In a profession often shaped by constant change – regulatory, economic and technological – it’s more important than ever to understand how advice firms are responding, to inform the wider industry and help to create a picture for the future. That’s why we’ve launched Advice 2025: a new annual health check for the UK advice industry.

Drawing on responses from more than 400 advisers, paraplanners and business decision makers across the UK, the findings offer a clear and candid view of what’s happening inside firms today – and what may lie ahead.

A confident outlook on growth

Despite the increased demands of Consumer Duty and a challenging operational landscape, the message from firms is one of optimism.

- 86% of advisers expect to grow their client base in the next 12 months

- 72% are already serving more clients than a year ago

- Smaller firms appear to be catching up with the efficiency gains their larger peers have already achieved

AI: high expectations, growing momentum

Artificial Intelligence stands out as a transformative force in this year’s results.

- 94% believe AI will have a positive impact on the profession

- Early use cases include meeting transcription, document analysis, and personalised reporting

- While only a minority of firms are actively using AI, the vast majority are investigating its potential – making the sector one to watch in the months ahead

Advisers see AI not as a threat to the personal nature of advice, but as a means to deliver high-quality service at scale, reduce costs, and reach more clients – including those who have traditionally found advice out of reach.

The data dividend

Alongside AI, firms are also recognising the power of data and their growing ability to use it.

- 85% say data is essential or useful for their business decision making

- As tech stacks improve and data becomes more accessible, firms are using it to gain clearer visibility over operations, client trends and future planning

- Firms are recognising that better data can enable more proportionate regulation and help deliver consistent, compliant advice

What comes next?

While challenges remain – including recruitment, integration, and pressure on margins – the survey reveals a sector actively responding to change, investing in technology, and looking to grow its reach.

As Ben Goss, CEO of Dynamic Planner, says:

“Firms are rising to the challenges and facing the future with confidence. Advice 2025 highlights the real-world issues — growth, scale, cost to serve — with the insight of those on the front line. We’re proud to bring their voices together in this report.”

Advice 2025 is just the beginning. As we share more findings in the weeks ahead, we hope the report helps you reflect, benchmark, and plan for what’s next — not just for your business, but for the advice profession as a whole.

Download the full Advice 2025 report here

by Dr Louis Williams, Head of Psychology and Behavioural Science

How do your clients interpret past performance? Is the information you provide valuable, or could it be leading them to make poor decisions?

Under the consumer understanding outcome of Consumer Duty, the FCA wants firms to support customers to make informed decisions by giving them the information they need, at the right time, in a way they can understand it. To support alignment with this outcome, we at Dynamic Planner wanted to find out how clients interpret the performance charts they are shown by their advisers.

Despite the requirement to include disclaimers to the contrary, research shows that past performance data is often relied on as a useful source of information for decision making1. This can lead to poor choices due to behavioural biases such as availability bias, where clients use information that comes to mind quickly, and recency bias, where clients assume that future events and trends will resemble recent experiences2.

Benchmarks are used in past performance charts to provide clients with a point of comparison, but little research has explored how these are used in making decisions, and whether they are or are not beneficial.

In collaboration with Mark Pittaccio (Quilter), Dr Eugene McSorley and Dr Rachel McCloy ( University of Reading), we conducted a research project to explore eye movements and decisions of experts and non-experts when interacting with past performance charts. A total of 60 participants took part in the study, and were categorised into three groups – students, clients, and experts – based on their background and experience.

Eye tracking technology monitors eye movements during decision-making processes, providing insight into how we process complex information before making a choice. Such techniques have been used across disciplines including sports, art, medicine and decision theory.

We used the technology to monitor the eye movements of participants while they viewed a range of charts depicting one year of hypothetical performance. Participants were fitted with an EyeLink II tracker headset, and answered questions for each graph about what they would do in the situation – would they stay invested? – and how they felt. They were also asked to estimate the maximum return and the return at the start of month nine to gauge their level of understanding.

We found that clients spent more time and made more fixations and visits to the last two months and the y-axis of performance charts than both experts and students – that is, they relied significantly more on recent performance to help with decisions.

