For those of you who couldn’t join us last month for our sustainable investing events, you may not yet have seen the new sustainability questionnaire in Dynamic Planner.

This has been specifically purposed to help you engage with your clients in a structured way, so you can properly understand their level of preferences when it comes to ESG investing.

Using proven, psychometric techniques, the questionnaire has been carefully constructed to enable you to bring out the level of client preferences, calibrated across five categories from ‘low’ to ‘very high’ importance and also, further guidance around what type of solution to consider once a profile has been agreed.

Catch-up on-demand with our sustainable investing event in June, discussing how Dynamic Planner can support you here

To help join up the process of recommending suitable, risk-aligned solutions with a client’s sustainability preferences, we have teamed up with MSCI to host their ESG fund research reports in Dynamic Planner. These are available on an open-architecture basis, so you can easily assess the ESG metrics of funds you are already actively recommending within your current shortlist by downloading the research reports.

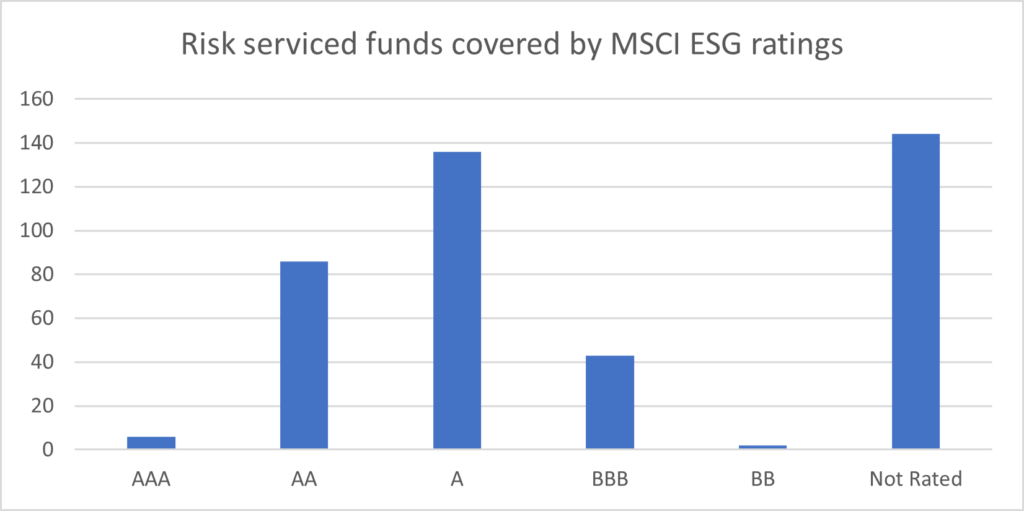

The MSCI research is also available across the multi-asset fund solutions we already risk profile and latest analysis shows a positive set of results across the range, with the majority of solutions rated within the MSCI ‘average’ range [A to BB] and plenty too within the ‘leaders’ [AAA to AA].

For your clients who have registered a higher level of interest in sustainable investments, click here for the latest list of risk profiled funds where there is an express policy commitment to an ESG objective.

Not a Dynamic Planner user? We’d love to talk to you about how our end-to-end financial planning process can help your firm, and how we make implementation and onboarding a breeze. Book a call

By Close Brothers Asset Management

In January 2021, Close Brothers Asset Management commissioned Censuswide to survey over 2,000 investors across the UK. Those surveyed had an average of £320,000 invested in a general investment account, stocks and shares ISA, self-invested personal pension or share dealing account. Here, we explore some of the key findings.

By the end of 2019, 38% of the UK’s assets under management were subject to ESG integration, which includes both pooled vehicles and segregated mandates. There was an 89% increase in investment within responsible funds in the 18 months leading to June 2020; sales for the first half of 2020 were four times higher than in the first half of 2019.¹

PwC Luxembourg predicts that by 2025, more than half of total mutual fund assets in Europe could be sitting in ESG-focused funds.²

Our research shows that this surge in demand is reflective of investors’ priorities. Only around a third (35%) of all investors identified as traditional, in that their only priority when investing is to maximise financial returns. This is truer of men than women, at 40% compared to 31%.

Investor types by priority

Clients who use an adviser are by far the most likely to want to invest responsibly, likely a result of access to increased education and insight.

It’s vital that advisers are equipped to meet that demand, by providing solutions that incorporate ethical screens at a minimum; ethical being the top priority for responsible investors.

Investor types by advice

Download the full results of the Responsible investing survey 2021 >

Capital is at risk. Investments can go down as well as up.

