The rapid changes in environment over the past year, and what this means for sources of long-term portfolio growth in a post-COVID-19 era, have put the importance of an active approach to portfolio management firmly back at the front of investors’ considerations, write Brooks Macdonald.

When managing a portfolio, having the flexibility to actively adjust the mix of investments held can be beneficial, both in terms of reacting to a changing environment and allocating to potential sources of long-term growth.

Considering the implications of COVID-19 on portfolios, we might first think about volatile markets in general. We saw dramatic moves downwards earlier in the year as lockdowns came into effect and investors feared an unknown outcome, followed by sharp moves upwards on the back of continued economic support from policymakers, lifting of lockdown restrictions and positive news regarding vaccines.

The year to date gains in global equity markets, as shown in the graph below, disguise significant volatility during the year.

Taking an active role in portfolio management allows us to take advantage of the investment opportunities that this post-COVID-19 world presents and manage any risks as they arise. In this challenging environment, having the flexibility to seek out and allocate to sources of potential growth and income from across a broad investment universe, and the freedom to adjust these allocations as the outlook changes, is a powerful combination.

Ordinarily, we might treat moves such as those observed earlier this year, and their timescales, as influences on our shorter-term, tactical asset allocation changes. But the COVID-19 pandemic has much longer-term implications as we look beyond the immediate recovery. How economies might contend with a muted outlook for growth, interest rates and inflation, the hangover from the debt required to fund the various support packages, as well as Environmental, Social and Governance (ESG) factors, will all play a role in society and investments.

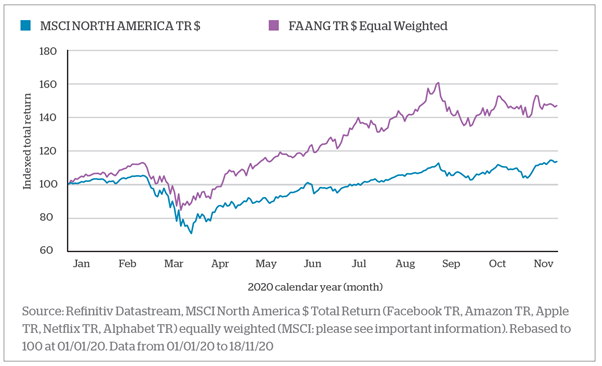

When considering certain equity sectors, technology stocks that provided the key hardware and software that enabled large parts of the labour force to work effectively from home, and those that have supported life at home (such as online retailers and streaming services), have benefitted. The chart below shows that, year to date, the majority of the recovery in the US equity market (MSCI North America) is led by the FAANGs – Facebook, Apple, Amazon, Netflix and Alphabet (formerly Google) – which together account for around 20% of the index.

Post the pandemic, we continue to see long-term growth from technology’s ability to identify, enter and disrupt new markets, creating new revenue streams and barriers to entry for new players. The popular focus is on the FAANG stocks but, in reality, the technology sector is much broader than this. An active approach ensures that risk management with regards to the narrow leadership of the recovery can be managed effectively, given the ability to reduce allocations to specific holdings or market sectors when risks get too large, and seek out less well-known companies who are still attractively valued.

COVID-19 quickened the transition to online shopping, increased the ability and acceptance of flexible working practices and other factors which have now become entrenched in society. It also accelerated the trend for a more sustainable approach to investing. Companies with good governance, promoting improvements to society and controlling their impact on the environment, have displayed defensive qualities during downturns as well as delivering strong investment returns.

With increased publicity, investor flows and government stimulus linked to environmental projects, we see continued growth in ESG prominence. Allocations to investments directly related to ESG issues, and alternative assets such as renewable infrastructure and energy, provide opportunities for portfolios to benefit from gaining exposure to this long-term, structural theme. An active role in portfolio management is key, given the diverse nature of some of these issues, themes and topics.