They made even more visits to the last two months when they were provided with a benchmark, whether returns were positive or negative. The availability of a benchmark appears to be very important for clients, providing useful information on whether to remain invested and affecting their views on the future of their investments. However, paying too much attention to the benchmark and to recent performance can distort decisions.

A benchmark was helpful in reducing concerns when participants had achieved negative returns. However, the inclusion of a benchmark reduced their propensity to remain invested. The presence of a benchmark also increased the complexity of the charts for non-experts, with both students and clients requiring more time to make a decision when a benchmark was shown.

Benchmarks and portfolio values are factual representations of what has actually happened, but they tend to be presented without context of the client’s own financial objectives or whether or not their financial plan is on track. This lack of context could lead to poor assumptions being made based on very recent performance.

The adviser’s skill is important to help make the information relevant to the client’s individual circumstances and help them resist the temptation to act on detrimental behavioural biases.

A personalised benchmark that demonstrates whether the client is ‘on track’ to achieve their objectives may be more appropriate than generic benchmarks. Further research can help us understand this and the effects of visual framing on clients’ interactions with past performance data.

Sources:

- N. Capon, G. J. Fitzsimons, & R. Alan Prince (1996). An individual level analysis of the mutual fund investment decision. Journal of financial services research, 10(1), 59-82.

- S. Diacon & J. Hasseldine (2007). Framing effects and risk perception: The effect of prior performance presentation format on investment fund choice. Journal of Economic Psychology, 28(1), 31-52; W. Bailey, A. Kumar & D. Ng (2011). Behavioural biases of mutual fund investors. Journal of financial economics, 102(1), 1-27.

Dynamic Planner, the UK’s leading digital advice platform, has relaunched Content Hub, which is free to use and available on its website.

Financial planning professionals now have a revitalised range of articles, data, analysis and insight at their fingertips – all designed with clients in mind, to ensure compliance and support an engaging and informative planning process.

Launched in 2020 to provide additional ways to explain and tackle the many topics that arose from the pandemic, material on Content Hub has been enhanced and expanded, providing visual aids, checklists and financial education to help bring conversations with clients to life.

Drawing on the academic expertise of Dr Louis Williams, Dynamic Planner’s Head of Psychology and Behavioural Insights, Content Hub also contains a range of investor behaviour-based topics, plus his expertise on vulnerability and financial wellbeing.

Chris Jones, Financial Services Director at Dynamic Planner said: “We saw huge demand for Content Hub when we originally launched it back in 2020. With world market events changing at a rapid pace, ongoing cost of living issues at home and ever-changing industry regulation, firms have a seemingly never-ending range of issues to discuss and unpack with clients. Relaunching Content Hub enables us to better support firms in delivering expert insight and make explaining challenging topics, such as new regulations or what can be unsettling market events, much easier.”

Currently on Content Hub, firms can find insight on a range of topics including:

- How our emotions can lead us to good and bad decisions

- Understanding the impact of currency risk

- The benefits of diversification for investors

- Financial Personality

To find out more, visit: Dynamic Planner’s Content Hub.

Liberation Day has arrived – and we can’t say we weren’t warned. But the way forward is still unclear.

Even the most experienced Trump watchers, used to a more rhetoric-driven, flip-flop approach, have been caught on the wrong foot. Knowing the incumbent president’s love of the “art of the deal”, trade rhetoric and executive orders were considered to be pressure tactics to achieve various objectives. But we should not have been surprised: for once, Trump has been surprisingly consistent. Tariffs were an issue on which he ran his election campaign, and tariffs were what we got. What is ironic is the faith in protectionism from a committed capitalist.

Whether this is the beginning of a trade war is matter of much debate and discussion, and depends on the reaction of the countries in the EU and Asia facing the brunt of the tariffs. Various options come to mind, none of them remotely beneficial to the global economy. One potential approach is reminiscent of the period between 2009 and 2011, where economies devalued their currency to maintain their exports, with China being singled out. Another would be a reconfiguration of supply chains and closer cooperation among tariff-hit markets, creating an agglomeration of manufacturing and consuming countries outside the US. Either way, there will be pressure on global growth and prices, leading to a period of uncertainty with respect to interest rates and inflation.

