By Maria Municchi, Multi Asset Fund Manager, M&G

The recent bout of volatility has affected both equities and fixed income markets. In this article, by Multi Asset Fund Manager Maria Municchi, we would like to explain our views on the current interest rate regime and our assessment of the inflation scenario.

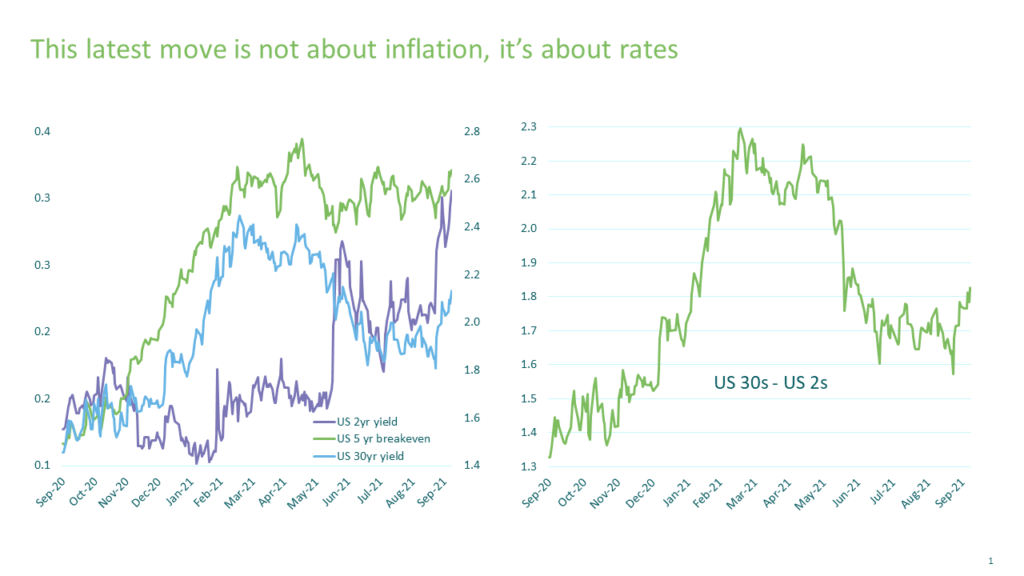

Recent market movements are about interest rates NOT inflation

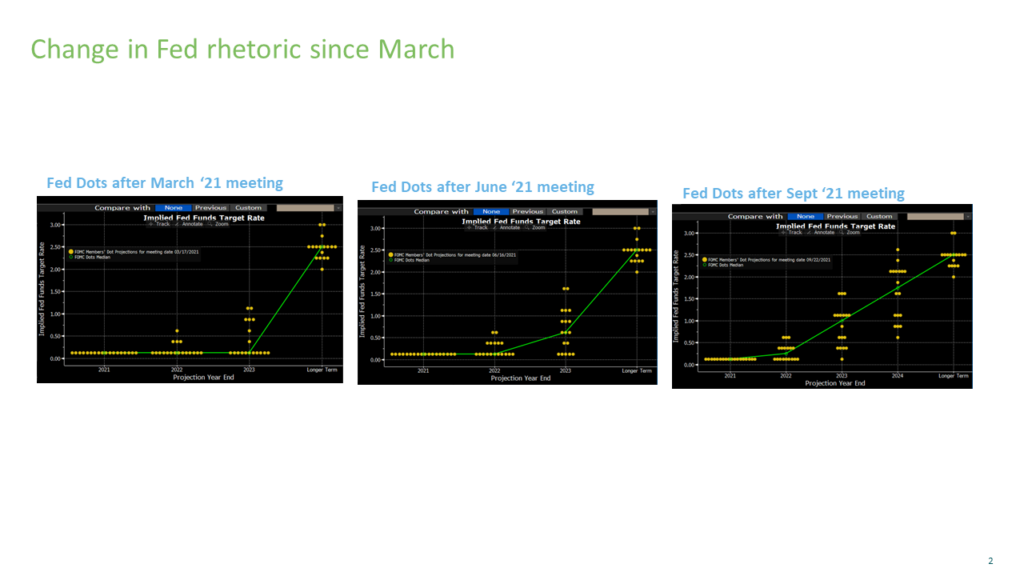

Market moves earlier in the year were primarily driven by increased inflation expectations, as demonstrated by the rise the five-year breakeven rate, and also had a significant impact at the longer end of the US yield curve. The broad consensus, including that of the Federal Reserve (Fed), seemed to be that inflation would be transitory and that interest rate hikes were a long way off, and not before the end of 2023. As a result, the short end barely moved and the yield curve steepened.

More recently, however, this has changed as during the summer the Fed changed its rhetoric regarding rate rises and the first increase is now expected to occur in 2022. There is also increased talk about tapering if economic progress continues, but long-term interest rate expectations have not changed. This is consistent with what is happening in the yield curve; in recent months rate rises have started to be priced in at the short end, while the long end moved less and the yield curve has flattened.