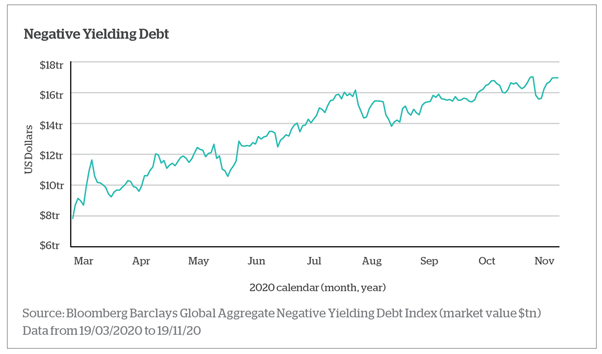

Attractive traditional income options remain scarce in a low growth and low interest rate environment, enforced by the US Federal Reserve (Fed) guiding to low rates through to at least 2023, and pressure from medium-term inflation expectations remaining absent. Staggeringly, over $17trn of global investment grade debt now yields below 0%.

Going forward, actively managing fixed income allocations in portfolios and seeking out opportunities from this universe will be crucial. For example, as policy makers, including the Fed, take bold steps to support their corporate credit markets, the risk-reward opportunity in this sector has become more constructive within investment grade debt. It is also important to bear in mind that many companies have raised large amounts of cash in order to shore up their balance sheets, supportive for those who are holding their debt securities.

‘Alternative’ assets also help fill the income void, while generally showing low correlation to other assets. Options such as music royalty, convertible bonds, infrastructure and property have become increasingly important for income focussed investors. We remain cognisant of the issues commercial real estate may face in the post-COVID-19 environment, but remain optimistic that many areas of the market will take advantage of the opportunities available within healthcare, for example, and large warehouse space as consumer demand continues to shift online. Again, actively managing portfolios to take advantage of these opportunities is beneficial, and these allocations can complement the traditional bond-equity partnership by offering additional levels of diversification, income and growth.

At Brooks Macdonald, we have actively managed client portfolios for almost 30 years and offer a range of investment solutions that can help you achieve your financial goals.

In these challenging times, the ability to plan and implement an active approach to portfolio management is vitally important. We work in partnership with you, leveraging the breadth of our global investment expertise to position portfolios for the post-COVID-19 world – taking advantage of the opportunities and managing the risks to help deliver long-term investment goals.

Please get in touch – with your Brooks Macdonald representative or send us an email at info@brooksmacdonald.com – to find out how we can help guide your investment journey. We would be delighted to hear from you!

Important Information

Investors should be aware that the price of investments and the income from them can go down as well as up and that neither is guaranteed. Past performance is not a reliable indicator of future results. Investors may not get back the amount invested. Changes in rates of exchange may have an adverse effect on the value, price or income of an investment. Investors should be aware of the additional risks associated with funds investing in emerging or developing markets.

The information in this document does not constitute advice or a recommendation and you should not make any investment decisions on the basis of it. This document is for the information of the recipient only and should not be reproduced, copied or made available to others.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com).

Brooks Macdonald is a trading name of Brooks Macdonald Group plc used by various companies in the Brooks Macdonald group of companies. Brooks Macdonald Group plc is registered in England No 4402058. Registered office: 21 Lombard Street London EC3V 9AH. Brooks Macdonald Asset Management Limited is authorised and regulated by the Financial Conduct Authority. Registered in England No 3417519. Registered office: 21 Lombard Street London EC3V 9AH.

Brooks Macdonald Asset Management (International) Limited is licensed and regulated by the Guernsey Financial Services Commission. Its Jersey Branch is licensed and regulated by the Jersey Financial Services Commission.

Brooks Macdonald Asset Management (International) Limited is an authorised Financial Services Provider, regulated by the South African Financial Sector Conduct Authority. Registered in Guernsey No 47575. Registered office: First Floor, Royal Chambers, St. Julian’s Avenue, St. Peter Port, Guernsey GY1 2HH.