The impact felt at the corporate level will be a more significant factor in either the persistence or abolition of imposed tariffs. The major corporations on the S&P 500 have invested significantly in the economies facing the largest tariffs. Given the ubiquitousness of the silicon chip in all businesses, the tariffs could have a broad impact, but the first-order effects will be felt by companies in the US involved in chip manufacturing or use. These companies have invested heavily in building up manufacturing capabilities in Asia. While the idea behind the tariffs is to stimulate the onshoring of manufacturing and create jobs, the abject reality is that recreating these facilities will take time and investment. Commitments to invest onshore need to be viewed through the prism of return on investment – which does factor in what has already been invested. The result might be serious lobbying from the corporate world for exemptions from tariffs to protect their investments and manufacturing processes. But until these are granted – if indeed they are granted at all – all that remains is uncertainty around future cashflows, which translates into stock price volatility.

For investors, then, anticipate a period of elevated market volatility, which could be sharp or protracted. As with any volatility, the key will be to ride it out, rather than making portfolio decisions on the back of an announcement. As my old mentor used to say, choosing not to act is also an active decision. As the smoke from the opening salvos clears, there will be time to take a more balanced approach to any portfolio changes, based on hard facts rather than on what today feels almost emotional. Right now, it’s more important to follow the tenet our country made famous: “Keep calm and carry on”.

