By Fidelity

Our investment team discuss how we are evolving and enhancing our sustainability research and ratings. Find out more about how we are moving away from solely using ESG as a risk management tool, with an increasing focus on delivering real world change.

In recent years, we have seen rapid growth in interest in sustainability and rising desire for sophistication from investors in how it is approached. Today, investors are increasingly looking to influence positive change by directing capital to address ESG problems, not least climate change.

As part of this evolution, we have developed the core tools within our sustainable research platform, making enhancements. We have evolved our ESG ratings and version 2.0 now makes more in-depth assessments of how companies are managing the impacts of their businesses and mitigating any negative effects on all stakeholders, including workers, society, the environment, etc. We are also measuring alignment with the SDGs and how companies are making positive contributions to these goals; as part of this, we try to disaggregate different activities to provide more granular information.

Broadly speaking, what we are doing is moving away from using ESG as a risk management tool that contributes solely to financial outcomes. Instead, we are moving towards an approach focused on delivering real world change. It means much more holistic assessments of the opportunities and risks faced by an issuer, as well as more forward looking.

The first stage in our process regards materiality mapping – we have developed customised materiality maps for 127 individual industry subsectors, each with a different weighting combination of 14 social and 26 environmental indicators. These maps are determined by our research analysts alongside our dedicated sustainable investing team on the basis of each company’s operations, but also the context of their impact on other stakeholders, such as suppliers and broader society. For example, we would include Scope 3 emissions linked to airports, whereas other ESG ratings might not.

Our extensive corporate access enables us to engage with corporates to investigate sustainability issues in great depth. This is a key differentiator – we use a combination of qualitative and quantitative inputs, rather than relying on publicly-disclosed quantitative data as many external rating systems do. Our qualitative assessments are undertaken by our analysts, who have detailed knowledge of the companies in their coverage.

We are lucky to have relationships with and access to senior management teams all around the world that enable us to take this approach, it is not something that every firm can accomplish. Our local research teams are able to engage on ESG issues with countries in all cultures and languages in order to drive improvements in their behaviour.

Click here to read the full article and watch the webinar >

Important information

This information is for investment professionals only and should not be relied upon by private investors. Past performance is not a reliable indicator of future returns. Investors should note that the views expressed may no longer be current and may have already been acted upon. Changes in currency exchange rates may affect the value of an investment in overseas markets. A focus on securities of companies which maintain strong environmental, social and governance (“ESG”) credentials may result in a return that at times compares unfavourably to similar products without such focus. No representation nor warranty is made with respect to the fairness, accuracy or completeness of such credentials. The status of a security’s ESG credentials can change over time. Issued by Financial Administration Services Limited and FIL Pensions Management, authorised and regulated by the Financial Conduct Authority. Fidelity, Fidelity International, the Fidelity International logo and F symbol are trademarks of FIL Limited.

By Louisiana Salge, Senior Sustainability Specialist, EQ Investors

Whilst the number of investors who would like to make a positive impact to society and the environment continues to grow, we still encounter misconceptions that prevent some from taking the plunge. This piece dispels some of the common myths associated with sustainable investing.

Misconception 1: All sustainable investment approaches are the same

There are a variety of ways in which sustainability considerations can influence investment mandates and portfolio management. To summarise the three most common approaches:

Traditional ethical investing focuses on excluding a set of industries or companies based on controversial behaviour, often called the “sin stocks”. Investment strategies will apply a values-based negative screen on industries like tobacco, alcohol, or pornography. The rest of the strategy is then managed with traditional investments.

ESG investing introduces information on how well companies manage relevant operational Environmental Social and Governance (ESG) factors into the investment decision-making. Investment strategies can integrate this information differently. Common approaches may overweight or set inclusion thresholds based on company ESG performance, relative to peers. This approach usually overlooks the analysis of companies’ products and services.

Impact investing focuses on creating material, measurable positive impacts on people & planet. Instead of being a relative assessment, such as ESG, the focus here is on maximising the absolute positive impact associated with investments. Investment strategies can do this by positively targeting sustainable themes like clean water, renewable energy, or accessible healthcare. This approach puts a very strong emphasis on companies’ products and services and the solutions they bring to the many challenges we face.

Misconception 2: Sustainable investing will sacrifice investment returns

There is mounting evidence that sustainable investing does not sacrifice performance, in fact, incorporating ESG factors into investments can help boost financial performance. Overall, businesses that demonstrate greater operational sustainability (ESG) and sustainable products & services, can perform better.