¹The Investment Association: UK investment management resilient in the face of headwinds, 24 September 2020.

²PwC report: The growth opportunity of the century.

RSMR has been offering model portfolios since 2012 through a number of partnerships and some of you will know RSMR through using these advisory models. We caught up with RSMR’s Ken Rayner to hear about the problems that some of their advisory model clients have been facing.

The dreaded quarterly review

“We do receive feedback about the drawbacks of advisory models. One of the comments I get from advisers and paraplanners is that they don’t look forward to the RSMR quarterly review, because that’s when we’ll recommend any portfolio changes – and any changes then have to be agreed by end clients. To apply those changes properly across all end clients is a lot of work.”

Treating customers unfairly

“An advisory model service can’t generally be applied to all end clients at the same time. This means that some will have a more up to date portfolio than others, simply because they’ve agreed to the changes more quickly. Plus, there’s the fact that most advisers will see a client once, perhaps twice a year. So, if a portfolio is being reviewed quarterly, what happens to recommended changes that don’t coincide with an end client review meeting?”

The risk of portfolio drift

“It’s almost impossible for each individual client to have a portfolio that’s exactly aligned with the central set of portfolios that we’re providing through an advisory model. This makes it very difficult to properly monitor where end clients are sitting on the risk scale.”

What’s to be done?

“With our advisory models we try not to make too many portfolio changes on a quarter to quarter basis, which prevents advisers falling too far behind with getting changes agreed by end clients. We are also mindful of the differences in fund availability across different platforms; we consider carefully which funds to include so that this doesn’t cause a problem.”

The RSMR Managed Portfolio Service: 12 portfolios available on Dynamic Planner

“Many advice firms could be better served by choosing the RSMR Managed Portfolio Service instead, which we operate on a discretionary basis. We formally review the whole range of portfolios monthly and the portfolio management team have complete control of making all necessary changes. This doesn’t require the end client’s approval and the same changes are made across all platforms.

“That said, we don’t tend to make lots of portfolio changes. We focus on the medium to long-term, but running portfolios on a discretionary basis allows us to be more nimble when we need to be. Our structured, team-based approach to qualitative fund research and portfolio management has generated consistently good returns. This ensures that Dynamic Planner users have a range of attractive options to align with investor risk tolerances and investment preferences with each of the 12 portfolios being formally risk profiled by Dynamic Planner on a quarterly basis.”

The three RSMR Responsible managed portfolios are part of a suite of 12 in the RSMR Managed Portfolio Service. The Cautious and Dynamic portfolios launched three years ago and join the more established Balanced portfolio. In Dynamic Planner, the Cautious, Balanced and Dynamic funds are currently a risk profile 4, 5 and 7, respectively.

For further information, contact Jon Lycett at RSMR on 01535 656 555 or by email: jon.lycett@rsmr.co.uk. Or visit rsmr.co.uk

By Joshua Knight, Head of Product

It’s been a busy few months! And now, in our May release, we’re excited to release a number of exciting changes.

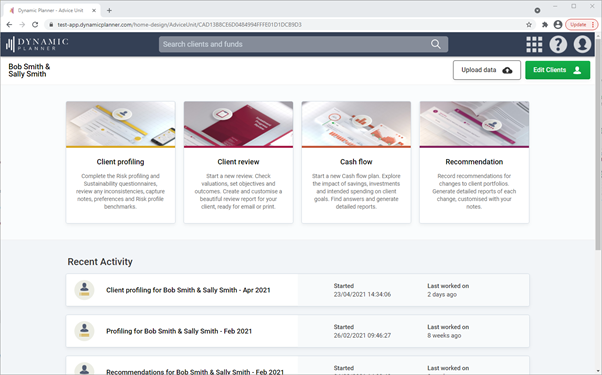

Firstly, our new Sustainability questionnaire is now available for all users. You’ll notice the ‘Risk profiling’ process has been reborn as the ‘Client profiling’ process, with its broader remit of helping you explore other relevant facets of a client’s personality.

Along with the new questionnaire (which has previously been covered here), we’ve introduced a new way for you to select which questionnaires you want to complete with your client. We know it’s not one size fits all.

The new questionnaire responses and results are included in the final report. We’re working on incorporating the questionnaire into a revised client invite process. More on this to follow in the coming weeks.

We’ve also taken the opportunity for a small cosmetic enhancement. The client landing page (pictured below, where you select the planning process you’d like to complete) has been redesigned to make the recent activity more prominent and making it easier to return to your last activity for the client.

