By Bordier UK

The FCA has now published its final Consumer Duty rules, with a definitive implementation date set for July 2023.

There is now no excuse for adviser firms to have not begun their preparations, especially given that a firm’s board (or equivalent) must have agreed and signed off on their Consumer Duty implementation plans by 31 October 2022.

The FCA’s new outcomes-based approach focuses on ensuring adviser firms always put good consumer outcomes at the centre of their business and that they focus on the diverse needs of their customers at every stage. Included in the new rules is a new consumer principle, which is underpinned by four expected outcomes:

- Products and services: ‘Fit for purpose’ – Advisers should be recommending products and services that are clearly designed to meet the needs of the customer and their known objectives.

- Price and value: ‘Fair value’ – Advisers should ensure customers are paying an appropriate fee for the service provided and that they are getting value for money.

- Consumer understanding: Customers must be enabled to make informed decisions about products and services. This includes the timing of information, and how it is delivered.

- Consumer support: Customers are supported by the firm to realise their financial objectives and realise the benefits of products they buy. The support should be delivered by channels that the customer wants, not what the firm chooses.

‘Fit for purpose’

Whilst many advisers should now be aware of the incoming principle, they may not necessarily appreciate the greater governance requirements for ensuring the products and services they offer their clients meet the needs of the target market and, most importantly, work as expected.

Throughout the FCA’s review, they highlighted several areas of poor practice where customers could receive a poor outcome. One particular area was the recommendation of ‘products and services that are not fit for purpose in delivering the benefits that consumers reasonably expect, or are not appropriate for the consumers they are being targeted at and sold to’.

The higher expectations for adviser firms regarding ongoing suitability and expected client outcomes has shined a greater light on an adviser’s chosen investment solutions and whether those propositions truly support clients in achieving their financial objectives, particularly with regard to clients in drawdown.

Centralised propositions and Consumer Duty

The introduction of Consumer Duty has signalled just how important it is for a firm to have a robust governance process, documented in a clear and concise PROD document, demonstrating client segmentation and how the chosen investment propositions meet the needs and characteristics of their target market.

It is evident that a substantial proportion of adviser firms (just under 78% based on research from Aegon) have an established centralised investment proposition (CIP) for clients accumulating wealth. It may come as no surprise that many advisers are confident that their current CIPs meet many of the product governance requirements of the incoming Consumer Duty through existing processes as a result of PROD.

However, with over 60% of adviser assets on average linked to clients receiving retirement advice (according to research from NextWealth), it is surprising that only around 50% of firms have implemented a centralised retirement proposition (CRP). This begs the question as to whether an adviser’s current investment solution for clients in or nearing retirement is suitable and provides the right outcomes for clients drawing a regular income.

This is often reflected in adviser investment propositions, with at times minor variation between an adviser’s CIP and their solutions for clients in retirement – the same risk profile often kept for both, which may be appropriate but could have some short comings depending on the adviser’s chosen investment solution.

What the new consumer principle brings into focus is whether those accumulation strategies and the maintenance of a client’s risk profile, are now providing the right outcomes for clients who need to preserve capital and manage their stock market risk whilst taking a regular income.

A different approach needed

Creating a CRP can be challenging – as clients move from accumulation into decumulation, advisers have to deal with much more complicated decisions and associated risks. Drawdown is complex and there are many challenges of managing clients who are drawing a regular income, in particular, the management of sequencing risk.

These added complexities have been masked by a decade of strong market performance; as a result, some advisers have maintained a more traditional accumulation approach to clients in drawdown. This often entails retaining a client’s existing risk profile on reaching retirement, which may not be the best approach to meet the client’s required outcome.

The conversation around the risks in drawdown (sequencing risk included) needs to be reframed. Advisers should shift their focus from growth-driven accumulation to investment strategies that put capital preservation first for clients in retirement, who need to ensure their retirement provisions can meet their income needs throughout their retirement with reduced market volatility and without the timing of their withdrawals significantly impacting the size of their pot.

Sequencing risk remains one of the biggest dangers facing client portfolios in drawdown and recent market volatility should focus the minds of advisers on the impact it has on investments. Greater focus should, therefore, be placed on managing risk within the client’s portfolio to reduce the fluctuations in its value to ensure the impact of withdrawals is minimised. This can be achieved by assessing risk on a monthly basis (as opposed to an annual one) against specific ‘value at risk’ boundaries, a more forward-looking measure, to help assess potential max drawdowns.

A client’s investment objective in retirement is also likely to be fundamentally different – many switch their focus from investment returns, to maintaining a regular income and a smooth investment journey. This aspirational change could in turn alter the underlying asset allocation, expected return profile and the management of risk within their portfolio and should, therefore, be reflected accordingly.

Adopting an active risk management approach in decumulation, to ensure the level of risk within a client’s portfolio is not only appropriate but also proactively managed to help provide a smoother retirement journey for clients, is an ideal solution.

This dovetails with the consumer principle and is a prime example of meeting the needs of the client. This approach can also assist and provide assurance for advisers with their ongoing client suitability.

Not long left

Now that the final rules have been published, and with the new consumer principle due to come into practice next year, adviser firms should be looking at their investment propositions to identify any gaps in their existing processes and ensure that they are delivering good outcomes for their client – those in accumulation as well as decumulation.

- If you require help with building your centralised retirement proposition, or are looking to manage both client and business risk through a risk-targeted approach, please contact Mark Duggan on 0207 667 6600 or at mark.duggan@bordieruk.com

By Dynamic Planner Investment Committee [Aug 2022]

Dynamic Planner’s Investment Services team and the independent members of the Investment Committee [IC] have been identifying the risks of rising inflation and interest rates for a considerable time, being actively discussed at the quarterly meetings and reflected in decisions taken. This quarter is no different.