The Fed is not the only central bank to have issued more hawkish comments; central banks across the globe have moved in the same direction, with the Bank of England’s hint at a potential rate hike this year a possible trigger for the volatility that followed.

Inflation still driven by transitory forces

Although we do not believe that the recent bond moves were about inflation, questions about this topic are recurring in client meetings. We still believe that inflation is likely to be transitory and that price pressures should normalise once supply/demand imbalances have been resolved. We expect this to happen over the next 12 months. Additionally, we believe that the long-term structural factors that have kept inflation on a downward track for the past 30 years, such as globalisation, demographics and technology, are still intact. However, we continue to closely monitor inflation dynamics, such as supply chain disruptions, energy prices and growth in wages.

Supply chain disruption has led to current supply and demand imbalances

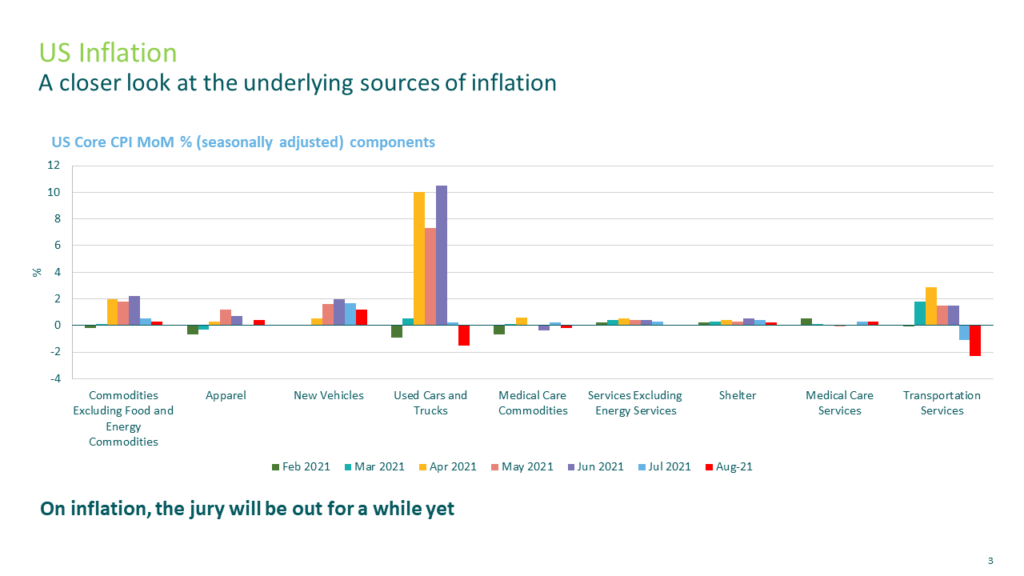

Global economies are reopening at different speeds and this has resulted in supply chain disruption, which could continue into the first half of 2022. The imbalances between supply and demand have led to an upward squeeze in prices, not only on the products included in core CPI measures but also food and energy. Although remarkable, the most significant price increases reflect the distinct nature of the COVID-19 crisis, characterised by the sudden stop and gradual reopening of the economy.

