By Jim Leaviss, Fund Manager at M&G Investments

After a tumultuous year for fixed income markets, fund manager Jim Leaviss presents his outlook for 2022. Jim considers the outlook for inflation and what this means for central bank policy and financial markets. He also looks at some of the more recent macro developments, such as the emergence of the Omicron variant, a hawkish pivot from the Federal Reserve and a rate hike from the Bank of England.

The value and income from a fund’s assets will go down as well as up. This will cause the value of your investment to fall as well as rise and you may get back less than you originally invested. Where any performance is mentioned, please note that past performance is not a guide to future performance.

Inflation – The dominant theme in 2021

If I had been asked at the beginning of the year where yields would be if US inflation were to hit 6.8% ‒ the highest since 1982 ‒ I wouldn’t have believed that 10-year Treasuries would be yielding just 1.4%. In the UK, the Retail Prices Index (RPI) reached 7.1%, yet 10-year gilt yields remain stuck at around 0.8%. Real yields are therefore in deeply negative territory.

It’s a similar story in the US Treasury Inflation Protected Securities (TIPS) market, with inflation breakevens having seen only modest rises this year. While 5-year US breakevens did climb to around 3.2% earlier in the year on the back of rising oil prices, they have since eased back to around 2.7%, which compares with around 2% at the start of the year.