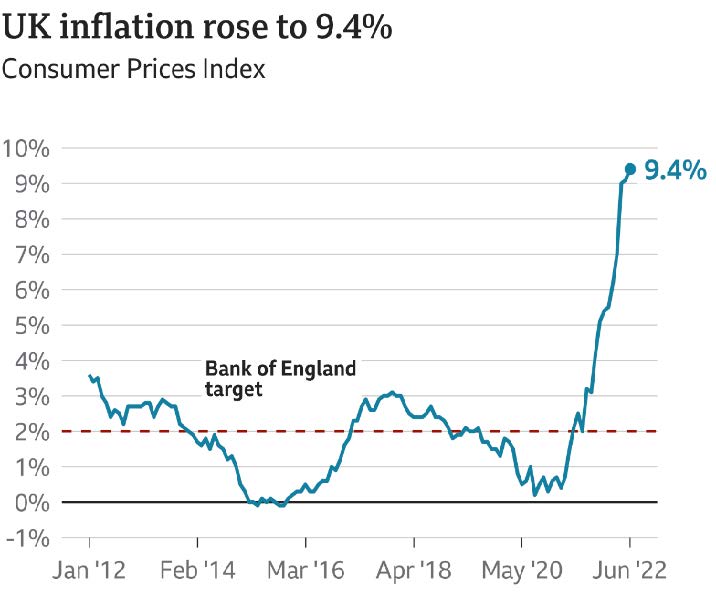

As the IC met on 23 July 2022, it was prepared for the subsequent UK interest rate rise and remains confident that its capital market assumptions are valid in these market conditions. Following the rapid economic bounce back from Covid lockdowns, the IC had become increasingly concerned about the impact of rising inflation expectations taking hold. With UK inflation currently running at 9.4%, the highest level experienced for more than 40 years, it is understandably grabbing the headlines.

The corrosive impact of inflation on living standards and reduction in spending power of accumulated wealth should not be underestimated, even when at modest levels. So, what can be done when the Bank of England is warning of inflation reaching 13% and staying at ‘very elevated levels’ throughout much of next year, before eventually returning to its long term 2% target in 2024?

Interest rates are already on the rise, with the biggest UK increase in 27 years announced last month (the Bank of England base rate now stands at 1.75%). Similar measures to put up borrowing costs are happening elsewhere around the world, with the US Federal Reserve having hawkishly raised rates to a range of 2.25% to 2.5%, and the European Central Bank delivering its first interest rate hike in over a decade, taking the eurozone out of negative rates.

A tightrope for central banks

The current combination of stagnating economic growth and rising inflation, referred to as ‘stagflation’, is particularly troublesome for asset allocators. Tightening monetary policy to tackle stubbornly high inflation, at a time when the economy is already slowing, can be a very difficult tightrope for central banks to walk, if recession is to be avoided. This unwelcome scenario had been a risk of growing concern for the IC, even back when market consensus expected inflationary pressures to be temporary in nature.

Oversight of ex-ante and ex-post forecasts and scenario analysis are essential functions of the IC. Results from detailed stress-testing conducted last year showed that a drawn-out stagflationary environment would create the most serious challenge for the multi-asset portfolio benchmarks. This was mainly due to the potential impact of sharply rising interest rates on bond values and their increasing correlation with equities. The latter has been magnified as yields have been driven to rock-bottom levels, due to unprecedented monetary stimulus post the 2008/09 Financial Crisis.

So, what has the IC been doing?

Using long-term trend analysis and research sources, the strategic direction of travel of the asset allocation decisions taken by the IC over a number of years can be summarised below:

- Managed reduction in bond exposures

- Continuing global diversification trend

- Prudent increases in cash positions

The multi-asset benchmarks, which have been running since 2005, have experienced periods of considerable market stress, but these decisions have helped prove them to be extremely resilient and perform in line with our long-term expectations.

As we navigate these prevailing cross currents of acute economic and geo-political uncertainties, the IC will continue its laser focus on ensuring the benchmarks remain best positioned for long-term investors looking for protection of their wealth against both inflation and volatility. You will be hearing more from us again in early September, when we announce changes to the 2022/23 benchmarks following the annual review process.

- On 20 October 2022, join our Chief Investment Strategist, Abhi Chatterjee for a quarterly webinar, updating you on the performance of the Dynamic Planner asset allocation benchmarks and wider market outlook

By Sam Liddle, Sales Director, Church House Investment Management

Whether it’s shifting interest rates, soaring inflation, or heightened geopolitical tension, there’s a lot of short-term risk and uncertainty on the table right now.

The reality is investors are quite right to be cautious – a look at the volatile performance of any major index since the beginning of this year alone can show you that. With all this in mind, it’s hardly surprising that in May, Bank of America reported the average cash holding of a global asset allocator to be at its highest level since 9/11. But should this really be the case?

A major part of any investment professional’s job should be to see the forest when the rest of the market sees the trees. As Warren Buffett, the Sage of Omaha himself, once said: “Be fearful when others are greedy and greedy when others are fearful.”

With so much value on the table in today’s period of economic retraction, there’s a strong argument to be made that right now is the time for investment professionals to be brave. Indeed, rather than hide in cash, these individuals must instead ask themselves a critical question: what can I do today that my clients will thank me for in five years’ time? I suspect in this inflationary time, the answer won’t be, ‘sitting in cash.’

It’s difficult, but rather than peering into the seemingly bottomless abyss of bad news, we should lift our heads, look across to the other side, and consider what opportunities we can exploit in the current volatility.

Don’t panic

The bottom line is markets are cyclical. That doesn’t mean they are easy to predict, but it does mean they tend to follow a sequence of stages over time. It’s the macro events that are unknown and that trigger the move from one stage to the next.

After a prolonged period of ultra-loose monetary policy and escalating equity valuations, a move from market “euphoria” into bearish territory was inevitable coming into 2022. However, it’s clear now that post-pandemic inflation, central bank tightening, and uncertainty around the Ukraine crisis were together enough to catalyse the beginning of this transition.

While the days of simply investing in something indiscriminately and watching its value rise may now be over, markets have made this transition time and time again throughout history, and every time, it has been possible to enhance returns by choosing the right investments while they were trading at a discount.

Spotting value

The idea that bottomed-out markets offer an opportunity to scoop up bargains to maximise upside potential is no doubt an attractive one although, in practice, this approach is by no means easy.

Increasingly short-term reporting requirements and a natural tendency to focus on the news headlines rather than individual stock fundamentals tend to make us blind to opportunities or shrink from making the bold call to invest.

Maybe it’s the memory of that saying from 2001 that a stock that’s fallen 90% is one that fell 80% and then halved. Whatever it is that deters us, being greedy when others are fearful isn’t easy, but you wait, at some point after markets have recovered some smart aleck will tell you, ‘The easy money has been made’.

Making the best of it

There’s no question that the responsibility of managing someone’s money can be a daunting one at a time when everything seems to be collapsing in value. However, it’s important to keep perspective and take Warren Buffet’s advice – markets have recovered many times before and they will again, but you can’t partake in a market recovery if you’re invested in cash.

