Each week Abhimanyu Chatterjee, Chief Investment Strategist at Dynamic Planner provides a clear and concise overview of how our Benchmark Allocations performed, its key drivers and trends along with notable movements within the portfolio. Designed to support you and keep you informed of how our portfolios have been performing and providing information you can discuss with your clients.

Last week: Week ending 7 November 2025

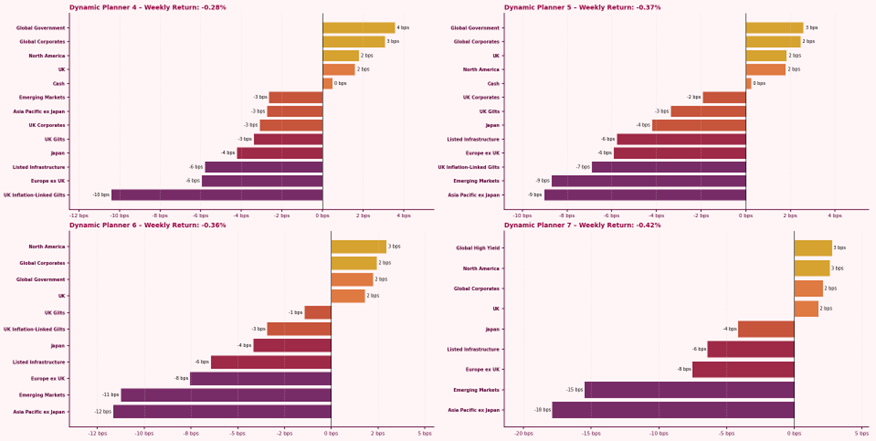

The Dynamic Planner Benchmarks recorded modest declines last week, with returns ranging from -0.28% to -0.42%. Global risk sentiment softened following the Federal Reserve’s hint at potential bond buybacks to address the effects of its recent period of quantitative tightening. Global Government and Corporate bonds posted small gains as yields eased, though broader markets remained cautious.

Equities faced renewed selling pressure amid a shift to safety. Emerging Market and Asia Pacific ex Japan equities were the main detractors from performance, reflecting a rotation away from higher-beta assets, while UK and European equities also edged lower. North American equities proved resilient but still finished down compared to the previous week, as investors pared back exposure following recent gains.

For more content to support your conversation with clients, visit our Content Hub