For this year’s International Women’s Day we analysed the difference in men and women’s attitudes towards investing. The analysis is based on the data from our market leading suite of psychometric client profiling questionnaires, used by over 40% of advisers in the UK to support more than two million investors. This rich dataset allows us to understand what drives client attitudes and their preferences, but further exploring differences due to demographic factors, such as gender, can enable us to develop interventions and strategies to help clients.

Attitude to risk and financial personality

We made some interesting findings – in terms of attitude to risk*, on average, men are more risk tolerant than women across risk profiles 1-10, with more women than men being RP1-5, and more men than women RP6-10. Across all elements of financial personality, men are more risk tolerant. They tend to view themselves as more risk-seeking, more fearful of missing out on investment opportunities, better able to tolerate the ups and downs and have stronger positive emotions towards taking risk, but a weaker desire for certainty in comparison to women.

Retirement income preferences and sacrifices

Overall, women and men are quite similar in their views on retirement income preferences. Although, women care more than men about leaving something behind after they’re gone (legacy) and having a fixed income (consistency), whilst for men, having flexibility in the amount of income they can take each year is more important than both of these. Women are more willing than men to cut back their expenditure during retirement but less willing to return to work or access income from another source. Finally, a smaller percentage of women than men are ready to commit and make a lasting decision about their retirement plan.

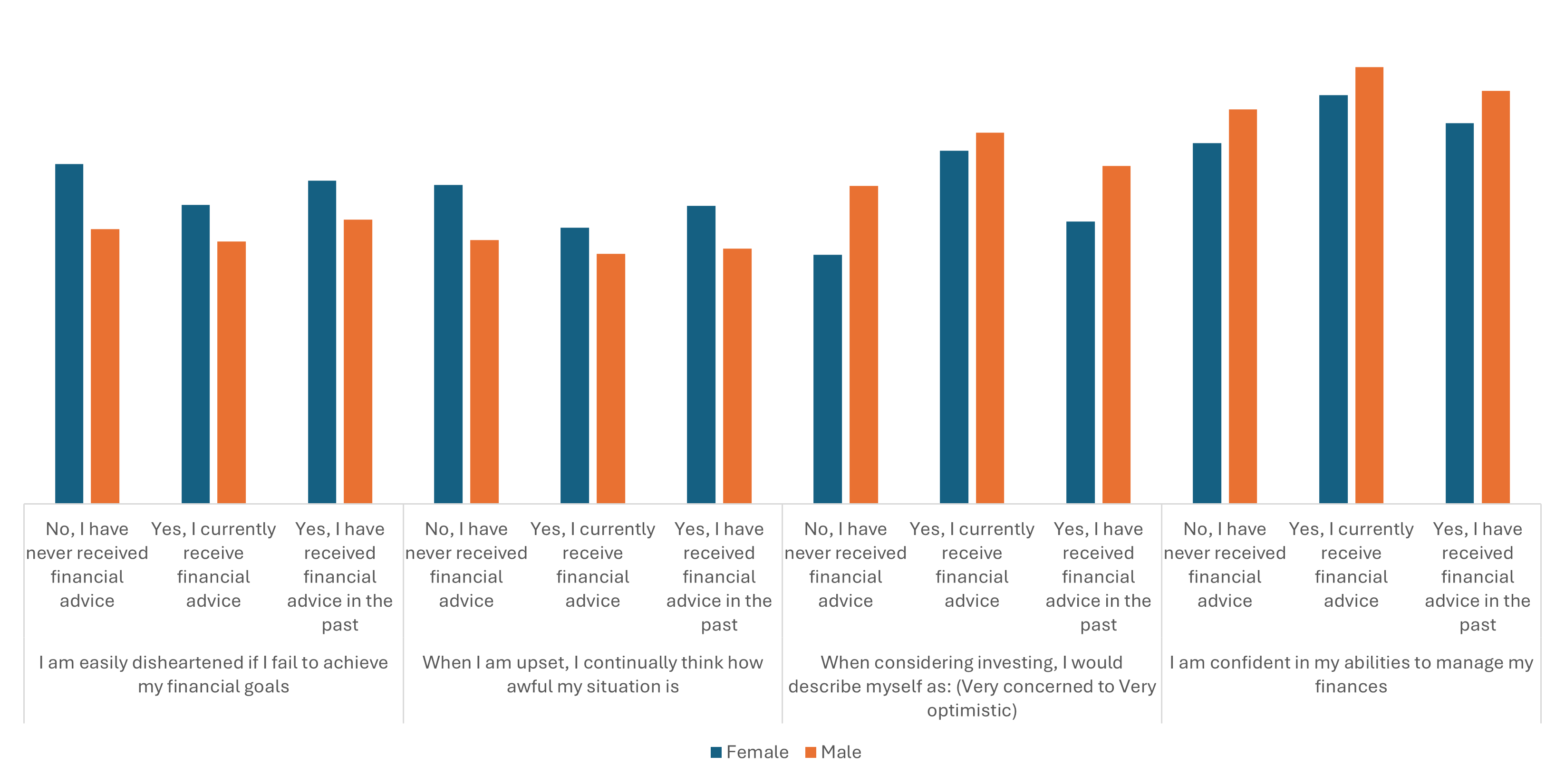

Financial wellbeing

Regardless of gender, working with a financial adviser can have a positive impact. Women appear to benefit more from advice in terms of their emotional resilience, emotion during uncertainty and emotion regulation. Women are less disheartened if they fail to achieve their financial goals, this change being greater than what we observe for men. They dwell less on their problems after receiving advice and are more optimistic about investing, again the effect of advice appears stronger than that for men. Women’s financial self-efficacy and knowledge, appears to be positively but more equally effected when making comparisons with men.

Subjective Measures of Financial Wellbeing

Often our findings show that women can be more risk averse and less confident in managing their finances, but what we discovered is that financial advice can have a significantly positive impact on women. The next steps within the industry should be to identify what elements of financial advice are driving this positive difference in order to create interventions tailored to enable women greater inclusion in financial planning and increased confidence and resilience.

*Risk profiles featured are based on Dynamic Planner’s 75 asset class asset risk model, that currently risk profiles over 1800 funds and solutions from over 150 asset managers.