Each week Abhimanyu Chatterjee, Chief Investment Strategist at Dynamic Planner provides a clear and concise overview of how our Benchmark Allocations performed, its key drivers and trends along with notable movements within the portfolio. Designed to support you and keep you informed of how our portfolios have been performing and providing information you can discuss with your clients.

Last week: Week ending 16 January 2026

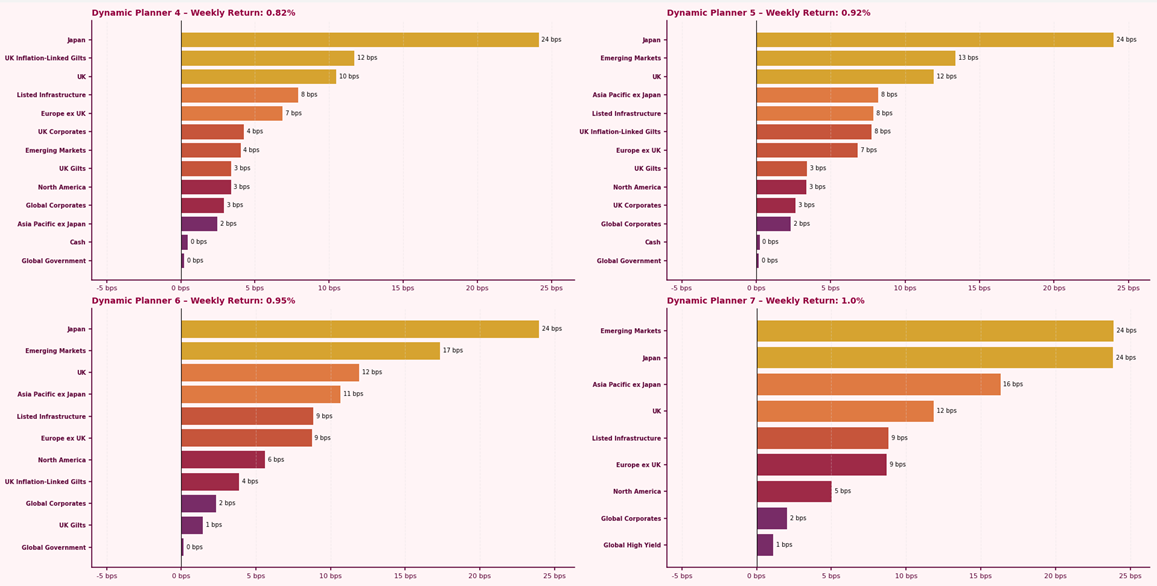

The Dynamic Planner Benchmarks delivered positive returns last week, ranging from 0.82% to 1.0%, supported by a constructive risk backdrop. Japanese equities were a key contributor, buoyed by speculation around a snap election and confidence in the likely incoming leadership, reinforcing expectations of continued fiscal support. Emerging markets and Asia Pacific ex Japan also advanced, helped by falling oil prices as markets adjusted to continued geopolitical tensions linked to Iran and Venezuela, supporting risk appetite across oil-importing regions. By contrast, North American equities posted more muted gains, reflecting ongoing geopolitical uncertainty and heightened political noise in the US, which reinforced market sensitivity to developments surrounding Federal Reserve Chair Jerome Powell and the broader policy outlook.

For more content to support your conversation with clients, visit our Content Hub