Evidence indicates that the positive correlation between sustainability and performance holds both at the corporate accounting, and investment performance level. The reasoning is that businesses managing E, S and G better than peers demonstrate better risk control and compliance, suffer fewer severe incidents (for example, fraud, environmental spill litigation) and ultimately carry lower tail risk. ESG leaders invest more in Research and Development, foresee future risks and plan ahead to remain competitive.

Impactful companies are those that have turned the largest societal challenges into profitable business opportunities. These companies benefit from the growing global demands for their products and services, greater regulatory support and from avoiding reputational and stranded asset risks.

Misconception 3: Sustainable investing is too risky

It is true that many high-impact investments can be in more volatile markets (such as emerging markets), but real opportunities exist across all asset classes, from small to large companies located in the US, in the UK and all regions of the world – and risks vary between these. For example, social housing investments can provide reliable government backed income streams while providing significant societal benefits. Water utilities prevent industrial wastewater from polluting natural ecosystems and provide defensive investment characteristics.

Therefore, portfolio managers like EQ Investors can adhere to normal risk categories and create portfolios for different ‘risk appetites’, as well as tailor these to sustainability preferences.

Misconception 4: It is a narrow investment universe

There is no single defined investment universe for impact investors. Investor preference defines the opportunity set by deciding on risk, return and impact theme targets. The amount of companies eligible for investment can depend on the impact or ESG standards set by investors.

While this means that we can’t give a reliable impact universe estimate, opportunities are larger than some might assume. For example, the EQ Positive Impact Balanced Portfolio has exposure to about 1,000 unique companies and organisations globally.

This universe is also expanding. As much as investor interests are turning to sustainability, companies’ business models are too. In 1999 Impax Asset Management had an investment universe of 250 companies which generated more than 50% of their revenues from environmental solutions. This universe has now grown to about 1,400 companies. The same would apply to the healthcare, financial inclusion and education universes.

Misconception 5: Sustainable investing cannot make a positive impact

When investing through traditionally managed portfolios, disregarding the impact of investments on people & planet can contribute to business activity that actively works against the client’s values. On the other hand, investing a client account through a positive impact mandate, the output of companies and that associated with an investment can align with the client’s values.

Even in listed markets, allocating equity capital or investing in bond issues of businesses that create positive sustainable impact, will support their share price, and provide easier access to capital thereby producing a license to operate. Using capital to invest for positive impact will signal to the market that such non-financial impacts are valued and nudge laggards in the right direction.

Sustainable investors will use their company relationships to engage boards on any sustainability weaknesses and thus create change. They are also able to use voting rights to back or block strategic decisions that concern the company’s ESG performance.

The dual objective to create financial and sustainability outcomes means that the investment reporting that private clients receive should not solely cover the financials.

At EQ Investors we invest significant resources to bring the impact that our portfolios have “to life” and demonstrate that we are delivering on our clients’ positive impact objectives. For example, we have created an interactive impact calculator that shows the investments’ associated positive impacts, like renewable energy generated or hours of education provided. We also transparently disclose alignment with the UN Sustainable Development goals, and how portfolios are aligned to climate change scenarios.

Canada Life Asset Management Portfolio Funds offer a straightforward and cost-effective solution to the challenge of choosing a mix of investments to suit the investment needs of a broad range of clients. They offer you simplicity, significant time savings and – crucially – the reassurance that the funds will remain appropriate for the risk appetites of your clients over time.

The range comprises five globally diversified fund of funds aligned to Dynamic Planner’s risk profiles 3 to 7. The Portfolio Funds access the investment expertise of Canada Life Asset Management in-house fund range, allowing the funds to offer competitive charging structures.

They are available within a wide selection of wrappers, which now includes OEICs, ISAs, ISA transfers, Pensions, offshore and onshore bonds.

Canada Life Asset Management has more than ten years of proven capability in risk-targeted fund management. Canlife Portfolio Funds 4 to 7 launched in March 2008, with Canlife Portfolio 3 added in March 2012. This capability was extended in November 2013, with the launch of OEIC fund versions, the LF Canlife Portfolio Funds III to VII and the Canlife Portfolio TRA Pension funds which were released in May 2018. Both the OEIC and Life & TRA Pension ranges share the same fund managers, investment process, philosophy, asset allocation and underlying holdings.

In December 2018 the Life portfolio funds directly invested into the equivalent OEIC funds. Prior to this, the Life funds invested through other Life funds through a fund of funds structure.

