Each week Abhimanyu Chatterjee, Chief Investment Strategist at Dynamic Planner provides a clear and concise overview of how our Benchmark Allocations performed, its key drivers and trends along with notable movements within the portfolio. Designed to support you and keep you informed of how our portfolios have been performing and providing information you can discuss with your clients.

Last week: Week ending 17 October 2025

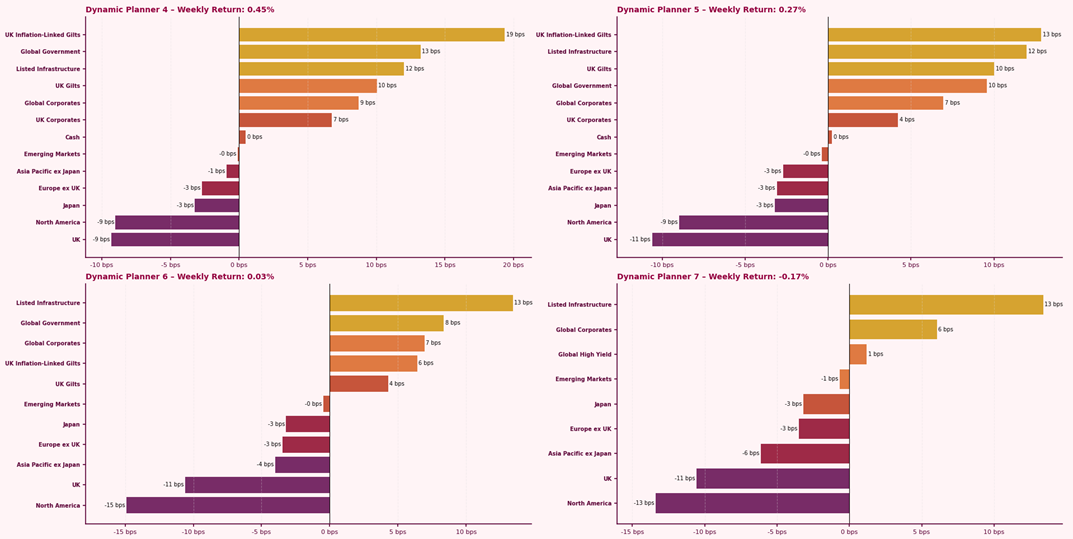

The Dynamic Planner Benchmarks generated returns ranging from -0.17% to 0.45%, as investor sentiment turned more defensive. Safe-haven assets like global government bonds added to performance, whilst equities retreated. North American and UK equities experienced sharp pullbacks as investors digested Trump’s tariff announcement on Chinese imports, rekindling fears of broader trade confrontation and dampening risk appetite.

Emerging Market and Asia Pacific ex-Japan equities softened, further reflecting heightened global uncertainty and heavy rotation away from higher-beta assets. Meanwhile, UK markets continued to face domestic headwinds, with speculation of higher taxes in the upcoming November budget weighing on sentiment, though gilt yields eased as investors favoured government bonds.

The shift in market tone suggests investors are reassessing valuations following a strong run in risk assets – but is this the beginning of the pullback?

For more content to support your conversation with clients, visit our Content Hub