It’s critical to stick to the fundamental principles of investing and leverage today’s weakness as an opportunity. Always asking oneself: what can I do today that my clients will thank me for in five years’ time?

Find out more about Church House Investment Management funds.

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article. Please also note the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

By Chris Jones, Proposition Director

If I were governing an island nation and wanted to connect to the mainland, I would have a number of choices. Would I go bridge, or would I go tunnel? More importantly, would I pay for it from the public purse, or would I outsource for it to be built privately? I would have a lot to consider.

The costs, the benefits, does my state have the money, could I raise it with taxes, could I borrow it with sovereign debt, do I have the expertise to build it, what toll would people pay and how often? Would I want to carry the iron triangle of scope, cost and time? It’s a lot to take on.

For example, I could look to the Channel Tunnel and to the Queen Elizabeth/ Dartford Bridge. There is a plaque at the bridge that says it: ‘Marks the first time this century that the Government has contracted to the private sector the financing, design, construction and management of a major road’. This Private Finance Initiative concession was enabled by the Dartford-Thurrock Crossing Act 1988 and it was opened on the 30th October 1991. Three years isn’t bad.

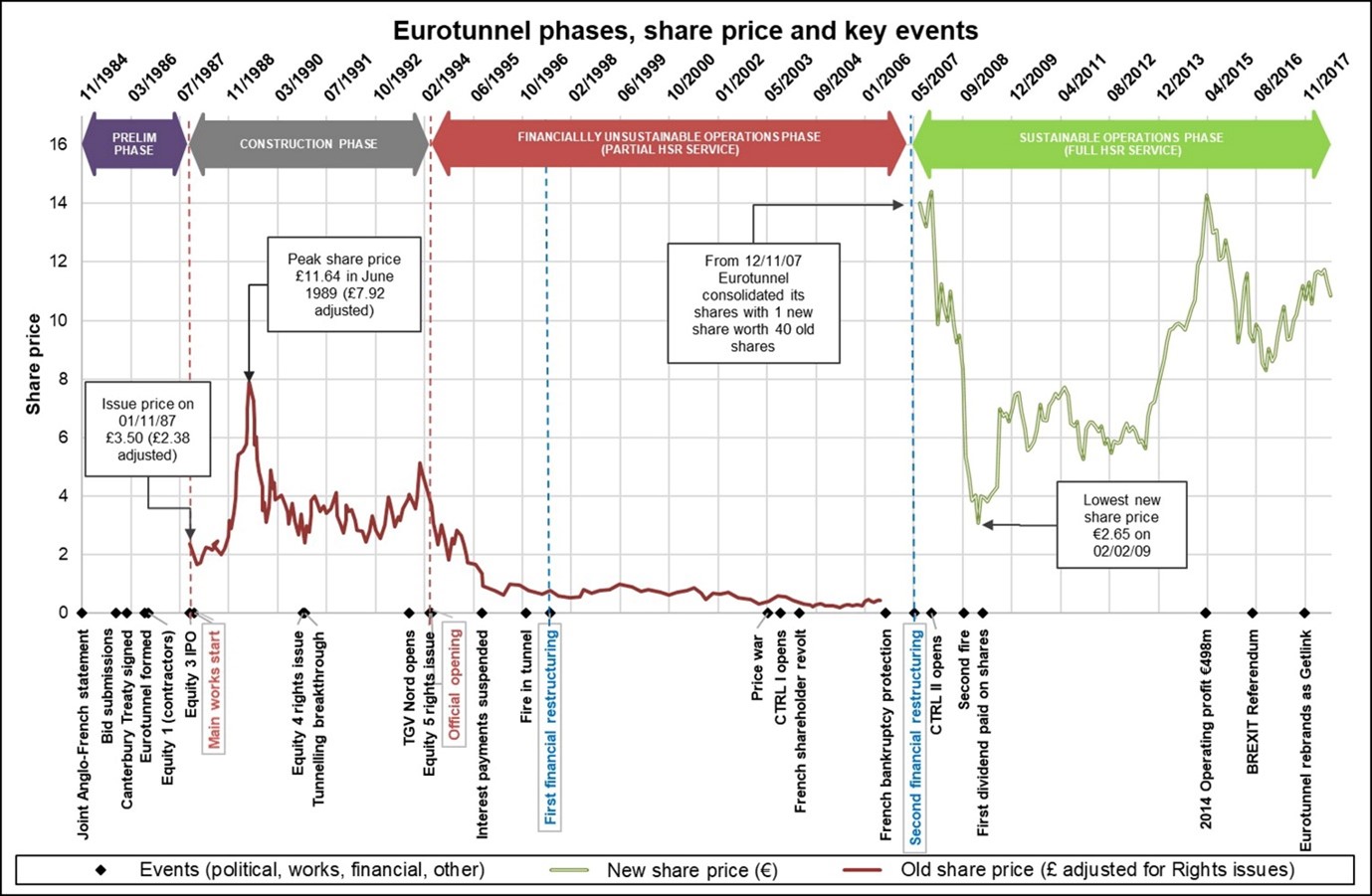

When it comes to the Tunnel, Article 1 of the Anglo-French Treaty of Canterbury signed on 12 February 1986 says that: ‘The Channel fixed link shall be financed without recourse to government funds or to government guarantees of a financial or commercial nature’. It opened on 6th May 1994. All which is quiet compelling.

Then I look at the fact that the Dartford Crossing is now raking in £100m annual profit and that in 2019, post-Brexit pre-Covid, the GetLink group (formerly Eurotunnel) had a net profit of 159m euros and my head is turned. Maybe I want that revenue for the state, but would I get it? Would my sovereign debt-funded public sector project have the lean, cold-blooded efficiency of the business world, where the imperatives of the market would, by default, reduce waste and inefficiency?

The big problem is what happens between the investment of capital over 30 years ago and these returns. For both projects it was a very bumpy ride, and it was only 10 years ago that meaningful profits began.

Whilst the Tunnel is often portrayed as a financial failure, in fact, finance did its job to raise funds and absorb risks amazingly well. Risks were transferred to private investors and the private investors bore them. If the project had been delivered on time and budget and if demand had materialised as forecast, the banks expected an 18.8 per cent return on investors’ capital. No-one should be surprised if there are risks associated with such returns.

