Each week Abhimanyu Chatterjee, Chief Investment Strategist at Dynamic Planner provides a clear and concise overview of how our Benchmark Allocations performed, its key drivers and trends along with notable movements within the portfolio. Designed to support you and keep you informed of how our portfolios have been performing and providing information you can discuss with your clients.

Last week: Week ending 12 December 2025

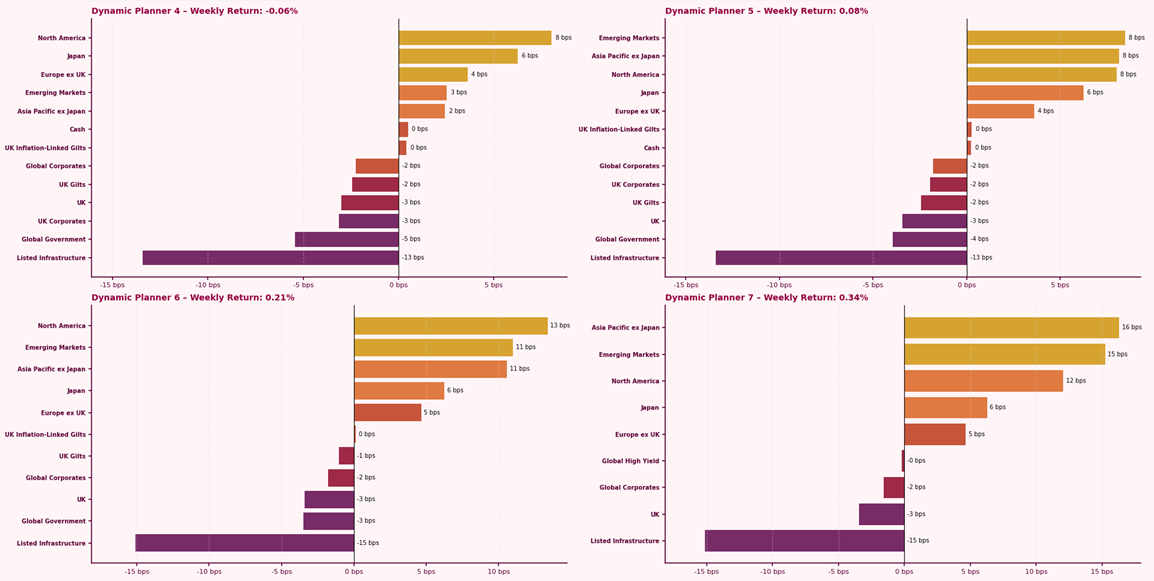

The Dynamic Planner Benchmarks posted mixed returns last week, ranging from -0.06% to 0.34%, as markets lacked clear direction. Investor conviction remained limited amid indecisive Federal Reserve messaging, with the committee appearing split between cutting rates and holding policy steady. This uncertainty kept both equities and fixed income range-bound, as investors balanced the anticipation of further easing against the risk of delayed action.

Asia Pacific ex Japan and Emerging Market equities edged higher, signalling a subtle improvement in risk appetite, while North American equities delivered modest gains.

Listed Infrastructure continued to detract, reflecting ongoing pressure on longer-duration assets within an uncertain rate environment. Overall, the week reflected a pause in momentum, driven by hesitation rather than a decisive shift in sentiment.

For more content to support your conversation with clients, visit our Content Hub