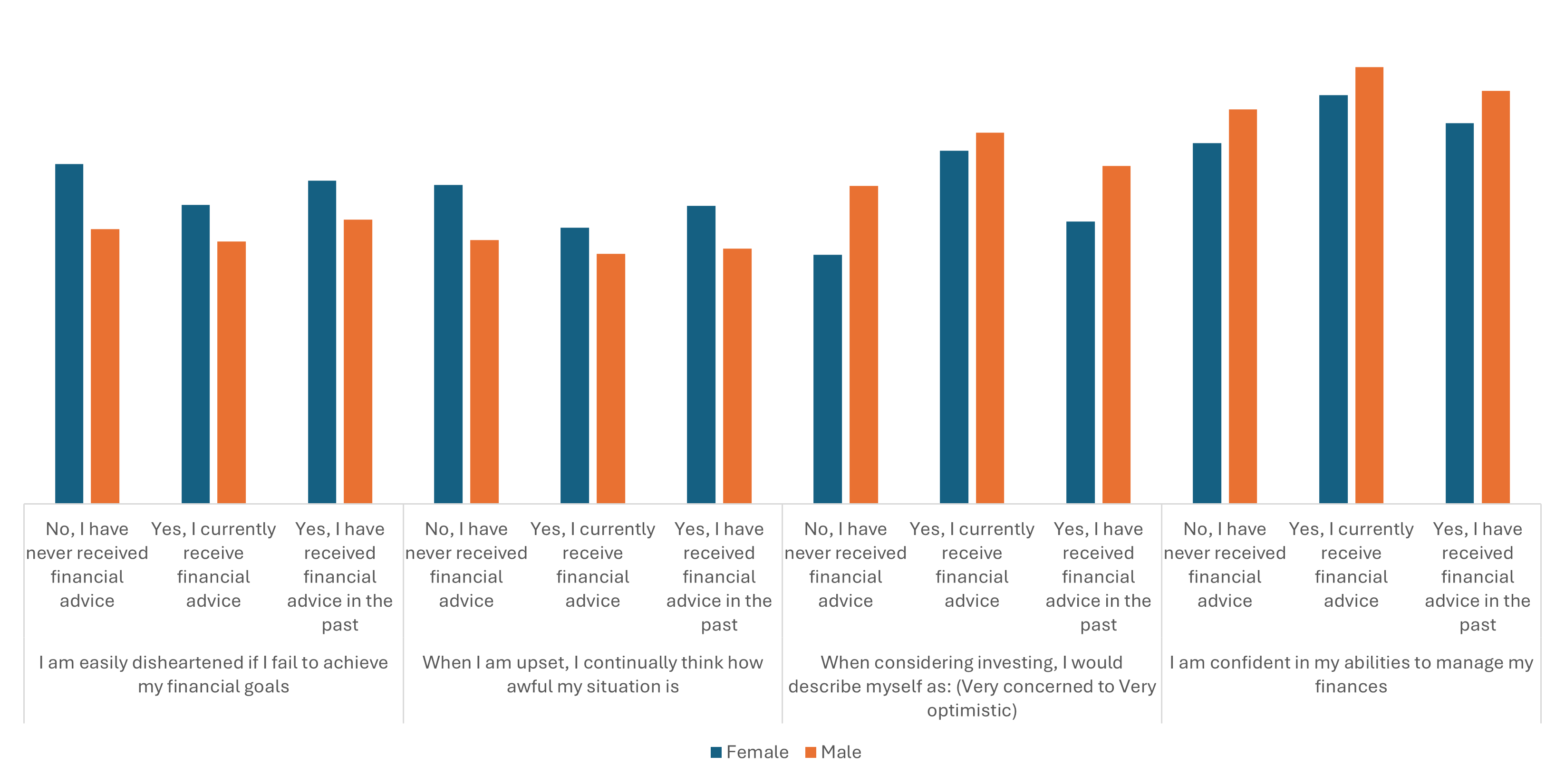

For this year’s International Women’s Day we analysed the difference in men and women’s attitudes towards investing. The analysis is based on the data from our market leading suite of psychometric client profiling questionnaires, used by over 40% of advisers in the UK to support more than two million investors. This rich dataset allows us to understand what drives client attitudes and their preferences, but further exploring differences due to demographic factors, such as gender, can enable us to develop interventions and strategies to help clients.

Attitude to risk and financial personality

We made some interesting findings – in terms of attitude to risk*, on average, men are more risk tolerant than women across risk profiles 1-10, with more women than men being RP1-5, and more men than women RP6-10. Across all elements of financial personality, men are more risk tolerant. They tend to view themselves as more risk-seeking, more fearful of missing out on investment opportunities, better able to tolerate the ups and downs and have stronger positive emotions towards taking risk, but a weaker desire for certainty in comparison to women.

Retirement income preferences and sacrifices

Overall, women and men are quite similar in their views on retirement income preferences. Although, women care more than men about leaving something behind after they’re gone (legacy) and having a fixed income (consistency), whilst for men, having flexibility in the amount of income they can take each year is more important than both of these. Women are more willing than men to cut back their expenditure during retirement but less willing to return to work or access income from another source. Finally, a smaller percentage of women than men are ready to commit and make a lasting decision about their retirement plan.

Financial wellbeing

Regardless of gender, working with a financial adviser can have a positive impact. Women appear to benefit more from advice in terms of their emotional resilience, emotion during uncertainty and emotion regulation. Women are less disheartened if they fail to achieve their financial goals, this change being greater than what we observe for men. They dwell less on their problems after receiving advice and are more optimistic about investing, again the effect of advice appears stronger than that for men. Women’s financial self-efficacy and knowledge, appears to be positively but more equally effected when making comparisons with men.

Subjective Measures of Financial Wellbeing

Often our findings show that women can be more risk averse and less confident in managing their finances, but what we discovered is that financial advice can have a significantly positive impact on women. The next steps within the industry should be to identify what elements of financial advice are driving this positive difference in order to create interventions tailored to enable women greater inclusion in financial planning and increased confidence and resilience.

*Risk profiles featured are based on Dynamic Planner’s 75 asset class asset risk model, that currently risk profiles over 1800 funds and solutions from over 150 asset managers.

Last year, FTRC undertook research with Opinium on behalf of Dynamic Planner with 4,000 members of the public.* We commissioned the survey to explore the opportunity for technology to narrow the advice gap, after Dame Harriett Baldwin, MP, gave a keynote at the 2024 Dynamic Planner Conference where she said: “Only the rich, the 8%, can benefit from the healthy financial options. The remaining 92% are being left in the generic aisles’’.

For International Women’s Day 2025, we decided to look further into what this means for women specifically, and found that despite many advances in terms of equality and income, women are still less likely to seek financial advice than men – the research showed that 18% of men were receiving financial advice versus 11% of women.

Why does this matter?

