Advice 2025, a new independent survey from Dynamic Planner, the UK’s leading digital advice platform, has found that ahead of the Advice Guidance Boundary final policy proposals, 1 in 2 firms are reviewing their client bases for potential segmentation.

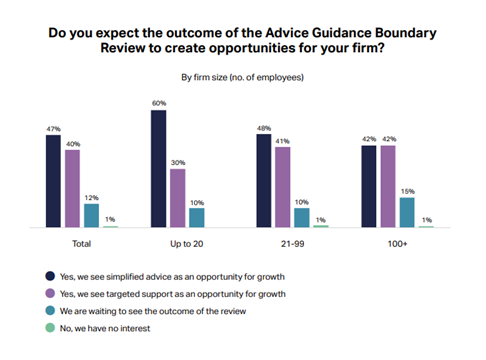

While advice firms have worked hard to embed the requirements of Consumer Duty in their processes, regulatory change is not viewed as uniformly bad news. The Advice Guidance Boundary Review is widely perceived as a source of potential opportunity for the new business avenues it could open. With work on both the simplified advice and targeted support pillars of the review ongoing, firms are split on where the opportunity lies, while less than 1% do not see an opportunity at all.

Smaller firms are particularly interested in the potential to provide simplified advice, while larger firms are split – and the most likely to be taking a wait-and-see approach. Among those who expect either simplified advice or targeted support to drive growth, work is already underway to capture the opportunity.

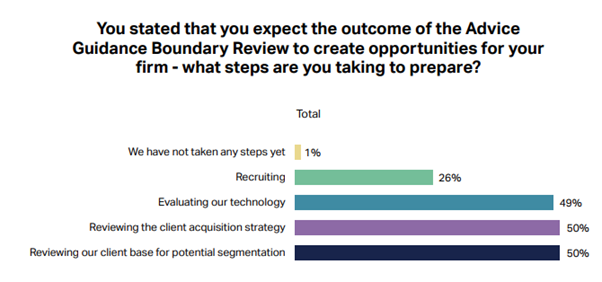

Half of firms in this group are reviewing their client bases for potential segmentation, half are looking at how they acquire clients, and almost half are evaluating their resulting technology needs. More than a quarter are recruiting. Only 1% have done no preparation at all to date.

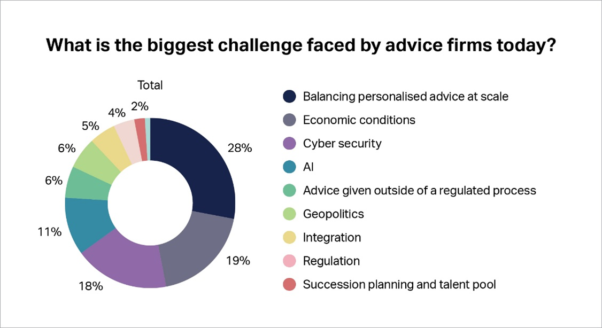

The biggest challenge advice professionals identify is balancing personal advice with scale. Firms recognise that the need for financial advice vastly outstrips supply – and this is not only a social challenge but a business opportunity. However, expanding the delivery of the personal service at the heart of the adviser-client relationship hasn’t proved easy, particularly in a Consumer Duty world. This is particularly the case for small and mid-size firms, who lack the resources and economies of scale of their larger peers.

As respondents acknowledge elsewhere in the survey, both regulatory change, in the form of the Advice Guidance Boundary Review, and technology, including AI, have the potential to move the needle.

Chris Jones, Financial Services Director, Dynamic Planner said: “Change is coming from all directions. From the regulator, advice firms await the final outcomes of the Advice Guidance Boundary Review and potentially a new and broader definition of ongoing advice, among other possible changes. The regulatory regime could also become more streamlined and less risk-averse under the FCA’s new five-year strategy. Encouragingly, findings from Advice 2025 show an advice community that is not only ready but embracing the changes that lie ahead.

“In the months and years to come, firms have an opportunity to play their part in redrawing the industry map. Customer-focused technology will be key to supporting both established models and emerging digital-first services for lower-value clients. Evolutions to the charging model could include subscription approaches or the ability to pause the ongoing service. Targeted support may enable more people to access help with their finances earlier, meaning clients come to full advice more informed and in a stronger financial position.”

To find out more, download the full report here.