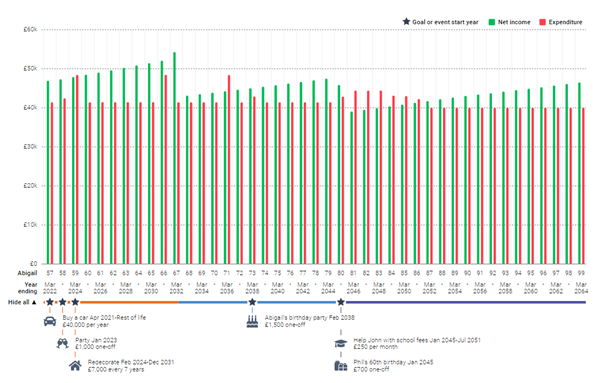

We’ve also been busy in our Cash flow process. To help make plans more personalised and engaging, we’ve introduced a visual tweak for client goals and financial objectives.

Where the client has some aspirational future expenditure, be it a round-the-world cruise (once possible!), education costs or just a big party, you can now give the expenditure an icon which will appear in the timeline under the cash flow charts, as you can see below.

The forecast shows the key life phases for the clients and the important financial goals along the way.

On more technical matters, we’ve enhanced the way in which you describe pensions withdrawals, giving you more flexibility with regard to crystallisation, PCLS and drawdown income. We know this can be a complex area, so we’ve added supporting videos in Dynamic Planner you can watch to help show how you model common scenarios.

This is a significant update to our latest Cash flow since it was launched in November last year. Of course, if you do get stuck, we’re always here to help. Please reach out to our Client Success team, in the usual way and they will be happy to assist.

Advice firms can now benefit from EQ Investors range of solutions being risk profiled on Dynamic Planner. EQ Investors (EQ) is an award-winning B Corp discretionary fund manager focused on sustainable and impact investing and has been running sustainable portfolios since 2012.

EQ offers two sustainable solutions for advisers: Positive Impact (active) and Future Leaders (passive) portfolios. Both are diversified, multi-asset portfolios. The EQ Positive Impact portfolios have a dual mandate: maximising risk-adjusted financial returns while making a positive social and environmental impact. The EQ Future Leaders portfolios use only low cost, passive funds that focus on ESG leaders with additional overweights in selected impact themes. Both solutions have been risk profiled in Dynamic Planner.

Yasmina Siadatan, Sales and Marketing Director at Dynamic Planner said:

“Having recently launched our sustainable investing solution we are focussed on ensuring advice firms have the very latest in understanding the sustainability of both people and portfolios. That also entails partnering with asset managers committed to providing sustainable solutions for the growing demand from investors.

“I’m delighted to welcome our very first B Corp to the risk profiling service, EQ Investors, who have opted to behave as an organisation responsible to both the investment returns according to the level of risk taken, alongside having a positive impact on the environment and society, with both a passive and an active range. Suitability and sustainability are becoming hand in hand, and we feel proud to be part of the jigsaw of positive change.”

Damien Lardoux, Head of Impact Investing at, EQ Investors added:

“Risk-profiling tools have become an integral part of the advice process to ensure investment plans are best suited for each client’s unique goals and circumstances. As we expand our sustainable model & bespoke portfolio service, we are keen to integrate with strategic partners to enhance our offering to advisers, Dynamic Planner is the perfect fit.”

The EQ portfolios now available risk profiled on Dynamic Planner are:

- Future Leaders Defensive

- Future Leaders Cautious

- Future Leaders Balanced

- Future Leaders Balanced Plus

- Future Leaders Adventurous

- Future Leaders All Equity

- Positive Impact Defensive

- Positive Impact Cautious

- Positive Impact Balanced

- Positive Impact Adventurous

- Positive Impact All Equity

About EQ Investors

EQ Investors (EQ) is an award-winning, wealth manager providing financial advice and investment management services to individuals, small businesses and charitable endowments. EQ is a Certified B Corporation, an internationally recognised standard for companies that believe in business as a force for good. Making a positive contribution to the wider community is a core part of its business philosophy. EQ operates a matched giving programme to help its clients and staff raise extra funds for their favourite causes and has set up The EQ Foundation as a registered charity.

