6min read

Abhimanyu Chatterjee, Dynamic Planner’s Chief Investment Strategist, discusses the hot topic of inflation amid increasing concerns it could soon rapidly rise. How has it been viewed over time? What are arguments both for and against?

Abhimanyu then analyses what could happen next before outlining four extreme inflation scenarios Dynamic Planner has run to robustly stress test its Asset Risk Model. Finally, he considers cash flow planning and inflation’s potentially acute impact here now for financial planners

Everyone worries about rising prices, especially savers. This general increase (or decrease) in prices of goods and services in an economy is referred to as inflation (or deflation). Margaret Thatcher referred to it as ‘the robber of those who have saved’, while the high priest of the ‘Free Market Economy’, Milton Freidman, called it ‘taxation without legislation’.

The general rise in the price level in an economy results in a sustained drop in the purchasing power of money, as each unit of currency buys fewer goods and services. It reflects a loss in the real value of the medium of exchange.

The opposite scenario, deflation, is characterized by a sustained decrease in prices in the economy.

Market participants are firmly of the opinion that low, positive and stable inflation is generally good for the economy as inflation causes reconfiguration of labour markets through increasing wages and lower unemployment. Excessive inflation or deflation is generally the cause for concern, often caused by step changes in monetary policy.

Inflation: Arguments for and against

It is said that if there are 10 economists in a room, there are 11 opinions. A debate on the causes of inflation results in 20 opinions in the same room.

One often cited reason for inflation is an increase in money supply – both steady or sudden as we have observed during the continuing Covid crisis or during the financial crisis of 2008.

Central banks in the developed world this year have expanded their balance sheets to previously unseen levels to stimulate their economies. Governments have moved beyond monetary policy to fiscal measures, given diminishing marginal returns of monetary policies. In addition, central banks are prepared to move away from their mandates of inflation stability for a period of time to jump-start economies.

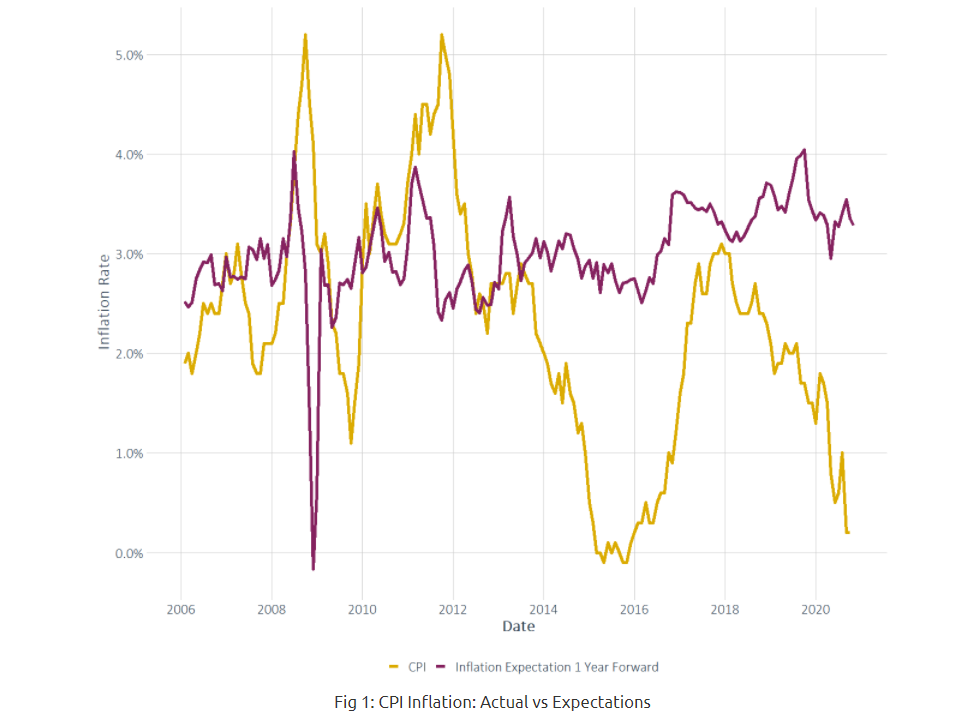

As can be seen in Figure 1 above, while CPI inflation has dropped significantly due to the slowdown in demand, the expectations of inflation has picked up from previous levels. On the other hand, the case for disinflation is gaining traction.

At Dynamic Planner, we feel that, rather than being a financial crisis, as seen in the past, this is a social crisis – a crisis in which consumers are voluntarily choosing to socially distance themselves and postpone consumption, due to uncertainties surrounding health and employment. In addition, there is a sizeable output gap across the global economy, indicating spare capacity.

In China, the current output gap is around 7.5%, an historical high, as it is in the US (8%), which stands at the same levels of the Great Depression. In addition, there is a school of thought that the link between money supply and inflation has broken down – a case in point being the large stimulus measures implemented during the Financial Crisis 2008 did not result in runaway inflation as was expected then.

Further, given the nature of the current pandemic, it is obvious there will be sectors which will be worse off than others and hamstrung in their efforts to grow. Previous bouts of quantitative easing and other fiscal measures failed to increase inflation materially, with divergence being even more stark and asset prices rising and the bulk of the economy facing disinflationary forces.

