By Daniel Needham, Global Chief Investment Officer, Morningstar

Key Takeaways

- Active management may not be in decline, rather the type of active management is changing to benefit active asset allocation. This presents investment opportunities for long-term asset allocators.

- Research shows that investors need to not only be active to outperform; they need to be patient.

- Long-term investing can be psychologically challenging, so it’s important investors have an adviser to keep their focus on what really matters.

All Investing is Active Investing

The move to passive investing has been a powerful trend, but to date has focused on security selection. In this context, passive refers to the replication of a market capitalisation-weighted index, while active may describe everything else. The same principle may apply to asset allocation, with passive classically defined as holding the entire investable market in proportion to the abundance of each part.

Clearly, few, if any, investors proportionally own every investable asset.1 Therefore, almost every investor is active on some level. Furthermore, replicating an equity index such as the FTSE 100 is therefore not strictly ‘passive’ since trading is required to match the constituents of the index.2 In this sense, the connection between ‘buy and hold investing’ and ‘passive investing’ can be misleading.

When we look at how assets are invested through more accurate definitions, we believe the share of actively managed assets hasn’t declined as much as shifted from security-selection to asset allocation.

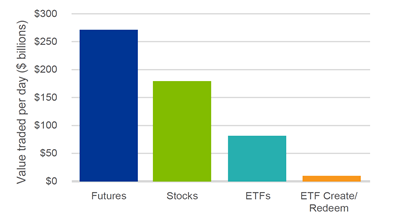

That is, those buying exchange-traded funds (ETFs) aren’t buying them for keeps. They’re using them to express an active investment decision (sometimes to meet a client need) and often trading them frequently, invalidating the term ‘passive’.

Exhibit 1 ETFs are Traded Frequently, Supporting Active Asset Allocation

Source: Blackrock, Index Investing Supports Vibrant Capital Markets, October 2017. Bloomberg, KCG Market Commentary: ETF Insights (Feb 8, 2017)

On balance, this shift in active management increases the opportunity to outperform, we believe, for investment managers who are able to take broader views on asset classes, sectors, industries, and other characteristics. In turn, this may increase the opportunity for investors who are patient.

Shorter Time Horizons Hurt Investors

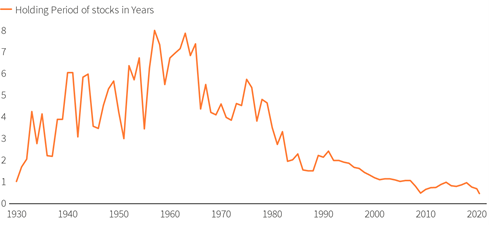

Time horizon turns out to be critical for taking advantage of investment opportunities for truly active management and receiving the benefits of compound interest—benefits that are hard to overestimate.3 Yet, this observation contrasts with the fact that average holding periods continue to fall. Holding periods have arguably been shortened by the rise of passive management, which appears to be a contradiction given passive funds’ low turnover rates.

Exhibit 2 The Reduction in Holding Period

Source: NYSE, Refinitiv. Note: Holding periods measured by value of stocks divided by turnover. https://www.reuters.com/article/us-health-coronavirus-short-termism-anal/buy-sell-repeat-no-room-for-hold-in-whipsawing-markets-idUSKBN24Z0XZ

If index-tracking holdings aren’t frequently buying and selling stocks, how could they contribute to shortening horizons? Because they themselves are being bought and sold. With the rise of lower-cost investment vehicles that can be traded like individual stocks, ETF volumes have risen to meaningful proportions of the market activity relative to their size. Still, it has been estimated that only about 10% of ETF volumes leads directly to the creation/redemption of shares.4 Despite this, it does appear that this turnover and activity impacts the underlying securities5, with higher volatility and turnover for stocks included within ETFs amplified by arbitrage activity—often impacting sectors, countries, industries, styles, or themes.6

This presents an opportunity, through active asset allocation of sectors, industries, and countries across equity markets, and for bottom-up investors that can take more active risk by including focused exposure to these areas. While the game may be getting harder in the more narrowly defined subsectors, it may be an opening for those with a long time horizon and a high active share.

By Definition, You Must Do Something Different to Outperform

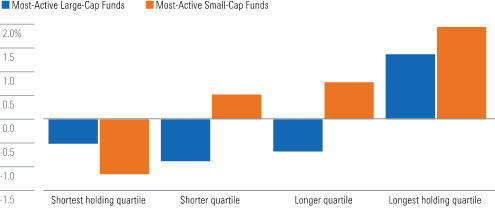

According to Sir John Templeton, one of the great investors of the 20th century, it’s impossible to produce superior performance unless you do something different from the majority. Academics call this ‘active share’, which is loosely defined as how different an investment strategy is from its benchmark. High active share should not be interpreted as having a higher likelihood of outperformance on its own. Like all things, one should be cautious in drawing conclusions from a single metric. On this point, author and academic Martijn Cremers7 identified that funds with high active share and low turnover tended to do better on average. This makes sense to us.

