Dynamic Planner, the UK’s leading risk based financial planning system, has refreshed and relaunched its website to better serve adviser needs.

Mirroring how its one system technology works, the revitalised website now follows the ‘advise, research, tailor’ adviser and client journey within Dynamic Planner.

Yasmina Siadatan, Sales and Marketing Director at Dynamic Planner said: “The revitalised website has been designed to help advice firms get the very best out of using our one system technology. Mirroring the Dynamic Planner journey of advise, research and tailor, advice firms will enjoy a raft of enhancements including simplified navigation and our new Support Hub. We constantly take on board what advisers tell us they need and are excited to see their feedback and suggestions go live.”

17 January 2023: Dynamic Planner, the UK’s leading financial planning system and Quilter Financial Planning, a leading financial advice network, have entered into a long-term partnership agreement which will see Dynamic Planner provided to advisers within the Quilter group.

Quilter advisers will be able to fully access everything in Dynamic Planner’s one system including: industry leading psychometric risk and sustainability profiling; investment progress reviews; cash flow modelling; digital client access, recommendations, and research. Quilter will benefit from Dynamic Planner’s product governance target market and panelling functionality, which along with a shared consumer focused culture, will support them in meeting the new Consumer Duty. Dynamic Planner already works closely with Quilter Investors, Quilter Cheviot and the customer proposition team.

Dynamic Planner will fully integrate into technology already used by Quilter Financial Planning to ensure ease of data flow for users and maximise operational efficiency centrally. Roll out of Dynamic Planner to Quilter advisers has begun and is expected to be completed by Spring 2023.

In an early adoption programme, Quilter advisers using Dynamic Planner have already seen significant improvement in productivity, with feedback indicating that advisers can move from servicing 80 clients to over 300, an increase of 275%, whilst at the same time deepening relationships and spending less time on paperwork.

Ben Goss, CEO, Dynamic Planner said: “We are delighted to partner with Quilter Financial Planning to support their thousands of financial advisers in the delivery of outcome focused financial planning in an age of Consumer Duty. We have invested heavily in our one system technology in recent years and look forward to working closely with Quilter as a partner to help power their financial planning process with Dynamic Planner at scale.”

Steve Gazard, CEO, Quilter Financial Planning said: “We have been piloting the Dynamic Planner system with a number of key firms and advisers across our business for the last 18 months and have been delighted with the efficiency gains those firms have seen and the improvement in client experience. I am pleased that we have been able to further strengthen our offering by working closely with Dynamic Planner, and as such have a close relationship that will now allow us to rapidly deliver this to our wider adviser base.”

12 January 2023: Dynamic Planner, the UK’s leading risk-based financial planning system has appointed Michael Whitfield as its new Chair following FPE’s investment last year. Michael’s career in financial services spans four decades working in a variety of roles focusing on people and creating the technology to best serve their needs.

Michael founded Thomson Online Benefits in 2000, which he led for 17 years as CEO. He built the organisation from start-up to 500 people serving clients in over 90 countries, cementing its place as a market leader in global benefits software. Since 2018, Michael has focused on injecting his world-class expertise into guiding companies that inspire him, many of which are technology providers directly used by the end client.

Ben Goss, CEO at Dynamic Planner said: “We warmly welcome Michael as our new Chair. He has world-class experience of scaling a UK FinTech business internationally and understands the importance of culture and client focus in a successful business. I and the team look forward to working with him.

“I would like to thank Neil Brown, our previous Chair for his chairmanship, advice and support over the years.”

Fidelity Sustainable Multi Asset Fund range portfolio manager Caroline Shaw examines the outlook for the year ahead

We expect central banks to have to tighten further if inflation remains sticky on the back of Russia’s invasion of Ukraine, and in the face of slowing growth prospects across most of the world.

In these circumstances, we would retain a cautious, risk-off stance and expect volatility to remain high as investors adjust to fast moving variables such as conflicts in monetary and fiscal policy, China’s growth prospects, as well as the longer-term impact due to rising commodity prices and climate change. The varying impact of these variables on different parts of the world will mean that tactical allocation will be an important source of value-add. However, we do think that this will lead to attractive opportunities to add to risk-on positions.