The incomes of women continue to rise, along with the average age of death, yet they unfortunately remain underserved by both advisers and the financial structures that we have today. Analysis of our risk profiling data shows that while women can be more risk adverse, have lower levels of confidence and financial wellbeing, given the right tools they can make better financial decisions than men. The confidence having a financial coach, the right information and that information delivered to them in the right way can be invaluable. As clients, women offer great potential, so what is standing in the way of firms shifting the balance to having a more diversified client base?

Engagement and communicating to women in the right way is crucial – our research found that 53% of men receive advice in person versus 46% of women, and this could indicate that some women may prefer to engage with their adviser in a different way. When asked, 1 in 2 women (54%) said they would like to track investments and access personalised financial content via a mobile phone app – which was significantly higher than any other form of communication – including email and video call.

Currently just 18% of women receive financial advice via an app – indicating that of those women who say they would like an app, a third do not have one – the question is, how do we get apps like Tram to them? Technology has been transformational for financial planning and it has the power to help firms break down barriers in a way we’ve not seen before. We need to work together to #AccelerateAction and bring women into this new way of shaping their future – digitalisation of the financial planning process could be the gamechanger women need.

*An AdviserSoftware.com report commissioned by Dynamic Planner in 2024: Meeting the future financial planning needs of consumers through technology.

by Chris Jones, Chief Product Officer, Dynamic Planner

The Financial Conduct Authority have published the long-awaited findings of its review into the delivery of ongoing advice – and the news is good.

In 83% of cases where firms had committed to providing suitability reviews, those reviews were delivered. In 15% of cases, clients either declined or did not respond to the firm’s offer of a review. In fewer than 2% of cases did firms report they had made no attempt to provide the promised review.

In response, the FCA is asking all advice firms to review its findings, and to consider whether they have met their regulatory requirements and contractual obligations regarding ongoing services. In the cases where reviews were neither offered nor provided, the regulator expects redress to be due.

Oversight is key to ensuring compliance

The FCA’s review focused on larger firms – and provided examples of best practice that smaller firms should now look to follow. Firms that got it right had ‘effective systems and adequate resources’ to ensure reviews were scheduled and offered as agreed with the client.

Many of those larger firms are already Dynamic Planner users, so this is no surprise to us. We know firms need processes and management information they can rely on to enable them to control, oversee and evidence compliance with their contractual and regulatory obligations.

Dynamic Planner Insights provides you with a comprehensive suite of reports to monitor and manage your clients and your business. Reports cover all client, advice and planning activity undertaken in Dynamic Planner – including reporting on ongoing servicing tailored to meet FCA information requests.

A good time to rethink your advice and service proposition

While the regulator does not expect redress to be due in the cases in which clients declined or failed to take up an offer to complete a suitability review, it does raise a question over the future provision of ongoing advice to such clients.

If a client has persistently declined a review or failed to engage over a number of years, the FCA expects firms to consider whether an ongoing service remains in that client’s best interest. At 15%, those refusing or failing to take up reviews represent a sizeable proportion of the advised population, and firms who wish to retain those clients should take action now.

While there a wide range of platforms, products and investment solutions to choose from for different client groups, the most important advice and service propositions are quite homogenous. Why not mix it up with something new that the client will enjoy and engage with, and which you can afford to deliver?

Our white-labelled mobile app, Tram, is a powerful route to enhanced engagement, putting the financial plan in the palm of the client’s hand through a seamless digital experience.

With Tram, clients have instant access to their portfolio, objectives and risk level, wherever and whenever they need it. Secure in-app messaging reduces the email and admin burden for both adviser and client. A growing library of tailored content can help you strengthen and deepen the relationship, drive return visits and demonstrate your ongoing value.

Look out for further developments

Finally, the FCA has committed to review the rules relating to ongoing services ‘to make sure they remain fit for the future and help as many people as possible to get good support in managing their financial lives’.

The requirements for an ongoing service have been ripe for a revisit for some years, so this should be seen as a positive for the sector. As the regulator notes, new business models and technology have come to market in the decade-plus since the Retail Distribution Review, and client needs are changing too. A service centred on the annual review may no longer be right for all your customers.