For example, looking at the core CPI components in the US, one of the largest price increases has been for second-hand cars, which has been a substitute for new cars given the lack of semiconductors affecting new vehicle production. This phenomenon is likely to be temporary as the higher prices should be expected to normalise and possibly revert over time. The incredible windfalls resulting from selling your used car more expensively than when you first bought it are unlikely to be repeated.

Supply and demand imbalances in the energy sector

Supply and demand imbalances in the energy sector

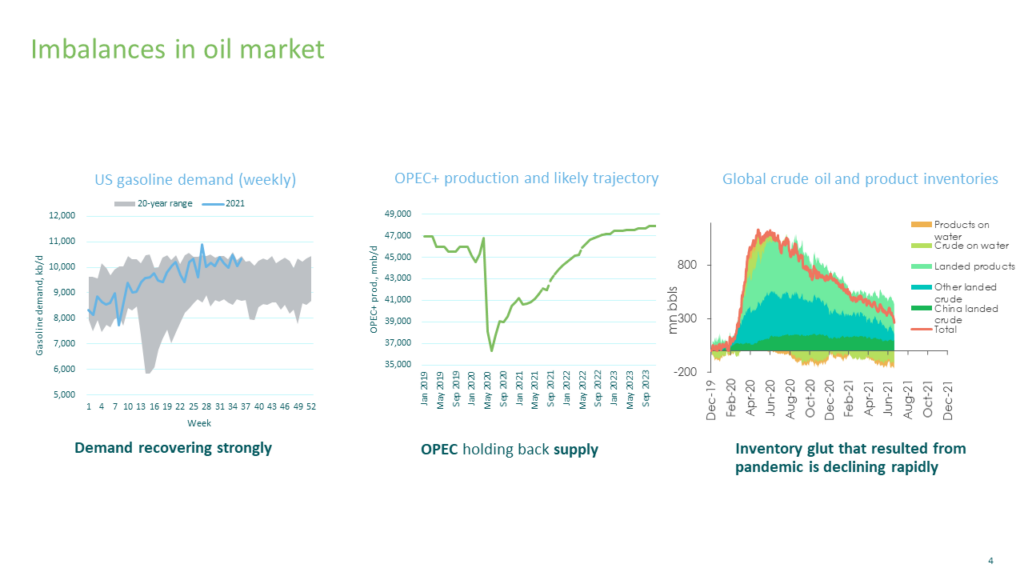

Another area where prices have increased significantly is energy prices, particularly gas. While demand has increased significantly during the reopening, supply hasn’t responded to the same extent and the switch from coal to less carbon-intensive energy sources has exacerbated pricing pressures. However, going forward, supply should increase from a ramping up of oil and gas production, as well as greater use of renewable energy sources.

Source: Bloomberg (left chart), Goldman Sachs (middle and right chart)

Supply and demand imbalances in the labour market

At long last, we are now seeing some signs of wage inflation, particularly in low paid jobs in the US. As companies are increasingly looking to hire, as shown by the high levels of available jobs, and labour market participation remains low, some sectors have seen material wage growth. However, with unemployment still above pre-Covid levels and benefits now coming to an end, there is scope for labour participation to increase and for workers to come back into the economy in the next few months, potentially reducing the inflationary forces on wages that are now in place.

Our view on the market

Overall, our asset allocation stance remains one of selective participation in risk assets, with equities providing the main upward driver, balanced by a substantial exposure to long-dated US Treasuries. We believe that the current environment can still be characterised as ‘benign’, which means economic growth and recovery are dominating, rather than the fight against inflation.

We continue to closely monitor the market’s price behaviour and correlations, particularly with regard to the re-pricing of rate beliefs. That said, we remain aware that, as always, genuine surprise usually arises where the market is least expecting it!

Read more M&G Investments ‘Latest insights’.