Each week Abhimanyu Chatterjee, Chief Investment Strategist at Dynamic Planner provides a clear and concise overview of how our Benchmark Allocations performed, its key drivers and trends along with notable movements within the portfolio. Designed to support you and keep you informed of how our portfolios have been performing and providing information you can discuss with your clients.

Last week: Week ending 10 October 2025

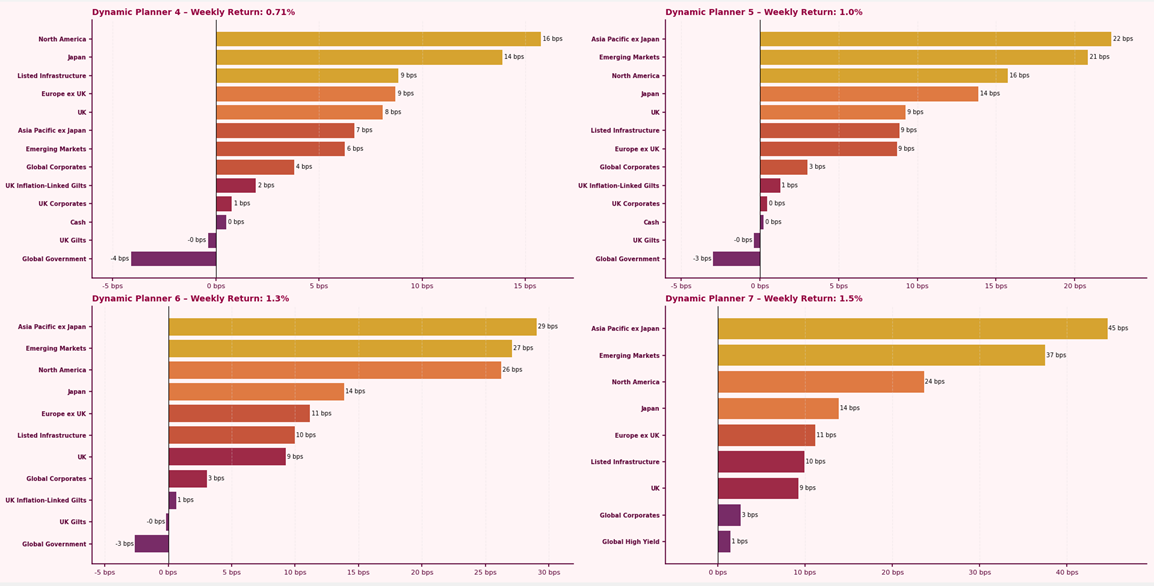

Dynamic Planner Portfolios rose by 0.7% to 1.5% last week, lifted by broad equity strength. Asia Pacific ex-Japan and Emerging Markets led gains, driven by AI and semiconductor demand. Japanese equities rallied on leadership continuity and yen weakness, while UK and European markets benefitted from a softer dollar and strong defensives.

US equities edged higher despite political noise. In contrast, global government bonds extended losses as yields climbed, reflecting hawkish central bank rhetoric and resilient economic data. The sell-off was most pronounced in longer-dated maturities, as investors recalibrated duration risk amid expectations of higher-for-longer interest rates.

For more content to support your conversation with clients, visit our Content Hub