With perfect hindsight on demand risks and cost overruns, a public sector investment subsidy of another 50% of the capital costs would have been required to make the project financially attractive to private investors. Importantly, however, the government didn’t have to make this commitment. Overall, it generated an economic rate of return over the life of the concession estimated between 3 and 6%. Not so bad when you consider how gilt yields have fallen over the same period.

Outsourcing and infrastructure

Overall, you can see why outsourcing these things would be attractive to me as the government of an island nation. Of course, in reality we are unlikely to be on the government’s side of the table and would be looking at this question from the other side, on behalf of investors. The free market must demand a premium for the risk and the long-term nature of investments such as these.

With gilt and other yields low, infrastructure can be tempting for fund managers. However, whilst they serve the government in a similar way, they carry quiet different risk and return characteristics for the investor:

| Infrastructure | Gilt |

| Credit risk | Little credit risk |

| Liquidity risk | liquid |

| Default risk | Little default risk |

| Extra return | Lower return |

| Generally longer term | 5 to 45 years |

| Can be inflation proofed | No inflation proofing |

| Can be variable income stream | Fixed income |

Analysing Risk

Beyond these generic differences, at Dynamic Planner we analyse the risk of infrastructure investments within the funds that we profile on an individual basis in whatever format they take: equity, debt, physical property, structured product etc.

We therefore consider it more like an instrument to be considered for its own idiosyncratic risk characteristics rather than an asset class, with an index that captures its systematic risk characteristics. As you can see from the bridge and tunnel examples above, one infrastructure initiative is quite different from another, and the various investment structures are different again.

In his last budget, Sunak committed to fixing the UK’s infrastructure as part of a levelling-up push, a central tenet of the government’s plans to kickstart the economy after the coronavirus pandemic. The Treasury’s pitchbook for Investing in Infrastructure UK says this generates new investment into priority areas (including energy, transport and water) by matching the UK’s needs to investor interest. The majority of the £383bn national infrastructure pipeline will be funded through private sources. It also sets out its own Risk UK Infrastructure risk and return profiles.

On the other side of the Atlantic in the US (to whom we are connected by cables that were built by a more recent popular infrastructure investment), Biden has announced a $2.25 trillion infrastructure package.

Well before Sunak and Biden’s interventions, there was a lot of capital in infrastructure investment:

- The top 5 infrastructure debt managers: Blackrock, EIG, AMP, AXA and Macquarie, raised $52bn in the last 5 years.

- The top 5 global infrastructure fund managers: Mcquarie; Global Infrastructure Partners, Brookfield, Stonepeak and KKR manage $232.1bn. The top 50 raised $78.5bn last year alone of infrastructure assets (Nov 2020).

Such a large amount of local and global capital investment cannot be ignored.

In Conclusion

Whether or not you invest in infrastructure within your retirement solution, with whom and how, all requires careful consideration and analysis of the risk factors, which you would outsource to a fund manager.

But if I were governing an island looking to build a bridge or a tunnel, I would definitely outsource it to the private sector rather than raise sovereign debt. Whilst I would certainly benefit from their resources, technology and expertise, the simple idea of making the whole thing somebody else’s problem clinches it for me. I suspect that also plays a significant part in real government decisions.

So, if outsourcing to offload the problem onto somebody else is a good idea for Governments, it must be even better for advisers and their clients. It’s not the cold utility of whether you look back at the end of 30 years and quantify the financial benefits; it’s the outsourcing of not only the work and time but the worry that makes it so compelling.

I am very sceptical that a client could self-direct and self-manage and get a better investment outcome than if they paid for advice, but the more important thing is what else they could have been doing with their time and mental capacity. Focusing on work and getting a promotion, studying for an exam, doing overtime, helping their kids study to get a scholarship etc. Outsourcing the work frees up time and it frees up mental capacity.

A number of US studies show that for many people, just the simple act of passing the responsibility and liability to their adviser is worth the advice fee.

According to Dynamic Planner’s own Head of Psychology and Behavioural Insights, Louis Williams:

“People miss out by not shifting this responsibility.

“Many struggle to accumulate their savings for retirement because they lack financial knowledge, resources, and are susceptible to various cognitive and emotional biases. The two most appropriate solutions for this are either significantly improving your financial literacy or increasing your uptake of financial advice.”

With all else being equal, outsourcing is worth it just to make it somebody else’s problem. In most cases you also get time expertise, resources and technology that you don’t have. It’s more efficient, particularly where a task can be done once and its result is used by many.

Advisers thinking about infrastructure within their clients’ solutions are going to need to rely on a multi-asset fund manager to handle all the variables and complexities described above.

Asset managers can rely on Dynamic Planner to consistently assess the risks of infrastructure within their funds.

And advisers can outsource to Dynamic Planner and build our system into their own infrastructure, so that our technology and expertise is yours, freeing up your time and capacity to add value for your clients.

Not yet a Dynamic Planner user? Schedule a free no-obligation demo with a business consultant and experience the full functionality of Dynamic Planner.

- Leading UK software focused private equity growth firm backs Dynamic Planner’s management team and ambitious growth plans

- Dynamic Planner’s independent focus and strategy will remain

14 July 2022: Dynamic Planner, the UK’s leading risk based financial planning system, has welcomed a significant investment from FPE Capital.

The investment from FPE, a leading UK software focused private equity growth firm, will back the current management team and help accelerate the growth of Dynamic Planner and the delivery of its ambitious plans in the UK and Europe.

Dynamic Planner has been growing rapidly in recent years and now serves almost 40% of wealth advice firms and over 150 asset managers, profiling over £250 billion of assets via its SaaS platform. Headquartered in Reading, the company employs over 100 diverse and talented people and is on track to pass £10m in annual recurring licence revenues this year. In the last 12 months it has launched a raft of upgrades to ensure Dynamic Planner and its open API is the one end-to-end financial planning system firms need in a hybrid world. Earlier this year it appointed Christophe Ponette as European managing director based in Luxembourg to lead the company’s continental expansion.

FPE Capital has a successful track record in backing SaaS businesses with a focus on market leading, quality products and strong, client focused, cultures.

Ben Goss, CEO at Dynamic Planner said:

“As a fast growing, privately owned company we were looking for an institutional investor partner to help us take the business to the next level in the UK and internationally. Our selection of FPE was based not just on their track record of backing software companies that successfully scale, but also on their team who we feel share our values.

