By Andrzej Pioch, Lead Fund Manager, L&G Multi-Index Funds

A typical broad global equity benchmark has around two-thirds of its stocks domiciled in the US1. Perhaps unsurprisingly, global equity indices therefore share the majority of their top 10 constituents with US equity indices, and the typical overall portfolio overlap between the two is currently over 60%2.

Comparing the S&P 500 index’s top five holdings in 2009 versus today, they share only one name – Microsoft – and the concentration in top holdings has also increased from 10% to over 26% as at 25 January 2024. This has resulted in recent positive US equity index performance being driven by a relatively small number of stocks, namely the ‘Magnificent 7’ of Apple*, Amazon*, Alphabet*, Meta*, Microsoft*, Nvidia* and Tesla*. We believe this poses concentration risk not only for investors who hold US index exposure, but also for multi-asset strategies that hold global equity indices with common underlying exposure.

What can we do about it?

Some multi-asset strategies that align their equity exposure with global equity indices may increasingly look like a material bet on mega-cap tech companies becoming even larger. So, what can investors do to manage that risk?

They could always move back to active management for their equity exposure, where the manager might lower exposure to the ‘Magnificent 7’ and offer exposure to other themes that they believe could provide more attractive risk-adjusted return potential. However, this may introduce other types of stock-specific risk given the active nature of the approach and may potentially increase costs.

If they would like to preserve the simplicity and transparency of the index approach, they essentially have three options:

- Use regional equity indices to build a more geographically-balanced equity portfolio. This preserves the transparency of the market-cap weighted index approach within individual regions, but lowers reliance on US stocks and in particular US mega-cap tech within the overall portfolio.

- Complement their global market-cap exposure with a single- or multi-factor equity index exposure, which will tilt their exposure towards equity factors that have been shown to reward investors with long-term premia such as value, low volatility, quality, size or momentum.

- Complement their market-cap exposure with equal-weighted investments leveraging emerging areas shaping our future. When identified and designed carefully, thematic portfolios can potentially act as a diversifier, while providing access to important areas such as clean energy, access to clean water and cyber defence.

In our L&G Multi-Index range, we seek the cost-effectiveness, diversification and transparency an index approach can deliver to individual asset classes, and then we combine this with dynamic asset allocation.

With a wide range of L&G index funds at our fingertips, we don’t need to accept global benchmarks’ implicit biases or concentration risks. That’s why we seek to spread our equity risk across a number of regional equity indices and gain exposure to long-term thematics via well-diversified L&G ETFs.

For example, while we are positive on artificial intelligence (AI), we don’t believe the ‘magnificent seven’ are the only companies set to benefit from this theme. We have spread our allocation equally over approximately 60 companies with distinct portions of their businesses and revenues derived from AI, that have the potential to grow in this space.

While certain index benchmarks have become increasingly concentrated, when introducing new risks to index investors we need to be careful not to throw the index baby out with the bathwater.

We think the innovation and ingenuity we have seen in this space makes index investing an exciting area to explore, not just for growth investors but also those looking for potential higher income, or who want to go further when it comes to ESG investing. That’s why they are a core foundation of our entire Multi-Index fund range.

Sources:

1 The MSCI World, for instance, has a 69.7% allocation to US stocks. Source: https://www.msci.com/documents/10199/178e6643-6ae6-47b9-82be-e1fc565ededb

2 Nine of the top 10 portfolio holdings are the same in the S&P 500 and the MSCI World, and the overall portfolio overlap is around 66%. Source: Bloomberg data using ETFs as a proxy of index compositions, as of 02 October 2023

Key risk warnings

The value of investments and the income from them can go down as well as up and you may not get back the amount invested.