In these circumstances, the ability to remain nimble, react quickly to changes in markets and the ability to focus on finding secular growth opportunities will be key.

What could surprise markets in 2023?

Given appropriate policy support, it could be the European equity market that offers a positive surprise in 2023. Markets have severely corrected during 2022 and valuations are starting to look attractive in some sectors. For sustainable investors, Europe leads the way with sustainability standards, high levels of corporate disclosure and transparency and in the early adoption of a double materiality approach.

There are risks within Europe, not least the ongoing energy crisis and the war in Ukraine. Whilst gas storage levels look sufficient to cope with the imminent winter, based on reduced demand across Europe, it is next winter that appears less secure. We are therefore mindful of the bigger picture and long-term nature of the energy crisis solutions.

Positioning for what lies ahead in 2023

Listed alternative investments focused on renewables and infrastructure have been at the mercy of energy prices, rising rates and UK political (and fiscal policy) uncertainty from short lived policies through to leadership changes. From a sustainability perspective, renewable infrastructure investments are a key element in the transition to net zero and in energy security. From an investment perspective, the inflation linkage is an attractive characteristic, in addition to the differentiated sources of revenue. Experienced management teams running trusts with valuation cushions against higher risk-free rates look attractive for the longer term though we are mindful of the policy risks facing the UK given the economic backdrop and the politics of support for the energy transition in such an environment.

Being well diversified across both asset classes and underlying investments has been helpful during 2022. The key has been a cautious approach overall with lower equity exposure and lower fixed income exposure than during a typical year.

The offset has been higher than usual cash positions which we do not expect to sustain through 2023. We expect to see plenty of interesting investment opportunities to redeploy this cash into though the trigger for this is likely to be sight of the ending of rate hikes in the US and across Europe, and a change in the upward trajectory of inflation. With that in mind, we expect to have lower cash levels and higher equity exposure during 2023, reflecting more of a risk on environment.

Sustainability considerations

Climate risks, most easily seen in changing weather patterns around the world, are hard to ignore. We anticipate greater recognition of the need to assess, understand and disclose climate risks and opportunities and embed these into risk management and strategic planning at company level. Preparedness for change will be one factor that will influence shareholder returns as this isn’t just about minimising climate risks

CDP, a global non-profit which runs the world’s environmental disclosure system, estimates that US$4 trillion worth of assets will be at risk from climate change by 2030. Importantly, its recent report based on US company disclosure identifies potential financial benefits of climate transition opportunities at least 15 times higher than the potential financial impact of the risks.

Within multi-asset, we expect increased levels of active engagement with our internal and third-party managers as we seek improved integration of ESG and climate factors in investment decision making, increased transparency, measurable data points and consideration of the management of ESG and climate risks, alongside pathways to net zero and recognition of the opportunities afforded by the transition. We believe our engagement efforts positively influence returns to our investors.

Hear more from Fidelity, a 2023 Dynamic Planner Conference Partner, live in London on Tuesday 7 February.

Important information

This information is for investment professionals only and should not be relied upon by private investors. Past performance is not a reliable indicator of future returns. Investors should note that the views expressed may no longer be current and may have already been acted upon. Fidelity’s Multi Asset funds can use financial derivative instruments for investment purposes, which may expose the fund to a higher degree of risk and can cause investments to experience larger than average price fluctuations. Changes in currency exchange rates may affect the value of investments in overseas markets. Investments in emerging markets can be more volatile than other more developed markets. The value of bonds is influenced by movements in interest rates and bond yields. If interest rates and so bond yields rise, bond prices tend to fall, and vice versa. The price of bonds with a longer lifetime until maturity is generally more sensitive to interest rate movements than those with a shorter lifetime to maturity. The risk of default is based on the issuers ability to make interest payments and to repay the loan at maturity. Default risk may therefore vary between government issuers as well as between different corporate issuers. Reference to specific securities should not be construed as a recommendation to buy or sell these securities and is included for the purposes of illustration only. Issued by Financial Administration Services Limited and FIL Pensions Management, authorised and regulated by the Financial Conduct Authority. Fidelity, Fidelity International, the Fidelity International logo and F symbol are trademarks of FIL Limited.

