Each week Abhimanyu Chatterjee, Chief Investment Strategist at Dynamic Planner provides a clear and concise overview of how our Benchmark Allocations performed, its key drivers and trends along with notable movements within the portfolio. Designed to support you and keep you informed of how our portfolios have been performing and providing information you can discuss with your clients.

Last week: Week ending 21 November 2025

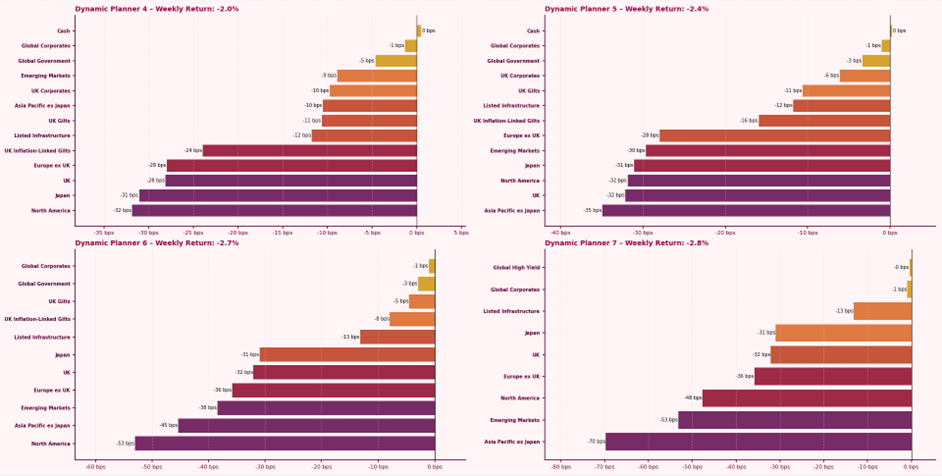

The Dynamic Planner Benchmarks fell sharply last week, with returns ranging from -2% to -2.8%. Risk-off sentiment dominated global markets, while political turmoil pressured government bonds and limited opportunities for investors to seek safety, leaving cash as the only effective diversifier. Equities across North America, Asia Pacific ex Japan and Emerging markets declined heavily, though losses were partly cushioned by strong earnings from Nvidia, stabilising sentiment in parts of the technology sector. Though we should not be reading much into one data point, this week’s performance offers an insight into how allocations may behave if the recent risk-on trend reverses more decisively. Despite the weakness, markets continue to price the potential for further Federal Reserve rate cuts, which could help rebuild confidence if growth conditions soften.

For more content to support your conversation with clients, visit our Content Hub