Each week Abhimanyu Chatterjee, Chief Investment Strategist at Dynamic Planner provides a clear and concise overview of how our Benchmark Allocations performed, its key drivers and trends along with notable movements within the portfolio. Designed to support you and keep you informed of how our portfolios have been performing and providing information you can discuss with your clients.

Last week: Week ending 13 February 2026

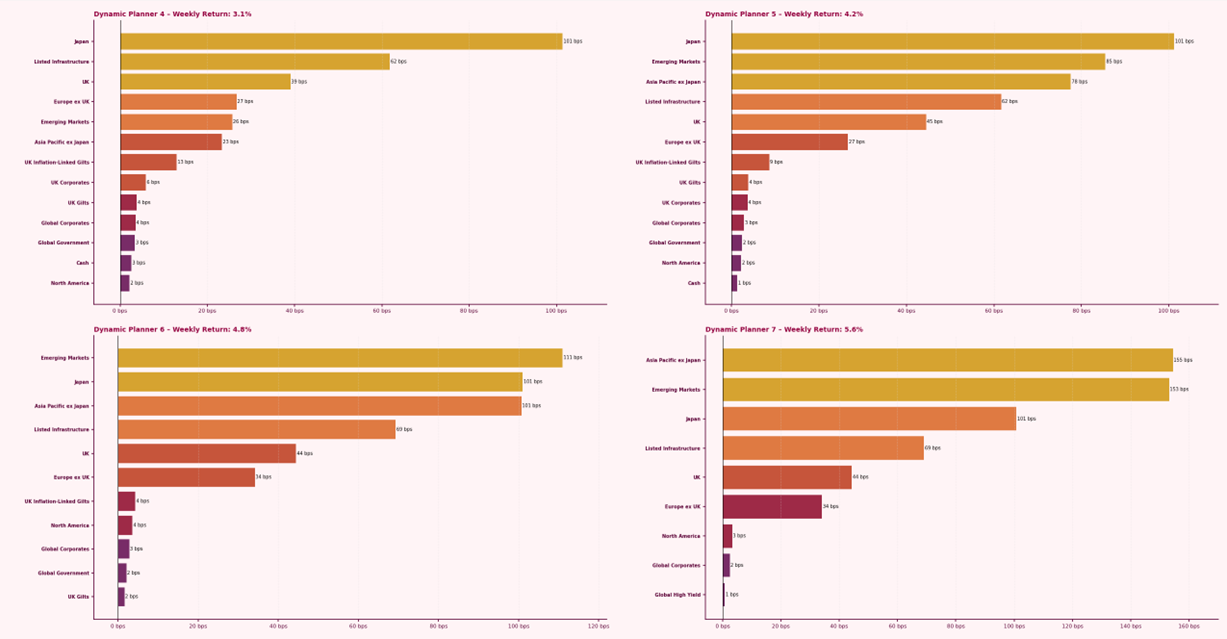

TThe Dynamic Planner Benchmarks delivered strong returns last week, ranging from 3.1% to 5.6%, driven by renewed appetite for risk assets. A softer US dollar, amid ongoing political and trade-related noise, provided a significant tailwind for Emerging Market and Asia Pacific ex Japan equities, which led performance across higher-risk portfolios. Japanese equities were also key contributors following the appointment of new leadership, reinforcing confidence in policy continuity and fiscal support. In the US, weakness in parts of the AI and software sector prompted rotation within equities rather than a broad market sell-off, limiting North American equity contributions relative to other regions.

For more content to support your conversation with clients, visit our Content Hub