By Brooks Macdonald

While headlines announcing equity dividend cuts may be alarming for those seeking income, it is important to bear in mind that this is only one of a broad range of income sources available to multi-asset managers. By actively managing a portfolio’s allocation to each type of investment available, we can see an attractive level of yield as we look to smooth the investment journey.

Income is an important component of a balanced portfolio and is often used for the purposes of receiving a regular, dependable amount of money during retirement. Equity dividends are often the first port of call for such purposes, but when circumstances alter the landscape, what are the alternative options?

If a reasonable level of income is required, portfolios need to be structured to give the best chance of meeting this ambition. In the current environment, this can prove challenging. A good starting point is when portfolios are set up to take advantage of opportunities that exist in the expanded investment universe, as well as the flexibility to alter these allocations in response to changing market conditions.

Equities are a prominent source of income as many companies pay out a proportion of their profits to shareholders in the form of dividend payments. However, the economic shock caused by the COVID-19 pandemic has resulted in large numbers of companies suspending or reducing their dividend payments, as they look to retain cash to shore up their balance sheets to better navigate the economic shutdown period. This impact on dividends has dominated financial news headlines and while this should (with some exceptions) be temporary, the prospect of a reduction in this type of income has understandably caused concern for those with income focused portfolios.

It is important, however, to consider that there are many other sources of income generating investments available in addition to equities, and that diversification of sources of income is just as important as sources of capital growth.

Traditionally, fixed income or bond investments can provide a stable and predictable source of income and provide a valuable counterweight to equities in times of market stress. Bonds are debt instruments which most commonly have two forms of payment: a final payment of ‘principal’ at maturity, and a stream of smaller interest or ‘coupon’ payments during the lifetime of the bond. We might think of bonds in terms of government-issued debt, or corporate issued debt for example.

When considering corporate bonds, one benefit is that bondholders sit higher up the capital structure than equity shareholders – that is, coupon payments will be made to bondholders before dividends are paid to equity investors.

When analysing bonds, it’s important to consider various factors including the risk of the company issuing the bond defaulting, and interest rate expectations over the lifecycle of the bond. In the current environment, having the ability to move up the capital structure might be considered beneficial.

Convertible bonds are another option. These are debt instruments issued by companies, which are similar to conventional bonds, but which have an embedded conversion option that allows the bond to be converted into a certain number of equity shares of the issuing company. This means that the convertible bonds have a ‘floor’ and will behave similarly to a conventional bond and can also increase in an equity-like upside as prospects for the company and/or the wider market improve.

Beyond fixed income, there are a number of other investment opportunities in the expanded universe available to multi-asset investors. These can include real estate, infrastructure and other specialist strategies. This broader range of opportunities can be beneficial for income investors as, while bonds are a key multi-asset income portfolio component, the long period of very low interest rates, together with quantitative easing, means that income yields on lower-risk corporate and government debt are relatively low and, in some cases, actually negative (investors are paying to lend money to some governments).