“From the outset FPE understood the value that Dynamic Planner brings to our clients and industry as an independent provider of technology and asset risk modelling serving a growing community in the wealth management sector who trust and rely on us. They also share our vision for solving our industry’s major challenges through technology such as process digitisation, customer experience, investing sustainably for future generations, and omni channel financial planning in a post pandemic world.

“This investment allows us to progress our industry for the better and as a management team we look forward to sharing the benefits of this collaboration with our clients and team in the months and years ahead.”

David Barbour, Managing Partner at FPE commented:

“We are delighted to be working with the team at Dynamic Planner on their exciting growth ambitions and to build on their existing leading position in the wealth management sector with new products for this core market.”

By Chris Jones, first published in April 2021

If you lived and worked on an isolated island community, and you were able to source everything you needed from your fellow islanders, retirement would be a relatively simple thing to plan.

You would earn a wage or make a profit doing your thing. You would not only spend your income on your fellow islanders’ goods and services, but you could also invest whatever you had left over in their businesses. When you retired, your share of the profits in those business would be directly correlated to the cost of the goods and services, and everyone is happy.

You could, of course, lend money to these businesses instead but there would be no certainty that the fixed capital repayment or interest would be correlated to the cost of goods in the future. This inflation risk is why asset-backed and equity in particular are so good for retirement planning. We may not have felt it recently, but inflation does creep up on you over time.

In either case there are other risks: the business might go bust, the owner may not honour the agreement and so forth. These are things that apply to both the loan and the equity.

I am imagining my theoretical example set in the 18th or 19th century: a blacksmith, baker, farmer, publican, tailor, doctor etc. Since then, advancements in transportation, industrialisation, and communications have led to globalisation which brings improvements and challenges to this premise.

Reducing risk through diversification

Over the last generation, people have been able to invest in Mitsubishi, Nestle, Total, Tesco, BP, Diageo, M&S, GSK etc. Clearly being able to do this reduces risk through diversification and a fair and efficient market. It does introduce additional market and currency risks, but nonetheless people can easily invest in the companies that supply them and this is sensible and encouraging. I understand that the reason funds tend to show top 10 holdings is mainly because investors feel reassured by this.

If globalisation impinges on our remote island scenario, had you invested in your local small business supplier, would it have been acquired and integrated into a global company, or would it have just gone? Whilst investing in equities for long term future retirement needs is compelling, the question of which share is important.

At Dynamic Planner when we use phrases like U.K. Large Cap Equity or Short-term Bonds it has a very specific meaning. For these examples, it is the MSCI UK Equity Large Cap Total Return Index and ICE BofA 1-5 Year Sterling Corporate Index. Individual funds or stocks and shares vary from that both in performance and in risk characteristics, as we can all easily observe. We of course calculate and measure this variance and use it when we risk profile funds at a holdings level.

Expected real returns

Whilst indices are great for consistency of term and qualitative analysis, their components are very fluid and they are totally ex-post (or after the event) in nature. When a share grows, it enters or forms a larger part of that index; that doesn’t mean that it will stay there or remain at that proportion of the index.

Our service provides ex-ante, expected real returns; volatility, correlations and covariances as well as a Monte-Carlo stochastic forecaster. What we cannot do is tell you what stock will make up an index in 30 years’ time. If we could, I would be living on my own private island right now. When you think about asset manager charges, caps and their value, it’s worth reflecting on how difficult yet worthwhile it is for them to try to do this on your behalf.

Whose labour, goods and services will be needed when you retire?

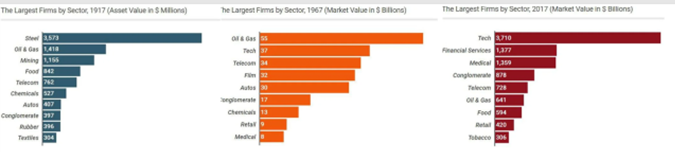

The companies that make up local indices and the countries that represent a global index change quite dramatically. At the end of the 19th century commodities and the UK were dominant.

By 1967 the largest companies in the US were GM, Exon, Ford, GE, Mobil, Chrysler, US Steel and Texaco -almost all car related. At the same time, the UK was busy devaluing its currency and voting not to allow women into the London Stock Exchange. Back then half of UK shares were directly owned by individuals, so in many ways the market was closer to my imagined island scenario than the globalised fund-led market of the 21st century.

Change in relative stock market size from 1899 to 2021.

Things change. Would anybody like to be living off Kodak, Blockbuster or even Tie Rack shares today?

Whilst the basic principle of exchanging your labour for capital whilst you work, and then exchanging your stored capital for labour when you can’t, has been consistent and remains valid today, when it comes to choosing where to store your capital the fundamental question remains: whose labour, goods and services will be needed when you retire?

There has been a lot written about ESG and sustainability. Everyone has an opinion and many people have suddenly become experts. I am certainly not an expert and I won’t add my opinions to the pile.

It does, however, appear sensible to invest in companies that will still be around in the future, and it might be that use of the word ‘sustainability’ is all you need to prompt you to consider ESG information and your client’s preferences. A psychometric sustainability questionnaire and objective MSCI ESG data is available in our system.

Not yet a Dynamic Planner user? Schedule a free no-obligation demo with a business consultant and experience the full functionality of Dynamic Planner.

By Cantab Asset Management

The last decade has seen significant asset price appreciation, accommodated by expansionary monetary policy. Alongside this, periods of uncertainty have led to spikes in volatility. Whilst recent levels of Quantitative Easing are unprecedented in historical terms, volatility and market corrections are not. This note considers the relationship between active management and market volatility in the context of achieving strong long-term performance. The main takeaways from the following analysis are:

- The actively managed funds tended to exhibit higher volatility than their passive peers

- Over each period of heightened volatility, the actively managed funds tended to outperform their passive peers

- Over the full period, the actively managed funds all materially outperformed their passive peers

- Despite higher levels of volatility, the actively managed funds tended to prove more resilient than their passive peers from a maximum drawdown perspective. This demonstrates one challenge associated with relying on volatility alone as a measure of risk – it captures upside as well as downside movements

- Similar results were obtained when comparing the actively managed Cantab multi-asset portfolio to a passive peer

