Ahead of the 2nd anniversary of Consumer Duty on 31st July, Dynamic Planner, the UK’s leading digital advice platform, now has a record £100bn of client holdings, while the number of client reviews taking place since August 2023 has increased by 69%.

Analysis of Dynamic Planner data which covers over 40% of the UK advice market that it serves, has revealed how firms have embraced technology to meet the Consumer Duty requirements. With the spotlight on target markets, the number of linked recommendations since August 2023 has rocketed by 146%. Similarly, the number of cash flow reports generated have also been boosted – with the number rising by 177%. Dynamic Planner’s Financial Wellbeing Questionnaire, launched just over two years ago to enable advisers to identify client vulnerabilities, has now been used to profile over 12,000 clients.

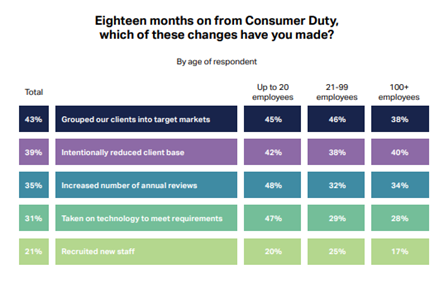

Outside of Dynamic Planner’s client base, its Advice 2025 survey undertaken with over 400 advice professionals across the UK, consisting of 304 financial advisers, 52 decision makers and 50 paraplanners tells a similar story. Firms were asked which changes they made following the implementation of Consumer Duty 18 months on. Over 40% had grouped clients into target markets; 35% had increased the number of annual reviews; and almost 1 in 3 had taken on new technology to meet the requirements.

Chris Jones, Financial Services Director at Dynamic Planner said: “Two years on and Consumer Duty is now a part of the normal thinking and philosophy of the industry. It has been a success at encouraging client centricity, and this is borne out in our analysis.

“The change in regulation has reshaped the industry, changing the way advice firms work and deal with their clients. They are using technology as a trusted partner which offers a combination of adherence, evidence, compliance, and at the same time, scale. There’s no doubt that the level of technological evidence gathering it offers combined with spending as much or more time with clients would have been fantasy not that long ago.

“While there has been some reported detriment to the Advice Gap – that some firms have found it hard to cover the cost to serve all clients, we are confident that the FCA’s recently announced Targeted Support Proposals will go some way to alleviating that issue in the medium term. A successful regulatory environment that delivers for all is probably the most difficult jigsaw of all to complete, but the direction of travel is currently a positive one.”

To find out more, firms can register here: Advice 2025.