The key ingredient for inflation protection may be hiding in plain sight

By Steve Russell, Investment Director, Ruffer LLP

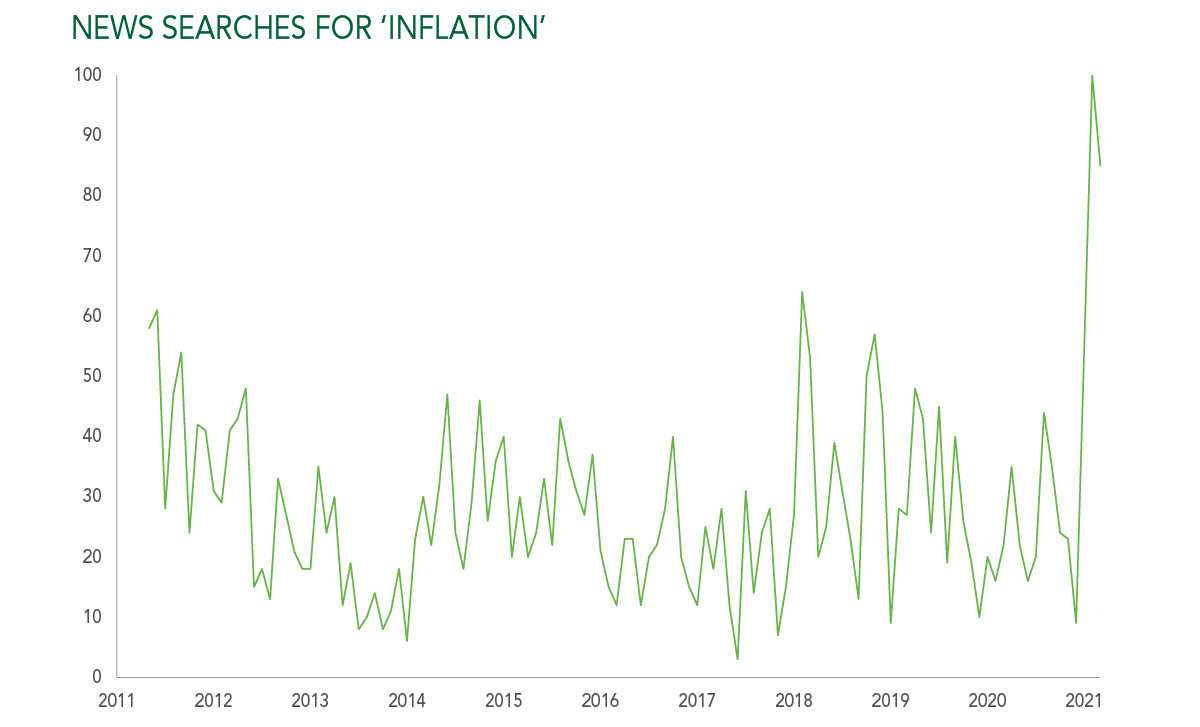

Source: Google trends, Ruffer LLP. Figures represent search interest relative to highest point in the period. 100 equals peak popularity, 50 means the term is half as popular.

Source: Google trends, Ruffer LLP. Figures represent search interest relative to highest point in the period. 100 equals peak popularity, 50 means the term is half as popular.

Inflation is in the news again. Many prices are rising even before we can physically get out and spend, and governments are pouring vast amounts into the economy.

Whichever side of the inflation debate you are on, it makes sense to assess the impact inflation could have on portfolios. Most of today’s investors have never seen meaningful inflation in the whole of their professional careers. So, as we emerge from lockdowns and pent-up demand meets ongoing supply constraints, we consider how different asset classes might fare if inflation does return.

Bonds – higher inflation will be the death knell for the bull market in conventional bonds. Between 1946 and 1981, 30-year US Treasuries lost over 80% of their value and British Consols lost 97% of their purchasing power1. Government bonds became known as ‘certificates of confiscation’. Before we even consider equities, this spells the end of the 60/40 portfolio.

Cash – inflation is the erosion of the purchasing power of money. If interest rates are kept below the level of inflation, as the US Federal Reserve has promised, huge amounts of cash and money market funds could be in search of a new inflation-proof home.

Equities – many investors who have never experienced inflation are pinning their hopes on stocks to ride out any storm. But periods of high inflation have been disastrous for stock markets. As inflation rose from 1966 to 1974, the US cyclically-adjusted price/earnings ratio (CAPE) fell from 24x to just 8x2. Even if interest rates are held to the floor, rising inflation means the discount rate on future earnings also rises. This would be a calamity for highly rated growth stocks and profitless businesses.

Commodities – getting warmer now, as long as inflation is accompanied by strong economic growth. This could happen as we recover from the pandemic, so this is the best place to hide within equity markets.

Infrastructure – the ‘inflation protection’ of choice for many. Essentially disguised bonds or equities with inflation-linked revenues. At risk from a derating of equities or bonds, with added illiquidity and execution risk. Most infrastructure projects rely on governments to honour the inflation promise – and governments have a habit of changing the terms of trade – remember solar energy subsidies?

