Each week Abhimanyu Chatterjee, Chief Investment Strategist at Dynamic Planner provides a clear and concise overview of how our Benchmark Allocations performed, its key drivers and trends along with notable movements within the portfolio. Designed to support you and keep you informed of how our portfolios have been performing and providing information you can discuss with your clients.

Last week: Week ending 28 November 2025

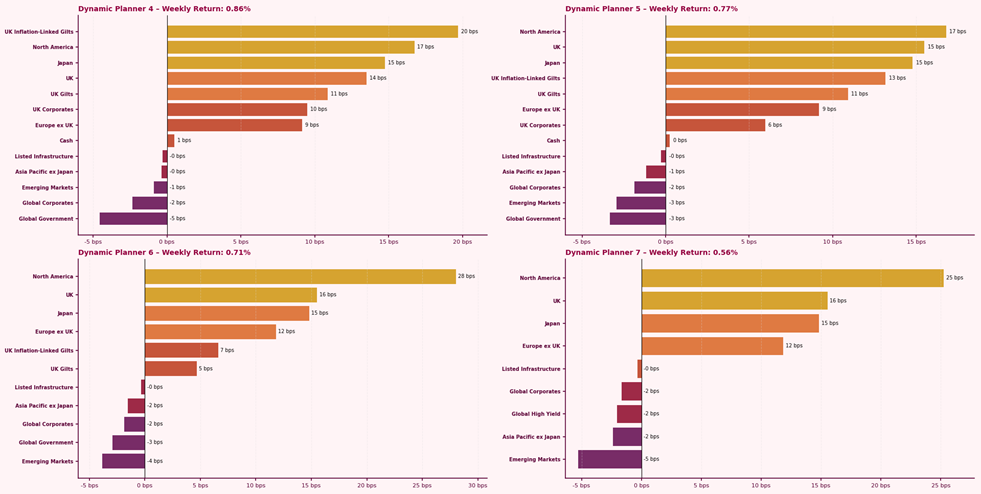

The Dynamic Planner Benchmarks delivered positive returns last week, ranging from 0.56% to 0.86%, as risk sentiment stabilised following the previous week’s sell-off. North American equities led gains as investors unwound some of the prior week’s defensive positioning and shifted back towards risk-taking.

Fixed income produced mixed results: UK Gilts firmed amid activity surrounding the Budget announcement, while UK Inflation-Linked Gilts lagged following sluggish inflation data, reflecting a rotation towards nominal assets.

Overall, the week reflected a measured and sentiment-driven recovery in risk assets, though conditions remain fragile and markets continue to adjust quickly when confidence shifts.

For more content to support your conversation with clients, visit our Content Hub