Past performance is not a guide to future performance. *The details contained here are for information purposes only and do not constitute investment advice or a recommendation or offer to buy or sell any security. The information above is provided on a general basis and does not take into account any individual investor’s circumstances. Any views expressed are those of LGIM as at the date of publication. Not for distribution to any person resident in any jurisdiction where such distribution would be contrary to local law or regulation. Please refer to the fund offering documents which can be found at https://fundcentres.lgim.com/

This financial promotion is issued by Legal & General Investment Management Ltd. Registered in England and Wales No. 02091894. Registered office: One Coleman Street, London EC2R 5AA. Authorised and regulated by the Financial Conduct Authority. Legal & General (Unit Trust Managers) Limited. Registered in England and Wales No. 01009418. Registered Office: One Coleman Street, London, EC2R 5AA. Authorised and regulated by the Financial Conduct Authority, No. 119273

By TIME Investments

Market landscape

Inflation has been one of the key macroeconomic drivers of investment performance over the last 18 months and this will likely persist into 2024, albeit to a lesser extent. We have however started to see a shift, with annual inflation in the UK and other Western major economies now well below its peak. The debate, therefore, has largely moved to when UK CPI will meet the Bank of England’s (BoE) 2% target. The BoE itself forecasts this to occur in calendar Q2 2025 but the performance of the UK economy could influence this timing heavily according to market forecasters. Capital Economics estimates that UK CPI could be below 2% before the end of 2024 with a large element of this a weakening of economic growth, and potentially a recession early this year.

Inflation will be a key factor in any BoE decision making when it comes to the pathway of interest rates. According to a Reuters poll taken on the 9 November, consensus forecasts estimate that the UK base rate will remain at the current 5.25% level until calendar Q3. From here consensus forecasts the base rate to decline over the final two quarters of 2024 to 4.5% and then to 4.0% by Q2 2025. Central Banks, including in the UK and US have been firm in stating that interest rates will be kept at least at their current levels until inflation is clearly on track to meet central banks targets. However, some influential rate-setters in countries including in the UK have added support to potential rate cuts in 2024 with data looking broadly supportive in late 2023 and early 2024.

The impact on Real Assets

Real assets, particularly those that seek to provide long-term income, have been heavily influenced by changes to monetary policy and this will likely continue in 2024. A large proportion of infrastructure and real estate investment valuations are directly or indirectly influenced by government bonds. This has been a negative influence over the past twelve months but could now start to create more favourable conditions. In the past, we have seen that increased confidence in the downward pathway in interest rates has supported lower long-term UK government bond yields and we saw some early evidence of this in the last two months of 2023. Traditionally, this has been a catalyst for the stabilisation of real asset capital values, before leading to a return to growth. The conditions for 2024 will likely be more supportive than much of 2023 for real assets, including listed infrastructure.

Returns when investing in Infrastructure

Whilst both heavily influenced, listed infrastructure is generally more sensitive to bond yields than listed real estate. Most sectors we target acquire assets with long-term cash flow streams, often with income linked to inflation meaning that the securities act as an indexed-fixed income proxy, in an equity wrapper. A number of the securities we have invested in saw their share prices negatively impacted by rising longer-dated UK government bond yields. Reducing bond yields will likely see many sectors see greater stability in their portfolio values in 2024. Income in the meantime has remained very resilient with many sectors seeing persistent income growth, often translating into growing dividends.

Whilst political risk is elevated in a general election year, UK infrastructure looks well supported by the two main Westminster parties. In October 2023, shadow chancellor, Rachel Reeves, stated that a Labour government would, “get Britain building again,” and plans would “accelerate the building of critical infrastructure for energy, transport and technology.” UK public debt remains highly elevated and though infrastructure has been an easy target for spending cuts such as in the early 2010s, there seems to be a greater understanding of the need for continued, well-targeted infrastructure investment, further creating confidence.

For more information on our offering, including the key risks of the fund, please visit our website (time-investments.com)

TIME Investments is a trading name of Alpha Real Property Investment Advisers LLP which is the Investment Manager of the Fund with delegated authority from Alpha Real Capital LLP, the authorised corporate director of the Fund, both of which are authorised and regulated by the Financial Conduct Authority. Please note investors capital is at risk.

By Sarasin & Partners

Just how does an adviser go about identifying the best MPS providers for their specific needs?

