Each week Abhimanyu Chatterjee, Chief Investment Strategist at Dynamic Planner provides a clear and concise overview of how our Benchmark Allocations performed, its key drivers and trends along with notable movements within the portfolio. Designed to support you and keep you informed of how our portfolios have been performing and providing information you can discuss with your clients.

Last week: Week ending 30 January 2026

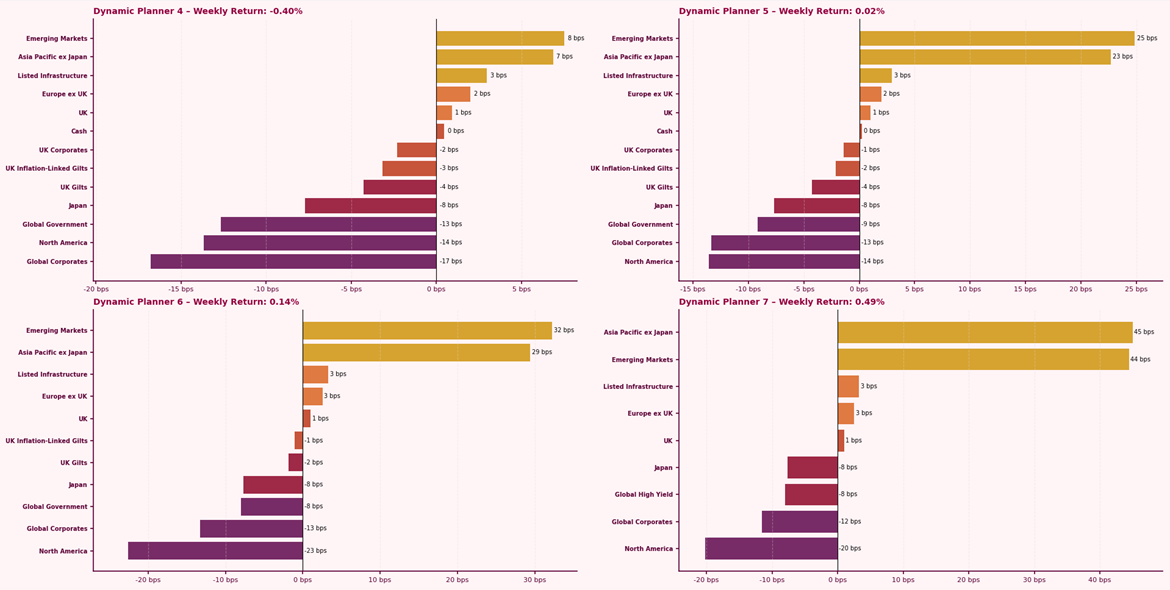

The Dynamic Planner Benchmarks delivered mixed returns last week, ranging from -0.40% to 0.49%, as volatility persisted and markets remained highly sentiment driven. Emerging Market and Asia Pacific ex Japan equities were largely range-bound, reflecting cautious risk taking amid ongoing uncertainty rather than a clear directional shift. A softer US dollar provided some support for equities in these regions, particularly in higher-risk portfolios, but gains remained fragile. By contrast, North American equities continued to detract, as investors grappled with political noise and an uneven macro backdrop. Market moves appeared driven by short-term sentiment and shifting expectations rather than by new fundamental developments, leaving investors navigating a volatile and uncertain environment with limited conviction.

For more content to support your conversation with clients, visit our Content Hub