The news from the Office of National Statistics (ONS) that inflation has eased slightly from its 41 year high at 11.1% to 10.7%, will provide a little hope but not quite enough to eradicate the worry that people feel for the immediate future and their financial position.

For those already struggling to cope with the rising cost of living, this will only compound the situation. For people fortunate enough to have investments, some may need to make decisions about how to plan to support the increasing cost of living. For many, a better understanding of cognitive and emotional biases could help.

Unfortunately, as humans, we have limitations on our abilities to process all the necessary information when making a decision in order to make the most rational choice, particularly as we are often bombarded with a wealth of information and have time constraints in which to make decisions. So, when it becomes challenging to keep track of the ever-changing prices of goods, interest rates, and trends in inflation, then we can often make shortcuts in our thinking to simplify the decision-making process, but this can lead us to make errors.

Dynamic Planner outlines below well-known biases that are particularly fuelled by the news of high inflation, along with ways to reduce or avoid them:

- Framing effect– this refers to how information is presented. People rely too much on the way a message is framed which can affect how they interpret information and therefore act on it.

How to avoid: Try to reframe a problem or message and find alternative perspectives. Research also shows that those who are more knowledgeable and up-to-date on an issue are less susceptible to the framing bias and the way a message is portrayed. It is therefore important to discuss inflation and its impact with an expert or read the financial sections in newspapers and online to help understanding. - Anchoring bias– During uncertain times decisions can be influenced by fixating on a reference point or information you have received. People may make comparisons, estimates and decisions in relation to this reference, which is known as anchoring, ignoring other relevant information.

How to avoid: Research shows that just the way in which information is presented can cause people to look at a reference point and ignore all other relevant information. Even though a reference point, whether one you have determined or have observed in the media, may seem important, don’t be fixated on a figure, they are often arbitrary and irrelevant, and can cause greater worry. - Regret aversion– Anticipating regret and envisioning the emotional discomfort of making a poor decision can result in inertia, where people may fail to act or stick with a default option for fear of making an active choice which later turns out to be sub-optimal.

How to avoid: Not making or avoiding a decision still involves making a choice. Research found that automatic pension enrolment increased pension participant rates from 49% to 86% in 2001, and this is why such behavioural nudges (an opt-out rather than an opt-in system) have been applied today, helping us to save more for the future. Spend time thinking about your priorities and viewing the future with optimism, finding ways to better regulate your emotions can also help reduce fear and succumbing to feelings of regret when facing a difficult decision. - Present bias– Individuals can have the tendency to pursue instant gratification by overvaluing present rewards at the expense of future returns. We often engage in impulsive behaviour in return for immediate pleasure, whether opting for unhealthy fast food or spending money today rather than saving for tomorrow.

How to avoid: It is important to delay gratification particularly when we consider saving for retirement, immediate rewards can often lead to regret. When saving, set realistic goals as setting yourself up for failure can reinforce the desire to accept instant rewards and discourage you from persevering and saving for the future. - Availability bias – refers to our tendency to use readily available information, information that comes to mind quickly and easily when making decisions. We also often evaluate the likelihood of future events on recent memories without putting them in perspective of the longer-term past which can lead us to make poor financial choices.

How to avoid: Perceptions of inflation can be heavily influenced by your personal purchasing experiences. Research shows that price changes of items that were recently purchased, bought frequently, resulted in an increase in price, and particularly a large increase, influenced people’s perceptions of inflation. Gain a more accurate and objective picture of inflation and discuss with an expert or research the current situation, as recent events and personal experiences can cloud your judgement and lead to greater worries.

Louis Williams, Dynamic Planner’s Head of Psychology & Behavioural Insights said: “The current situation is worrying for everyone, some of us will not have experienced inflation anywhere near as high in our lifetime.