Increasingly onerous regulations are prompting many IFAs to partner with discretionary fund managers (DFMs), and utilise platform-based model portfolio services (MPS). That said, choosing the right DFM partner can be daunting. So how does an adviser go about identifying the best MPS providers for their specific needs?

Focus on performance

It may be tempting to choose a DFM who has achieved short-term outperformance, but performance should be measured with care. For example, it is not unusual to find that last year’s worst-performing fund manager achieves top-quartile performance this year.

Periods of three to five years and longer provide a more informed view. It is also important to consider performance over discrete, one-year time periods to ascertain whether five-year performance is due to outperformance over a very short time period, or achieved gradually. Risk-adjusted performance is also important and a key indicator of whether an investment process will provide smooth or stop-start returns.

Sensible costs and value for money

Fees have long been a central consideration when evaluating any investment product or service. But it’s not just these costs that an adviser must consider – platform charges, wrapper costs and the adviser’s own fees must also be accounted for.

Under MiFID II legislation, DFMs must provide a breakdown of the total cost of their investment services, including transaction costs, so advisers can now scrutinise costs and compare DFMs more easily. Costs should also represent fair value. Under Consumer Duty regulations, DFMs are required to provide value for money analysis of their MPS.

Solvency and robustness

When evaluating the financial strength of a DFM, an independent measure of an investment manager’s financial strength such as an AKG rating can provide a useful third-party view. Recent or planned changes of ownership should also be considered.

Attentive service and clear communication

Good two-way communication is fundamental to forming a close business relationship, developing trust and retaining confidence. DFMs should be in regular communication with their advisers, keeping them abreast of investment views and how portfolios are positioned. They should also inform advisers of upcoming rebalances and say why the changes are being made.

First impressions count. A client’s first encounter with an MPS service is often via client-facing literature. Well-presented and clearly-written client literature – perhaps with the option of dual-branding – can go a long way to enhancing your client’s experience.

Team and culture

Running a successful MPS over a multi-year period requires an experienced and skilled portfolio management team. But experience and skill may count for nothing if the portfolio managers aren’t well supported by administrators, fund researchers, economists, strategists and a dedicated risk office.

The investment process should not rely on any one individual and investment decisions should be scrutinised by peers. Risk controls should ensure portfolios are managed in accordance with the agreed mandate and risk parameters.

Enhancing your MPS selection

Many advisers split larger client accounts between several DFM partners to achieve additional diversification. Blending DFMs that have different approaches and performance outcomes can help provide a smoother return profile across the economic cycle.

Take time to decide

Partnering with discretionary fund managers is an increasingly attractive proposition for many IFAs. But with a vast array of DFMs and investment strategies to choose from, finding the best fit can take time. Being armed with the relevant selection criteria and a checklist of questions are essential first steps in exploring whether to partner with a DFM.

If you would like to discuss any of the issues mentioned in this article, please contact Sarasin and Partners:

T +44 (0)20 7038 7000

E contact@sarasin.co.uk

sarasinandpartners.com

If you are a private investor, you should not act or rely on this document but should contact your professional adviser. The value of your investments and any income derived from them can fall as well as rise and you may not get back the amount originally invested. Past performance is not a guide to future returns and may not be repeated. Sarasin & Partners LLP is a limited liability partnership registered in England and Wales with registered number OC329859 and is authorised and regulated by the Financial Conduct Authority.

© 2023 Sarasin & Partners LLP – all rights reserved.

RSMR has introduced its Passive Plus MPS range to the wider market, using an investment approach that has been successfully applied to individual bespoke portfolios for six years, on both an advisory and discretionary MPS basis.

The Passive Plus portfolios comprise chiefly RSMR-rated passive funds, plus targeted exposure to RSMR-rated active funds, to add diversification and/or dampen down volatility. The range is aimed at advisers and their clients who prefer the simplicity and lower charges of passive funds, but who are concerned about the relative risk of 100% passive exposure, or fear missing out on the opportunities that active funds can access.

The portfolios will be risk profiled by Dynamic Planner on a quarterly basis. Platform availability is via abrdn Elevate, abrdn Wrap, Aviva, Fidelity Adviser Solutions, Nucleus, Quilter and Transact.