In March 2019 the Canlife Index Portfolio’s 3-7 were launched.

The risk-targeted portfolios at a glance

We have two ranges of risk-targeted portfolios – an active range and a passive range. Within each range, there are five portfolios. They are ready-made, cost effective solutions delivering ongoing suitability for your clients. Each portfolio invests in a range of geographies and asset classes and is closely managed to a defined risk/reward profile, aiming to align to Dynamic Planner’s asset allocation for risk profiles 3 to 7. Each portfolio is monitored daily to ensure it achieves its aims and Dynamic Planner Risk Profile allocations. If necessary, they are rebalanced.

By Sam Liddle, Director, Church House Investment Management

How will central banks respond to current global tensions? It’s one of the most important questions any market participant can ask right now.

The scene has long been set for an extended period of aggressive hiking to address rampant inflation resulting from years of ultra-loose policy. The Federal Reserve raised rates in March for the first time since 2018 and, at the time of writing, is anticipated to increase them further, while the UK’s Monetary Policy Committee has hiked rates three times since December 2021. Yet with market uncertainty and slowing growth, many are positing that policymakers will be more inclined to temper their approach in the second half of this year.

There’s no questioning the idea of prolonged pandemic levels of fiscal stimulus is likely to sound attractive to many. However, our belief is that the transition away from the ‘easy money’ era has become unavoidable and, as such, any temporary delays are essentially prolonging the inevitable¬.

In fact, with inflation set to continue rising amid current conditions, kicking the proverbial can when it comes to unwinding central bank balance sheets could even make things worse.

With this in mind, we believe it is becoming increasingly important for investors to move with the market cycle. And in real terms, this means placing less emphasis on maximising returns and more on preserving gains that have already been made.

A return to the norm

The fact of the matter is that it is has long been easy to overlook the concept of market cyclicality. Remember that?

For one thing, interest rates have been kept at incredibly low levels ever since the Global Financial Crisis. But alongside this, monetary policy has also been extremely accommodating, culminating in an extraordinary injection of capital during the pandemic.

As a result, it has been relatively easy for individuals to take on debt and service the costs of that debt for years now. Consequently, markets have been able to prosper and valuations have hit extraordinary levels as individuals have secured their stake in the global growth boom en masse.

Now, things are beginning to change in a big way. As mentioned, the tremendous injection of liquidity by central banks during the pandemic has pushed inflation to unsustainable, multi-decade highs in many economies.

As such, those same central banks are now being forced to increase rates in earnest to steer clear of hyperinflation territory. Likewise, institutions such as the Bank of England and the Fed are now moving away from their role as the de facto buyers of corporate debt and even unwinding their recent purchases back into the market.

Macro uncertainty, the likes of which we are currently experiencing, can only hold back the tightening of monetary policy for so long – it is now an inevitability.

And for many, this means a harsh reminder of the fact that markets do not stay in the growth phase indefinitely, and instead cycle through booms, slowdowns, recessions, and recoveries.

After all, the enormous concentration of risk present in markets, due, in part, to the rise of ETFs means the sell-off could be vast when the questioning of sky-high valuations really starts.

Just look at Meta – a bedrock of the modern-day, mega cap tech boom: the Facebook owner recorded the biggest ever daily loss for a US firm in February, slumping more than $230bn after its quarterly figures disappointed investors.

Where to turn

So, what’s the solution? Well, there’s no definitive answer. But where investors were long able to pile into the next big stock and benefit from its unstoppable escalation, the answer could now lie in taking a more demure approach and riding the market cycle until the next growth period begins.

The key here, then, is to shift from thinking about wealth creation and onto wealth preservation.

One multi-asset approach is to establish a large allocation to ultra-low risk “cash plus” investments like floating rate bonds and short duration corporate debt. These can help to take out the volatility presented by wider markets in a portfolio, and can be paired with a smaller allocation to higher risk assets that tend to perform well in times of rising interest rates–such as banks, property, or retailers with strong pricing power–to target an overall return in excess of inflation.

Moving with the times

Clearly, when the market begins to slow and monetary policy begins to tighten, minimising downside risk and preventing capital erosion becomes extremely important. However, many out there stand a very real risk of being caught out by the sudden change in pace after such a long period of euphoric stasis and support that has seen markets thrive.

The key to avoiding this is to move with the market. With central banks the clear focus of the market this week, now is the time to take stock and prepare one’s portfolio allocation for a marked change in dynamics.

Find out more about Church House Investment Management.