Inflation scenarios: Stress testing the Dynamic Planner asset allocations

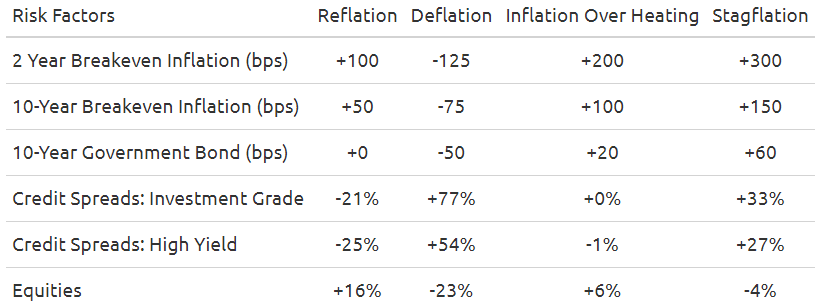

In stress testing our allocations, we consider four specific scenarios:

- Reflation: In this first scenario, monetary and fiscal policy proves to be successful and stimulus brings the economy closer to its pre-Covid long-term trend growth. Nominal rates remain relatively stable, inflation picks up to levels slightly above 2% and the US dollar strengthens. This is good news for equity markets in general. With real rates and risk premia decreasing further, they could gain around 16%.

- Deflation: A grimmer scenario where dis-inflationary trends get the upper hand despite central banks across developed markets keeping yields of all maturities close to zero. With economic growth impaired and increased uncertainty, this is bad news for equity markets, which could lose around 23% in this scenario, with growth stocks underperforming the market.

- Inflation overheating: In this scenario, inflation picks up slightly more than planned, which leads to disrupted economic growth and increases in nominal rates as the US Fed reacts to rising inflation. Equities benefit moderately from decreasing real rates with growth stocks benefiting more from declining real rates.

- Stagflation: This final test is a more extreme version of the previous one, with inflation going up even more. However, this scenario assumes developed market economies are impacted more severely than other regions, as a result of more aggressive fiscal and monetary stimulus. Although real rates decline, growth disruption and uncertainty take the upper hand, pushing equities into slightly negative territory and resulting in a positive bond-equity correlation.

In assessing these scenarios, we have set out the major risk factors to perform in Figure 2 below:

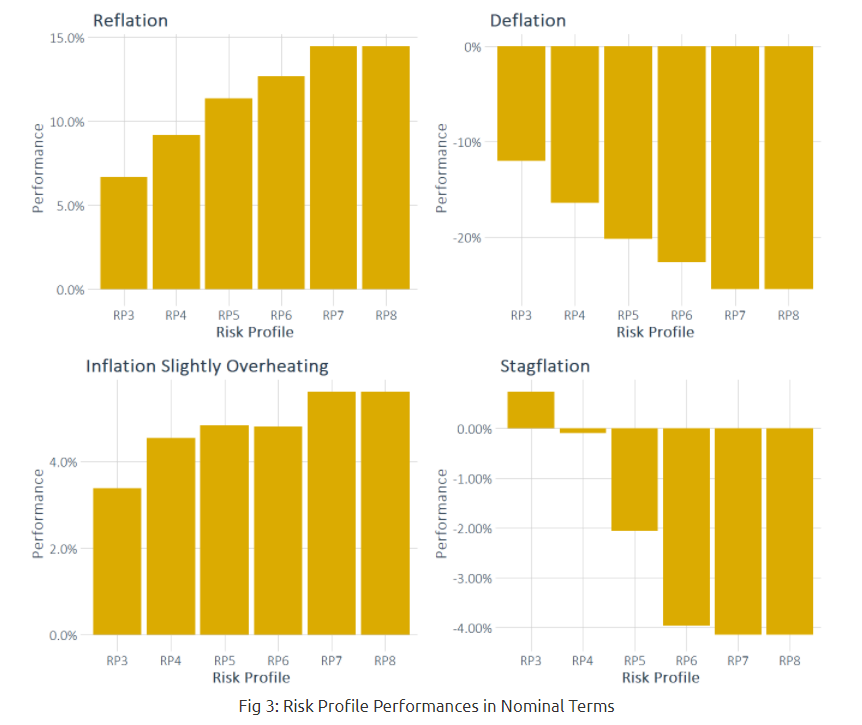

Based on the above scenarios above, we calculate the performance of the allocations for the different Dynamic Planner Risk Profiles.

As can be seen from the graphs in Figure 3 below, the deflationary scenario is the worst one for our allocations, which is understandable, as in this scenario all growth assets underperform immensely.

On the other hand, modest inflation increases or a re-emergence of the economy from the stress and uncertainty of the pandemic would be extremely beneficial for the allocations. In the stagflationary scenario, allocations for the more conservative risk profiles would be safe while the more aggressive allocations with higher equity allocations would suffer mild negative performances.

As fiscal and monetary policies expand to allow governments to deal with the fall out of the pandemic, market participants have started engaging in conversations regarding the possibilities of inflation. This analysis is meant to add structure around conversations for our clients, who use our allocations as a guide to making allocation decisions.

Cash flow planning with confidence

To navigate scenarios as mentioned, our clients, at the coalface of financial planning, need to create a long-term cash flow plan for their clients.

If the plan uses inflation and growth assumptions which are reasonable and based on objective data, a financial planner can engage more effectively with their client and create a quality and understandable plan.

Dynamic Planner forecasts real returns – i.e. net of inflation – across its system, in the risk-reward trade-off shown for risk profiling, in investment portfolio reviews and in cash flow planning.

The forecast is generated by a Monte Carlo scenario engine that generates thousands of possible real returns. As the returns are real to begin with, the various possibilities for inflation at different times are already factored in. It is therefore inappropriate to guess and factor in other numbers for inflation and apply them to the forecast.

With current events set to make inflation more confusing and volatile, clients will need your advice and explanation even more. It is therefore even more important that growth assumptions used are risk-based, real, reasonable and based on objective data. We conduct extreme stress testing like this, so that you can have confidence in ours and plan confidently with your client.

Read about new Dynamic Planner Cash flow planning