By Mark Harris, Head of DFM Solutions, EPIC Investment Partners

Worrying dynamics in the UK pension market have combined with a dearth of products to properly help clients in the decumulation phase.

Pensions are a long-term game but there’s a growing concern about the increasing number of people about to hang up their proverbial savings boots. There are worries about people entering retirement at both ends of the savings spectrum. The UK suffers from a worryingly low average pension pot, meaning many savers will have to make what they’ve squirreled away go further, while those with a larger bank of savings might still be exposing themselves to investments that are too risky for their stage in life.

To compound these issues, there appears to be a dearth of investment products specifically formulated for the decumulation phase, whereby investors begin to use their hard-earned savings to fund their retirement. An ageing population means larger numbers of people are entering retirement every year, making these issues increasingly urgent.

Precious savings

Everyone who saves into a pension works hard to do so, but it’s inescapable that the size of the average UK pension pot raises questions about the quality of life retirees can expect.

According to data from the Financial Conduct Authority, the average UK pension pot sits at around £62,000. This is not an insignificant sum of money, however, with life expectancy rising, it’s not inconceivable that a saver’s pension pot could have to last them 20 years.

That £62,000 only equates to £3,100 per year over that two-decade timeframe. Of course, the state pension (currently £9,339 per year) would bolster this, but probably not enough to provide a comfortable lifestyle.

Research from the Pensions and Lifetime Savings Association has estimated that to live a moderate lifestyle in retirement, a single person in the UK would need an average retirement income of £20,200 by today’s standards. That jumps to £33,000 per annum if you’re looking for an especially comfortable retirement. This gap between the average pot and what is deemed a ‘moderate lifestyle’ is something that an investment strategy needs to address.

Questionable quality

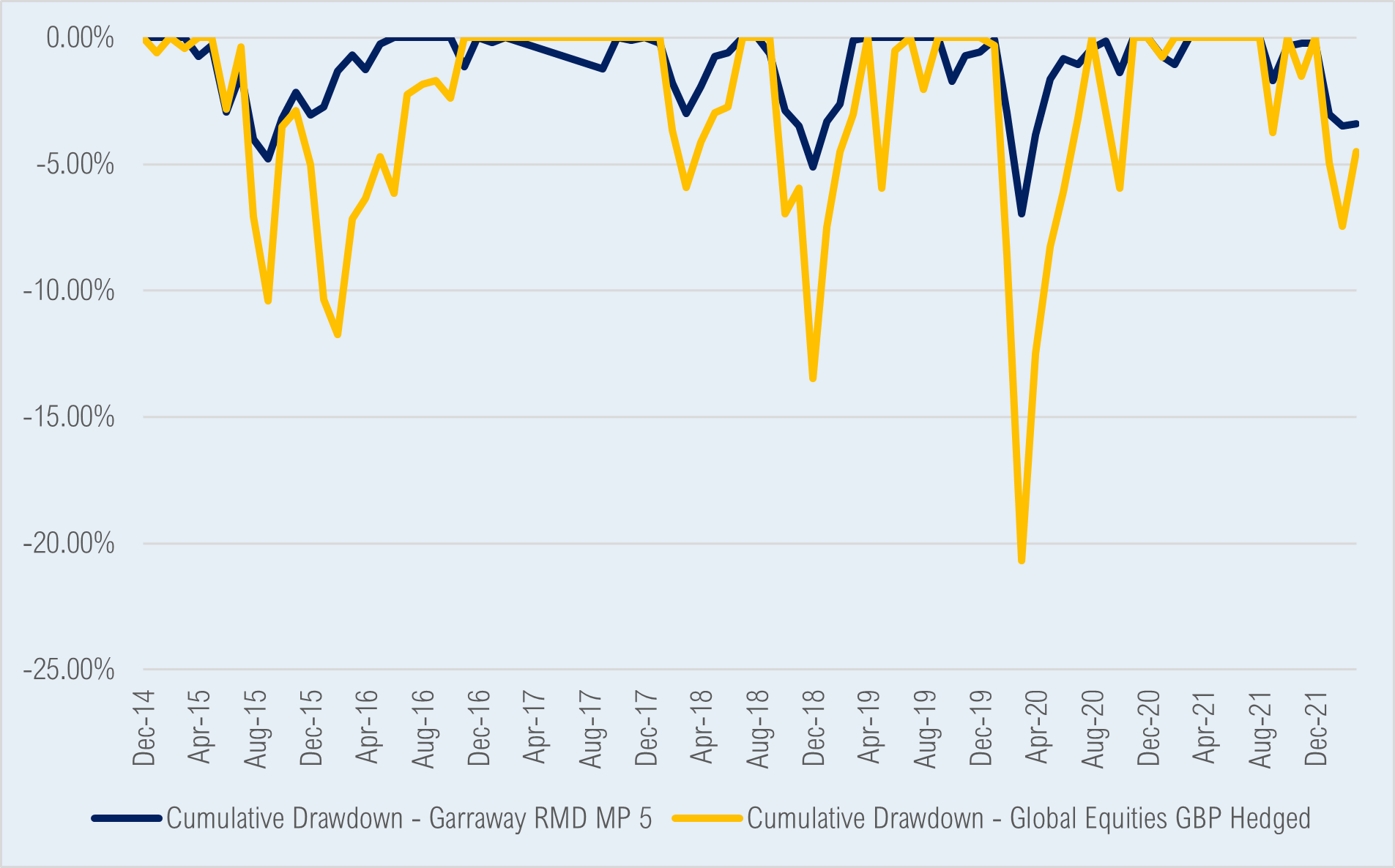

Retirees drawing on their savings don’t have as long as those who are years away from retirement to recoup losses if markets fall, meaning capital preservation is paramount. The chart below shows cumulative drawdown over the last 6 years with four drops below 10% since 2015. If you’re in your retirement, protecting against such periods, whilst drawing consistent income (i.e. without the ability to take riskier equity calls) is crucial.

Cumulative market drawdown – December 2014 – March 2022

Given the average size of pension pots reacting swiftly to protect capital against such periods is paramount

Unfortunately, the quality of many decumulation funds poses a worry, and there are legitimate concerns that if markets come under real stress that these products may not perform as they should.

Looking at the FTSE 100, equities have been a one-way trade since the market bottomed in March 2009, experiencing no real sustained period of stress. Even the Covid-19 drop appears to have been a short blip judging by the rebound in markets, while the bull market in bonds has been even more elongated.

It’s common for risk tolerance to be dialed down as a saver nears retirement, but there’s a potential that funds claiming they are decumulation products still carry too much risk, because returns from equities and bonds have been so easily achieved in the past decade that these asset classes are not treated with the caution they should be.

This is not just a finger-pointing exercise. We’ve putting our money where our mouth is after conducting extensive analysis to understand the specific risk-management needs of the decumulation fund market.

What it told us was that decumulation products should be built to be lowly correlated with traditional asset classes and to tilt more defensively if and when risk indicators are triggered.

Given the UK’s over-75 population is expected to pass six million for the first time this year, and grow by 50 per cent by 2040 to reach nine million in total, there’s a growing need for robust decumulation products for those coming to the end of their savings game.