Each week Abhimanyu Chatterjee, Chief Investment Strategist at Dynamic Planner provides a clear and concise overview of how our Benchmark Allocations performed, its key drivers and trends along with notable movements within the portfolio. Designed to support you and keep you informed of how our portfolios have been performing and providing information you can discuss with your clients.

Last week: Week ending 24 October 2025

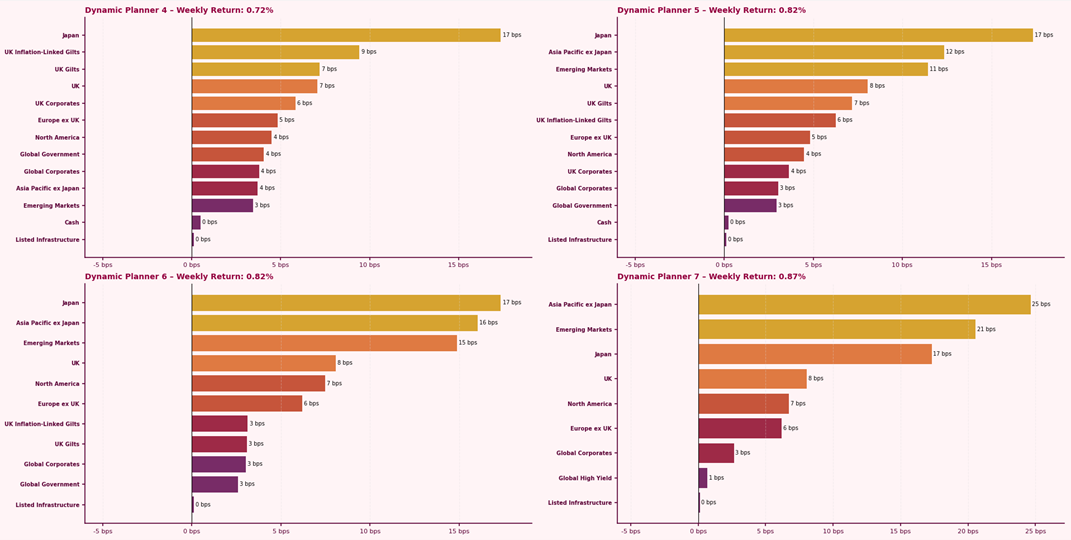

The Dynamic Planner Benchmarks delivered positive returns last week, ranging from 0.7% to 0.9%. Global risk sentiment improved following the previous week’s pullback. Japanese equities led performance, supported by strong corporate earnings, yen weakness, and expectations of further fiscal stimulus, though the Bank of Japan cautioned that parts of the market may be overheating amid heavy inflows.

Asia Pacific ex Japan and Emerging Market equities also advanced, aided by a softer dollar and renewed demand for technology and export-oriented sectors.

UK and European equities gained modestly, helped by stabilising bond yields and firmer energy prices. UK retail sales rose by 0.5%, though speculation of higher taxes in the upcoming November Budget added to caution. In the US, renewed tensions with China over trade and technology policy weighed on sentiment, while government shutdown risks lingered.

For more content to support your conversation with clients, visit our Content Hub