by Gareth Harries, Director of Nationals & Networks, HSBC Global Asset Management.

Whilst most of us might not speak Greek, we will know the extent to which it has influenced the English language. Take the root word ‘idios’, which means ‘one’s own’ or ‘self’, leading to words like ‘idiosyncrasy’. But what does this have to do with the current pandemic and how we should consider investing?

There’s no doubt we are experiencing unprecedented market risk (‘systematic’), but is the line between this and idiosyncratic risk (‘unsystematic’) becoming blurred, and if so, what can we take from this convergence?

Outlook – the world re-boots?

If you have dialled into our updates on the current macro environment, you will have heard us talk through the various post-COVID-19 recovery scenarios: v-shaped, u-shaped or a ‘Nike’ swoosh. Clearly, we don’t know the length and severity of the recession, but if we consider the ‘sudden stop’ in the world economy akin to a power cut, we will need to assess the damage when it comes back on.

Some companies will have fared well, some will have a pulse and some won’t have survived. For those who make it, the question will be if they are suited to the new environment and if not, do they have the resources and insight to adjust? As advisers, will there be a filter by which you can help your clients assess the future prospects of these companies post-COVID-19?

Looking beyond the ‘macro’, let’s also take a look at the response of the pandemic from a societal perspective to date (end of May) and consider how this will affect the lens through which we may examine the world (and companies) in the future.

Social

The process of adjusting to our ‘new normal’ isn’t linear. But across the spectrum we’ve seen panic, selfishness and blame through to acceptance, resilience and generosity. It could be said that for all the news of mass poor behaviours, there have been far more examples of the good as people slow down and find ways to be resourceful and thoughtful.

We’ve seen pop stars performing free concerts or workouts from their lounges, rainbows in windows and who hasn’t been inspired by Captain Tom’s actions and words!

Work

Most of our industry has been adjusting to working from home and rising to the challenge of finding ways to help and calm our clients virtually. But many will believe we are more connected thanks to the increased usage of video conferencing and a willingness to be part of this. Who would’ve thought that people would be logging on after work to be doing online pub quizzes on Zoom?

Companies

There’s no manual for companies to use to survive during this time; some have furloughed their staff, some have chosen not to despite being eligible, and some have changed their minds. What’s ‘right’ or ‘wrong’ is decidedly grey.

On the other hand, some company behaviours have been clearer to judge; we’ve seen senior staff donate or cut their salaries and companies adapt their manufacturing lines to produce hand sanitiser or PPE, alongside large retailers leaving contracts unpaid and workers destitute.

E, S and G

Environmental, Social and Governance (ESG) investing has been garnering more attention over the last few years. Some of the largest ESG funds are outperforming the broader market during the coronavirus crisis. This could arguably be more of a lower carbon play, so, in addition, it’s important to look over the longer term and, of course, at the post-COVID-19 environment.

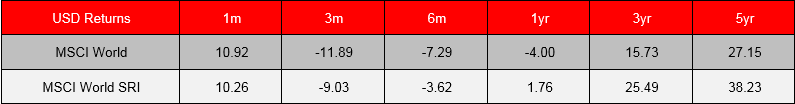

If we look below on a more generic level, at two indices, the difference is noticeable.

Past performance is not an indication of future returns

Source: FE Analytics 30 April 2020

COVID-19 could be a defining moment as we respond to what we’re experiencing and re-calibrate based on these experiences our true values and those that are aligned to them. ‘Environmental’ has been a key focus in the ESG conversations thus far. But will the ‘S’ and ‘G’ now come to the fore? Some companies may be tarnished by their actions, while some may be more admired.

Post-COVID-19, will you and your clients think differently around your actions – be it travel, consuming and investing? For example:

Will consumers question whether the company or provider supported their staff / suppliers, as they deem, fairly?

Will consumers be less cost conscious and more values focused, a sort of value for peace of mind? Or will costs still be king?

Will you and your clients proactively want to invest in companies who behaved well during the crisis, from a moral and economic viewpoint?

Going back to the Greek root word ‘idios’, meaning ‘one’s one’ or ‘self’, it is also the basis of the word ‘idiot’! Putting it into today’s context, those not displaying actions to benefit the collective could be akin to idiocy, especially for companies.

ESG filters could be a way of helping advisers and their clients sift out those that won’t survive in the new world, where moral alignment is another consideration alongside price, service and product.

And going back to the initial question, when it comes to investing, it could be that you and your clients will be saying ‘adios’ to those companies and providers who don’t align to values in a post pandemic by showing too much ‘idios’ during it!

About HSBC Global Asset Management

HSBC Global Asset Management has over 25 years of experience designing multi-asset solutions to meet investors’ long-term financial objectives. The firm manages $131.2bn [at 31 March 2020] in multi-asset strategies and is committed to sustainability and ESG.

HSBC Global Asset Management has added three more funds to its Global Sustainable Multi Asset Portfolios, taking the range up to five:

- HSBC Global Multi Asset Sustainable Cautious

- HSBC Global Multi Asset Sustainable Conservative – Dynamic Planner Rating 5

- HSBC Global Multi Asset Sustainable Balanced – Dynamic Planner Rating 6

- HSBC Global Multi Asset Sustainable Dynamic

- HSBC Global Multi Asset Sustainable Adventurous

Important information:

For professional clients only.

This commentary is for information purposes only. It is a marketing communication and does not constitute investment advice or a recommendation to any reader of this content to buy or sell investments nor should it be regarded as investment research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination.

Any views expressed were held at the time of preparation and are subject to change without notice. While any forecast, projection or target where provided is indicative only and not guaranteed in any way. HSBC Global Asset Management (UK) Limited accepts no liability for any failure to meet such forecast, projection or target. These portfolios are sub-funds of HSBC OpenFunds an Open Ended Investment Company that is authorised in the UK by the Financial Conduct Authority. The Authorised Corporate Director and Investment Manager is HSBC Global Asset Management (UK) Limited.

All applications are made on the basis of the prospectus, Key Investor Information Document (KIID), Supplementary Information Document (SID) and most recent annual and semiannual report, which can be obtained upon request free of charge from HSBC Global Asset Management (UK) Limited, 8, Canada Square, Canary Wharf, London, E14 5HQ, UK, or the local distributors.

Investors and potential investors should read and note the risk warnings in the prospectus and relevant KIID and additionally, in the case of retail clients, the information contained in the supporting SID.

Where overseas investments are held the rate of currency exchange may also cause the value of such investments to fluctuate. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Stock market investments should be viewed as a medium to long term investment and should be held for at least five years.

To help improve our service and in the interests of security we may record and/or monitor your communication with us. Approved for issue in the UK by HSBC Global Asset Management (UK) Limited, who are authorised and regulated by the Financial Conduct Authority. www.assetmanagement.hsbc.com/uk

Copyright © HSBC Global Asset Management (UK) Limited 2020. All rights reserved.