Each week Abhimanyu Chatterjee, Chief Investment Strategist at Dynamic Planner provides a clear and concise overview of how our Benchmark Allocations performed, its key drivers and trends along with notable movements within the portfolio. Designed to support you and keep you informed of how our portfolios have been performing and providing information you can discuss with your clients.

Last week: Week ending 3 October 2025

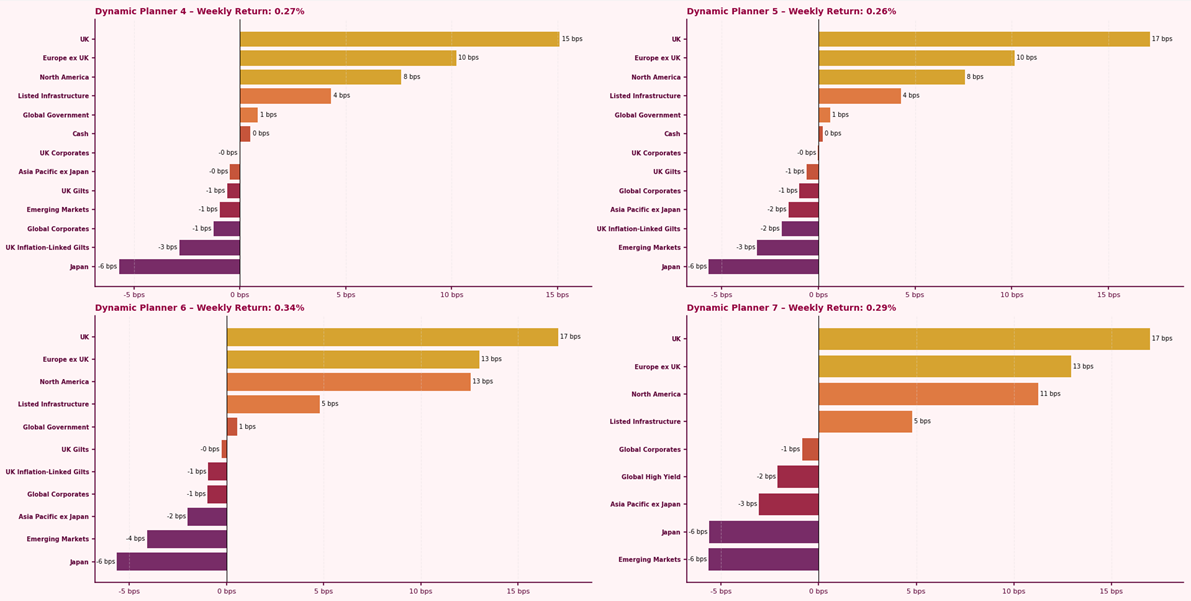

Dynamic Planner Portfolios achieved modest returns last week, ranging from 0.26% to 0.34%. UK equities were the standout contributors, benefitting from relative US dollar weakness, which in turn favoured exporters and bolstered the FTSE 100. This surge, led by Pharmaceuticals, came as a result of tariff headlines which targeted US drug imports, shifting profit expectations outside of the US.

European equities also gained under the softer dollar backdrop, while North American equities contributed modestly but underperformed relative to previous weeks, as political risks rose with the US government shutdown looming. In contrast, Japanese equities detracted, with a firmer yen and higher domestic bond yields weighing on performance.

Global fixed income offered little relief, with Treasuries and gilts under pressure as the risk of an impending US government shutdown pushed yields higher, compounded by weak auction demand and elevated borrowing needs.

For more content to support your conversation with clients, visit our Content Hub