Exhibit 3 More-Active Strategies Held for the Long Run Tend to Outperform

Source: Cremers, M. 2016. “Active Share and the Three Pillars of Active Management: Skill, Conviction and Opportunity.” See online appendix at https://papers.ssm.com/sol3/papers.cfm?abstract_id-2891047

In our opinion, while certain strategies with lower active share and higher turnover can and do outperform, for fundamental investors time horizon seems to be the road less traveled. This concept of patient capital has been described as time horizon arbitrage and is tied to the idea of limits to arbitrage. In other words, patient investors may reap rewards—these rewards are available to any investor, but in practice go to only those who do what it takes.

Arbitrage Comes in Different Forms, Including Time Horizon

Arbitrage typically refers to different prices set for the same asset, a condition that generally requires not enough market participants seeing the big picture. The astute investor can buy at the lower price and sell at the higher one, keeping the difference.

Once, arbitrage involved buying something (gold, for example) at a lower price in one port, and sailing it to another port to sell at a higher price. With a large enough spread (and trustworthy enough sailors), anyone could take advantage of the price difference, but of course not everyone did.

Time horizon arbitrage is the idea that many investors are so focused on the short term, with lots of competition for investment results, that they don’t see the big picture, in this case the value of the investment for a long-term owner. Whether due to incentives or to psychology or career risk,8 there’s a reluctance to extend one’s horizon. With all the focus on winning over the short-term, this reduces the competition for information that is only relevant over the long term.

While there are no doubt opportunities over short horizons for talented investors and traders, as the time horizon extends, competition appears to decline. The desire or need for quick results is the siren song for most investors. This presents an arbitrage opportunity for those willing to tie themselves to the mast and wait patiently for potential returns.

Bringing It All Together

While headlines decry the decline of active management, we may be seeing a change of active management from purely security selection to active asset allocation. This utilises portfolios of stocks, principally ETFs, rather than the underlying stocks themselves. The rise of passive management may imply less activity and longer holding periods. However, the opposite may be occurring.

With the rise of active asset allocation through ETF trading, we see an opportunity for asset managers willing to be different, taking a long-term view. As the security selection asset manager universe shortens their time horizon and increase their activities, the opportunities may well be in doing the opposite—fishing where the fishermen aren’t9 – reinforcing one of the few durable investment advantages, a long-term investment horizon.

We think this changing nature of active management is therefore an opportunity and an advantage for us at Morningstar Investment Management. Our investment process is designed to opportunistically buy assets and patiently hold them until they appreciate. At times this means that we are well out of step with markets as we wait for prices to return to their long-term fair values, but we believe that we will significantly help investors meet their goals in the long run.

Of course, we can’t do this without their help. Changing strategies midstream can destroy value for investors because it often means selling low and buying high—something commonly referred to as ‘chasing returns’.

Financial advisers can help clients stay the course by reminding them of the big picture and keeping their focus on the long term.

References:

[1] https://www.nytimes.com/2015/10/25/magazine/should-you-be-allowed-to-invest-in-a-lawsuit.html

[2] “Being passive” is in fact still an active choice. As Lasse Pederson pointed out, even “passive” managers of indexes are required to trade[1] due to buy-backs, dividends, re-constitutions and corporate actions, often with active investors on the other side. This isn’t talked about often but could be argued as a potential source of alpha. https://www.tandfonline.com/doi/full/10.2469/faj.v74.n1.4

[3] Albert Einstein supposedly said that compound interest was the eighth wonder of the world, and even modest returns compounded over very long time periods turn into large sums. Legendary investor Warren Buffett said his life has been the product of compound interest.

[4] In the BlackRock’s October 2017 Viewpoint, they point out that the average creation/redemption was 11% of secondary daily ETF flow and 5% of all US stock trading.

[5] https://www.troweprice.com/content/dam/ide/articles/pdfs/2019/q3/the-revenge-of-the-stock-pickers.pdf

[6] This potentially increases non-fundamental information and reducing efficiency. The more trading of baskets of stocks via ETFs, the more this can impact prices of the underlying basket of stocks. https://www.nber.org/system/files/working_papers/w20071/w20071.pdf

[7] Who coauthored a 2009 paper that introduced the active share concept, and identified in a 2016 paper the relationship between active share and holding periods.

[8] The challenge is that most arbitrageurs manage other people’s money, and the fund manager may be fired before their long-term investments deliver results. The irony of the lack of competition for long-term investment ideas due to the institutional limits to arbitrage is that the benefits of compounding returns is best over very long horizons.

[9] An expression that’s a clever contrarian twist on Charlie Munger’s advice to fish where the fish are, borrowed from Jeremy Hosking, an outstanding investor of the eponymous Hosking Partners LLP.