“For those who are fortunate to still have a degree of choice in how to manage their money, understanding the biases that may influence their attitudes and behaviour could help them achieve better longer-term outcomes as well as counter some of the impact of inflation.

“Having a much deeper understanding of our susceptibilities to behavioural biases can be a great help in overcoming rash or ill-thought-out decision making, especially when faced with all the uncertainty we have right now combined with the soaring cost of living.”

By Jim Henning,

Head of Sustainable Investment

When it comes to doing our washing, we all know it’s important to read the clothing labels to avoid any unfortunate mishaps (as well as trying to reduce the water consumption and temperature levels). Similarly, when it comes to sustainable investing, the risk of ‘greenwashing’ has been a persistent issue.

The ever-widening range of sustainable investment objectives, definitions and related solutions has led to misunderstandings, confusion and sometimes claims are being made that simply wouldn’t stand up to scrutiny. This can lead to the unintended consequences of eroding trust in the financial services industry and lowering levels of capital flows into sustainable enterprises than would have otherwise been the case.

Global regulatory bodies have been busy trying to fix this problem by defining what exactly a sustainable investment means, thereby bringing more clarity, standardisation and raising standards. Greater transparency is vitally important but is an incredibly complex and technical task and remains very much work-in-progress.

It’s also interesting to note that the EU, US and UK regulators have chosen three definition categories, but predictably each have important differences in approach. Based on the recent FCA consultation paper ‘CP22/20 Sustainability Disclosure Requirements (SDR) and Investment Labels’, the UK proposals look more aligned to the US than the EU scheme. In the latter case the EU’s SFDR was intended to be a disclosure regime only, while the FCA’s proposals introduce a labelling regime with three sustainable categories and new consumer‑facing summary disclosures.

Sustainability Disclosure Requirements – Proposed fund labels

*At least 70% of a ‘sustainable focus’ product’s assets must meet a credible standard of environmental and / or social sustainability, or align with a specified environmental and / or social sustainability theme. These products will typically be highly active and selective.

**These products will typically be highly selective, emphasising investment in assets that offer solutions to environmental or social problems and that align with a clearly specified theory of positive change.

Importantly, the new labels will also apply to discretionary managed portfolio services (MPS). For an MPS to qualify to use one of these labels, 90% of the total value of the underlying products in which it invests must meet the qualifying criteria for the same label. The DFM provider must then make the disclosures for each of the underlying products available to retail investors.

Choosing the right name for a product has always been important and often the subject of much internal debate within marketing departments. As it’s likely the first thing a retail investor is made aware of, the FCA intends to prohibit the use of sustainability related terms in either product names or marketing material for those products that do not qualify for a sustainable label. Examples of these terms would include ‘ESG’, ‘climate’, ‘impact’, ‘sustainable’ or ‘responsible’.

Following the consultation period, the final rules are due to be published by end of June 2023 and new labelling, naming and marketing restrictions will follow on 12 months later. The disclosure proposals in CP22/20 are far-reaching, covering all regulated funds to varying degrees, not just the labelled ones. They will require much more granular transparency and ongoing disclosures particularly surrounding investment objectives and policy, alongside progress reporting against published KPI’s.

There is no doubt that qualifying for a sustainable label will be a high bar to meet for many asset managers. In fact, based on the FCA’s own initial estimates, of those products that currently have sustainability-related terms in their names and marketing, two-thirds could decide to remove them accordingly.

