By Abhi Chatterjee, Chief Investment Strategist

The ‘Corona Crash’

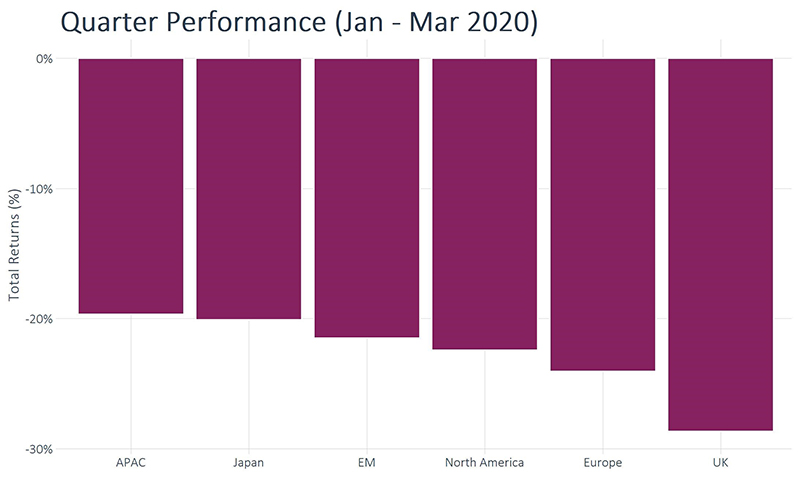

The Covid-19 outbreak triggered a geo-economic panic, resulting in an unprecedented spike in global equity market volatility, with severe declines exceeding 20% and extreme daily swings on a scale comparable to the financial crash of 2008.

Thus, we dramatically marked the end of a remarkably resilient equity bull market, that had begun back in March 2009. The moves largely occurred in late-February and March as numerous countries went into lockdown in response to the pandemic, bringing economic activity to a virtual standstill globally.

Meanwhile, government bond yields and prices were incredibly volatile. Yields first hit extreme lows on heightened fear, but then rose, as panicked investors sold off liquid assets indiscriminately, in order to raise cash. High yield credit was hardest hit given this dramatic spike in risk aversion, with the rout most evident in sectors perceived as most vulnerable, such as those related to travel and retail, as well as energy, given the price of Brent crude plummeted to its lowest level since 2003.

In emerging markets, the heaviest falls were suffered by local currency denominated bonds. There were double-digit declines, in some cases of around 20%, linked to issuance in currencies perceived as more sensitive to the economic growth shutdown, falling oil prices, and those with more market liquidity.

Maintaining essential checks and balances

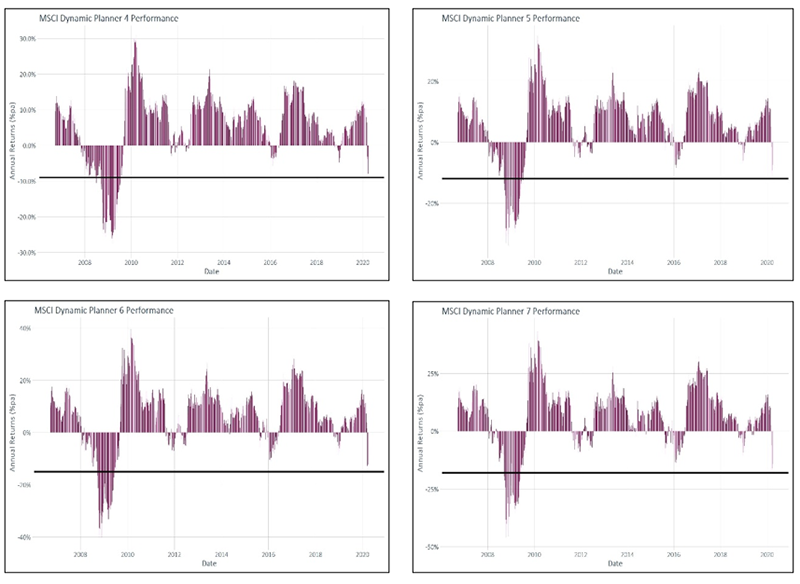

The committee reviewed the performance of the current benchmark asset allocations, which have proven so resilient during this and other periods of extreme market volatility, with none breaching their defined, 95% value at risk limits over the quarter.

The above charts show the rolling, 12-month index returns for risk profiles 4, 5, 6 and 7 updated each month.

The horizontal lines are the respective, 95% value at risk limits for each.

The key role of the Investment Committee [IC] is to ensure that prudent checks and balances are in place, so the integrity of Dynamic Planner’s forward-looking asset and risk model is maintained. During the meeting, the IC carefully considered what could be learned from recent events and whether its current process in forecasting asset class growth and volatility remained appropriate if we are witnessing a significant macro-economic regime change in the making.

Given these extreme market swings and the current uncertainty, as to how long the global lockdown measures will remain in place, after much discussion, the IC agreed that now was not the time to make any changes to its long-term growth forecasts or strategic asset allocation benchmarks. There are just too many unknowns presently over the scale of the economic impact and recovery trajectory, the downstream implications of the huge fiscal and monetary stimulus measures on growth, inflation and interest rates and the likelihood of a viable vaccine becoming widely available.

The current process used for volatility forecasting involves detailed analysis and interpretation of data trends from both a long and short-term perspective. This requires striking a careful balance with the data inputs to the model. The danger of giving too much credence to short-term noise is the potential for overshooting of data in times of extreme market anxiety, potentially leading to significant misalignment in the forecasts generated.

Conversely, the process needs to be sufficiently sensitive to detect emerging changes in how asset classes are expected to behave and their impact on future volatility and correlations over the longer term. For this particular quarter, given the extent of recent extreme data outliers, the IC agreed that their use would be inappropriate on this occasion. Therefore, the longer term data trends for volatility and correlations were used for the Q2 2020 volatility and correlation assumption setting. The data derived from the shorter term modelling techniques were not included.

The IC also noted that post-Brexit negotiations between the UK and the EU were still ongoing, but no significant breakthroughs before the end of the December transition period that could have any bearing on the model assumptions have yet to be announced.

Summary of Investment Committee Q2 2020 decisions:

- No changes to strategic asset allocations

- Previous quarter’s growth forecasts remain unchanged for Q2 2020

- Forecasts for volatility and correlations were based solely on the long-term data modelling approach for this quarter

Disclaimers

You should not rely on this information in making an investment decision and it does not constitute a recommendation or advice in the selection of a specific investment or class of investments.