Analysis

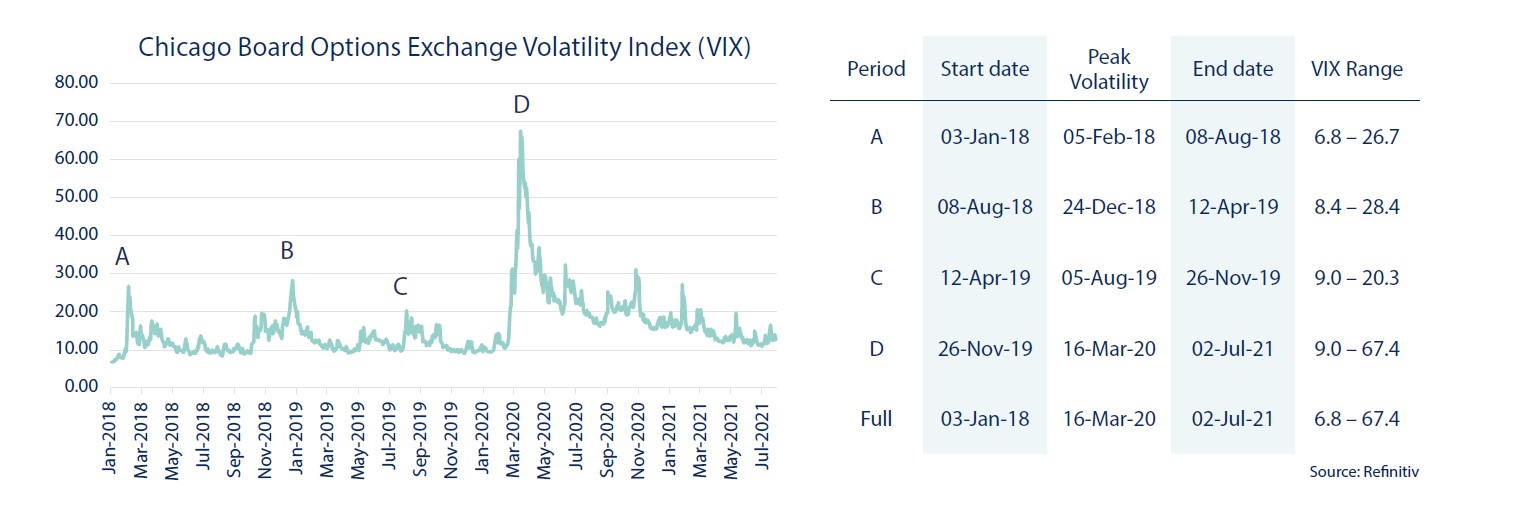

The VIX index is used by investors as a measure of implied volatility in financial markets. It is based on S&P500 option prices and is commonly referred to as the “Fear Index”. Between 2018 and 2021, the VIX has breached level 20, which is considered to be ‘high’, on four occasions, as illustrated below.

Each of the four highlighted periods captures a date range in which the index level moved from low-to-high-to-low and is used as a proxy for short-term market volatility. Performance during these periods is illustrated below, alongside commonly-used risk metrics for three actively managed funds and their respective passive alternatives.

Each of the four highlighted periods captures a date range in which the index level moved from low-to-high-to-low and is used as a proxy for short-term market volatility. Performance during these periods is illustrated below, alongside commonly-used risk metrics for three actively managed funds and their respective passive alternatives.

Summary

Summary

These findings may or may not be representative of the entire active universe of funds; to test them is beyond the scope of this analysis. What is clear however, is that within the universe of actively managed funds, there are options that provide significant outperformance on a risk–adjusted basis during periods of heightened volatility. It is our role as advisors to identify and monitor these.

When applying the same analysis to the actively managed Cantab multi-asset portfolio, not only did the portfolio outperform its passive equivalent over the full period but also achieved relatively similar volatility and max drawdown metrics overall. The analysis also found that after a material peak-to-trough movement, the actively managed Cantab portfolio recovered considerably faster to previous highs when compared to the passive equivalent.

The results from the analysis not only highlight the importance of taking a long-term view, but also demonstrate that there are two sides to volatility: downside and upside. Volatility is usually calculated using variance or standard deviation, by summing the square of the deviation of returns from the mean return and dividing by the number of observations in the data set. By definition, upside and downside deviations are treated equally. Whilst higher volatility implies higher risk, due to less predictability of asset pricing, investors are typically in favour of upside volatility in practice. By pursuing a passive strategy, investors avoid the downside risk of underperforming a benchmark index; unfortunately, they also miss out on the upside potential of outperformance.

Periods of short-term volatility have been common throughout history and will continue to be common in the future. However, during such periods, investors tend to focus on the negative side of volatility rather than directing their focus to the bright side of volatility that is offered by good active management.

Notes:

- Both the start and end dates for each of the respective volatility periods were obtained by identifying the lowest VIX level before and after breaching level 20. A VIX level of below 12 is considered low, a level exceeding 20 is considered high.

- The Vanguard fund was selected based on similar equity exposure to the Cantab portfolio for comparison.

- Cantab’s Managed Portfolio Service (MPS) performance data is presented net of 0.36% pa MPS fees which do not attract VA

Risk warnings:

This content has been prepared based on our understanding of current UK law and HM Revenue and Customs practice, both of which may be the subject of change in the future. The opinions expressed herein are those of Cantab Asset Management Ltd and should not be construed as investment advice. Cantab Asset Management Ltd is authorised and regulated by the Financial Conduct Authority. As with all equity-based and bond-based investments, the value and the income therefrom can fall as well as rise and you may not get back all the money that you invested. The value of overseas securities will be influenced by the exchange rate used to convert these to sterling. Investments in stocks and shares should therefore be viewed as a medium to long-term investment. Past performance is not a guide to the future. It is important to note that in selecting ESG investments, a screening out process has taken place which eliminates many investments potentially providing good financial returns. By reducing the universe of possible investments, the investment performance of ESG portfolios might be less than that potentially produced by selecting from the larger unscreened universe.

By Josh Knight, Head of Product

It has been a busy spring at Dynamic Planner. We have several, exciting new product features to help make your advice process even more efficient and engaging for your clients.

Notably, we launched our new Client Access feature. This allows you to capture responses to the client profiling questionnaires directly from the client before your meetings. You might have used the earlier version of this in the old version of Dynamic Planner. It quickly gained a lot of attention during Covid and lockdowns in the past two years.

The new version of this feature has even more flexibility to help you integrate it into your advice process. You can find out more about it.

1. Get a link rather than email

By default, Dynamic Planner will send out an email to the client containing the link; one less thing for you to worry about. But we know that the personal touch can be preferable and you may already be sending an email to your client with prep work ahead of a meeting.

