By Chris Jones, Proposition Director

If I were governing an island nation and wanted to connect to the mainland, I would have a number of choices. Would I go bridge, or would I go tunnel? More importantly, would I pay for it from the public purse, or would I outsource for it to be built privately? I would have a lot to consider.

The costs, the benefits, does my state have the money, could I raise it with taxes, could I borrow it with sovereign debt, do I have the expertise to build it, what toll would people pay and how often? Would I want to carry the iron triangle of scope, cost and time? It’s a lot to take on.

For example, I could look to the Channel Tunnel and to the Queen Elizabeth/ Dartford Bridge. There is a plaque at the bridge that says it: ‘Marks the first time this century that the Government has contracted to the private sector the financing, design, construction and management of a major road’. This Private Finance Initiative concession was enabled by the Dartford-Thurrock Crossing Act 1988 and it was opened on the 30th October 1991. Three years isn’t bad.

When it comes to the Tunnel, Article 1 of the Anglo-French Treaty of Canterbury signed on 12 February 1986 says that: ‘The Channel fixed link shall be financed without recourse to government funds or to government guarantees of a financial or commercial nature’. It opened on 6th May 1994. All which is quiet compelling.

Then I look at the fact that the Dartford Crossing is now raking in £100m annual profit and that in 2019, post-Brexit pre-Covid, the GetLink group (formerly Eurotunnel) had a net profit of 159m euros and my head is turned. Maybe I want that revenue for the state, but would I get it? Would my sovereign debt-funded public sector project have the lean, cold-blooded efficiency of the business world, where the imperatives of the market would, by default, reduce waste and inefficiency?

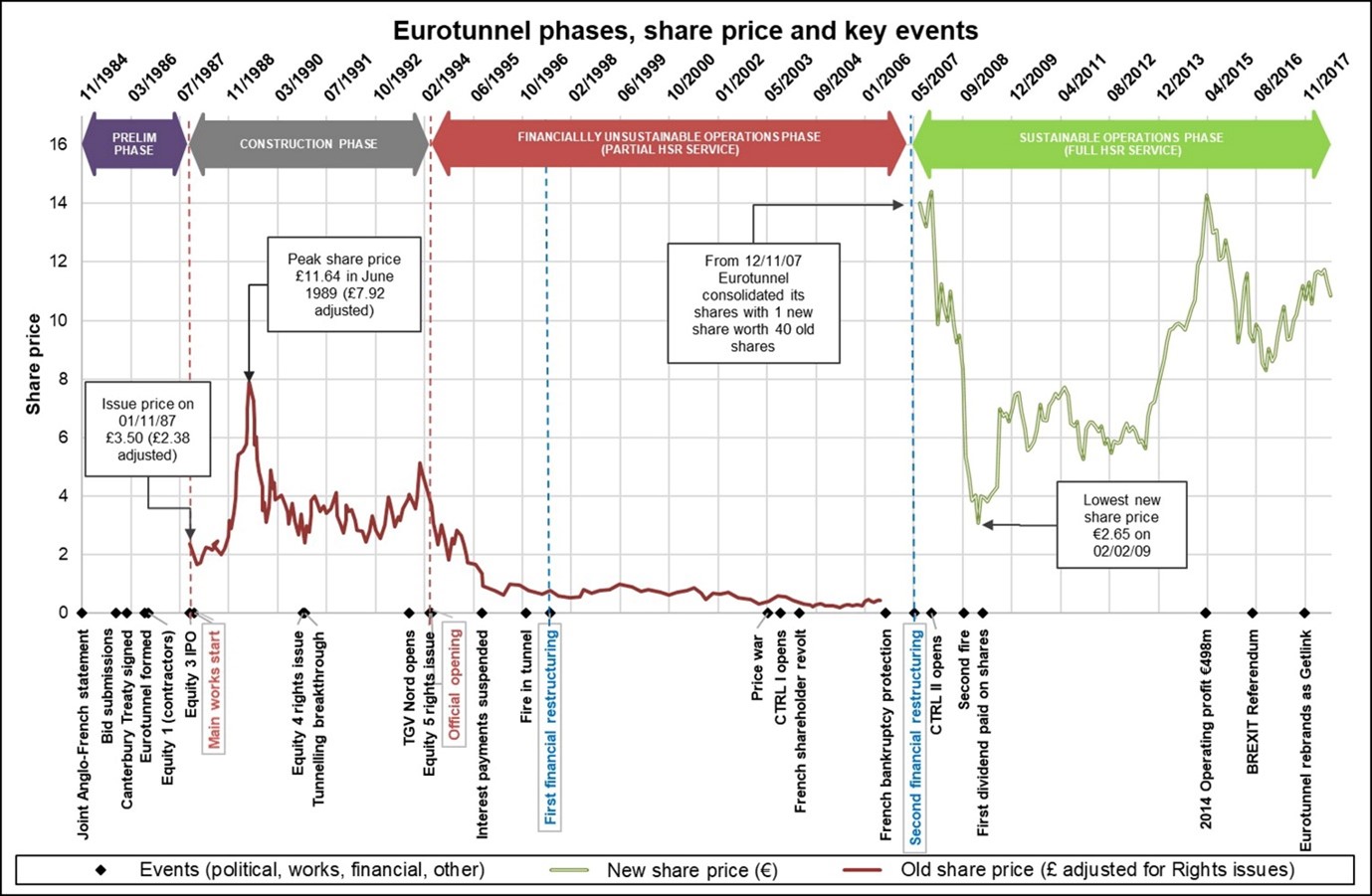

The big problem is what happens between the investment of capital over 30 years ago and these returns. For both projects it was a very bumpy ride, and it was only 10 years ago that meaningful profits began.