By Mark Harris, Head of DFM Solutions, EPIC Investment Partners

Worrying dynamics in the UK pension market have combined with a dearth of products to properly help clients in the decumulation phase.

Pensions are a long-term game but there’s a growing concern about the increasing number of people about to hang up their proverbial savings boots. There are worries about people entering retirement at both ends of the savings spectrum. The UK suffers from a worryingly low average pension pot, meaning many savers will have to make what they’ve squirreled away go further, while those with a larger bank of savings might still be exposing themselves to investments that are too risky for their stage in life.

To compound these issues, there appears to be a dearth of investment products specifically formulated for the decumulation phase, whereby investors begin to use their hard-earned savings to fund their retirement. An ageing population means larger numbers of people are entering retirement every year, making these issues increasingly urgent.

Precious savings

Everyone who saves into a pension works hard to do so, but it’s inescapable that the size of the average UK pension pot raises questions about the quality of life retirees can expect.

According to data from the Financial Conduct Authority, the average UK pension pot sits at around £62,000. This is not an insignificant sum of money, however, with life expectancy rising, it’s not inconceivable that a saver’s pension pot could have to last them 20 years.

That £62,000 only equates to £3,100 per year over that two-decade timeframe. Of course, the state pension (currently £9,339 per year) would bolster this, but probably not enough to provide a comfortable lifestyle.

Research from the Pensions and Lifetime Savings Association has estimated that to live a moderate lifestyle in retirement, a single person in the UK would need an average retirement income of £20,200 by today’s standards. That jumps to £33,000 per annum if you’re looking for an especially comfortable retirement. This gap between the average pot and what is deemed a ‘moderate lifestyle’ is something that an investment strategy needs to address.