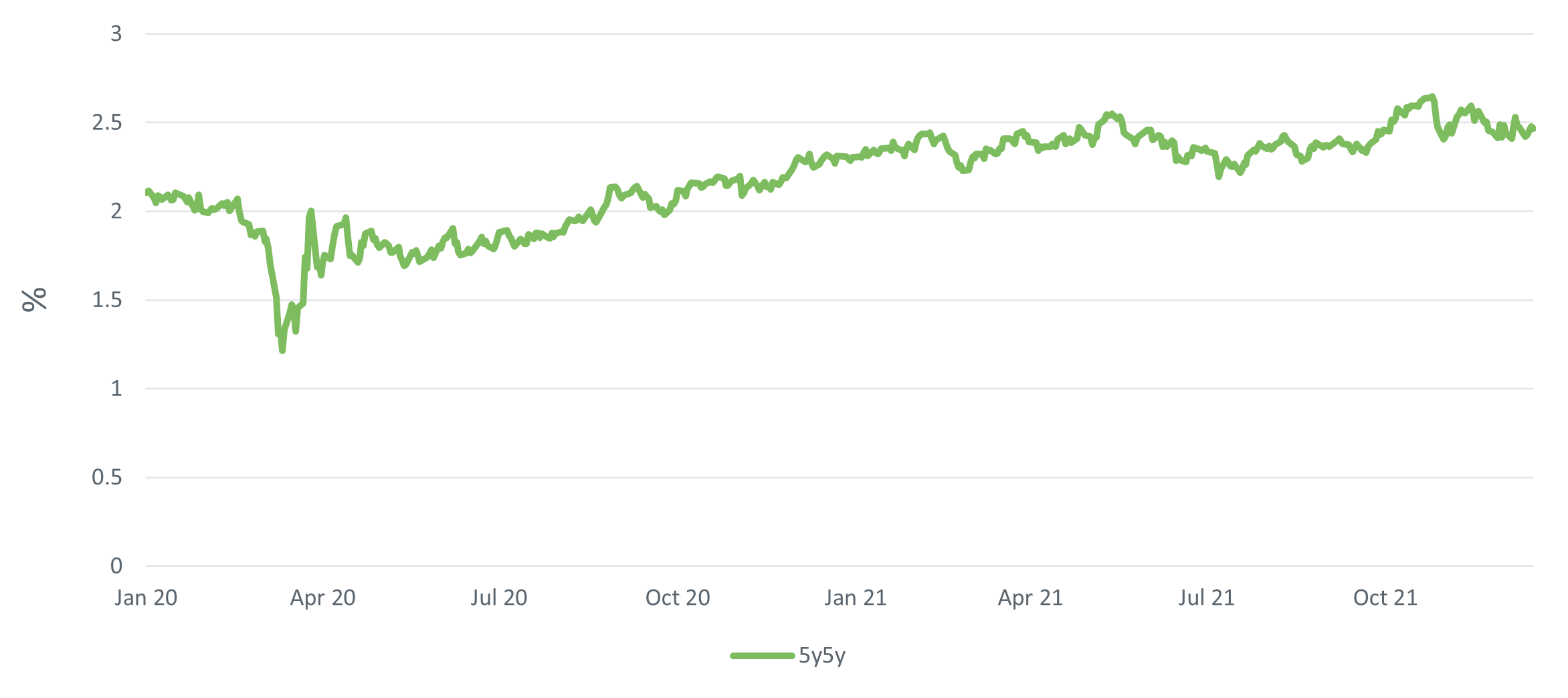

Looking at the 5y5y breakeven rates (which shows us what inflation breakevens are expected to be 5 years from now, thus removing all of the COVID noise), we can see these are only modestly higher over the year, from 2% in January to around 2.5% now (see Figure 1). All of this clearly suggests that the market thinks inflation will be transitory.

Figure 1. 5y5y inflation swap: market’s expectation of 5-year inflation, in 5 years

US 5y5y inflation swap

Source: Bloomberg, 18 December 2021.

Past performance is not a guide to future performance

To a certain extent, this downward trajectory in inflation is baked in, with inflation likely to moderate from its current high levels. For instance, unless we see another doubling in oil prices, base effects will start to fall out of the equation over the next few months. Meanwhile, new manufacturing capacity coming on line should help reduce product costs – after all, semiconductors cannot be stuck on ships forever – and this will help bring down the prices of things such as new cars.

Wages are a key driver of inflation over the longer term, but, so far, we see little evidence of a 1970s-style wage price spiral. While increases in the US minimum wage could have some impact, union representation remains very low, and the rise of the gig economy is likely to continue to suppress wages.

Inflation is also likely to be an increasingly dominant issue from a political perspective. Indeed, in the 1980s inflation was the number one election issue, and I can see inflation becoming a hot topic once again as we approach the mid-term elections in 2022.

Central bank watch

US Federal Reserve (Fed): the December meeting saw a hawkish pivot from the Fed, with inflation very much the dominant theme. The Fed ‘dot plots’ now indicate three 0.25% rate hikes in 2022, followed by another three in 2023 and another two in 2024. This equates to a 2% tightening over the next three years, which was slightly more than anticipated.

The Fed also increased the tapering of its bond purchases by $30bn, with tapering set to end altogether by March 2022. So far, the bond market reaction has been very muted and certainly nothing to compare with the sell-off we saw during the ‘taper tantrum’ of 2013.

