The FCA wants clear communications, timely support and proof that every client gets fair value. You want what’s best for your client. Tram brings both together. Clients get a calm place to check their plan and message you when it suits them. You get a clean record of what was shared, when it was seen and how reviews were delivered.

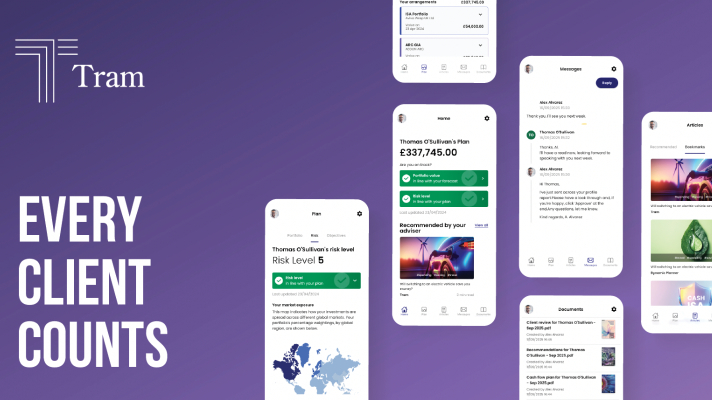

Every client counts

Personal advice at scale

Every client’s plan is a story, not a stack of paperwork. It’s the retirement they’re planning, the holidays they dream of and the family they care for. No one understands that more than you, their adviser.

With the Tram app you give them a place to check in, review their progress against life goals and have more confidence in their financial future. A personal connection wherever they are.

What are advisers and clients saying about Tram?

Request a discovery call

With 26+ integrations, powerful automation and AI, Dynamic Planner is Tram’s driving force, making your streamlined advice process palm sized.

We work hand-in-hand with your team to deliver the most robust and personalised onboarding possible. From day one, you have access to a dedicated specialist who will provide practical advice and insights to help you get the very best from Tram.

There are no long projects or endless workshops. You’ll have agreed goals, clear checklists, and brief sessions. Then, after launch, you’ll receive ongoing support from real people, guides, webinars, and regular product updates as your firm grows.

Enter your details on the form and a member of our team will be in touch.

Tram. One simple app to solve so many problems.

Connect differently

Clients love it

You choose

Advice firms benefit from

Clients love it, so will the FCA

What clients love

- Plain English and clear pictures turn jargon into understanding

- Friendly reminders to approve documents and acknowledge their understanding

- Valuable guidance for specific groups to have more confidence in their financial future

- A visible trail of messages, files and approvals shows ongoing value

- Review bookings and simple prompts help clients who may need extra support check in

What the FCA wants to see

- Clear and understandable information that anyone can understand

- Evidence that clients understand what they receive

- Targeted Support updates reach the right groups with clear signposting back to advice

- Fair value shown and documented with an audit trail for every client.

- Reviews and ongoing service delivered as promised