Gold – a centuries-old inflation hedge. Deserves a place in a diversified portfolio, despite possible mounting competition from bitcoin.

Index-linked bonds (UK)/Treasury Inflation-Protected Securities (US) – the clue is in the name. Hiding in plain sight, but missing from too many lists of inflation protections. They pay income that rises with inflation and return your capital with compensation for inflation. If inflation returns, and especially if interest rates are held below the rate of inflation, investors could find themselves panicking into this asset.

Our recipe for protecting against inflation – take some index-linked bonds, mix with value/commodity equities, add a decent slug of gold and, if liked, at most a pinch of infrastructure. Avoid conventional bonds and high-priced growth stocks as these stop your mixture rising. Beware cash – it can cause a bitter aftertaste.

To receive the Green Line monthly, please click here to sign up.

If you would like to discuss the article in further detail with someone at Ruffer, please do not hesitate to contact Toby Barklem, Business Development Director.

tbarklem@ruffer.co.uk

+44 (0)20 7963 8127

1 Reuters

2 Financial Times

Past performance is not a guide to future performance. The value of investments and the income derived therefrom can decrease as well as increase and you may not get back the full amount originally invested. Ruffer performance is shown after deduction of all fees and management charges, and on the basis of income being reinvested. The value of overseas investments will be influenced by the rate of exchange.

The views expressed in this article are not intended as an offer or solicitation for the purchase or sale of any investment or financial instrument, including interests in any of Ruffer’s funds. The information contained in the article is fact based and does not constitute investment research, investment advice or a personal recommendation, and should not be used as the basis for any investment decision. This document does not take account of any potential investor’s investment objectives, particular needs or financial situation. This document reflects Ruffer’s opinions at the date of publication only, the opinions are subject to change without notice and Ruffer shall bear no responsibility for the opinions offered. Read the full disclaimer.

By Louis Williams, Head of Psychology & Behavioural Insights

Advice firms aim to optimise their clients’ investment returns. But the potential impact sustainable investing can have can be misjudged, alongside the importance clients place on returns and their sustainability preferences.

As sustainable investing, as a subject, considers managing risk, doing well by doing good, reduced financial opportunities, potential for lower returns, and emotional and ethical motivations, conversations pivot on a clear understanding of someone’s goals.

Designing a measure to effectively understand clients’ sustainability preferences, covering such a broad acknowledged area is therefore crucial.

How are a client’s sustainability preferences currently captured?

To date, emphasis has been placed on understanding the impact companies have concerning environmental, social and governance [ESG] issues. However, few advances have been made to create a true process where a client’s sustainability preferences are accurately captured.

Multiple choice questions, using mock scenarios, are one path being explored, allowing a client to select preferred investments after being provided with information about their sustainability and returns. There are advantages to this approach as it removes a very direct line of questioning which can potentially invite a respondent’s biases into the equation. However, such an approach also has disadvantages.

First, hypothetical scenarios are not indicative of decisions made in reality. Second, the fund universe and dynamics within an investment portfolio reach far beyond what can be encompassed by a simple multiple-choice task.

Third, it is incorrect arguably to situate ‘sustainability’ at one end of a spectrum and ‘investment returns’ at the other, when sustainable investments can generate greater returns.

Fourth, multiple choice questions and mock scenarios demand a client has prior financial and mathematical knowledge, which they may not. Finally, fifth, a client’s responses may be distorted in a mock scenario – for instance – involving a company they have a view on.

Why adopt a psychometric questionnaire here?

It is not useful to view sustainable investing as simply a box ticking exercise. Nor is it helpful to overwhelm a client with information available.

To understand a client’s preferences the key is real engagement, so their preferences can be captured and also the implications of their choices can be discussed. Sustainable investing preferences, as we have noted, can be complex, encompassing a broad church of relevant factors. Therefore, a suitable step in your firm’s process is required to serve as a trusted foundation for a conversation with a client.

Psychometrics combines thinking from the schools of psychology and statistics. A psychometric questionnaire therefore is created to cut through the noise of, as we have noted, direct questioning to effectively understand how someone might feel and act both in the short and long-term.

While there is no history or track record of psychometric ESG questionnaires, at Dynamic Planner, we are fortunate that our team have the experience of successfully creating the most popular and most proven risk profiling questionnaire in the UK, supporting more than one million clients of advice firms since 2013.

At the beginning of 2018, we launched in Dynamic Planner a new psychometric attitude to risk questionnaire, which again has proved hugely popular with advice firms and, in the last 12 months, during the Covid-19 crisis, has stood up robustly when continuing to measure a client’s attitudes to investment risk.

