by Ruffer LLP

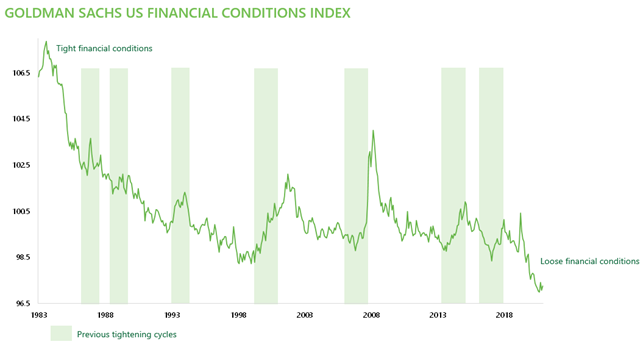

Financial conditions have never been so accommodative

Source: Ruffer LLP, Bloomberg

Omicron or not, the US economy is booming. The cocktail of pent-up animal spirits, household net worth at all-time highs plus hefty measures of monetary and fiscal stimulus is a potent one!

The Atlanta Federal Reserve ‘NowCast’ has US Q4 real GDP at 7%; add 6% CPI inflation and you get a 13% nominal growth rate . The growth picture is similar in Europe and the UK. One would have to go back 50 years to find a similar surge.

The fly in the ointment is inflation– from energy and housing to wages, raw materials, and food. In a nutshell, too much money is chasing too few goods.

With this backdrop, does the US really need the easiest financial conditions on record? As former Federal Reserve Chair McChesney Martin once said: “the job of the Fed is to take away the punch bowl just as the party is warming up”.

It’s time to poop the party

This month’s chart shows the Goldman Sachs Financial Conditions Index, a composite including interest rates, equity valuations, borrowing costs and currency data to assess how ‘easy’ or ‘tight’ financial conditions are. This offers a broader gauge than the blunt tool of interest rates. The message is clear: the current concoction is almost all vodka, with just a dash of fruit juice.

This matters because asset prices have been driven higher on a sea of abundant liquidity and stimulus. For the first time in at least a decade, central bankers are beginning to acknowledge they are behind the curve. The political pressure to ‘do something’ is rising.

In 2022, it seems likely interest rates and bond yields will rise, quantitative easing will melt away and there will be less of a fiscal stimulus impulse.

We must be clear on the broader context here: policy makers are still extraordinarily supportive of the economy. In reality, tapering amounts to less easing rather than meaningful tightening; interest rates will remain negative in real terms and near multi-century lows. But prices are set at the margin – markets respond as much to flows as they do to the stock – and financial conditions will tighten.

In a highly financialised world policymakers face a conundrum: to tame inflation and moderate growth they must reverse the very conditions that have been so beneficial for stock markets. We are bullish on economic prospects coming into the new year. But the irony is that the stronger the economy, the more vulnerable capital markets look. What the real economy needs, financial markets can’t handle.

So how to position portfolios? Avoid the obvious beneficiaries of easy money and liquidity – profitless ‘unicorn’ technology and the Jenga tower of corporate debt. Seek out assets which benefit from strong economic activity and recovery – energy stocks for example. Own the beneficiaries of those rising interest rates: UK and European banks alongside interest rate options which hedge your portfolio duration. This is how we are positioned.

One notion of successful investing is to have the world come to agree with you… but later. What excites us is the valuation gulf between these assets suggests most market participants don’t agree with us.

Duncan MacInnes

Investment Director

To receive the Green Line monthly, please click here to sign up.

If you would like to discuss the article in further detail with someone at Ruffer, please do not hesitate to contact Toby Barklem, Business Development Director.

tbarklem@ruffer.co.uk

+44 (0)20 7963 8127

The views expressed in this article are not intended as an offer or solicitation for the purchase or sale of any investment or financial instrument, including interests in any of Ruffer’s funds. The information contained in the article is fact based and does not constitute investment research, investment advice or a personal recommendation, and should not be used as the basis for any investment decision. This document does not take account of any potential investor’s investment objectives, particular needs or financial situation. This document reflects Ruffer’s opinions at the date of publication only, the opinions are subject to change without notice and Ruffer shall bear no responsibility for the opinions offered. This financial promotion is issued by Ruffer LLP, 80 Victoria Street, London SW1E 5JL. Ruffer LLP is authorised and regulated by the Financial Conduct Authorityd. Read the full disclaimer