By Brooks Macdonald

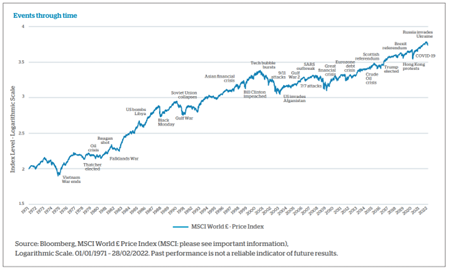

Several major global events – including most recently the coronavirus pandemic and the Russia/Ukraine situation – have prompted investors to flee financial markets, but history shows this could have been a mistake. In this article, we discuss the importance of remaining invested and how missing the best performing days could have led to a portfolio’s significant underperformance over the long-term.

What potentially seems a distant memory, the stay at home orders and dystopian feel to everyday life sent shockwaves through financials markets at the start of 2020, as a result of COVID-19. More recently, Russia’s invasion of Ukraine has rocked markets. In such conditions, it may be tempting to consider exiting the financial markets or switching to cash, with the intention of reducing further expected losses.

Trying to time the market can seriously damage your investment returns

Amidst heightened volatility, it is understandable that many are concerned about the impact on the value of their investments. But, while sharp declines in markets can naturally be disconcerting, if you want to give your investments the best chance of earning a long-term return, then it’s a good idea to practice the art of patience.

When markets fall and fear dominates, it can be difficult to resist the temptation to sell out of the financial markets and switch to cash, with the idea of reinvesting in the future when feeling more positive about market prospects – trying to ‘time the market’. But this is a strategy that carries with it the risk of missing out on some of the best days of market performance. And this could have a devastating impact on long-term returns.

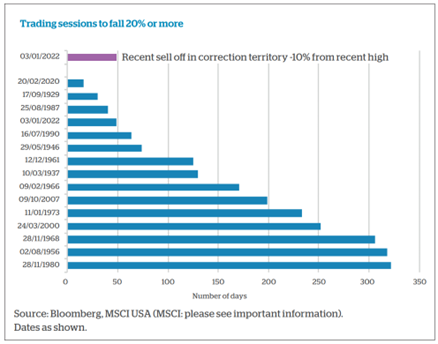

Remaining invested may be an emotional rollercoaster during times of market stress, but research shows time and again that this is the best investment approach over the long term. For example, one study of US equity mutual fund investors showed that their tendency to try and time the market was a key driver of their underperformance (Dalbar, 2019)1. In the current environment, it is understandable that many people are concerned about geopolitical risks, and how this is being reflected in the value of their investments. To give some context, the speed at which the market entered into ‘bear’ territory (typically a 20% decline) in response to the coronavirus pandemic was the fastest in history. The current sell off does not qualify as a bear market but has dropped 10% since recent highs as shown in the chart below.

1 Dalbar (2019). ‘Quantitative Analysis of Investor Behaviour

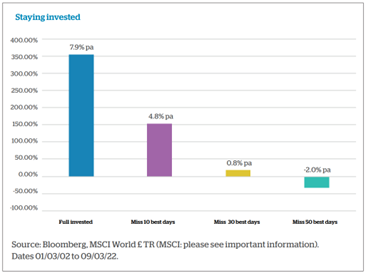

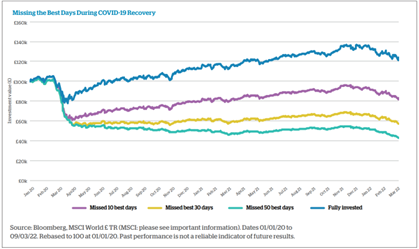

Despite temptations to switch into cash, data shows that missing out on just the 10 best market performing days can have a big impact on long-term returns.

Staying ‘fully invested’ during the ups and downs has resulted in an initial £100,000 portfolio, for example, having an ending value of £445,000, compared to £250,000 for those that missed the 10 best days in previous 20 years. This effect also highlights the powerful effect of ‘compounding returns’ over time. If, for example, the 50 best days are missed, the long-term returns are indeed negative.

A different way of delivering the same message, where staying invested over the 20-year period generates annualised returns of 7.9%, compared to 0.8% annualised returns if one misses the 30 best days:

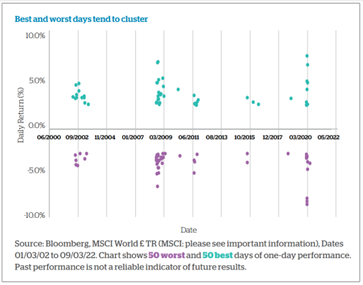

One of the most common reasons investors lose money is when they try to time the market, trying to avoid the worst days of the stock market by cashing out and then re-investing when they think the market is going to pick up. However, as the chart shows, the best and worst days of the stock market cluster. Try to miss the lows and you’ll probably miss the highs too.

Missing the best days during the downturn and subsequent upturn can again have a large impact on the returns generated over the subsequent period.

With the benefit of hindsight, we are now fully aware of the global impact of COVID-19, and the rapidity in which it has hit equity markets. While markets rivalled the speed of the virus in trying to price-in the near-term damage, we expected they could also be swift to act when a tipping-point was seen to be close- at-hand. World equity markets returned to highs around 120 days following 2020 lows.

By keeping to an established and proven investment framework, we can look to take advantage of short-term volatility as we continue to seek out longer-term investment opportunities. We look to avoid behavioural biases that may result in decisions that negatively impact long-term return potential. Yes, the journey may not be smooth, but generally it is important to look through the noise, and remain invested during times of market stress.

Important information

Investors should be aware that the price of investments and the income from them can go down as well as up and that neither is guaranteed. Past performance is not a reliable indicator of future results. Investors may not get back the amount invested. Changes in rates of exchange may have an adverse effect on the value, price or income of an investment. Investors should be aware of the additional risks associated with funds investing in emerging or developing markets. The information in this document does not constitute advice or a recommendation and you should not make any investment decisions on the basis of it. This document is for the information of the recipient only and should not be reproduced, copied or made available to others. The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

Brooks Macdonald is a trading name of Brooks Macdonald Group plc used by various companies in the Brooks Macdonald group of companies. Brooks Macdonald Group plc is registered in England No 4402058. Registered office: 21 Lombard Street, London, EC3V 9AH. Brooks Macdonald Asset Management Limited is regulated by the Financial Conduct Authority. Registered in England No 3417519. Registered office: 21 Lombard Street, London, EC3V 9AH.

More information about the Brooks Macdonald Group can be found at: www.brooksmacdonald.com