Questionable quality

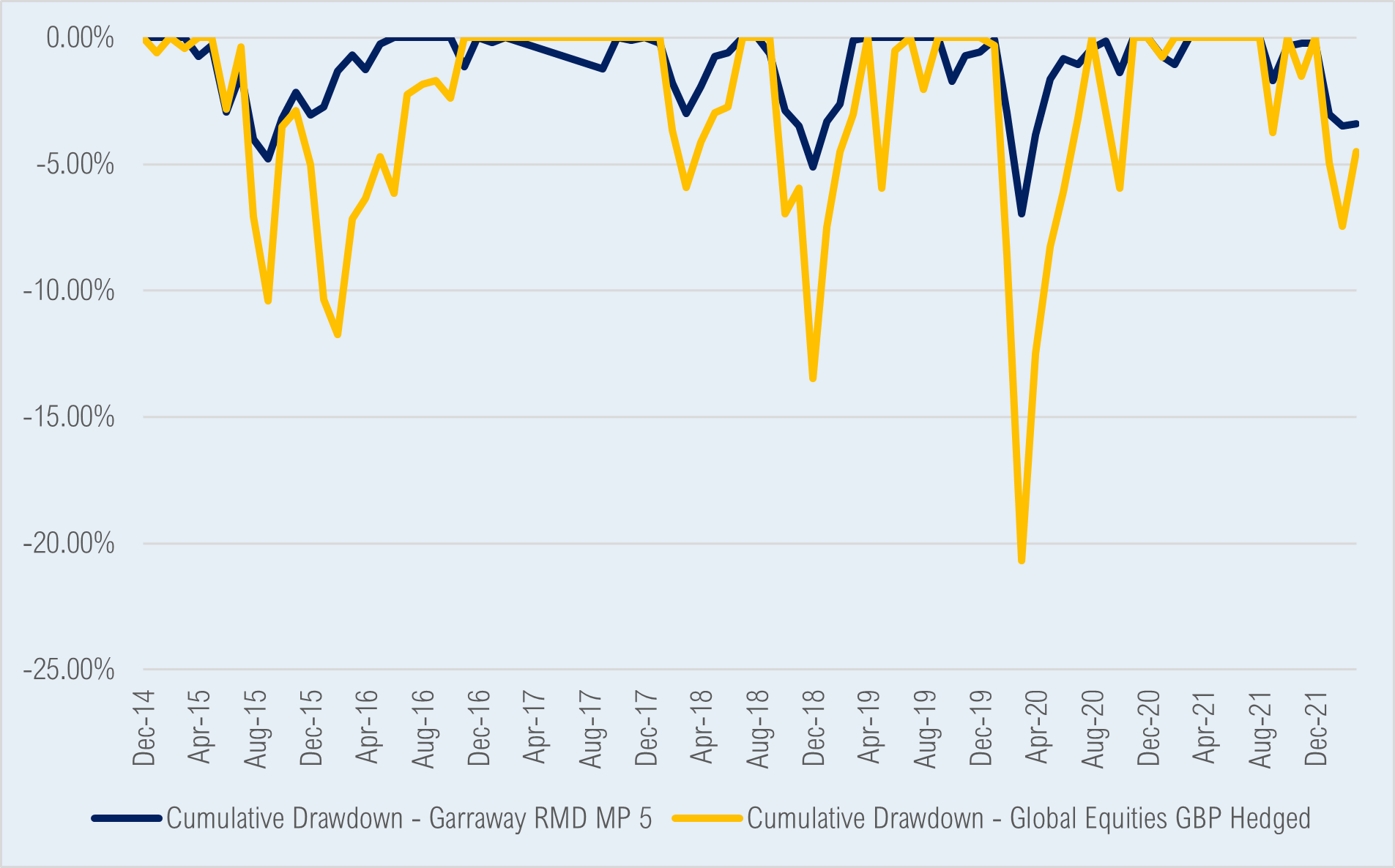

Retirees drawing on their savings don’t have as long as those who are years away from retirement to recoup losses if markets fall, meaning capital preservation is paramount. The chart below shows cumulative drawdown over the last 6 years with four drops below 10% since 2015. If you’re in your retirement, protecting against such periods, whilst drawing consistent income (i.e. without the ability to take riskier equity calls) is crucial.

Cumulative market drawdown – December 2014 – March 2022

Given the average size of pension pots reacting swiftly to protect capital against such periods is paramount

Unfortunately, the quality of many decumulation funds poses a worry, and there are legitimate concerns that if markets come under real stress that these products may not perform as they should.

Looking at the FTSE 100, equities have been a one-way trade since the market bottomed in March 2009, experiencing no real sustained period of stress. Even the Covid-19 drop appears to have been a short blip judging by the rebound in markets, while the bull market in bonds has been even more elongated.

It’s common for risk tolerance to be dialed down as a saver nears retirement, but there’s a potential that funds claiming they are decumulation products still carry too much risk, because returns from equities and bonds have been so easily achieved in the past decade that these asset classes are not treated with the caution they should be.

This is not just a finger-pointing exercise. We’ve putting our money where our mouth is after conducting extensive analysis to understand the specific risk-management needs of the decumulation fund market.

What it told us was that decumulation products should be built to be lowly correlated with traditional asset classes and to tilt more defensively if and when risk indicators are triggered.

Given the UK’s over-75 population is expected to pass six million for the first time this year, and grow by 50 per cent by 2040 to reach nine million in total, there’s a growing need for robust decumulation products for those coming to the end of their savings game.

By Jerry Wharton, CEO, Church House Investment Management

There have been significant losses for some bond investors so far this year and we have been asked how we have protected our holdings from the worst of the volatility in the Church House Tenax Absolute Return Strategies Fund.

We have always been very proactive about protecting our holdings, either through curve positioning (duration), credit quality, or explicit interest rate hedges. This has enabled us to embrace higher yields whilst avoiding the risks to capital values.

Government benchmark yields have indeed risen sharply and holders of too much duration have certainly paid the price. Bear in mind though the opportunities that this readjustment has created.

Only a few months ago, the short end of the Gilt curve was almost negative, now we have two-year Gilts offering a mighty 1.6%. Not that attractive in itself, but when you add a credit spread on top, you are now able to access a fair yield on a total return basis.

There are now a number of quality bonds, issued last year when yields were low, that are trading well below par. Remember that bonds are redeemed at par, 100p. A good example is a green bond issued by Berkeley Homes last year. The proceeds of this issue can only be used for the construction of new housing stock that qualifies for the highest rating of EPC (Energy Performance Certificate). These bonds are currently trading at 87 offering a yield to redemption in nine years’ time of over 4%. Given the current risk-free rate of return, this is a wonderful opportunity.

Another fine example is a sustainable bond from Tesco (well ahead on reducing their carbon footprint since 2015). These five-year instruments are investment grade and pay a coupon of 1.875%. We can buy them at around 93, which therefore gives us a yield of 3%.

The other weapon we have is using AAA-rated floating rate notes. These tend to be of the highest quality, mostly covered bonds secured by residential mortgage loans with loans-to-value of about 45%. The coupons of these bonds refix on a quarterly basis using a spread above SONIA (the LIBOR replacement) and therefore the capital value of these bonds actually increases as interest rates rise, providing a hedge against rising inflation.

