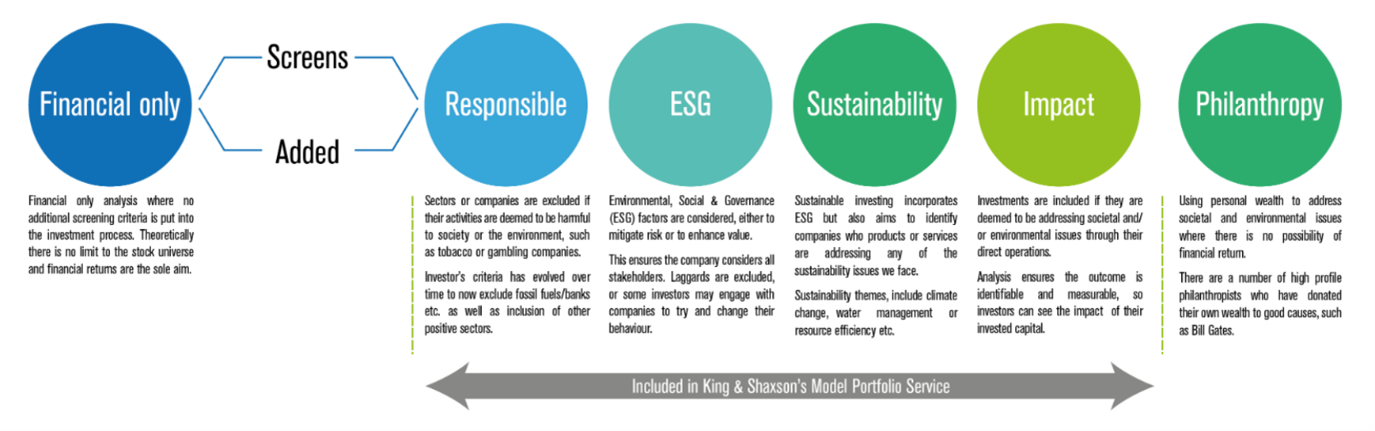

Firstly, we need to understand what ESG and Impact investing really means. Put simply, it’s an additional step in the investment process. Non-financial factors, such as those associated with the environment, society or corporate governance are analysed alongside the traditional investment process.

Beyond this, a fund can have Impact considerations, where investments are identified as having a positive and measurable outcome on people or the planet. In many places, these outcomes are supporting solutions linked to the UN Sustainable Development Goals.

The considerations above will define where the product sits on the spectrum of capital (highlighted below).

Into the mainstream

No doubt we can attribute some of the growth in ESG and Impact investing to the desire of investors to ‘do good’. However, other factors have played a pivotal role in its growth.

The first is the maturity of sectors associated with ESG and Impact, and with that, its relative out-performance. Many of the technologies, such as renewable energy, electric vehicles, energy efficiency, environmental technology, medical Artificial Intelligence, fintech, and the internet of things have developed in the last 20 years.

The investment universe has grown alongside the growth of the sectors, albeit at a slower pace. Companies that were smaller and riskier some 20 years ago, are now large-cap companies. Other companies have repurposed themselves, or have been spun out of conglomerates to align. All of which have altered the size and structure of the universe.

What cannot be understated as perhaps the most significant factor is the growth in data. This enables the analysis of ESG and Impact factors, which had previously been a laborious process for asset managers. Now there are numerous services run by large rating agencies, providing scoring and supplemental non-financial information. At the same time, many companies today report on ESG or Impact metrics, albeit a process that’s in its infancy and will require further standardisation.

Importantly, it is not only asset managers who get this information. Internet sources and social media enable the underlying investor, who by their nature are more interested in their investments, to access both positive and negative information.

How the data is applied to the investment process is a key factor in investment selection. ESG data is an ever-growing source of information, but most ESG rating agencies process the data to determine an investment’s risk, rather than determine if the company is ‘doing good’. This may appear to be a small nuance in terms, but it is instrumental in the investment selection process.

