Each week Abhimanyu Chatterjee, Chief Investment Strategist at Dynamic Planner provides a clear and concise overview of how our Benchmark Allocations performed, its key drivers and trends along with notable movements within the portfolio. Designed to support you and keep you informed of how our portfolios have been performing and providing information you can discuss with your clients.

Last week: Week ending 31 October 2025

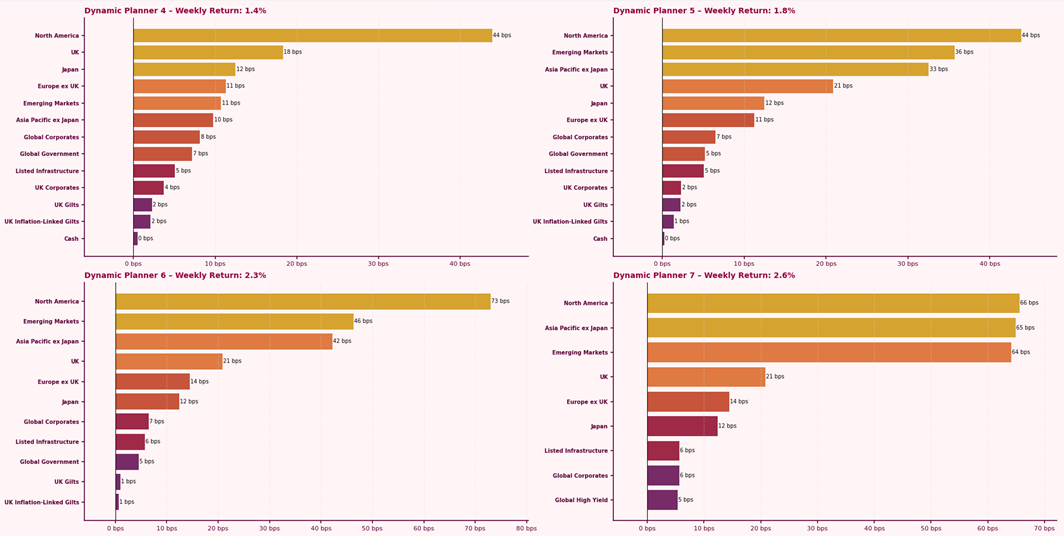

The Dynamic Planner Benchmarks continued last week’s gains, returning between 1.4% and 2.6%. Global equities rallied following the Federal Reserve’s rate cut decision, which reinforced expectations of further easing and reignited risk appetite across markets.

North American equities led performance, supported by the rate cut and optimism surrounding the US-China trade talks. Emerging Market and Asia Pacific ex-Japan equities advanced strongly, benefitting from a softer dollar and increased demand for growth-oriented sectors.

UK and European equities experienced a more modest increase, aided by firmer energy prices and stabilising bond yields, though investors remain cautious ahead of the November Budget announcement. Fixed income recorded small gains, supported by the Fed’s rate cut, which lowered yields and lifted bond prices, though the broader rotation into equities limited the upside.

For more content to support your conversation with clients, visit our Content Hub