Greater flexibility here will allow firms to innovate and design ongoing services that meet the full spectrum of client needs, helping you to address the growing digital audience and reach new target markets.

Not a Dynamic Planner user? Schedule a no obligation demo to see how we can support you with your review process.

Dynamic Planner, the UK’s leading digital advice platform, is now risk rating Aubrey Citadel Fund.

Aubrey Capital Management is a specialist boutique manager with a distinctive investment approach, primarily focused on global equities. Founded in 2006, it manages £795 million of client assets across long only growth equity strategies and a diversified, macro-driven strategy.

The Aubrey Citadel Fund is part of a £65m strategy managed by Jon Gumpel with a capital preservation mind-set. Jon has a strong long term track record of delivering consistent growth with low volatility. The Fund is positioned in a range of lower valuation and higher cashflow return global assets and pays a yield of c.4% pa.

Yasmina Siadatan, Chief Revenue Officer at Dynamic Planner said: “We are delighted to welcome Aubrey, a new fund partner to Dynamic Planner, underlining our commitment to continually expand the universe of funds on the platform and provide the largest choice for advisers.

“Joining over 150 asset managers and 1800+ funds and solutions, Aubrey Citadel will be risk profiled using our institutional quality, whole of market risk analysis. Our 75 asset class risk model is proven over two decades, including in periods of crisis, and trusted by over 45% of advice firms in the UK to match suitable solutions for their clients with confidence.”

Andrew Ward, CEO at Aubrey Capital Management said: “We are pleased that the Aubrey Citadel Fund is now risk profiled by Dynamic Planner, a leading software provider to UK financial advisers.

“With a three-year track record on the horizon later this year, we believe this important third-party validation of the Fund’s defensive and diversifying qualities will help support discussions with advisers around how the Fund can best support their clients’ portfolios.”

- Integration of AI into Dynamic Planner’s platform targeted to take annual review report production from 5 minutes to sub 5 seconds

- AI Charter published to set out how AI will be applied safely within Dynamic Planner

- Launch of Dynamic Planner Insights delivers actionable intelligence for firms including on their ongoing servicing

- Holistic, engaging fact find optimised for Tram, Dynamic Planner’s white label mobile app and smartphones makes firms’ services even more efficient and accessible

“The combination of support for smartphone fact finding, data driven insights and AI based automation is the catalyst needed to drive down the cost to serve clients compliantly and make advice more accessible to the millions of people who want it and more profitable to the firms that provide it.”

Ben Goss, CEO, Dynamic Planner.

At its ‘Pioneering Tomorrow’s Technology’ Conference, Dynamic Planner, the UK’s leading digital advice platform, has unveiled its 2025 developments including its plans for Generative AI, the integration of which will target a new benchmark in the time taken to produce annual review reports to under 5 seconds; an AI Charter; and a raft of new developments.

In his keynote speech, speaking to over 500 financial planning professionals and describing Dynamic Planner as ‘technology pioneers’, Ben Goss, CEO, set out the three key principles that technology must deliver on for advice firms:

- End-to-end support for the advice process, where regulatory scrutiny is ever increasing – with a firm’s proposition and advice policy embedded.

- Data driven processes to save time and provide the actionable intelligence firms need to demonstrate they are delivering under Consumer Duty.

- Thirdly, automation of as much of the technical and administrative process as possible – leaving advisers free to focus on higher-value activities in-particular client coaching.

To support this, Dynamic Planner has announced the following key developments designed to equip advice firms with the technology needed to navigate the challenges and complexities they face whilst creating the capacity in their firm to deliver the trust and confidence clients are looking for from personal, professional advice:

Generative AI within Dynamic Planner

- An Early Adopter programme for the use of Generative AI is launching today. Those involved will help shape how AI is integrated into the financial advice process in Dynamic Planner to drive automation and personalisation. AI within Dynamic Planner will capture unstructured data from client meetings, transcribe and summarise it, automate and personalise the suitability assessment process and report creation. Crucially, annual review report creation times are being targeted* for simple clients and cases to be reduced from the 5 minutes already experienced by the top 20% of Dynamic Planner users – to under 5 seconds.