Whilst the Tunnel is often portrayed as a financial failure, in fact, finance did its job to raise funds and absorb risks amazingly well. Risks were transferred to private investors and the private investors bore them. If the project had been delivered on time and budget and if demand had materialised as forecast, the banks expected an 18.8 per cent return on investors’ capital. No-one should be surprised if there are risks associated with such returns.

With perfect hindsight on demand risks and cost overruns, a public sector investment subsidy of another 50% of the capital costs would have been required to make the project financially attractive to private investors. Importantly, however, the government didn’t have to make this commitment. Overall, it generated an economic rate of return over the life of the concession estimated between 3 and 6%. Not so bad when you consider how gilt yields have fallen over the same period.

Outsourcing and infrastructure

Overall, you can see why outsourcing these things would be attractive to me as the government of an island nation. Of course, in reality we are unlikely to be on the government’s side of the table and would be looking at this question from the other side, on behalf of investors. The free market must demand a premium for the risk and the long-term nature of investments such as these.

With gilt and other yields low, infrastructure can be tempting for fund managers. However, whilst they serve the government in a similar way, they carry quiet different risk and return characteristics for the investor:

| Infrastructure | Gilt |

| Credit risk | Little credit risk |

| Liquidity risk | liquid |

| Default risk | Little default risk |

| Extra return | Lower return |

| Generally longer term | 5 to 45 years |

| Can be inflation proofed | No inflation proofing |

| Can be variable income stream | Fixed income |

Analysing Risk

Beyond these generic differences, at Dynamic Planner we analyse the risk of infrastructure investments within the funds that we profile on an individual basis in whatever format they take: equity, debt, physical property, structured product etc.

We therefore consider it more like an instrument to be considered for its own idiosyncratic risk characteristics rather than an asset class, with an index that captures its systematic risk characteristics. As you can see from the bridge and tunnel examples above, one infrastructure initiative is quite different from another, and the various investment structures are different again.

In his last budget, Sunak committed to fixing the UK’s infrastructure as part of a levelling-up push, a central tenet of the government’s plans to kickstart the economy after the coronavirus pandemic. The Treasury’s pitchbook for Investing in Infrastructure UK says this generates new investment into priority areas (including energy, transport and water) by matching the UK’s needs to investor interest. The majority of the £383bn national infrastructure pipeline will be funded through private sources. It also sets out its own Risk UK Infrastructure risk and return profiles.

On the other side of the Atlantic in the US (to whom we are connected by cables that were built by a more recent popular infrastructure investment), Biden has announced a $2.25 trillion infrastructure package.

Well before Sunak and Biden’s interventions, there was a lot of capital in infrastructure investment:

- The top 5 infrastructure debt managers: Blackrock, EIG, AMP, AXA and Macquarie, raised $52bn in the last 5 years.

- The top 5 global infrastructure fund managers: Mcquarie; Global Infrastructure Partners, Brookfield, Stonepeak and KKR manage $232.1bn. The top 50 raised $78.5bn last year alone of infrastructure assets (Nov 2020).

Such a large amount of local and global capital investment cannot be ignored.

In Conclusion

Whether or not you invest in infrastructure within your retirement solution, with whom and how, all requires careful consideration and analysis of the risk factors, which you would outsource to a fund manager.

But if I were governing an island looking to build a bridge or a tunnel, I would definitely outsource it to the private sector rather than raise sovereign debt. Whilst I would certainly benefit from their resources, technology and expertise, the simple idea of making the whole thing somebody else’s problem clinches it for me. I suspect that also plays a significant part in real government decisions.

So, if outsourcing to offload the problem onto somebody else is a good idea for Governments, it must be even better for advisers and their clients. It’s not the cold utility of whether you look back at the end of 30 years and quantify the financial benefits; it’s the outsourcing of not only the work and time but the worry that makes it so compelling.

I am very sceptical that a client could self-direct and self-manage and get a better investment outcome than if they paid for advice, but the more important thing is what else they could have been doing with their time and mental capacity. Focusing on work and getting a promotion, studying for an exam, doing overtime, helping their kids study to get a scholarship etc. Outsourcing the work frees up time and it frees up mental capacity.

A number of US studies show that for many people, just the simple act of passing the responsibility and liability to their adviser is worth the advice fee.

According to Dynamic Planner’s own Head of Psychology and Behavioural Insights, Louis Williams:

“People miss out by not shifting this responsibility.

“Many struggle to accumulate their savings for retirement because they lack financial knowledge, resources, and are susceptible to various cognitive and emotional biases. The two most appropriate solutions for this are either significantly improving your financial literacy or increasing your uptake of financial advice.”

With all else being equal, outsourcing is worth it just to make it somebody else’s problem. In most cases you also get time expertise, resources and technology that you don’t have. It’s more efficient, particularly where a task can be done once and its result is used by many.

Advisers thinking about infrastructure within their clients’ solutions are going to need to rely on a multi-asset fund manager to handle all the variables and complexities described above.

Asset managers can rely on Dynamic Planner to consistently assess the risks of infrastructure within their funds.

And advisers can outsource to Dynamic Planner and build our system into their own infrastructure, so that our technology and expertise is yours, freeing up your time and capacity to add value for your clients.

Not yet a Dynamic Planner user? Schedule a free no-obligation demo with a business consultant and experience the full functionality of Dynamic Planner.