Ken Rayner, RSMR CEO, said: “We’re very pleased to introduce our Passive Plus range to the wider market. Since launching RSMR 20 years ago, researching funds for advice businesses has been the bedrock of our business.”

Stewart Smith, Head of Managed Portfolio Services at RSMR, said: “The passive plus strategy has worked really well for advisers and their clients in a variety of markets. For our passive exposure, we select RSMR-rated funds from a range of fund groups such as Fidelity, HSBC, iShares, Legal & General and Vanguard. The exposure to RSMR-rated active funds, sitting alongside the larger exposure to passive funds, is targeted where it can add value.”

By Newton Investment Management

Against a backdrop of volatility and macroeconomic uncertainty, investors might be wary about the future. Here, Newton multi-asset chief investment officer Mitesh Sheth and FutureLegacy portfolio manager Lale Akoner outline what they think makes a robust multi-asset portfolio in the current environment.

We have entered a market regime characterised by deglobalisation, decarbonisation and divergence, which requires an active, dynamic and sustainable approach to portfolio management, according to Newton multi-asset chief investment officer Mitesh Sheth and FutureLegacy portfolio manager Lale Akoner.

“We believe this next decade will be unlike anything we have lived through before,” says Sheth. “We cannot just rely on historical models and data, or experience alone to navigate this volatile regime.”

Sheth thinks volatility in markets has led investors to be nervous about saving for the future.

“People want their investments to keep pace with inflation, they want to remain resilient through this market volatility and leave a legacy, not just for their own kids but for all our futures on this planet,” he adds.

He argues in this environment it is important for investment management to draw heavily on multiple research inputs across asset classes. At Newton these include quantitative, fundamental, and sustainability research and even investigative journalism.

On a thematic level, Newton’s research considers the macro themes of big government, China’s influence, financialisation and the great power competition; and micro themes of the internet of things, smart everything, tectonic shifts, picture of health and natural capital.

Sheth says bringing this all together enables the investment process to be ‘joined up, agile and able to spot opportunities others miss – now and in the future’.

Dynamic and active

Other important factors in the current environment, Sheth adds, include being directly invested and actively managed.

“At a time of great divergence, we believe passive strategies may struggle to deliver positive real returns,” he says.

Akoner concurs that as capital becomes limited, talented active managers have a higher chance of outperforming benchmarks. She notes 2022 was the first year since 2009 that most active asset managers of equity mutual funds were able to outperform the S&P 500 index .

“This is because liquidity is getting scarce and the dispersion between stocks and sectors is increasing, leading to a boarder opportunity set for active managers,” she adds.

Tactical overlay

In terms of portfolio construction, Akoner argues tactical asset allocation, using a derivative overlay, is fundamental to navigating the current market volatility.

“We look at things like liquidity indicators, positioning and flow indicators as well as spreads data to see if there is any froth in the market,” she says. “We can use futures, forwards, and physical securities to navigate the environment tactically.”

In terms of long-term positioning, Akoner says the portfolios are overweight in healthcare and utilities while underweight in consumer discretionary and energy. When it comes to fixed income, portfolios are underweight duration relative to the benchmark.

“We think market is incorrect in pricing quick Fed cuts,” she adds. “We think especially the ample amount of Treasury issuance could contribute to the peak rate environment in the short term. When those rates start to come down, we could go neutral and move long equity futures.”

Sustainability

With decarbonisation also being a key facet of the new market regime, Akoner says it is important for an investment process to support the transition to a low carbon economy. This, she adds, means adopting an investment process that incorporates red lines for excluding certain companies. The FutureLegacy team then look for three buckets of investment opportunities:

- Solution providers – companies solving problems on sustainability through products and solutions. For example, heating, ventilation and air conditioning (HVAC) businesses

- Balanced stakeholders – companies with sustainable internal processes. For example, companies best in class for governance or high standards on human capital management

- Transition – companies at the start of their sustainability journey but showing a credible commitment to a transition business model

Akoner notes sustainable strategies in the wider industry have tended to have a growth bias, because they consist to a large degree of technology companies which can have lower carbon emissions. However, she argues quality is the primary factor the team look for which could then result in a stock being either value or growth.