Dynamic Planner AI Charter

- As part of its commitment to working hand-in-hand with advice firms, Dynamic Planner has developed a five-point charter for the application of AI within the platform to ensure safety. With AI a fast moving, but still emerging technology, Dynamic Planner has set out how it will use the application of AI in a safe and secure manner. The charter covers 5 commitments: Data Security, Fairness, Transparency, Compliance, Responsible Use.

Launch of Dynamic Planner Insights:

- The new Insights module provides firms with a comprehensive suite of reports to monitor and manage their clients and their businesses and deliver automated actionable intelligence. Reports cover all client, advice and planning activity undertaken in Dynamic Planner including reporting on ongoing servicing tailored to meet FCA information requests.

Launch of holistic engaging, fact finding optimised for smartphones and Tram

- Dynamic Planner is launching holistic Fact Finding to extend its end-to-end support for the regulated advice process. The new fact find is optimised for use on smartphones as well as web browsers and will also be available through Tram. These new enhancements will speed up the Know Your Client process for firms and make their services even more accessible and engaging to clients.

Ben Goss, CEO, Dynamic Planner said: “As advice technology pioneers we continuously ask ourselves about the role we can play in helping everyone who wants financial advice to be able to access it and firms to be able to provide it even more compliantly and profitably. It’s well understood that while four million people benefit from personal advice currently, 12 million more would pay for it if it could be made more accessible and affordable. It is also true that firms often face an internal ‘advice gap’ struggling to profitably serve smaller value clients or the next generation of client. The power of personal financial advice is clear, but the barriers remain and cost to serve is an ongoing challenge.

“So where does technology come in to making this very human aspect of advice more accessible to more people? The combination of end-to-end process support including for smartphones, data driven processes and automation is the catalyst. It will create the capacity that’s needed; it will lower the cost to serve; it will help advice firms confidently meet the regulations; but most compellingly, it will enable the advice industry to scale the human element of what it does – acting as professional advisers and coaches to the many existing and new clients who need and want personal advice.”

Dynamic Planner – Technology Milestones

- 2004: Launched Dynamic Planner the first risk-based, web based financial planning application – now the most widely used in the UK

- 2012: The first to independently certify the risk of multi asset solutions – now the market standard

- 2019: The first to launch a semi-automated digital review process – now the most widely used in the market

- 2024: Tram launched – Dynamic Planner’s digital white labelled mobile app which puts the clients plan in the palm of their hand

- 2025: AI and Insights integrated into the Dynamic Planner digital advice platform

Notes:

* Industry average time to produce an annual review report 4.5 hours in October 2023. Dynamic Planner reduced the time for reviews from 4.5 hours to 35 minutes for 80% of clients and 5 mins for the top 20%. They are targeting to get this down to under 5 seconds with generative AI embedded within the platform.

St. James’s Place (SJP), the UK’s largest wealth manager, has entered into a long-term partnership with Dynamic Planner, the UK’s leading digital advice platform, to provide comprehensive client risk profiling services.

Dynamic Planner’s profiling capabilities will be made accessible to SJP’s 4,800 advisers and 7,500 support staff. This collaboration supports SJP’s commitment to delivering quality, long-term, one-to-one advice and supporting its advisers with advanced technology to improve the capture and evidencing of the risk preferences of its clients.

SJP selected Dynamic Planner for its comprehensive solution, ability to support the Partnership’s scale, and the strength of its methodology, research, and ongoing innovation. Dynamic Planner’s ability to reflect SJP’s risk categories through its platform was an essential factor in the decision.

John O’Driscoll, Divisional Director of Business Development and Advice at SJP, said: “Dynamic Planner’s reputation and shared values around one-to-one advice, combined with their commitment to empowering advisers through the latest technology, makes them the ideal partner as we continue to enhance our adviser proposition.”

Ben Goss, CEO, Dynamic Planner said: “We are proud to partner with St. James’s Place, to support a vital aspect of their advice process. SJP’s dedication to client-centred advice mirrors our own commitment to empowering advisers with technology that engages clients and demonstrates adviser value. As the UK’s leading digital advice platform, this partnership reinforces our capability to deliver scalable solutions configured to our clients’ advice policies.”