At the end of Q1 this year, the Tenax Fund had 34% invested in Sterling corporate bonds with duration of 4.4 and an average yield to redemption of 3.75%. A further 37% was invested in AAA floating rate notes, providing a hedge against inflation, a higher return than cash, and helping to dampen volatility across the fund.

In conclusion, there is no need to sit there and take all the medicine in the way that some bond investors have. Whilst it is not possible to have completely mitigated the downside, we have contained it through judicious curve positioning and interest rate hedges. The opportunities now abound for achieving a decent yield from fixed or floating bonds.

Find out more about Church House Investment Management.

Dynamic Planner, today announces the appointment of Christophe Ponette as Managing Director for Europe to lead the company’s EU expansion. Christophe was previously the MD of Avaloq, the European Banking and Wealth Technology Provider for Benelux, speaks multiple languages and has over 25 years’ experience working in sales and management positions in European markets including The Netherlands, Switzerland, France, Luxembourg and Belgium.

His appointment follows an extensive, two-year exploratory process which has looked intensively at the needs of European financial services firms, asset managers and clients as a result of MiFIDII, IDD and the growth in risk-based investing.

Christophe will work in collaboration with Simon Colboc who has joined Dynamic Planner in a non-executive capacity. Simon has 25 years’ experience in Financial Services, including executive positions at Fortis, BNP Paribas and Prudential Plc. He heads up FECIF’s work on pan-European pensions and runs the Financial Services Practice of Paris-based firm CMI Strategies.

Dynamic Planner has signed an agreement with The European Federation of Financial Advisers and Financial Intermediaries (FECIF) an independent and non-profit-making organisation exclusively at the service of its financial adviser and intermediary members, who are from the 27 EU countries plus the UK and Switzerland; it is the only European body representing European financial advisers and intermediaries. FECIF is based in Brussels, at the heart of Europe and will be working with Dynamic Planner to identify and introduce potential partners.

Dynamic Planner has already completed the localisation of its risk and sustainability profiling instruments for France, Germany, Italy, Spain and Belgium working with in-country experts and financial advisers to ensure they adapt to local requirements. Dynamic Planner will localise its full functionality including: reviews, goal based cash flow planning and suitability reporting to provide its one financial planning system to European clients.

Ben Goss, CEO, Dynamic Planner said: “Backed by almost two decades of experience of Dynamic Planner in the UK, we are now taking our leading financial planning system to the Continent. Europe is in the foothills of an enormous shift in the way that advisers help households manage their finances and prepare for retirement in terms of the investment risk they need to take and the regulation that they face. The market feedback we have had is that we can help financial services firms successfully meet these challenges as we do in the UK.

“This is a natural progression for Dynamic Planner and an incredibly exciting time for us as both a team and a business. We have already learnt a great deal from our engagements with European partners, advisers and experts about how financial advice is given in different countries, for example in the area of sustainability, and much of this will be beneficial for our overall product for our UK clients too.

“Our mission is to help firms match people to suitable portfolios through engaging financial planning and we believe there is a huge opportunity to contribute the expertise and one financial planning system technology we offer in the EU.”

As part of the exploratory process, Dynamic Planner’s Head of Psychology and Behavioural Insights Dr Louis Williams, conducted a large-scale country specific and analysis study of a cross section of the populations in France, Germany, Italy, Belgium and Spain to understand attitude to risk (ATR) and views on sustainability to assist in the creation of bespoke psychometric questionnaires for each territory. Local financial advisers reviewed translations and provided their views on the question set and framework.

Key differences between the five European countries and UK population include:

ATR Profiling:

- Belgium and Germany have significantly higher average levels of risk tolerance in regard to investments compared to France, Italy and Spain;

- All European countries appear to be more risk averse than the UK population;

- Significantly more Europeans from all five countries were a risk profile 2 (4.49%- 7.54%) and 3 (11.52%-18.87%) and fewer a risk profile 5 (14.75% – 18.62%);

- Significantly fewer UK respondents were a risk profile 1 (0.23%), 2 (0.74%), 3 (3.55%) and 4 (14.09%), and more a risk profile 5 (31.23%), 6 (27.19%) and 7 (16.7%).