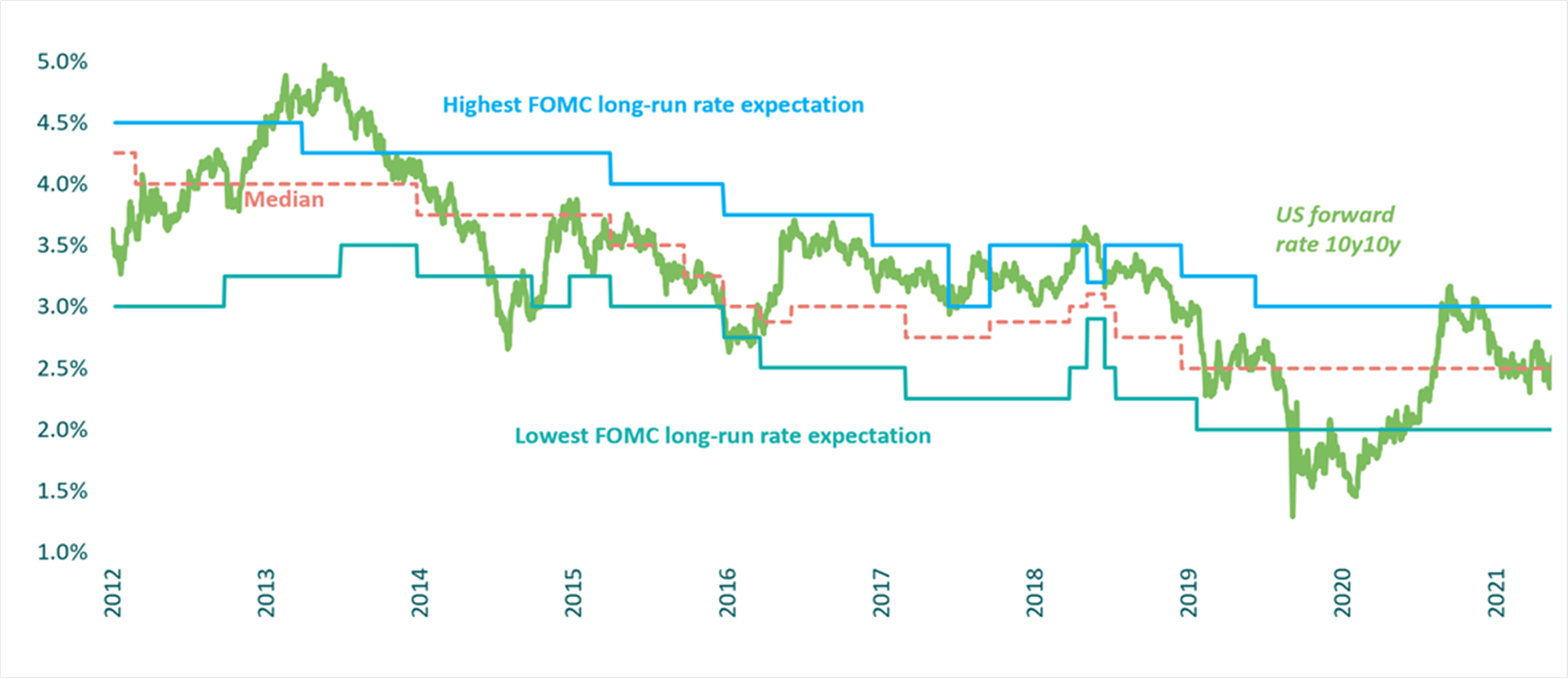

From a valuation perspective, we think US Treasuries currently look about fairly priced, with forward-looking yields now broadly in line with the Fed’s long-term expectations for rates (see Figure 2).

Figure 2. 10-year US Treasuries 10-year forward

Forward-looking yields versus the Fed’s long-term expectations

Source: Bloomberg, Federal Reserve, 17 December 2021.

Past performance is not a guide to future performance

European Central Bank (ECB): we also see a slightly more hawkish response at the latest meeting, with the ECB announcing a cut in its bond buying under its Pandemic Emergency Purchase Programme (PEPP). That said, the ECB has left itself some flexibility to adjust this programme if the outlook deteriorates. It is worth noting that the inflationary backdrop in the eurozone is very different from the US and the UK, with the region seeing much lower levels of inflation so far.

Bank of England (BoE): the bank recently hiked rates to 0.25% in response to the recent high CPI reading. However, this seems to overlook the fact that the UK is in the process of closing down its economy, while recent GDP figures suggested the UK economy was already slowing. Some commentators have suggested a possible policy error here, and it is unclear why the BoE has not waited until the impact of the Omicron variant was a bit clearer before making this decision.

Omicron – Economic impact could be underestimated

The emergence of the new Omicron variant of COVID-19 sent jitters through financial markets in the final weeks of 2021, leading to a sell-off in parts of the credit market. The new strain appears highly virulent, with hospitalisations almost certain to increase due to the sheer number of new cases. However, compared to this time last year there are grounds for some optimism given the high level of vaccinations and new treatments.

That said, we could be at risk of underestimating the economic damage the new variant will cause, especially in light of recent soft economic data in the UK. GDP is still well below its pre-COVID trend, and this could be exacerbated by wages failing to keep pace with inflation.

It is a similar story in the US, where we have seen a recent downturn in consumer confidence and weak retail sales. These are traditionally reliable lead indicators, and we shouldn’t completely dismiss the risk of a recession in 2022. A flattening yield curve is another bearish signal which needs to be considered.

What happens after a rate hike cycle begins?

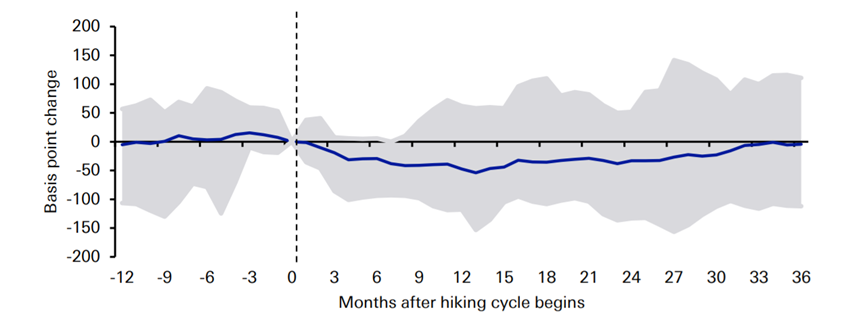

Research from Deutsche Bank takes a look at what has previously happened in the years following the start of a new rate hiking cycle. The research suggests that it generally takes three years after the first hike for a recession to hit. In the meantime, government bond yields tend to rise on average by 111 bps in the first year following a hike, before falling back over the following two years (see Figure 3).

