Each week Abhimanyu Chatterjee, Chief Investment Strategist at Dynamic Planner provides a clear and concise overview of how our Benchmark Allocations performed, its key drivers and trends along with notable movements within the portfolio. Designed to support you and keep you informed of how our portfolios have been performing and providing information you can discuss with your clients.

Last week: Week ending 19 September 2025

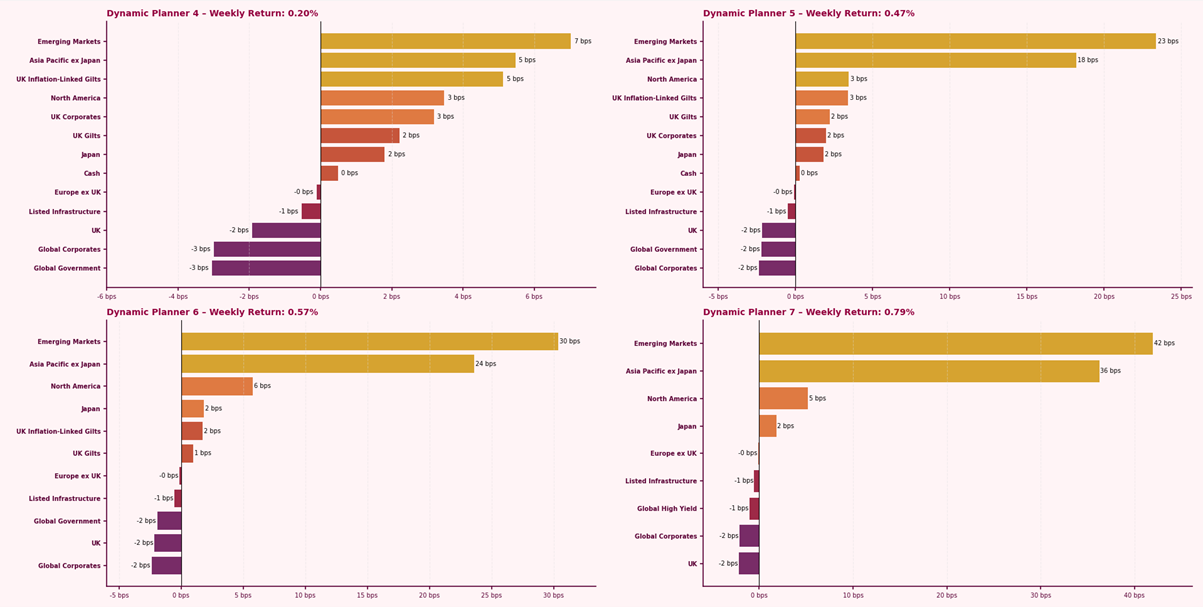

Dynamic Planner Portfolios achieved positive returns last week, ranging from 0.20% to 0.79%, galvanised by a surge in gains across risk assets. Performance was led by Emerging Markets and Asia Pacific ex Japan, due to increased demand in semiconductors and AI-linked hardware and thus boosting equities. This is despite China’s restriction on NVIDIA chip purchases weighing slightly on sentiment.

Although not as significant, North America also contributed, supported by solid earnings and resilient tech leadership. The U.S Federal Reserve’s rate cut further amplified risk appetite, driving flows into equities and higher-beta exposures. UK and European equities lagged as political uncertainty grows, bolstered by softer growth data in the region.

Listed Infrastructure and Global Bonds experienced modest detraction, fuelled by the Fed’s rate cut decision, as higher yields capped fixed income returns. Overall, the portfolios benefitted from equity-led strength, highlighting the supportive backdrop for risk assets in the aftermath of looser monetary policy.

For more content to support your conversation with clients, visit our Content Hub