Each week Abhimanyu Chatterjee, Chief Investment Strategist at Dynamic Planner provides a clear and concise overview of how our Benchmark Allocations performed, its key drivers and trends along with notable movements within the portfolio. Designed to support you and keep you informed of how our portfolios have been performing and providing information you can discuss with your clients.

Last week: Week ending 5 December 2025

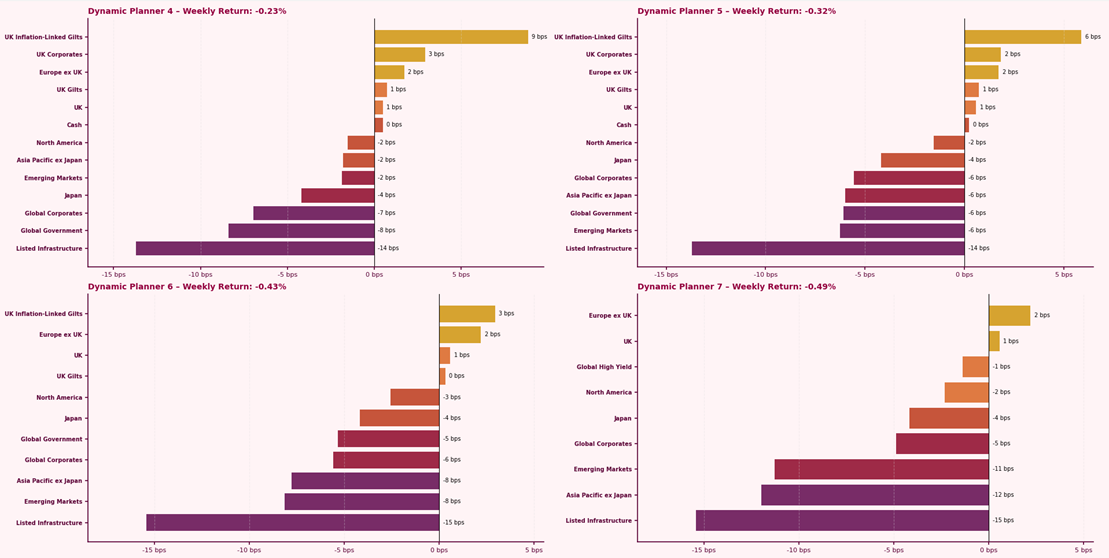

The Dynamic Planner Benchmarks recorded modest losses last week, with returns ranging from -0.23% to -0.49%, reflecting another week of weakened sentiment in global markets.

The unexpected 32,000 fall in US private payrolls raised concerns over slowing growth and prompted investors to scale back risk. This led to broad equity declines across North America, Emerging Markets and Asia Pacific ex Japan.

Listed Infrastructure saw the largest detraction, reflecting reduced appetite for longer-duration real assets. UK fixed income diverged, with UK Inflation-Linked Gilts providing one of the few positive contributions, while nominal Gilts remained steady following the budget. Overall, this week highlighted how quickly markets adjust when growth signals soften and risk appetite fades.

For more content to support your conversation with clients, visit our Content Hub