We have followed a similar formula now to build and release a psychometric questionnaire to capture a client’s sustainable investing preferences, ensuring it is reliable, valid and that it measures what it intends to.

How did we build our sustainability questionnaire?

There are a number of key things to consider when designing a psychometric questionnaire. They are:

- Avoid complex terminology or jargon

- No financial knowledge needed for completion

- Avoid repetition or redundant questions

- Capture multiple dimensions of what is being measured

- Avoid double-barrelled or ambiguous questions

- Employ an appropriate number of questions

- Choose an appropriate question order

That all said, even when questions are clear and well supported by academic thinking, a questionnaire can still fail to capture what it intends to. Clear, statistical steps must be taken to validate a questionnaire.

At Dynamic Planner, we tested our psychometric sustainability questionnaire on more than 1,000 UK investors, alongside taking significant steps before reaching a robust, final version. We also consulted with focus groups of advisers.

What does our questionnaire measure?

#1 Psychological distance

People are more likely to take greater risk regarding decisions which impact far in the future. If we consider the example of climate change, acting now may feel unattractive given that the promise of reward appears distant and uncertain.

An individual may acknowledge the importance of sustainable investing, but when considering benefits are largely for future generations, this can impact their decision in the short-term. Psychological distance measures this balance.

#2 Personal values

It can be assumed that a client’s sole desire is to maximise their wealth. However, they can also be motivated to promote social change, consistent with personal values and therefore be willing to accept lower returns.

It is important to understand an individual’s views on controversial or unsustainable areas of investment and how far their portfolio should reflect their values and beliefs.

#3 Emotional benefit

It is important to measure the emotional benefits of investing. People can benefit emotionally when they believe they have acted responsibly through their investments and can feel compensated if they receive lower returns, as a result.

Emotions are important when making financial decisions and taking risk. People who are positive can be more risk seeking, while decisions around sustainable investing can, as we have noted, evoke positive emotions. It is therefore important to understand a client’s positive or negative emotions towards how companies manage ESG risks.

#4 Positive impact

We know a proportion of investors express a desire to do good with their investments, producing social and / or environmental benefits. This extends beyond a company simply monitoring or managing ESG risks. Such individuals are socially motivated.

They may be prepared to accept lower returns in order to achieve their goals, whether it is their own investments directly having a positive impact, or whether they are contributing more broadly to change in investing. It is important to identify how a client seeks to actively engage with companies to generate positive and measurable social and environmental impact, alongside financial returns.

#5 Financial considerations

Although investors may display preferences for sustainable investing, there are trade-offs that they should be aware of. Studies have shown that ESG investments can produce at least competitive returns. Nevertheless, it is important to understand how a client prioritises investment opportunities and financial returns in relation to sustainability preferences.

How can Dynamic Planner help your firm regarding sustainable investing? Find out at one of three webinars from 8-10 June

Dynamic Planner is set to launch the industry’s first psychometric Sustainable Investing questionnaire. Launching on 7th May to all advice firms and clients using Dynamic Planner, the ESG investing questionnaire provides a simple, yet academically robust solution to the challenges advisers face when talking to their clients about environmental, social and governance (ESG) factors and sustainability.

The development of the questionnaire has been led by Louis Williams PhD FHEA, Dynamic Planner’s Head of Psychology and Behavioural Insights. It has been designed in consultation with focus groups of advisers and tested by 1000 investors. Its key aim is to provide advisers with a robust and repeatable process to hold sustainability discussions with clients, by accurately capturing an individual’s ESG preferences.

Louis Williams, Head of Psychology and Behavioural Insights at Dynamic Planner said:

“Sustainable investing is not a straightforward tick box exercise. Preferences can be complex, encompassing an incredibly broad range of factors. Expectations of the impact it can have can be misjudged, along with the importance and balance clients place on potential returns and their sustainability preferences. The key to fully understanding the ESG and sustainability hopes and expectations of a client is real engagement, so that their preferences can be accurately captured and the implications of their choices discussed.

“Until now, emphasis has been placed on understanding the impact companies have concerning ESG but few advances have been made to create a process which truly helps clients to understand the whole picture. Bringing together psychology and statistics in the form of our Sustainable Investing questionnaire enables us to help advisers cut through the noise and really understand how someone might feel and act both in the short and long-term. Successful investment and sustainability conversations pivot on a clear understanding of someone’s goals.”

