Each week Abhimanyu Chatterjee, Chief Investment Strategist at Dynamic Planner provides a clear and concise overview of how our Benchmark Allocations performed, its key drivers and trends along with notable movements within the portfolio. Designed to support you and keep you informed of how our portfolios have been performing and providing information you can discuss with your clients.

Last week: Week ending 26 September 2025

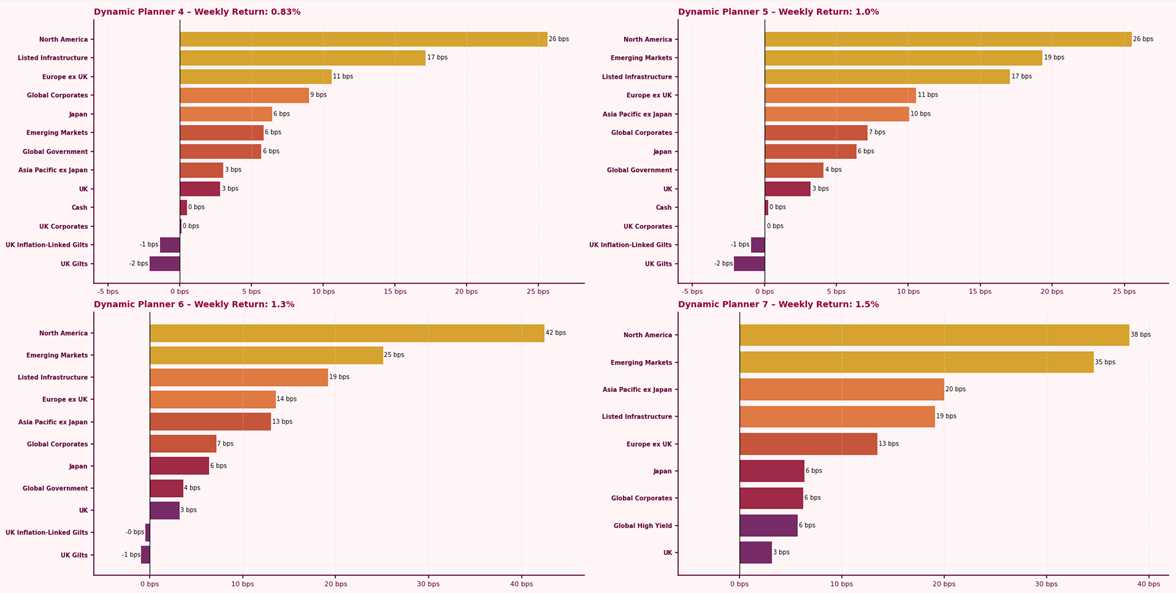

Dynamic Planner Portfolios achieved positive returns last week, ranging from 0.83% to 1.5%, supported by continued strength in risk assets. North American equities remained the standout contributor, with robust consumer expenditure lifting U.S retail sales and reinforcing the regions strong technology leadership.

The Federal Reserve’s recent rate cut continues to filter through markets, further influencing increased risk appetite. Despite ongoing concerns over China’s restrictions on NVIDIA chips, Emerging Market equities remained strong due to persistent semiconductor demand.

Listed Infrastructure also advanced, buoyed by expectations of rising demand for AI adoption linked data centres, following NVIDIA’s recently announced $100 billion partnership with OpenAI. In contrast, UK government fixed income assets detracted, echoing weak domestic output data, fiscal pressures, and elevated gilt yields.

For more content to support your conversation with clients, visit our Content Hub