Figure 3. The year after the Fed hikes

Average BBB credit spreads performance in Fed tightening cycles since 1955 by month

Source: Deutsche Bank Research (Jim Reid et al.), GFC, Haver Analytics – “When the Fed hikes”, December 2021. Grey shaded area represents range of outcomes in hiking cycles analysed.

Past performance is not a guide to future performance

Meanwhile, equities rally by an average 7.7% in the 250 days after the first hike, before giving back these gains over the rest of the year. Credit usually follows the path of equities, with spreads initially tightening, before widening back to their starting point in three years’ time. Of course, it should be highlighted that the starting point for credit is already very tight, so spreads perhaps may not see the initial 49bps tightening they have seen historically.

Can central banks really influence inflation?

There is much debate as to whether rate hikes can really dampen inflationary pressures. Higher rates will clearly have no direct impact on oil prices or supply-chain bottlenecks, the two big drivers of inflation this year. The majority of mortgages are now fixed – both in the US and the UK – so there will be no immediate impact through that mechanism.

Central banks took a lot of the credit for the fall in inflation since the 1980s, but in reality this was largely driven by other factors, such as globalisation and technology. The fact is, it is not clear how far rates really influence inflation, and how much central banks will really be able to do if inflation does get out of control.

Credit – A world of rising stars

We are currently in a world of ‘rising stars’, as opposed to the ‘fallen angels’ backdrop of 2020. We are currently seeing around $20bn a month of companies being upgraded from junk to investment grade, and the Bank of America expects to see a further $70bn worth of upgrades next year.

Another key trend in 2021 has been the return of dispersion. The months following the pandemic saw indiscriminate tightening across credit, but we are now seeing more diffusion between individual credits and sectors. This is especially apparent in the high yield space, where we are seeing the clear emergence of good credits and bad credits.

Looking at fundamentals, leverage has come down a bit in 2021 from last year. However, this is off a very high base, and debt relative to earnings is still twice as high as it was in 2010. Defaults remain very low, with default rates of less than 1% in the high yield space. From a regional perspective, US credit continues to offer a meaningful spread pick-up versus other regions, even after currency hedging costs are factored in.

Environmental, social and governance (ESG) continues to be a growing and important trend in global bond markets. In 2022, we expect to see further significant issuance in the ESG bond space, particularly sustainability-linked bonds and green bonds. While Europe has traditionally led the way in the sustainable investment area, we are also seeing increasing interest in the US.

As we look ahead to the new year, we would also highlight the so-called ‘January effect’. Typically, technical drivers have often led to outperformance for credit at the beginning of the year. This could be due to a variety of factors, such as macro investors being short credit relative to equities, and looking to rebalance their portfolios at the start of the year.

Emerging markets and currencies

It was a challenging year for emerging markets in 2021, dominated by themes such as the Evergrande debt crisis in China, COVID worries amid low vaccination rates, and rising inflation. Turkey was the big story as the lira collapsed by more than 50%.

Many EM local currencies got hammered, including many with reasonably solid fundamentals, such as the Mexican peso, which as an oil producer should have benefited from the recent rise in energy prices. If one is prepared to accept volatility, we do think EM contain many areas that offer attractive positive real yield.

It was also the year of the US dollar which was up against almost everything. This anticipated the likelihood of future Fed rate hikes, although dollar bullishness is starting to appear something of a consensus and the currency does appear expensive on some valuation metrics, such as Real Effective Exchange Rates (REER).

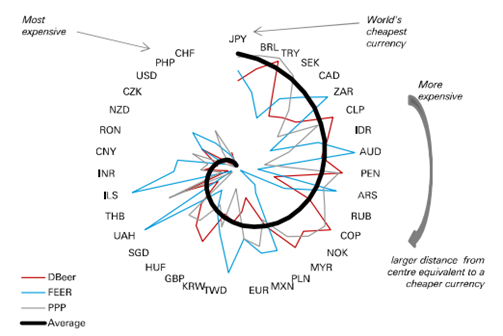

Looking at the OECD’s Purchasing Power Parity (PPP) measure, the euro is around 26% undervalued, while the Japanese yen, sterling and Mexican peso also appear somewhat cheap. As per the norm, the Swiss franc looks expensive, along with the Norwegian krone and Australian dollar (see Figure 4).