Please feel free to contact us if you would like more information on the FutureLegacy range.

The value of investments can fall. Investors may not get back the amount invested.

For Professional Clients only. This is a financial promotion.

Any views and opinions are those of the investment manager, unless otherwise noted. This is not investment research or a research recommendation for regulatory purposes.

For further information visit the BNY Mellon Investment Management website: http://www.bnymellonim.com.

Dynamic Planner, the UK’s leading risk based financial planning system, has analysed the data* of almost 17,500 advised investors views on the importance of sustainability.

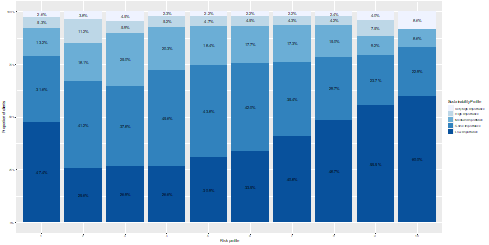

As COP 28 gets underway, Dynamic Planner has found that while investing sustainably remains an important factor, as willingness to take risk increases the importance of sustainability reduces. The analysis showed that of those investors in risk profile 10, Dynamic Planner’s highest risk level, 6 out of 10 viewed sustainability as of low importance **

Chart showing the relationship between an investors risk (1-10) and sustainability (low to very high profiles)

Dynamic Planner also found that a larger proportion of men (39%) than women (26%) view sustainability as something of low importance, while (32%) of women view sustainability as of medium to very high importance compared to men (21%).

The stereotype that younger clients have a greater preference for sustainable investments due to supposedly being more values-driven and having a greater desire to seek investments that align with their views were not borne out in the analysis, with no apparent differences across any of the age groups.

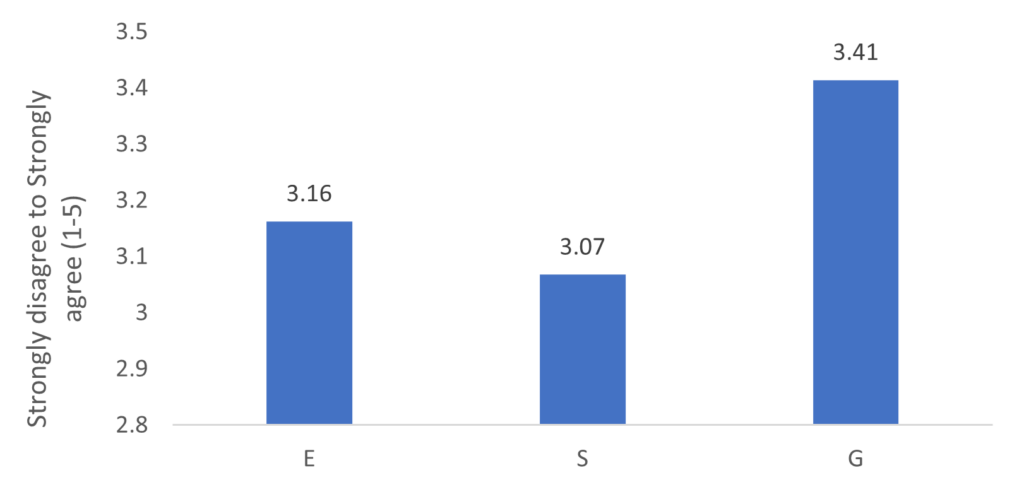

In terms of which aspect of sustainability is held in highest regard, more investors said the ‘G’ of ESG is a priority as it means investments help companies treat all stakeholders fairly. Even a proportion of around 70% of investors who consider sustainability to be of low or some importance, agree with this statement, 17% and 51% respectively. Surprisingly fewer placed as much importance on ‘E’ – that investments help to improve the environment. The ‘S’ – that their investments should help improve people’s living conditions was the lowest priority of the three ESG factors. However, of those who view sustainability as of high and very high importance, a higher percentage strongly agreed that it is priority to help improve the environment, compared to improving living conditions and treating stakeholders fairly.