The Sustainability Investing questionnaire will be used alongside Dynamic Planner’s Sustainable Investing insight, launched in February. It has been designed with the client in mind, to avoid jargon and complex terminology; no financial knowledge is needed to answer questions; it employs an appropriate number of questions in an appropriate order; all of this based on feedback and insight provided through testing and consultation with investors and advisers.

Ben Goss, CEO at Dynamic Planner said:

“Our psychometric Sustainable Investing questionnaire is an industry first, built on a combination of the robust academic thinking of schools of psychology and statistics. And importantly, in tandem with investors and advisers.

“Our team has the experience of successfully creating a risk profiling questionnaire that has supported more than one million clients of advice firms since 2013. What we are launching now is built on a similar formula, to capture a client’s sustainable investing preferences – an extension of our suitability process with the extra ‘s’ of sustainability.

“Combined with our Sustainable Investing insight launched earlier this year, we will be able to help advice firms deliver more deeply valuable and bespoke financial plans in line with clients ESG preferences.”

The Dynamic Planner Sustainable Investing questionnaire measures:

- Psychological distance: People are more likely to take greater risk regarding decisions which impact far in the future. An individual may acknowledge the importance of sustainable investing, but when considering how future generations or people elsewhere may benefit, this can impact their decision in the short-term.

- Personal values: It can be assumed that a client’s sole desire is to maximise their wealth. However, they can also be motivated to promote social change, consistent with personal values and therefore be willing to accept lower returns.

- Emotional benefit: It is important to measure the emotional benefits of investing. People can benefit emotionally when they believe they have acted responsibly through their investments and can feel compensated even if they receive different risk/reward outcomes, as a result.

- Positive impact: We know a proportion of investors express a desire to do good with their investments, producing social and / or environmental benefits. This extends beyond a company simply monitoring or managing ESG risks. Such individuals are socially motivated. They may be prepared to accept lower returns in order to achieve their goals.

- Financial considerations: Although investors may display preferences for sustainable investing, there are trade-offs that they should be aware of. Studies have shown that ESG investments can produce at least competitive returns. Nevertheless, it is important to understand how a client prioritises investment opportunities and financial returns in relation to sustainability preferences.

Dynamic Planner Sustainable Investing insight and the newly launched questionnaire will enable advisers to respond to increasing demand to talk about sustainability, ensure their clients fully understand both the ESG and sustainability opportunities and risk that their investments present, as well as helping to support advisers in fully meeting the fast-evolving regulatory requirements.

Dynamic Planner is running three Sustainable Investing Webinars from 8th-10th June. Visit the training academy page to find out more.

A conversation with Ken Rayner, CEO of RSMR

As ESG (Environmental, Social and Governance) becomes a major theme in investor preferences and adviser-investor conversations, the regulatory pressure also continues to build, with the FCA now fully embedding climate considerations into their remit.

RSMR, whose Managed Portfolio Service (MPS) is now available in Dynamic Planner, has been assessing ESG factors in funds for more than 15 years. Their best fund ideas are included in their MPS, including their three RSMR Responsible portfolios. Here are three questions they come across a lot from advice businesses, and how they respond:

So, what’s the difference between ESG and responsible investing?

“It depends who you ask. Others may say ethical or sustainable investing and that range of terminology is a growing problem. In RSMR’s fund research, we take ESG to mean the widest range of environmental, social and governance risk factors that exist. We have always believed that ESG factors represent potential risks to all companies and as a result, they play a core part in all the funds we rate, whatever they’re called, with ESG integral to the due diligence process.”

How do you help with ESG suitability?

“Many advisers and investors want funds that go further – ESG+ if you like – but find suitability hard to achieve, given the growing number of ESG approaches and fund names on offer. Since 2012, we have been addressing this with our ‘Responsible’ fund rating and we launched our first Responsible portfolio in 2006. Each Responsible fund we rate must satisfy our rigorous process and meet the requirement to be categorised in one of the following four ESG areas: Ethical, Sustainable, Thematic and Impact.”

How do you help with the adviser-investor ESG conversation?

“We provide a range of information in our Research Hub that helps advisers have effective and informed ESG conversations with their clients, focused on improving transparency and investment outcomes. This includes information at the fund and fund group level, incorporated in fund profiles and fund factsheets. We have summarised our ESG services in the ‘Our Approach to ESG’ document. All our information is available free of charge to advice businesses in the ‘Research’ section at www.rsmr.co.uk.”

The three RSMR discretionary models [Cautious, Balanced and Dynamic] also recently joined the Dynamic Planner risk profiling service in November 2020 and are currently badged as Risk Profile 4, 5 and 7 respectively.