Two ESG funds may sit alongside each other in terms of their label and risk profile, but have very different holdings as a result of the screen applied. A detailed understanding of how products are screened is essential. Our ethical screening policy explains some of the key areas we look at (click here to read).

This means that, for advisers, there is a risk of a clash between client expectations and the products offered. Understanding both client expectations and looking ‘under the bonnet’ of a product is therefore essential to ensure alignment. Experience has taught us that as clients become more interested, their views change over time. Therefore, this should always be regarded as a dynamic process.

Out of the woodwork

As mentioned, the recent reversal in relative performance for both ESG and Impact has provided a window for a number of critical comments (click here to read our recent comment on technology). Over the past years, we have cautioned about over-egging outperformance. Much of it boils down to lacklustre returns and higher volatility of sectors such as oil and gas, commodities, and large banks.

Whilst we have seen underperformance in the last 12 months, we call the longer-term nature of this into question. High commodity prices eventually lead to alternatives being used. We see high oil and gas prices as speeding up renewables and battery storage take-up. We still see major disruption from technology eroding older industries, from vehicles to finance.

Therefore, many of the longer-term structural trends associated with both ESG and Impact investments remain intact, and as efficiency and cost savings become a priority, we see these trends accelerating, rather than retreating. The much-needed decline in some valuations means that we see recent performance as a healthy correction after the pandemic.

Years of experience has helped us gain a healthy perspective on this sector, trends that come and go and those that stay and grow. As a team managing ESG and Impact portfolios, we are strictly discretionary and do not offer an advisory service. Our focus is helping financial advisers, not being one.

Boasting an 11-year track record, King & Shaxson Asset Management offers 11 model portfolios (Dynamic Planner Risk Profile 3-8), all of which incorporate a stringent negative and positive screen. To find out more and to request an MPS brochure, please click here.

Disclaimer: For Investment Professionals Only. The information contained in this document is for general information purposes only and should not be considered a personal recommendation or specific investment advice. Nothing in this document constitutes an offer to buy or sell securities of any type or should be construed as an offer or the solicitation of an offer to purchase or subscribe or sell any investment or to engage in any other transaction.

The team at Dynamic Planner have grown rapidly during Covid, meaning many members began roles in varying levels of lockdown in the UK. However, the award-winning firm’s commitment to remote and hybrid working has helped new starters hit the ground running in the field of financial planning technology.

Max Bowser began his career in financial services as a paraplanner, who taught himself programming in his spare time. When the principal financial adviser at his firm retired and sold up, he decided to make it a full-time profession. After a year of freelancing, he joined Dynamic Planner in February 2021.

Were you thinking about a move into financial technology when you started learning programming?

Not really. I was making games and I’d made a few apps and other tools. I realised I could apply what I’d learnt to my job, so over time I became more of a software developer who happened to be a former paraplanner. Then, when I was freelancing, I saw a job posting for Dynamic Planner. It looked like a good opportunity: being paid to do programming, which I really enjoy, without wasting my knowledge about financial advice.

You joined Dynamic Planner during a lockdown. What was that like?

I’d say it was a unique experience, except it’s one that lots of people have been through now. There’s obviously the challenge of not being in an office, not being able to wander over and chat with anyone, either socially or to ask questions. But everyone’s good at being available online, and there’s a lot of effort to bring people together remotely. From the tech side of things, the hardware is really good, which helped with getting up to speed.

What does your role involve?

I’ve ended up being the custodian of a new project to manage all our product data. When I joined, I began helping with the project, which had just started, and over a few weeks I was taking on more and more of the work. That freed up the developer who had been working on it to take on something else, and the project was handed over to me. It’s a nice thing about the company: it’s the right size that there’s plenty of interesting stuff going on, but it’s also small enough that you can take ownership of things.

Visit our careers page to view our latest vacancies