In instances like that, you can simply get the link from Dynamic Planner, without it being sent out. Copy and paste it into your own email, and you are good to go.

2. Brand the client screens for your firm

For some clients, using Client Access might be one of their first interactions with your firm, certainly in a digital environment. Presenting your brand across all your touchpoints is important and helps reassure clients.

To help here, you can easily customise the Client Access screens with your firm’s logo and main brand colour. You can have any colour, as long as it’s hexadecimal. You can tweak colours and upload your logo on the Client Access settings page.

3. Take personalisation to the next level. Add your profile photo

3. Take personalisation to the next level. Add your profile photo

While branding is applied at a firm level, to help your clients know that the request has come from you, you can also upload your profile photo to Dynamic Planner on your account settings page. Once uploaded, the Client Access screens will show your profile photo.

4. Set the defaults to match your process

The new Client Access tool allows you to capture responses to each of the four client profiling questionnaires in Dynamic Planner. We have, for reference, got further enhancements on the way to allow you to capture even more information from your client, but we will save that for a future blog post.

For now, you can choose any combination of the four questionnaires [experience, attitude to risk, capacity and sustainability] you would like the client to complete. For example, if you typically only ask a client to complete the experience questionnaire as part of initial onboarding, you can untick it by default, and then turn it back on as and when required. You can set the default questionnaires via the Client Access settings.

5. Edit the words to seamlessly integrate into your process

To ensure that your digital engagement seamlessly dovetails with your other methods of client engagement, you can set the wording used throughout the process.

You can set the default wording on the email that is sent out (e.g., if you wish to refer to some other emails or correspondence that are typically sent out). We’ve given you an easy-to-use editor that provides simple formatting and the inclusion of key data items.

You can tweak the wording used in the client journey as well. You can include links as well as formatting.

If you use a diary management / appointment booking system (like Calendly or Office 365 Bookings app), you could include a link for the client to book their appointment with you in the final step of the process. As with theming and default questionnaires, you can tweak these options via the Client Access settings.

If you come up with any creative uses for Client Access, please let us know. And as always, if you need any help or just want to chat about the new features, please do reach out to the Client Success team, who are always available to support you in your use of Dynamic Planner.

By Sam Liddle, Sales Director, Church House Investment Management

For a long time, the 60/40 approach to portfolio management was perfectly effective. Offering a combination of equity-like returns and stable income, it allowed investors to participate in any market upside, while at the same time offering protection during periods of volatility. Simple. However, the approach has faced snowballing criticism over recent years in the face of unprecedented market performance.

Why?

Well, over time, as the value of each asset in a portfolio shifts in line with its performance, its size within the total portfolio in percentage terms will naturally also change. To keep the 60/40 split between equities and bonds in check, then, it becomes necessary to sell overperforming assets and add to underperforming ones periodically.

In and of itself, this is not a problem. In fact, rebalancing in such a way is good practice –working to reduce concentration risk and prevent emotion-driven decisions like panic buying and euphoric selling. And in an ideal world, the underperforming assets into which the investor re-invests would see an uptick in performance, enhancing total portfolio returns and smoothing out volatility.

The issue, however, is that this hasn’t been the case at all in recent years. We have seen unprecedented global central bank support since the global financial crisis in the form of interest rates and other initiatives designed to aid economic recovery.

On the one hand, this has consistently suppressed bond yields, leaving them stuck at just a fraction of the level at which they have typically sat historically. On the other, it has enabled equity prices to soar to new records, with valuations stretching to levels consistently highlighted as unsustainable by commentators.

As you’d imagine, maintaining the 60/40 split against this backdrop has consistently required investors to sell off overperforming equities and invest in underperforming bonds. And in the eyes of many, this has been akin to throwing good money after bad, effectively wiping away returns time and time again for no good reason.

Turning tides

So, while the 60/40 approach may not have generated the best returns in recent years, is it fair to classify it as ‘dead’? No, we don’t think so. And the reason why is that things are now changing seismically in the market.

The tremendous injection of liquidity by central banks throughout, and in the wake of, the pandemic has pushed inflation to unsustainable, multi-decade highs worldwide. As a result, those same central banks are now being forced to increase rates in earnest to steer clear of hyperinflation.

Likewise, we are now seeing institutions like the Bank of England and the Federal Reserve move away from their roles as the de facto buyers of corporate debt. In some cases, they have even begun to unwind their recent purchases back into the market.

There’s an argument to be made, of course, that the ongoing conflict in Ukraine is slowing this tightening of monetary policy. But this will only be temporary – higher rates and tougher stances are an inevitability over the long term.

And for many investors, the move away from the seemingly endless ‘growth’ phase that has favoured equities and hurt bonds for so long and into the ‘slowdown’, ‘recession’ and ‘recovery’ phases is going to come as quite a shock.

Indeed, there’s a good chance that we will see heavily stretched equity valuations come into question as rising rates continue to elevate bond yields. And if this takes place, then something closer to the 60/40 approach – with its emphasis on income alongside growth, may suddenly become much more effective.

Yes, there have been significant losses for some bond investors so far this year but by proactively protecting holdings, either through curve positioning (the duration), credit quality or more explicit interest rate hedges via floating rate bonds, is crucial to getting the fixed income element of portfolios right.

Government benchmark yields have risen sharply and holders of too much duration have certainly paid the price. But bear in mind though the opportunities that this readjustment has created through a combination of the increase in the ten-year gilt yield (discounting a move to 1.5% in UK interest rates) and the widening of the credit spread above that.

Only a few months ago, the short end of the gilt curve was almost negative, now we have two-year gilts offering a mighty 1.3%. Not that attractive in itself, but when you add a credit spread on top, you can access a fair yield on a total return basis. There are now a number of quality bonds, issued last year when yields were low, that are trading well below par.

The 60/40 approach to portfolio construction was unquestionably of limited effectiveness throughout the enormous post-millennium equity bull market. However, to describe it as ‘dead’, as many commentators have, is so definitive. After all, it promotes a responsible approach to asset allocation that accounts for both growth and volatility. And in a world where many indicators suggest we are moving towards a more depressed stage of the market cycle, this is becoming increasingly invaluable.

Find out more about Church House investment solutions.