Figure 4. Currency valuations globally

Trade based valuations

Source: Bloomberg, 17 December 2021.

Currency valuation models key: DBeer = behavioural equilibrium exchange rate (Deutsche Bank); FEER = fundamental equilibrium exchange rate; PPP = purchase price parity

Another currency that looks strong is the Chinese renminbi. Potential intervention from the People’s Bank of China (PBOC) to weaken the currency could be something to watch out for in 2022.

An extraordinary time for bond investors

We are living through extraordinary times in bond markets. Despite US inflation heading above 6%, 30-year bond yields remain below 2%, while credit spreads remain near all-time tights. At face value, fixed income valuations don’t look very compelling, although we do think that pockets of value can be found.

In terms of fixed income assets that might do well in an inflationary, rising rate environment, we continue to see attractions in inflation-linked bonds, such as US TIPS. Another area which I think could do well is emerging market bonds. In contrast to the negative real yields in traditional developed markets bonds, emerging market bonds can provide positive real yields of around 2-3%. There’s going to be a lot of risk and volatility as always when investing in emerging market bonds, but in terms of valuation that probably looks the best place to be in fixed income at the moment.

2022 is likely to be the year when we find out whether inflation proves to be transitory or looks to become more permanent, and this is likely to be a key driver for fixed income markets. It will also be fascinating to see whether the high valuations across risk assets – such as equities and high yield bonds – can be sustained as the huge levels of monetary stimulus start to be reined in.

M&G

December 2021

The views expressed in this document should not be taken as a recommendation, advice or forecast. The views expressed in this document should not be taken as a recommendation, advice or forecast.

For Investment Professionals, Institutional Investors and Professional Investors only. Not for onward distribution. No other persons should rely on any information contained within. This information is not an offer or solicitation of an offer for the purchase of shares in any of M&G’s funds. Distribution of this document in or from Switzerland is not permissible with the exception of the distribution to Qualified Investors according to the Swiss Collective Investment Schemes Act, the Swiss Collective Investment Schemes Ordinance and the respective Circular issued by the Swiss supervisory authority (“Qualified Investors”). Supplied for the use by the initial recipient (provided it is a Qualified Investor) only. In Hong Kong, this financial promotion is issued by M&G Investments (Hong Kong) Limited, Office: Unit 1002, LHT Tower, 31 Queen’s Road Central, Hong Kong; in Singapore, by M&G Investments (Singapore) Pte. Ltd. (Co. Reg. No. 201131425R), regulated by the Monetary Authority of Singapore; in Switzerland, by M&G International Investments Switzerland AG, Talstrasse 66, 8001 Zurich, authorised and regulated by the Swiss Federal Financial Market Supervisory Authority; elsewhere by M&G International Investments S.A. Registered Office: 16, boulevard Royal, L 2449, Luxembourg. For Hong Kong only: If you have any questions about this financial promotion, please contact M&G Investments (Hong Kong) Limited. For Singapore only: All forms of investments carry risks. Such investments may not be suitable for everyone. The information contained herein is provided for information purposes only and does not constitute an offer of, or solicitation for, a purchase or sale of any investment product or class of investment products, and should not be relied upon as financial advice. The Portuguese Securities Market Commission (Comissão do Mercado de Valores Mobiliários, the “CMVM”) has received a passporting notification under Directive 2009/65/EC of the European Parliament and of the Council and the Commission Regulation (EU) 584/2010 enabling the fund to be distributed to the public in Portugal. M&G International Investments S.A. is duly passported into Portugal to provide certain investment services in such jurisdiction on a cross-border basis and is registered for such purposes with the CMVM and is therefore authorised to conduct the marketing (comercialização) of funds in Portugal. For Taiwan only: The information contained herein has not been reviewed or approved by the competent authorities and is not subject to any filing or reporting requirement. The information offered herein is only permitted to be provided to customers of an offshore banking unit of a bank (“OBU”)/offshore securities unit of a securities firm (“OSU”) which customers reside outside the R.O.C. Customers of an OBU/OSU are not eligible to use the financial consumer dispute resolution mechanism under the Financial Consumer Protection Law. Products offered by M&G International Investments S.A. may be made available for purchase by Taiwan OBUs/OSUs acting on behalf of non-Taiwan customers of such units but may not otherwise be offered or sold in Taiwan.

656603_PE_SG_HK_TWN