Sustainability:

- French respondents have significantly higher average scores when measuring the importance of sustainability in comparison to Germany, Italy, Spain and Belgium;

- More European respondents view sustainability as of higher importance than UK counterparts;

- Significantly fewer respondents from France, Germany, Italy and Spain (10.69% – 14.76%) have a low importance sustainability profile. The UK have significantly more within this profile (27.67%);

- Significantly fewer respondents from the UK consider sustainability to be of high (8.24%) and very high importance (3.8%).

Christophe Ponette, Managing Director, Europe, Dynamic Planner said: “We have undertaken extensive country specific research to enable us to understand what is needed and begin to adapt what we offer to each market. This has already informed the design of a range of country specific, multi-language risk profiling and sustainability questionnaires. This insight has also highlighted a need for more education around financial risk and this is central to what we do at Dynamic Planner.

“Large organisations in Europe face many challenges – ageing populations; low savings rates and clients with assets held across different institutions. Above all there is a need to create a culture of investment, improving the overall customer experience and establishing a better and more efficient integration of the financial planning process. We believe Dynamic Planner can provide the answer to these challenges.”

By Sam Liddle, Sales Director, Church House Investment Management

As rising inflation continues to grip markets, investors are looking for ways to protect their portfolios against the potentially damaging effects.

Whether inflation this time around is a short-term issue or something we all need to get used to the foreseeable future, its effect on cumulative returns can be long lasting if or when interest rates continue to rise in line with inflation.

Multi-asset investors, some with cash plus targets, face a dilemma in this scenario – how to beat inflation yet remain true to their investment process.

Do they simply move further up the risk scale increasing the potential of heavy losses if markets go against them? Do they buy ‘expensive defensives’, and at what cost? Do they move to cash or worse, negative-yielding bonds? What about derivatives – can asset managers justify and explain that position to investors who want to understand exactly where and how their cash is invested?

It could be that the investment instruments and tactics that portfolio managers employ to navigate through the potentially rough seas ahead will make all the difference.

No frills to avoid thrills and spills

Take, for example, the humble Floating Rate Note (FRN). “What on earth is a Floating Rate Note?” I hear you ask.

FRNs are debt instruments, typically issued by financial institutions, supranationals (e.g. the European Investment Bank) and governments, and, as the name implies, FRNs differ from other fixed income securities by having a variable (floating) coupon rate.

The coupon on a FRN is re-set every quarter to a specified level over the reference rate such as SONIA (Sterling Overnight Interest Average). When interest rates rise, SONIA, in turn, ratchets up and consequently, the coupons on FRNs increase.

Simply put, as interest rates rise, so does the coupon on FRNs.

They are therefore negatively correlated to, or provide a hedge against, a rise in interest rates, and unlike derivative hedging and structured products, the FRN hedge costs little.

Gilts and other debt instruments, such as investment grade and high yield corporate bonds are positively correlated to interest rate movements so will fall in value when interest rates rise.

For this reason, FRNs make up a significant component of the investment grade bond market and tend to be in high demand when interest rates are expected to increase.

For Absolute Return strategies, aiming for positive returns in excess of cash, FRNs provide a useful hedge against rising interest rates and help moderate volatility. They are also fully liquid so when volatility increases in other asset classes, creating mispricing, fund managers are able to sell FRNs to exploit those opportunities.

After decades of falling interest rates in the UK, the direction of travel might have changed, and rates have started to rise. James Mahon and Jerry Wharton, co-managers of our own Church House Tenax Absolute Return Strategies Fund are clearly placing a lot of faith in FRNs with a 38.3% allocation.

If rates now rise faster and further than most investors and commentators expect, gilts and corporate bonds will become more volatile – FRNs on the other hand will, much like the tortoise in Aesop’s fable, quietly and surreptitiously win the race against the inflation hare.

Advisers looking for risk rated investing solutions for their clients, can benefit from the revamped RSMR Responsible Managed Portfolio Service (MPS) now available through Dynamic Planner.

The newly launched RSMR Responsible Growth Portfolio means that advisers can now take advantage of four risk profiled portfolios in the RSMR Responsible MPS that is risk rated on Dynamic Planner: Responsible Cautious, Responsible Balanced, Responsible Growth and Responsible Dynamic. This new range of portfolios joins the RSMR Rfolios range of eight funds which has now been added to Dynamic Planner, having been launched in 2015.

RSMR Head of Managed Portfolio Services, Stewart Smith, said: “We have taken the opportunity to broaden our offering in the responsible investing area through the launch of the Responsible Growth Portfolio. Alongside our well-established RSMR Rfolios range, we offer advisers four RSMR Responsible portfolios, risk profiled by Dynamic Planner within risk levels 4, 5, 6 and 7.”

