By Wayne Bishop, King and Shaxson Asset Management

King and Shaxson Asset Management’s sole focus is managing ESG and Impact portfolios. We have been doing so since 2002, long before the terms were first coined.

In the years leading up to the pandemic, interest and assets under management in ESG and Impact products had been growing at a rapid pace. This was fuelled by relative outperformance and client interest; the pandemic’s arrival then provided a perfect catalyst.

The reflation trade in 2021 led to a reversal in this relative outperformance for the first time in 11 years, presenting a window for opponents to criticise ESG and Impact. In particular, they took aim at funds’ exposure to the technology sector. Increased retail interest has added a number of new considerations and risks to the financial adviser’s process. In this article we seek to explain the main risks and considerations advisers need to understand.

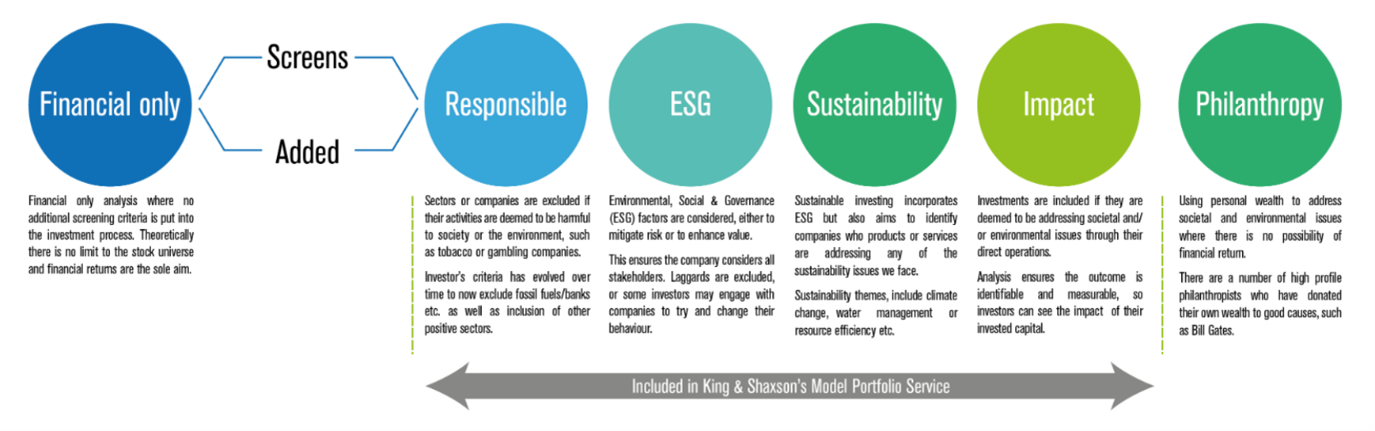

Firstly, we need to understand what ESG and Impact investing really means. Put simply, it’s an additional step in the investment process. Non-financial factors, such as those associated with the environment, society or corporate governance are analysed alongside the traditional investment process.

Beyond this, a fund can have Impact considerations, where investments are identified as having a positive and measurable outcome on people or the planet. In many places, these outcomes are supporting solutions linked to the UN Sustainable Development Goals.

The considerations above will define where the product sits on the spectrum of capital (highlighted below).

Into the mainstream

No doubt we can attribute some of the growth in ESG and Impact investing to the desire of investors to ‘do good’. However, other factors have played a pivotal role in its growth.

The first is the maturity of sectors associated with ESG and Impact, and with that, its relative out-performance. Many of the technologies, such as renewable energy, electric vehicles, energy efficiency, environmental technology, medical Artificial Intelligence, fintech, and the internet of things have developed in the last 20 years.

The investment universe has grown alongside the growth of the sectors, albeit at a slower pace. Companies that were smaller and riskier some 20 years ago, are now large-cap companies. Other companies have repurposed themselves, or have been spun out of conglomerates to align. All of which have altered the size and structure of the universe.

What cannot be understated as perhaps the most significant factor is the growth in data. This enables the analysis of ESG and Impact factors, which had previously been a laborious process for asset managers. Now there are numerous services run by large rating agencies, providing scoring and supplemental non-financial information. At the same time, many companies today report on ESG or Impact metrics, albeit a process that’s in its infancy and will require further standardisation.

Importantly, it is not only asset managers who get this information. Internet sources and social media enable the underlying investor, who by their nature are more interested in their investments, to access both positive and negative information.

How the data is applied to the investment process is a key factor in investment selection. ESG data is an ever-growing source of information, but most ESG rating agencies process the data to determine an investment’s risk, rather than determine if the company is ‘doing good’. This may appear to be a small nuance in terms, but it is instrumental in the investment selection process.

Two ESG funds may sit alongside each other in terms of their label and risk profile, but have very different holdings as a result of the screen applied. A detailed understanding of how products are screened is essential. Our ethical screening policy explains some of the key areas we look at (click here to read).

This means that, for advisers, there is a risk of a clash between client expectations and the products offered. Understanding both client expectations and looking ‘under the bonnet’ of a product is therefore essential to ensure alignment. Experience has taught us that as clients become more interested, their views change over time. Therefore, this should always be regarded as a dynamic process.

Out of the woodwork

As mentioned, the recent reversal in relative performance for both ESG and Impact has provided a window for a number of critical comments (click here to read our recent comment on technology). Over the past years, we have cautioned about over-egging outperformance. Much of it boils down to lacklustre returns and higher volatility of sectors such as oil and gas, commodities, and large banks.

Whilst we have seen underperformance in the last 12 months, we call the longer-term nature of this into question. High commodity prices eventually lead to alternatives being used. We see high oil and gas prices as speeding up renewables and battery storage take-up. We still see major disruption from technology eroding older industries, from vehicles to finance.

Therefore, many of the longer-term structural trends associated with both ESG and Impact investments remain intact, and as efficiency and cost savings become a priority, we see these trends accelerating, rather than retreating. The much-needed decline in some valuations means that we see recent performance as a healthy correction after the pandemic.

Years of experience has helped us gain a healthy perspective on this sector, trends that come and go and those that stay and grow. As a team managing ESG and Impact portfolios, we are strictly discretionary and do not offer an advisory service. Our focus is helping financial advisers, not being one.

Boasting an 11-year track record, King & Shaxson Asset Management offers 11 model portfolios (Dynamic Planner Risk Profile 3-8), all of which incorporate a stringent negative and positive screen. To find out more and to request an MPS brochure, please click here.

Disclaimer: For Investment Professionals Only. The information contained in this document is for general information purposes only and should not be considered a personal recommendation or specific investment advice. Nothing in this document constitutes an offer to buy or sell securities of any type or should be construed as an offer or the solicitation of an offer to purchase or subscribe or sell any investment or to engage in any other transaction.