First published on Trustnet. The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article. Please also note the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

By Brooks Macdonald

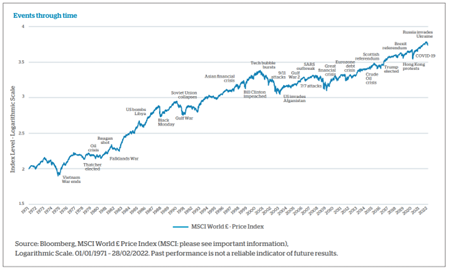

Several major global events – including most recently the coronavirus pandemic and the Russia/Ukraine situation – have prompted investors to flee financial markets, but history shows this could have been a mistake. In this article, we discuss the importance of remaining invested and how missing the best performing days could have led to a portfolio’s significant underperformance over the long-term.

What potentially seems a distant memory, the stay at home orders and dystopian feel to everyday life sent shockwaves through financials markets at the start of 2020, as a result of COVID-19. More recently, Russia’s invasion of Ukraine has rocked markets. In such conditions, it may be tempting to consider exiting the financial markets or switching to cash, with the intention of reducing further expected losses.

Trying to time the market can seriously damage your investment returns

Amidst heightened volatility, it is understandable that many are concerned about the impact on the value of their investments. But, while sharp declines in markets can naturally be disconcerting, if you want to give your investments the best chance of earning a long-term return, then it’s a good idea to practice the art of patience.

When markets fall and fear dominates, it can be difficult to resist the temptation to sell out of the financial markets and switch to cash, with the idea of reinvesting in the future when feeling more positive about market prospects – trying to ‘time the market’. But this is a strategy that carries with it the risk of missing out on some of the best days of market performance. And this could have a devastating impact on long-term returns.

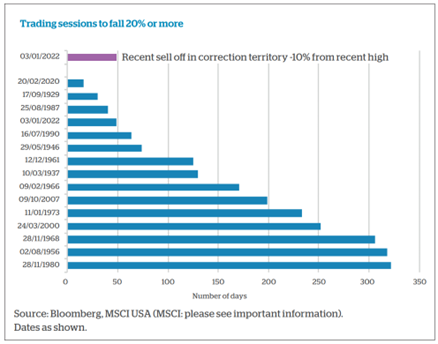

Remaining invested may be an emotional rollercoaster during times of market stress, but research shows time and again that this is the best investment approach over the long term. For example, one study of US equity mutual fund investors showed that their tendency to try and time the market was a key driver of their underperformance (Dalbar, 2019)1. In the current environment, it is understandable that many people are concerned about geopolitical risks, and how this is being reflected in the value of their investments. To give some context, the speed at which the market entered into ‘bear’ territory (typically a 20% decline) in response to the coronavirus pandemic was the fastest in history. The current sell off does not qualify as a bear market but has dropped 10% since recent highs as shown in the chart below.

1 Dalbar (2019). ‘Quantitative Analysis of Investor Behaviour

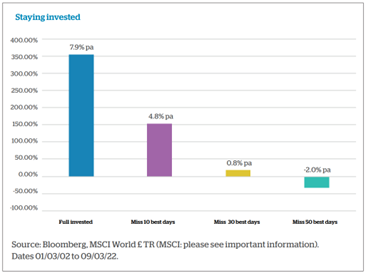

Despite temptations to switch into cash, data shows that missing out on just the 10 best market performing days can have a big impact on long-term returns.

Staying ‘fully invested’ during the ups and downs has resulted in an initial £100,000 portfolio, for example, having an ending value of £445,000, compared to £250,000 for those that missed the 10 best days in previous 20 years. This effect also highlights the powerful effect of ‘compounding returns’ over time. If, for example, the 50 best days are missed, the long-term returns are indeed negative.

A different way of delivering the same message, where staying invested over the 20-year period generates annualised returns of 7.9%, compared to 0.8% annualised returns if one misses the 30 best days:

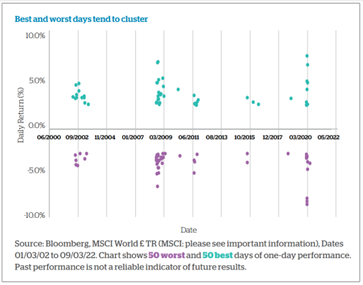

One of the most common reasons investors lose money is when they try to time the market, trying to avoid the worst days of the stock market by cashing out and then re-investing when they think the market is going to pick up. However, as the chart shows, the best and worst days of the stock market cluster. Try to miss the lows and you’ll probably miss the highs too.

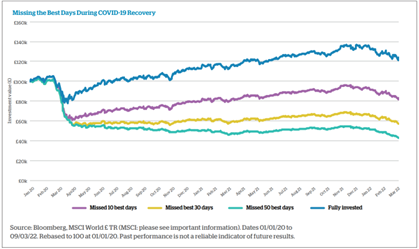

Missing the best days during the downturn and subsequent upturn can again have a large impact on the returns generated over the subsequent period.

With the benefit of hindsight, we are now fully aware of the global impact of COVID-19, and the rapidity in which it has hit equity markets. While markets rivalled the speed of the virus in trying to price-in the near-term damage, we expected they could also be swift to act when a tipping-point was seen to be close- at-hand. World equity markets returned to highs around 120 days following 2020 lows.

By keeping to an established and proven investment framework, we can look to take advantage of short-term volatility as we continue to seek out longer-term investment opportunities. We look to avoid behavioural biases that may result in decisions that negatively impact long-term return potential. Yes, the journey may not be smooth, but generally it is important to look through the noise, and remain invested during times of market stress.

Important information

Investors should be aware that the price of investments and the income from them can go down as well as up and that neither is guaranteed. Past performance is not a reliable indicator of future results. Investors may not get back the amount invested. Changes in rates of exchange may have an adverse effect on the value, price or income of an investment. Investors should be aware of the additional risks associated with funds investing in emerging or developing markets. The information in this document does not constitute advice or a recommendation and you should not make any investment decisions on the basis of it. This document is for the information of the recipient only and should not be reproduced, copied or made available to others. The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

Brooks Macdonald is a trading name of Brooks Macdonald Group plc used by various companies in the Brooks Macdonald group of companies. Brooks Macdonald Group plc is registered in England No 4402058. Registered office: 21 Lombard Street, London, EC3V 9AH. Brooks Macdonald Asset Management Limited is regulated by the Financial Conduct Authority. Registered in England No 3417519. Registered office: 21 Lombard Street, London, EC3V 9AH.

More information about the Brooks Macdonald Group can be found at: www.brooksmacdonald.com