Yasmina Siadatan, Sales & Marketing Director, Dynamic Planner said: “We are passionate about broadening out the range of risk rated funds with a focus on responsible investing to give advisers even greater choice within this area for their clients. We welcome the MPS Range from RSMR to Dynamic Planner. Continuing to expand the risk rated responsible fund universe in Dynamic Planner enables advisers to give clients increased opportunity to use their investments to deliver financial returns for the risk they are willing and able to take, alongside ensuring sustainability preferences are matched.”

What is RSMR’s approach to ESG?

Like all of us, we are deeply disturbed by what is happening in Ukraine. While it may not be equal to that, we fully understand your clients will have concerns right now.

We want to provide you with reassurance and information below regarding our model and processes, which you can share when speaking with your clients about their investments. If you have further questions or concerns, please do not hesitate to contact the Dynamic Planner Client Success team in the usual way.

Capital Market Assumptions and benchmark asset allocations

Dynamic Planner provides forward-looking, ex-Ante assumptions for real returns, volatility, correlations and covariances, and associated calculations such as 95% VaR. They are calculated objectively through proven, statistical models using many decades of data – and rigidly reviewed, monitored and governed to ensure discipline and objectivity.

In Dynamic Planner, you can accurately risk profile any combination of assets. So, however you choose to position yourself tactically, over or underweight to our benchmark, you can understand the risk and expected return.

At times like this, there will no doubt be assets, countries and companies that will do better or worse. This could also change quite quickly. Ultimately, in the medium to long-term, this will mean a change to the constituents and weighting or ranking of the indices that define the assets within our Capital Market Assumptions.

If you want your firm’s or your clients’ investments to react to these changes, then you would need to rely upon a professional fund manager to do that effectively on your behalf. We would therefore, as we always do, encourage the use of the appropriate Risk Target Managed [RTM], Risk Managed Decumulation [RMD] and Risk Profiled solutions in Dynamic Planner.

Risk characteristics within Risk Profiled solutions

Dynamic Planner is unique in the way that it calculates the risk profile of solutions, especially RTM and RMD. We insist that asset managers provide us with the underlying holdings and their weights throughout the review period, including specific stock and derivatives. We calculate the solution’s risk profile using the correlations and covariances of all those underlying instruments.

We hold a database of more than 40,000 instruments and continually review their risk characteristics relative to 72 asset class indices, considering a wide range of potential factors, depending on the nature of the instrument. Dynamic Planner’s Asset Risk team have been considering these risk factors and how they may change the risk factors of certain instruments in light of the crisis in Ukraine, sanctions and market closures.

The Solutions Risk team are using these live risk factors of the underlying instruments within any solution to calculate its risk profile, as well as engaging with asset managers as to whether and how they may be reacting within their mandate to meet a solution’s objectives.

MSCI ESG ratings

We have always known that this is an emotive, complex and evolving issue that we do not have the in-house expertise or resource to fully understand or monitor at an investment instrument level. We rely upon ESG research from MSCI, respected pioneers in this space. Currently, we only make the MSCI ESG fund reports available to Dynamic Planner users, but we do have the full MSCI stock holdings level data available to us.

We have engaged with MSCI and they have said that, owing to the unprecedented nature of the current crisis, and the severe economic pressures facing Russian listed companies, they have implemented a series of ESG ratings downgrades with immediate effect. MSCI will continue to assess these companies’ ratings on an ongoing basis.

They have applied an ESG ratings ceiling of ‘B’ for all Russian companies within their coverage. Companies that were already ‘B’ or ‘CCC’, retain that rating, but all others have been downgraded to this ‘Laggard’ status.

Within MSCI’s corporate governance methodology, Russian companies will see the application of a ‘Very severe’ assessment on the ‘Other high impact governance events’ key metric. Additionally, Russian state-owned enterprises will see the application of a ‘Severe’ flag on the ‘Financing difficulties’ key metric, owing to their additional risk and exposure to sanctions, export restrictions, and removal of access to international financing channels.

MSCI have also downgraded the ESG government rating for Russia from BBB to B (equivalent to ‘Laggard’ status).

At a multi-asset fund solution level, which are very diversified by nature, it is unlikely that such actions of Russian companies or state will have turned the dial on their overall MSCI ratings yet. However, for those relying upon Dynamic Planner and MSCI data, recent actions are being proactively picked up within the assessment of their ESG risks.

If you have any further concerns about market conditions and your customers, please get in touch with the Client Success team.