Each week Abhimanyu Chatterjee, Chief Investment Strategist at Dynamic Planner provides a clear and concise overview of how our Benchmark Allocations performed, its key drivers and trends along with notable movements within the portfolio. Designed to support you and keep you informed of how our portfolios have been performing and providing information you can discuss with your clients.

Last week: Week ending 19 December 2025

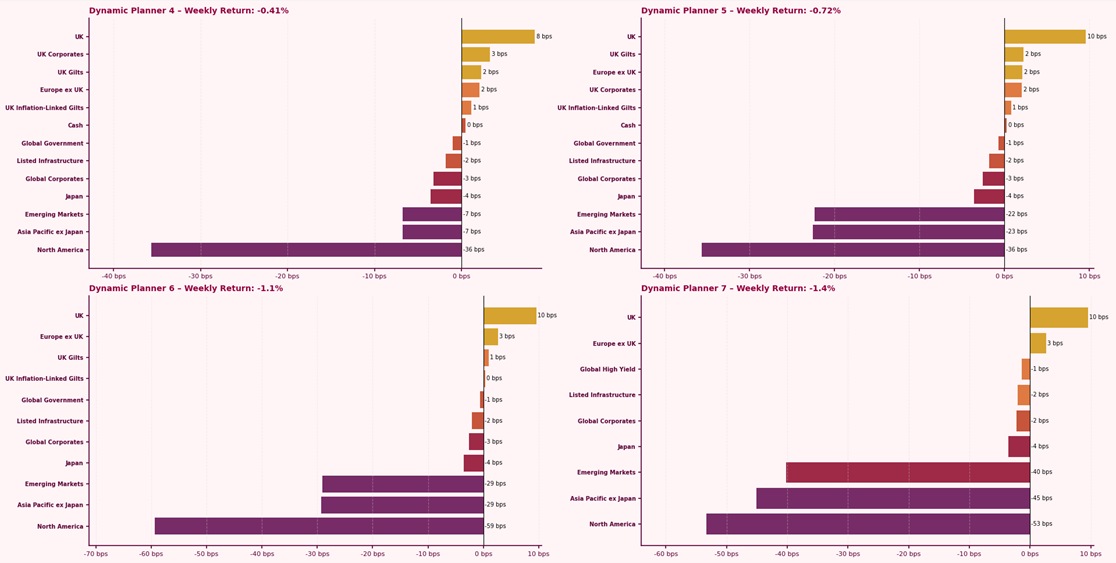

The Dynamic Planner Benchmarks posted negative returns last week, ranging from -0.41% to -1.4%, as risk sentiment deteriorated and markets moved decisively lower.

Losses were driven by a sharp pullback in North American equities, with Asia Pacific ex Japan and Emerging Markets also detracting as investors reduced exposure to higher-beta regions. In the US, softer inflation data alongside weakening labour indicators reinforced expectations that policy rates may be lowered in the new year, though uncertainty around timing kept risk appetite subdued. In the UK, a rate cut alongside weaker labour market data supported expectations of further easing, allowing UK equities and gilts to provide modest positive contributions relative to global peers. However, global fixed income offered limited protection as uncertainty persisted around pace and timing of further easing.

For more content to support your conversation with clients, visit our Content Hub