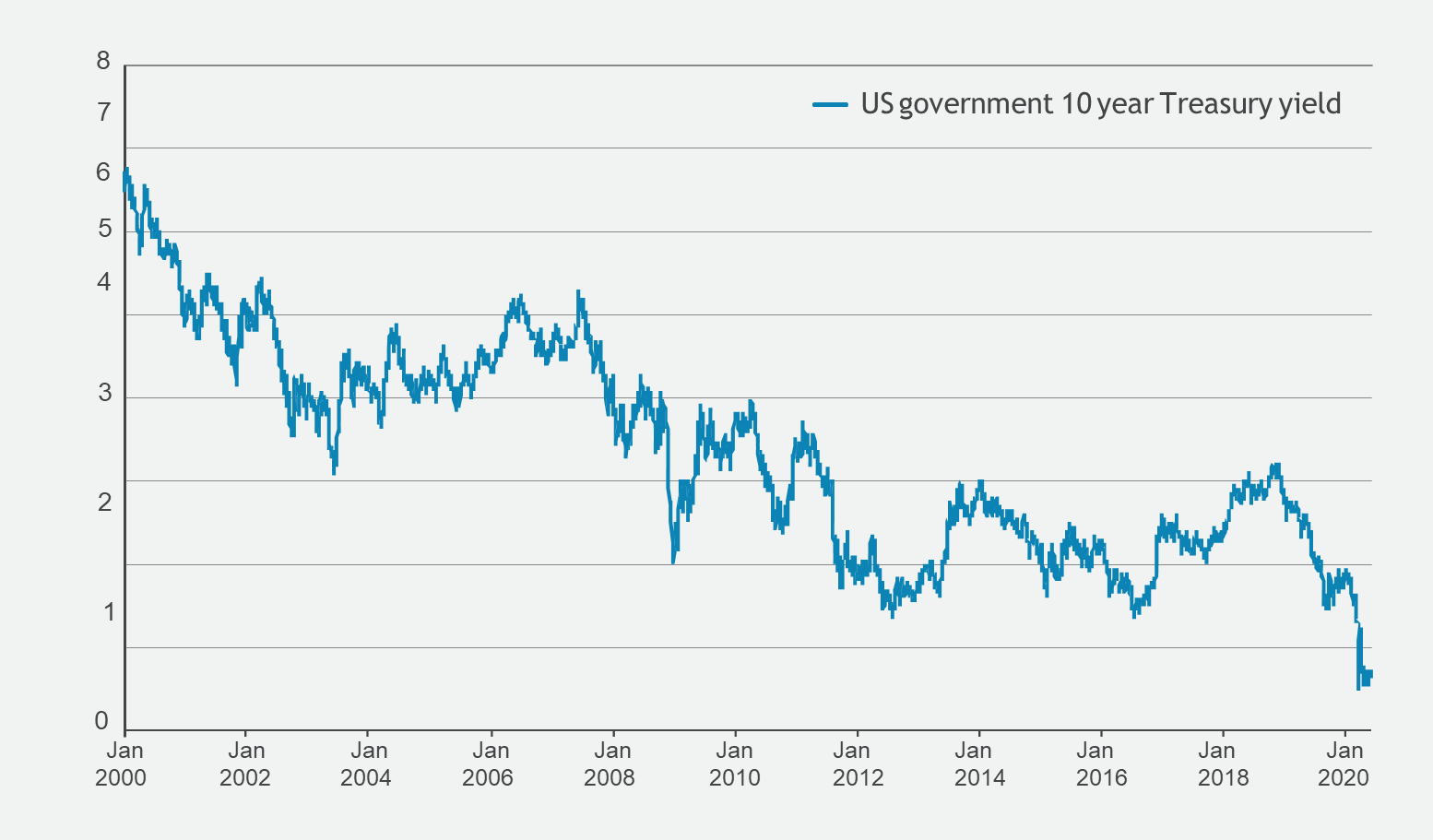

Chart 1: US Government 10yr Treasury Yield

Source: Refinitiv. Data from 01/01/2000 to 13/05/2020

The chart above illustrates this reduction in yield over time, using the example of US government bonds. Having the ability to complement fixed income exposure with appropriate allocations to alternative asset classes, is an opportunity to both diversify and enhance yield.

Infrastructure investment and debt financing can allow investors to gain exposure to critically important assets with a clear and enduring role in society and may offer a degree of inflation-linkage from the cashflows that are generated.

Traditionally, we might have thought of these assets as being roads and railways. However, these can now include computer data ‘cloud’ storage centres and undersea telecommunications cables, among others.

Real estate investment presents the opportunity to benefit from both a potential increase in capital valuations, as well as the contractual income stream from rental payments. While real estate faces certain risks and challenges in the current environment, opportunities still exist to own core operating assets in resilient sectors – for example, GP surgeries, medical centres and supermarkets – in which there could be an opportunity to benefit from long-term, high-quality cash flows which can often be linked to inflation.

Specialist investments – such as those aiming to generate income from music royalties, renewable power generation, energy storage, private debt, and healthcare royalties – can also offer attractive yields and act as beneficial additions to income portfolios.

The broadening universe of investment trusts provides greater opportunities for multi-asset managers to access these investments. While they may offer attractive yields, these investments do have additional risks that need to be understood, and therefore an experienced management team with the ability to conduct rigorous due diligence and actively manage exposures is essytential.

While headlines announcing equity dividend cuts may be alarming for those seeking income, it is important to bear in mind that this is only one of a broad range of income sources available to multi-asset managers. By actively managing a portfolio’s allocation to each type of investment available, we can seek an attractive level of yield as we look to smooth the investment journey.

Please get in touch to find out how we can help guide your investment journey. Contact your Brooks Macdonald representative or email us at info@brooksmacdonald.com. We would be delighted to hear from you!

www.brooksmacdonald.com

Important information

Investors should be aware that the price of investments and the income from them can go down as well as up and that neither is guaranteed. Past performance is not a reliable indicator of future results. Investors may not get back the amount invested. Changes in rates of exchange may have an adverse effect on the value, price or income of an investment. Investors should be aware of the additional risks associated with funds investing in emerging or developing markets. The information in this document does not constitute advice or a recommendation and you should not make any investment decisions on the basis of it. This document is for the information of the recipient only and should not be reproduced, copied or made available to others.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

Brooks Macdonald is a trading name of Brooks Macdonald Group plc used by various companies in the Brooks Macdonald group of companies. Brooks Macdonald Asset Management Limited is regulated by the Financial Conduct Authority. Registered in England No 3417519. Registered office: 21 Lombard Street, London EC3V 9AH. Brooks Macdonald Asset Management (International) Limited is licensed and regulated by the Guernsey Financial Services Commission. Its Jersey Branch is licensed and regulated by the Jersey Financial Services Commission. Brooks Macdonald Asset Management (International) Limited is an authorized Financial Services Provider, regulated by the South African Financial Sector Conduct Authority. Registered in Guernsey No 47575. Registered office: First Floor, Royal Chambers, St. Julian’s Avenue, St. Peter Port, Guernsey GY1 2HH.