Chart showing importance placed on ESG statements

Louis Williams, Head of Psychology and Behavioural Insights at Dynamic Planner, said: “Our analysis paints a nuanced picture of attitudes towards investing sustainably and ESG factors. Events like COP28 which bring the world together to focus on issues such as climate action have ensured that many people understand the importance of acting in a sustainable way. However, using the power of their investments to shape the world for the better is perhaps limited for some due to the greater focus on trying to achieve a better return.

“We have found those investors who are more comfortable with increased financial risk are prepared to invest in market opportunities that go beyond the realms of companies that act in a sustainable or ESG risk managed way. This may be because climate change and risks of stranded assets have not yet been properly understood or their appetite for not missing out on certain market sector returns is still the overriding motivation. There also may well be some investors who want their fund managers to engage (by remaining invested) to bring about change.”

* Research has been undertaken using data from Dynamic Planner’s sustainability questionnaire, an industry first when it was launched in 2021 and created by the team behind the UK’s leading risk profiling process. A client’s sustainability preference is profiled on a scale, like their attitude to risk, providing you with a foundation for a conversation and enabling you to match it with solutions with ESG ratings available to research in Dynamic Planner.

Dynamic Planner also offers clients access to independent and whole of market ESG research of more than 32,000 funds. Guard against greenwashing and trust that the research is objective and is rigorously completed by a 200-strong team of analysts at MSCI, a world leader in the field which has been doing it longer than anyone else.

** Risk Profile 10 – Likely to contain very-high-risk investments such as emerging market shares and a small amount in high-risk investments such as shares in UK and overseas developed markets.

By Minerva Fund Management Solutions

For a number of years, financial advisory firms have operated in an environment that is ever changing and bringing increased challenges to their business model. One challenge is managing a range of client portfolios across a range of clients and asset classes.

As a financial advisory firm, it is an expectation that the suite of products offered will be broad, flexible and potentially encompass a range of investment options that meets a varied set of client needs, particularly for firms holding themselves out as independent.

PROD has resulted in financial advisory firms offering their clients solutions based on client lifecycles (the ‘target market’), that can contain a variety of investment solutions including active, passive, blended options, bespoke investment management and the ability to meet a client’s ESG preferences.

Needless to say, Consumer Duty is a piece of FCA regulation that brings another challenge, which requires a financial advisory firm to scrutinise their business and formally document how they meet the four client outcomes, taking into consideration a number of requirements such as client needs and the associated costs aligned to a level of service or tariff that represents fair value.

This has led financial advisory firms to explore opportunities to simplify their processes, and one opportunity that is generating more interest is unitising existing client investment solutions within their Centralised Investment Proposition (CIP).

The rationale for this is due to a variety of reasons, so there is no ‘one size fits all’ approach but to give you an example; under the Consumer Duty, good client outcomes for all clients is one of the core principles, if a financial advisory firm is managing a CIP across multiple platforms and each platform trades with a different modus operandi, then investment outcomes will inevitably be varied across their client base. Firms will need to think through the implications of this under their Consumer Duty procedures.

A unitised fund solution can enable a financial advisory firm and its clients to access the same investment solution and have similar investment outcomes. In addition, there are a number of other factors that could lead a financial advisory firm to consider unitisation as an option for their business. It has the potential to provide:

- Greater transparency in terms of cost, performance, and volatility

- All client portfolios with access to the same investment strategy at the same cost, regardless of their asset value

- More efficient and lower cost portfolio rebalancing

- An additional layer of governance and investment oversight, through the ACD and the fund’s Depositary

- Access to a greater asset universe

- Scalability of client solutions and investment proposition

- Different tax treatment – a fund will be taxed differently from an MPS

In addition to the above, in our view, a unitised fund solution may help a financial advisory firm satisfy two of the four outcomes under Consumer Duty, namely Products and Services and Price and Value. This is because under the Consumer Duty, products that already comply with the Product Governance Rules in PROD and the Collective Investment Scheme Assessment of Value Rules in COLL, can satisfy these two Consumer Duty Outcomes. As a result, the use of FCA regulated unitised funds could achieve these two outcomes.