For further information on how Morningstar Investment Management can support your clients and practice:

Call

0203 107 2930

Email

UKManagedPortfolios@morningstar.com

funds@morningstar.co.uk

Visit

www.morningstarportfolios.co.uk

www.morningstarfunds.co.uk

www.morningstarinsights.co.uk

About Morningstar Multi-Asset Funds

Now available on a range of platforms, the Morningstar Multi-Asset Fund Range is a series of multi-asset funds that offer investors a choice of three different risk levels with equity exposure ranges of 30-50%, 50-70%, and 70-90% complemented by lower risk and diversifying investments:

- CG Morningstar Multi Asset 40 Fund

- CG Morningstar Multi Asset 60 Fund

- CG Morningstar Multi Asset 80 Fund

The funds predominantly invest in a blend of low-cost passive funds, looking to lower the cost for investors by comparing the ongoing charges figure (OCF) of these funds to the others in relevant Investment Association sectors, but will also have flexibility to target high-conviction active funds. They are designed for U.K. investors seeking capital growth and some capital preservation over the medium- to long-term within a risk-managed framework.

About Morningstar Managed Portfolios

Morningstar Managed Portfolios are designed to support investor needs as determined by our risk profiling process. Our Active, Passive, Income, Real return, Governed, ESG and International portfolios are built using our approach to valuation-driven asset allocation and portfolio construction, which is informed by manager research from Morningstar’s global analysts. All portfolios are fully supported with ongoing risk management and reporting capabilities. Morningstar Managed Portfolios are intended to help advisers offer their clients efficient and cost-effective investment choices delivered through a wide selection of platforms.

Since its original publication, this piece may have been edited to reflect the regulatory requirements of regions outside of the country it was originally published in.

About the Morningstar Investment Management Group

Morningstar’s Investment Management group, through its investment advisory units, creates investment solutions that combine award-winning research and global resources with proprietary Morningstar data. Morningstar’s Investment Management group provides comprehensive retirement, investment advisory, and portfolio management services for financial institutions, plan sponsors, and advisers around the world.

Morningstar’s Investment Management group comprises Morningstar Inc.’s registered entities worldwide including: Morningstar Investment Management LLC; Morningstar Investment Management Europe Limited; Morningstar Investment Management South Africa (Pty) Ltd; Morningstar Investment Consulting France; Ibbotson Associates Japan, Inc; Morningstar Investment Adviser India Private Limited; Morningstar Investment Management Asia Ltd; Morningstar Investment Services LLC; Morningstar Associates, Inc.; and Morningstar Investment Management Australia Ltd.

About Morningstar, Inc.

Morningstar, Inc. is a leading provider of independent investment research in North America, Europe, Australia, and Asia. The company offers an extensive line of products and services for individual investors, financial advisors, asset managers, retirement plan providers and sponsors, and institutional investors in the private capital markets. Morningstar provides data and research insights on a wide range of investment offerings, including managed investment products, publicly listed companies, private capital markets, and real-time global market data. The company has operations in 27 countries.

Important Information

The opinions, information, data, and analyses presented herein do not constitute investment advice; are provided as of the date written; and are subject to change without notice. Every effort has been made to ensure the accuracy of the information provided, but Morningstar makes no warranty, express or implied regarding such information. The information presented herein will be deemed to be superseded by any subsequent versions of this document. Except as otherwise required by law, Morningstar, Inc or its subsidiaries shall not be responsible for any trading decisions, damages or losses resulting from, or related to, the information, data, analyses or opinions or their use. Past performance is not a guide to future returns. The value of investments may go down as well as up and an investor may not get back the amount invested. Reference to any specific security is not a recommendation to buy or sell that security. There is no guarantee that a diversified portfolio will enhance overall returns or will outperform a non-diversified portfolio. Neither diversification nor asset allocation ensure a profit or guarantee against loss. It is important to note that investments in securities involve risk, including as a result of market and general economic conditions, and will not always be profitable. Indexes are unmanaged and not available for direct investment.

This commentary may contain certain forward-looking statements. We use words such as “expects”, “anticipates”, “believes”, “estimates”, “forecasts”, and similar expressions to identify forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason.

The Report and its contents are not directed to, or intended for distribution to or use by, any person or entity who is not a citizen or resident of or located in any locality, state, country or other jurisdiction listed below. This includes where such distribution, publication, availability or use would be contrary to law or regulation or which would subject Morningstar or its subsidiaries or affiliates to any registration or licensing requirements in such jurisdiction.

For Recipients in Europe: The Report is distributed by Morningstar Investment Management Europe Limited, which is authorised and regulated by the Financial Conduct Authority to provide services to Professional clients. Registered Address: 1 Oliver’s Yard, 55-71 City Road, London, EC1Y 1HQ

For Recipients in Dubai: The Report is distributed by Morningstar Investment Management Europe Limited Dubai Representative Office which is regulated by the DFSA as a Representative Office.

For Recipients in South Africa: The Report is distributed by Morningstar Investment Management South Africa (Pty) Limited, which is an authorized financial services provider (FSP 45679), regulated by the Financial Sector Conduct Authority.