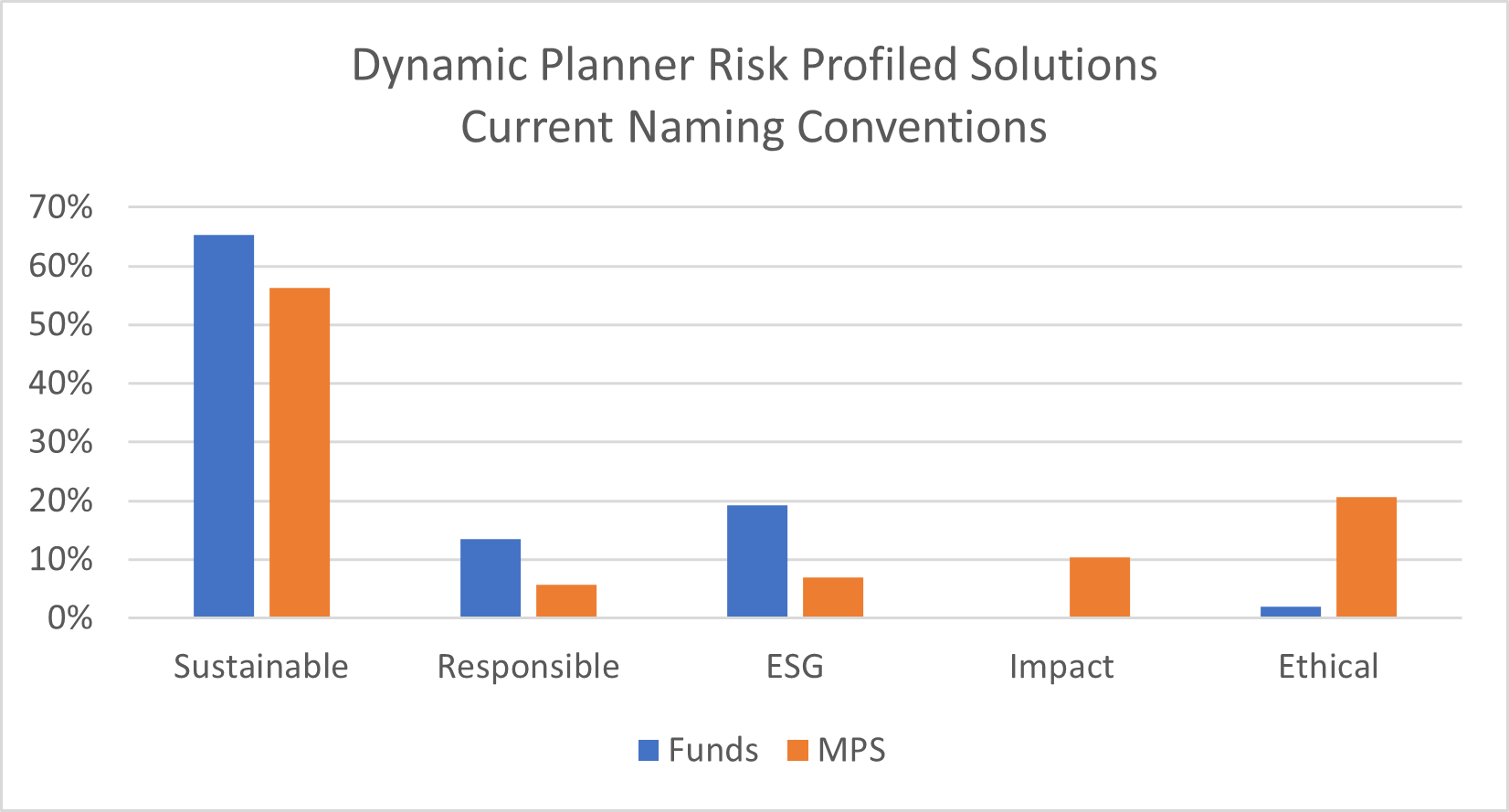

Based on the 139 risk profiled multi-asset solutions currently in Dynamic Planner that have such terms in their names, it is interesting to see the differences across both funds and MPS’s. ‘Sustainable’ is by far the most favoured naming option across both wrapper types, but there is notably a greater proportion of more specialist ‘Impact’ and ‘Ethical’ offerings in the MPS space. For ethical screened funds, I suspect many are likely to elect one of the new labels, as sustainability has always been an important underpin to their philosophy and the preference of their traditional dark green investor base.

Over coming months, we can expect a raft of objective and fund name changes in light of the proposed regulations. At Dynamic Planner, we will ensure that relevant and objective sustainability research is available in the system, covering both products adopting the new labels and those which don’t. In the latter category, many will continue to actively apply ESG screens in their stock selection process and engage with investee companies (and also more widely across the asset management firm) from a fiduciary risk management perspective.

