Each week Abhimanyu Chatterjee, Chief Investment Strategist at Dynamic Planner provides a clear and concise overview of how our Benchmark Allocations performed, its key drivers and trends along with notable movements within the portfolio. Designed to support you and keep you informed of how our portfolios have been performing and providing information you can discuss with your clients.

Last week: Week ending 14 November 2025

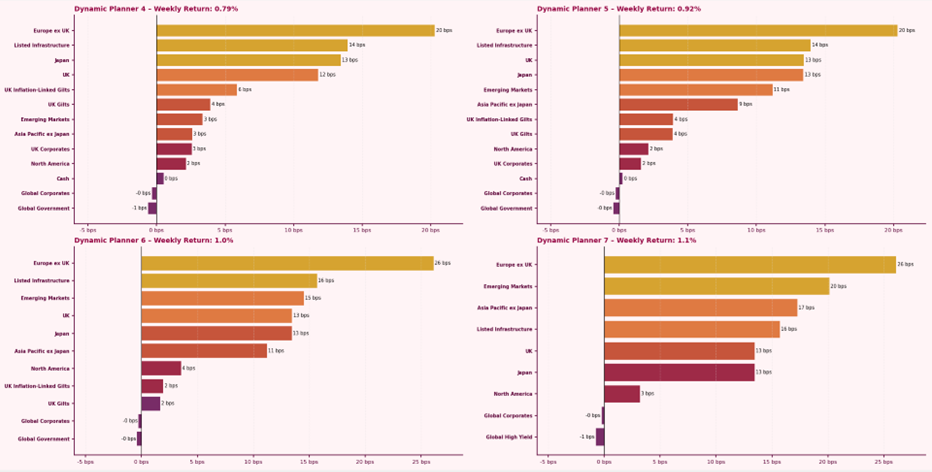

The Dynamic Planner Benchmarks delivered positive returns last week, ranging from 0.79% to 1.1%, with continued recovery following the previous week’s pullback. North American equities lagged on valuation concerns, credit spreads drifted wider, and rate expectations adjusted as fresh economic data returned following the US government reopening. Despite this, global equities held up well, with European, Japanese and Emerging Market equities performing well, supported by a softer dollar and an anticipated shift back towards a broader risk-on sentiment, which should benefit diversified portfolios. Looking forward, attention shifts to the UK budget, where fiscal decisions and gilt-issuance plans may influence domestic markets.

For more content to support your conversation with clients, visit our Content Hub