By Jim Henning, Head of Investment Services, Dynamic Planner

Concerns over the rising pace of inflation have seen interest rates start their gradual climb and the beginning of the end of the great financial experiment by central banks, referred to as quantitative easing.

This raises a number of questions for those clients relying on natural income in their retirement:

- How durable is the portfolio’s income and underlying capital, post the era of fiscal stimulus and interest rate manipulation since the Great Financial Crisis of 2008 and the Covid-19 pandemic?

- What is the nature of expected risks with the underlying assets, particularly within the fixed income space given their elevated sensitivity to interest rates changes?

- There has also been strong growth in demand for alternative asset classes, such as investment in infrastructure, to drive the transition to a clean, low carbon economy and generate an attractive yield. How can risks be assessed accurately?

Dynamic Planner’s Income Focused Fund Research Reports might just help you out at the next client annual review.

The latest set of six, monthly reports provide a wealth of research, both in terms of how the solution has delivered historically and also what types of risks the portfolio manager is taking from a forward lens perspective.

This research is only possible because of the in-depth risk profiling performed at individual holdings level by the Asset & Risk Modelling Team at Dynamic Planner. The reports also share detailed content as to process and philosophy adopted by the management team running the assets.

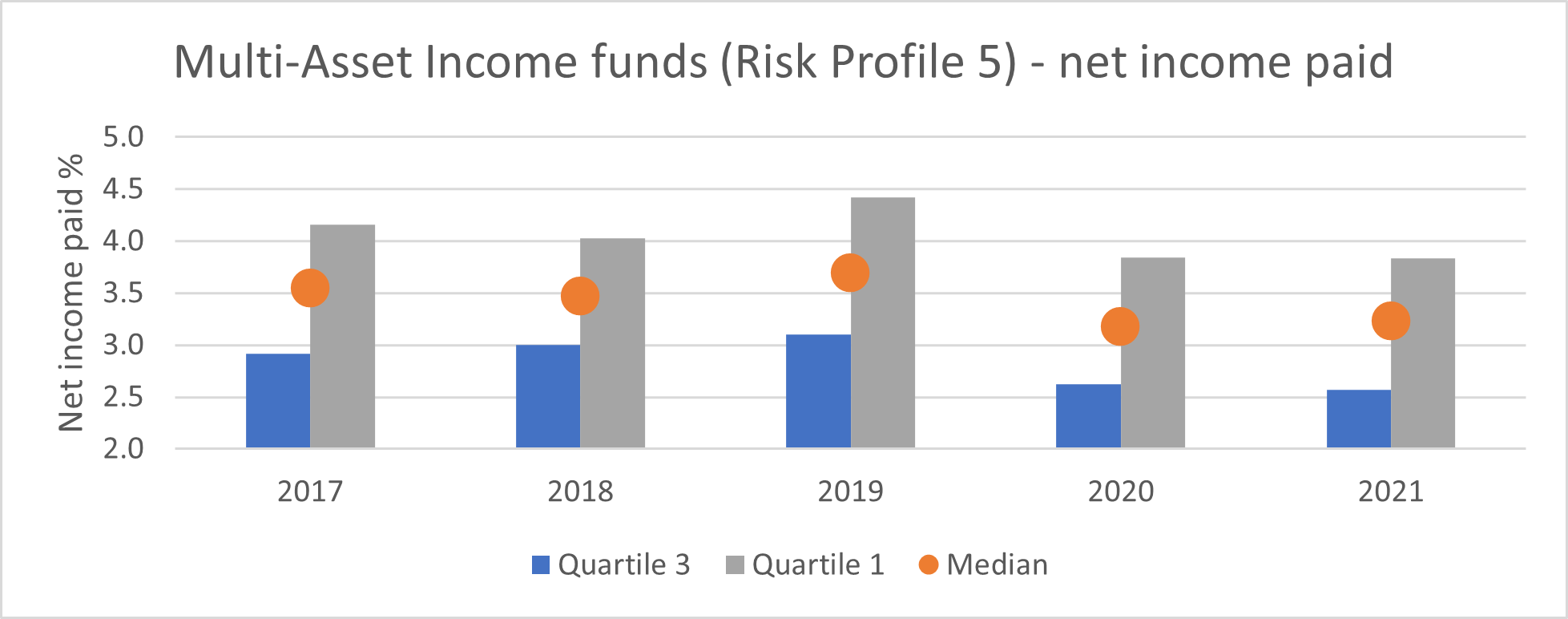

As the recovery from the Covid recession gathers pace, we can see how income payments from this subset of risk profiled funds have stabilised over the last year. Below, the net income paid by the Risk Profile 5 income focused funds over the last five years are shown (specifically the median and the mid 50% range).