Thereby, users will be fully equipped to connect the recommended solutions to both risk and sustainability preferences via our Client Profiling process and meet the forthcoming Consumer Duty requirements.

Not a Dynamic Planner user? Schedule a free no-obligation demo with a business consultant and experience the full functionality of Dynamic Planner.

Dynamic Planner’s Investment Committee (IC) met on 20 October, focusing on the unprecedented shockwaves suffered by UK assets and currency following the September mini-budget and in particular their impact on the lower risk benchmarks.

In expectation of a return to some form of fiscal normality in the UK, the IC considered the wider global perspective. As central banks play catch-up to quench ingrained inflationary pressures, less globally co-ordinated policy responses appear likely, which could further increase bouts of currency and economic volatility, suggesting that asset allocation decisions on country and currency still matter.

The IC discussed the importance of maintaining bond holdings in the lower risk benchmarks and other options, including the wide range of differing bond maturities modelled within Dynamic Planner.

This comprehensive range of asset classes can be used to assess the risk implications if tactical tilting of portfolios from the long-term benchmark allocations is being considered, given current volatile market conditions.

Read the Investment Committee’s full update.

By Sam Liddle, Church House Investment Management

The current backdrop of rampant inflation, soaring energy prices driven by geopolitical tensions, and impending recession has provoked much talk of the parallels with the UK’s last big inflationary crisis in the 1970s.

Back then, the retail price index peaked in 1975 at almost 27%, following chancellor Anthony Barber’s ill-fated 1972 ‘budget for growth’ under Edward Heath’s Conservative government and OPEC’s 1973 oil embargo.

Such comparisons – particularly with the ‘Barber Boom’ that fuelled wage rises and inflation – have become more meaningful in the aftermath of this year’s so-called Mini Budget announced in September by chancellor Kwazi Kwarteng, which sent sterling plunging to all-time lows against the dollar, and gilt yields soaring.

A more useful comparison

While the economic parallels between now and the 1970s make for illuminating (and alarming) macro commentary, it is also useful to consider their ramifications at a more granular level, for the value of asset classes held by UK investors.

The focus for investors was notably different back then, as there were no corporate bond or index-linked gilt markets; we are therefore concentrating on the impact for gilts, cash and equities, drawing on the Barclays Equity Gilt Study for the 20-year period between 1965 and 1985.

It is worth setting the scene by looking first at the corrosive effect of inflation on the buying power of sterling over that time. A lump sum worth £100 in 1965 would have bought only around £10 of goods in 1985. Clearly, then, those who simply held cash under the bed suffered huge losses over the two decades.

Fixed interest pain

What happened with government bonds? Yields rose from around 6% in 1965 to peak at 17% in 1974, falling back to around 10.5% by 1985; Barclays calculates that the total real return, taking account of capital values over those 20 years, amounted to -0.3% a year on a total return basis.

But perhaps a more useful analysis is to consider what would have happened to £100 of gilts bought in 1965 and held with gross interest reinvested. That £100 would have practically halved in real terms by 1974 as yields went through the roof and decimated capital values, but it recovered much of its value through the early 1980s.

Cash savings tread water

Barclays looks at returns from both UK Treasury Bills and building society accounts, which were a much more important feature of household savings in the 1970s. It finds that over the 20-year period Treasury Bills broke even in real terms, while the higher interest rates paid on building society accounts meant they achieved an annual average return of 0.3%.

But again, that long-term average masks the real losses suffered by building society savers through most of the 1970s as a result of inflation. By the end of the decade, a £100 deposit with gross interest reinvested would have bought just £85 worth of goods compared with 1965.

Equity volatility

UK equity investors had a torrid time during the bear market of April 1972 to December 1974. Share prices fell by more than 70%, compounded by a secondary banking crisis, falling pound and industrial unrest as well as the oil crisis and inflation.

Total return data for the FTSE All-Share index was not available until 1984, but the Barclays study (which runs an index based on data from 1899 onwards) shows massive swings in real equity values between 1965 and 1985.