Capturing a client’s preferences

Having a repeatable conversation with clients about sustainable investing can be tricky, and regulation is coming. To help you address this, why not find out more about Dynamic Planner’s new sustainability questionnaire?

The sustainability questionnaire is a set of 15 questions, constructed using robust, psychometric techniques, enabling you to assess your client’s sustainability preferences across a wide range of motivating factors. The experience for your clients will be consistent across the board, using simple language they understand and with the ability to produce magazine-quality, client profile reports to download at the end of the process. This provides a solid base from which to have deeper conversations on their sustainability preferences as required.

Sustainable investing in Dynamic Planner – Learn more

Sustainability and its implications for risk and for the suitability of investment portfolios is now centre stage for all parties across financial services.

Environmental, social and governance factors potentially having a negative effect on the value of investments are all in the spotlight. For example, the instances of workforce standards in a company’s supply chain or business ethics are increasingly making headlines and as a result, pose material risk. There appears to be no hiding place.

Financial markets are further perturbed by transition risks tied to change in global sentiment, politics or labour policy, all of which can trigger a reassessment of an asset’s value. In the future, there are additional liability risks potentially, still to be quantified, as people impacted by climate or social change pursue compensation.

All the while, the speed of change increases as governments and investors accelerate plans to transition economies and companies toward more sustainable practices.

Rising tide, rising demand

Larry Fink’s letter to investors in January this year laid bare BlackRock’s commitment to supporting net zero greenhouse gas emissions, across its portfolio by 2050, founded on their opinion that there is now a fundamental reallocation of capital towards sustainable assets. Meantime, in 2020, we saw household names like Barclays unveil a net zero target for businesses it lends to, while similar pledges too have been made by HSBC and JP Morgan Chase, adding weight to the movement.

Against this backdrop, advice firms are increasingly talking about sustainability, its risks and opportunities, with their clients. A survey we carried out last year, revealed that 55% of advisers, more than half, discussed sustainability with clients during reviews and 83%, more than four in five, wanted more information on the sustainability of investment solutions.

Measuring ESG risk – What’s the problem?

That said, how is the industry currently measuring sustainability risk and opportunity; explaining it; and accounting for it in client portfolios and final recommendations? The short answer is there is no accepted or uniform answer yet. Why? Below are three key reasons:

- Lack of consistent, objective disclosure of a company’s activities in relation to ESG risks alongside the practice of ‘greenwashing’ – implying sustainable credentials for funds when the reality is different

- Externalities – the wider cost paid by the environment or society from a company’s activities are not simple to understand or measure

- Longer term, the scale, incidence and impact of potential risks are uncertain and difficult to factor in. Five years ago, then Bank of England Governor Mark Carney called this the ‘tragedy of the horizon’ as investors discounted very long-term risks

At the heart of these three issues is measurement and the need for consistent, objective assessment here. Regulators around the world are driving this agenda. From next month [10 March], EU Regulation on sustainability-related disclosures in financial services [Disclosure Regulation or SFDR] must be implemented.

UK managers distributing in the EU are already preparing for this. The UK regulator has commented they are ‘working closely with the Government and other regulators on how to implement the EU’s proposals in the UK’. Already this year, new regulations in line with the Task Force on Climate Related Disclosure, a global initiative mandated by the G20’s Financial Stability Board, demand stricter disclosures from listed companies in the UK.

As better data becomes available as a result, so fund analysis around the risks and opportunities here will improve.

Going beyond manager questionnaires and self-descriptions is important in order to create more universal models founded on publicly available information, accurately capturing historic patterns and allowing for forward-looking risk assessment without an absolute reliance on opinion. In this way, we will match the way those models take a view on risk.

ESG research available to you today

At Dynamic Planner, we have long considered a wide range of risk factors of each individual holding, when assessing the overall risk of investments. In that light, our own approach here has been to incorporate similar, whole of market ESG data from MSCI, a world leader in gathering sustainability information from public sources.

We this year made this research available to advice firms, to inform objective conversations with clients and enable them to compare investments fairly like for like. Over time, we are interested in understanding what does or does not pose risk for investments, in particular against its risk profile peer group, as we do today with liquidity and credit risk, for example.

Without doubt, we are only part way along the ESG assessment journey. From an adviser’s standpoint, the key is to adopt tools and data available today and to not let ‘perfect’ be the enemy of ‘good’ in terms of having a meaningful discussion with a client. As measurement of sustainability improves, the market will become more accurate in its risk assessments.

Read more about sustainable investing research, available today in Dynamic Planner.