Source: Lipper Refinitiv, 12mth periods to end Jan each year

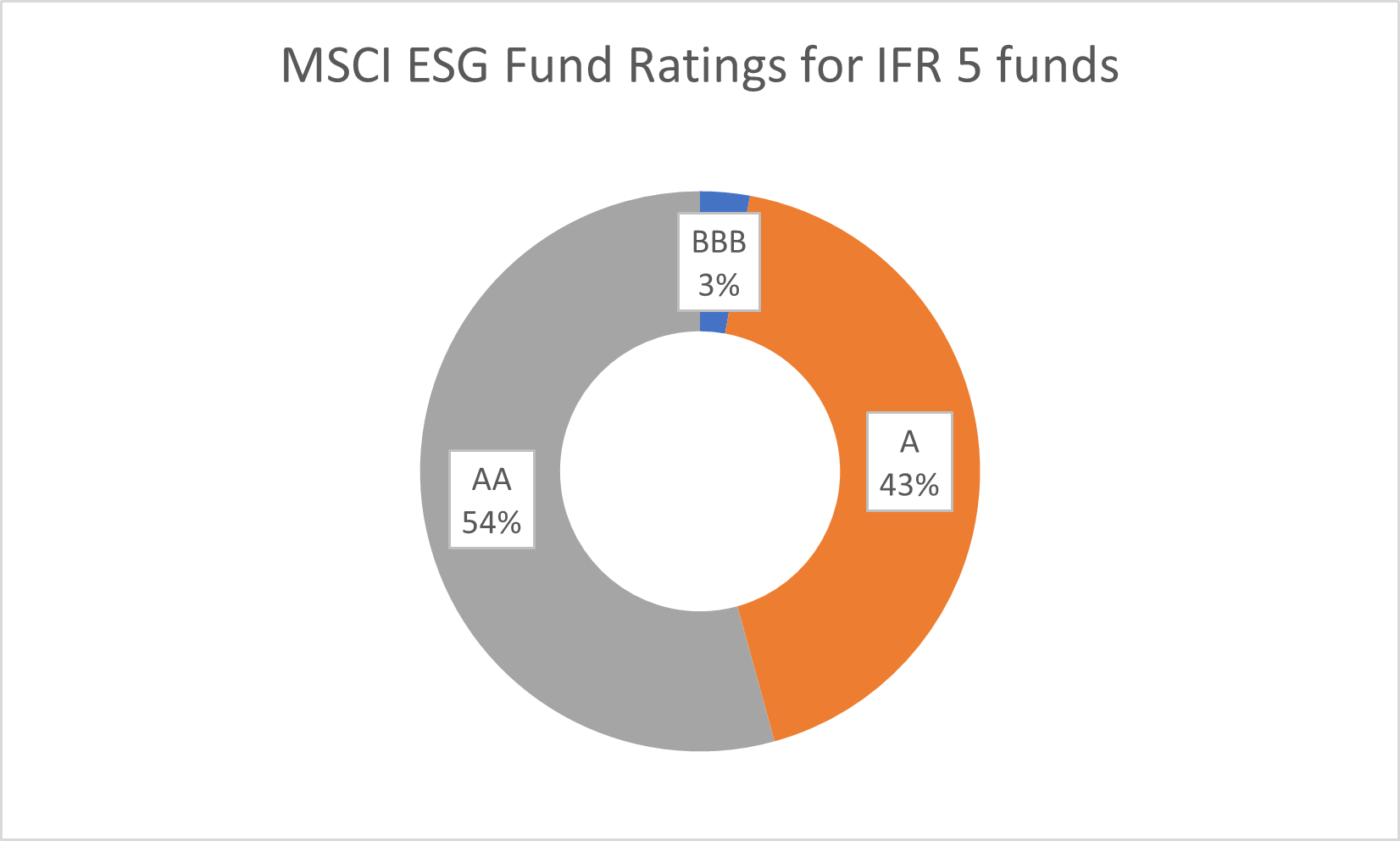

When it comes to talking about risks, your clients may be interested in widening the discussion to ESG.

If so, try Dynamic Planner’s sustainability questionnaire, launched last March and take a look at the MSCI ESG fund ratings available in the system. Using the above income focused Risk Profile 5 funds, it’s encouraging to see the MSCI fund ratings are predominantly AA and A, indicating the high quality of the underlying investee companies managing ESG risks (relative to their sector / industry peers) held within the portfolios.

Source: MSCI at end Jan 2022

The latest Income Focused Fund Research Reports are set to be available from Friday [11 Feb] in the latest version of Dynamic Planner for the following funds:

| Risk Profile | |

| BMO MM Navigator Distribution | 5 |

| Legal & General Multi-Index Income 4 | 4 |

| Legal & General Multi-Index Income 5 | 5 |

| Legal & General Multi-Index Income 6 | 6 |

| M&G Episode Income | 5 |

| Premier Miton Multi-Asset Distribution | 5 |

| Premier Miton Multi-Asset Growth & Income | 6 |

| Premier Miton Multi-Asset Monthly Income | 5 |

| Rathbone Multi-Asset Strategic Income | 5 |

| Santander Atlas Income | 4 |

| Schroder Monthly Income | 5 |

| VT Momentum Diversified Income* | 5 |

| UBS Global Diversified Income | 5 |

*Coming soon