Indeed, such was the impact of the 1972 slump that as of December 1974 the total real return for the previous 10 years was running at an annual average of -7.3%. But the subsequent recovery in share prices into the 80s meant that over the total 20-year period equities pulled off an average real return 5.4% per year.

To relate that to our £100 lump sum, if it had been invested in 1965 in the UK market with dividends reinvested, its real value would have plummeted to just £50 by the end of 1974, before soaring to well over £250 by 1985.

What is the takeaway?

Terrifying volatility, accompanied by many corporate and individual bankruptcies, was the price paid by equity investors for the best long-term real returns.

Closer examination of leading blue-chip companies in 1965 shows that a large number either went bust or were taken over during the following 20 years. The evidence backs up our ongoing concerns that capital-intensive, low-margin businesses are particularly vulnerable to inflation and rising interest rates.

More generally, it is encouraging to note that a focus on equities paid off over this period – but cash resources were vital to the survival of both companies and investors. The lesson remains that the surest protection for investors in such turbulent times is provided by holdings in high-quality companies with strong balance sheets and margins that can survive a significant downturn.

If you are a Dynamic Planner user, you can find Church House funds using the fund search tool

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article.

Please also note the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

Thank you. To you, the UK financial planning professionals – the advisers, paraplanners and administrators, all forming a growing community of Dynamic Planner users and making it what it is today. A financial planning system adopted by thousands.

Thank you to our asset management partners, who work so openly with us to make Dynamic Planner a trusted hub of whole of market investment and product research. And thank you to the myriad of other people and partners, who all make their important contribution in 2022.

The growth, in particular, of Dynamic Planner’s user community is reflected by the increased usage of the system’s expanding functionality, which caught the judges’ eyes in our entries for the 2022 Schroders UK Platform Awards and 2022 Money Marketing Awards, the ceremonies for which this year fell within a 10-day window in September.

Rare achievement

In 2021, something happened. Dynamic Planner was named the ‘Leading independent planning tool provider’ at the UK Platform Awards – before its name was announced again by awards hosts as the ‘Adviser technology provider of the year’ by Money Marketing.

On more than one level, it felt significant. Covid had then been with us in the UK for 18, to say even the least, unsettling months and yet the profession had shown such resilience to adapt overnight to the impact of national lockdowns.

Earlier in 2021 in May, Dynamic Planner’s psychometric sustainability questionnaire was launched, an industry-first, which you, our users, quickly began sharing with your clients to measure their attitude to ESG and sustainable investing. Cash flow planning had launched in Dynamic Planner by the time we sat down for Christmas 2020.

In Q1 2021, a mainstay of the year we could all mark in our diaries and look forward to, the Dynamic Planner Conference, could not be held face-to-face. Postpone? That was one option. But we perhaps took a risk and we determined to translate the social experience of Conference to a virtual platform. Was that really possible? It was. More of you than ever before attended that day and recreated the above sense of community in a wonderful way.

So. Back to the top. That rare achievement of Dynamic Planner receiving industry awards back-to-back could never happen again. 2021 was 2021. This was now. But we were wrong.

“Stop press. Dynamic Planner awarded winner’s trophy at 2022 Money Marketing ceremony,” Yasmina Siadatan, Dynamic Planner’s Sales and Marketing Director, soon shared on LinkedIn.

“We’re the ‘Adviser technology provider of the year’ for the second year in a row. So proud.

“A massive thanks to our clients and partners, who continue to trust us with an incredibly important part of their business.”

National IFA network New Leaf Distribution posted: “We are so happy Dynamic Planner, our IFA tech partner of choice, has won adviser technology provider of the year. All our IFA members use it to help give incredible value and advice to their clients.”

In fact, Dynamic Planner has now been named ‘Adviser technology provider of the year’ back-to-back in 2021 and 2022 by the Money Marketing Awards. And ‘Leading independent planning tool provider’ in 2020, 2021 and 2022 by the UK Platform Awards.

This year’s judges praised Dynamic Planner’s proven track record in the profession, dating back today to its foundation in 2003 and the 2004 launch of Dynamic Planner ‘Classic’, its first iteration.

Judges praised Dynamic Planner’s continued innovation, now approaching two decades later. And they praised its support for hybrid advice, two and year half years on from the first Covid lockdown which made us rethink so much.

Growth, refinement, expansion, evolvement, distilling into a single Dynamic Planner purpose: enabling you to match people with suitable portfolios through engaging financial planning. Why? In the end, so your clients can fund the things which are important to them.

Fantastic developments

Looking forward to 2023, we can’t say Dynamic Planner will win any awards. But we can say the system will continue to grow and significantly evolve in startling ways to help your firm and to help your clients achieve the above.

Dynamic Planner Co-Founder and CEO Ben Goss wrote in the wake of the 2022 awards: “Delighted to have won this again. Thanks to the judges who recognised the hard work that our team have put in working with clients, to make Dynamic Planner what it is.

“Over the last few years, we have invested heavily in the hybrid financial planning experience. Now our new platform is in place, we have some fantastic developments in the pipeline. Can’t wait to share them and see them add value to practices, small and large.”

Money Marketing added: “One judge particularly liked Dynamic Planner’s focus on areas that added real value to advisers, ‘That is what shone through’.”

Not a Dynamic Planner user? Schedule a free no-obligation demo with a business consultant and experience the full functionality of Dynamic Planner.

By James Mahon, Joint CIO, Church House Investment Management [27 Sept 2022]

September saw a further deterioration in markets, culminating in a disorderly end to the period with steep falls for equity and bond markets, and the makings of a currency crisis.

The US Federal Reserve raised the Fed Funds Rate by 75bp (now up to 3.25%), the European Central Bank (ECB) also raised by 75bp, while the Bank of England limited itself to 50bp (in a split decision), though, to be fair to the Bank, it was the day before the new UK Chancellor’s fiscal package (not to call it a mini budget).

With the accompanying tough talking from the central bankers, bond prices slumped and yields rose along the curve. The major central banks are continuing to signal that more tightening will be needed to bring inflation back to target, while admitting that an economic contraction is a means to this end.

The US yield curve has fully inverted now, the two-year yield rising to 4.3%, 10-year to 3.8% and 30-year to 3.7%. A mild recession in the US looks likely now. The ECB’s hawkish tones confront a European economy already in recession.

The UK Chancellor’s package delivered even more tax cuts than had been trailed, the lack of an accompanying budget or plan to pay for all these cuts quickly led to a focus on the potential inflationary effects, higher yields and weaker sterling.

Gilts have taken a hammering in recent days with the two-year yield jumping to 4.4% and the 10-year to 4.25%. The effect of duration on longer dated issues has been dramatic: the 30-year Gilt has fallen a further 30% in value over this past five weeks, taking it to a fall of 56% over the year. This is what ‘normalisation’ looks like when played out at pace. We are now back into the yield range that persisted from 1998 to 2008.

Equity markets have followed suit with falls of around 12% for the S&P 500, taking it back, almost exactly, to the end-June low points. All the major world markets fell, the only gainer was volatility. Interestingly, though possibly not a surprise, the price of oil has also fallen back along with metals prices.

It is still all about inflation. In the short-term, consumers and businesses are to be shielded from the prospect of massive jumps in fuel prices (though these are abating somewhat), which will provide significant relief. We expect inflation to begin to abate over the next six months, but remember that it is a lagging indicator and what matters to the markets is the time when they can see that the Federal Reserve really means what it says.

Europe was in the eye of the storm of gas prices and Putin. Now the storm has crossed the channel to the UK. Falls in sterling are inflationary (though much of this has been US dollar strength). A tax-cutting budget can be inflationary (unless the cuts can really be covered). Both increase the odds of a tougher response from the Bank of England.

The better side of the coin is that, for the first time in years, one can see decent returns on offer in the Gilt market and even better returns on offer in credit markets.

My suspicion is that markets (fixed interest and equity) have priced-in a lot of bad news and that fortune will favour the disciplined buyer of quality companies now. But, in the short-term, it feels like it could go anywhere.