So, there are a number of fundamentals as to why a financial advisory firm could consider this option to augment their CIP. However, before a financial advisory firm reaches a conclusion that a unitised offering is a good move for their business, there are other factors that need to be considered before they can press the start button.

As a starting point, a financial advisory firm will need to compare a client’s current proposition with the potential unitised investment offering. Prior to undertaking this comparison, there is perhaps a perception that a fund offering may increase the ongoing charges figure (‘OCF’). However, this is not always the case and before making this assumption, it is always worth having an in-depth discussion with potential providers. Of course, one key factor in an overall OCF is fund size, and in our experience, making a unitised solution as part of a CIP viable requires AuM of at least £50m per fund.

Another aspect to consider is client reporting. A client using a Model Portfolio Service for example, can have the added benefit of a client viewing individual holdings in a quarterly valuation and take comfort their portfolio is diversified; compared to a unitised solution with just one or two fund holdings. Having said that, there are technology solutions that are available and will offer a ‘look through’ service.

In essence, there is no overriding rationale as to why a financial advisory firm should, or should not, offer a unitised investment solution to their clients. The most optimal outcome will, of course depend on their business model, client requirements and what is most suitable for their clients.

Find out more. Contact Mark Catmull, Sales and Marketing Director, Minerva Fund Management Solutions.

Dynamic Planner, the UK’s leading risk based financial planning system, is now risk profiling the world’s oldest collective investment fund, F&C Investment Trust. Launched in 1868, F&C Investment Trust Plc is managed by Columbia Threadneedle Investments with Head of Asset Allocation (EMEA), Paul Niven, being the Trust’s Fund Manager. It is a constituent of the FTSE 100 index managing over £5bn in assets1.

Chris Jones, Chief Proposition Officer at Dynamic Planner, said: “We are delighted to welcome F&C Investment Trust to Dynamic Planner. When it comes to investment trusts, F&C is a household name, and having launched in 1868, it is the oldest collective investment.

“In recent years we have seen profound changes, both in the way advice is given and how technology is helping to power advice. If a 157 year old Investment Trust can embrace technology, then so can you. In a client focused world, understanding the client outcome that a solution can deliver is more important than its structure, and appropriately including Investment Trusts enables advisers to maintain a consistency of approach when assessing suitable investment solutions.”

Steve Armitage, Co-Head of UK Wholesale Distribution at Columbia Threadneedle Investments, added: “We are delighted F&C Investment Trust has been added to the suite of investment solutions being risk profiled by Dynamic Planner. Through our longstanding partnership with Dynamic Planner, advisers are now able to select portfolios that are aligned to their clients’ individual risk requirements from across our range of Multi Asset solutions, including our low cost, active CT Universal MAP range, our risk targeted CT MM Lifestyle range and now F&C Investment Trust.”

1 Total assets as at 31.08.2023 of £5.4bn – source: F&C Investment Trust & Global Trusts (fandc.com)

The aftermath of the Covid-19 pandemic and a tightening of global supply chains have unleashed an inflationary wave which looks set to drive greater corporate discipline, boost income stocks and increase the importance of dividends to investor returns, says Newton portfolio manager Jon Bell.

After years of low interest rates and low inflation, the economic tide is turning. Post the Covid-19 pandemic, Newton Investment Management’s Jon Bell says an injection of pent-up savings has introduced a fresh flood of liquidity to the market. This, in turn, has helped fuel a sharp spike in inflation across major markets – just as supply chains contract.

While the initial rise in inflation was at first considered a transient blip by some economists , Bell believes higher inflation levels are now here to stay, with major implications for global investors.

“Post-pandemic, we believe we are now seeing a regime change from a disinflationary world to one which is more inflationary,” he says.

“In recent months markets have seen growing evidence of deglobalisation and increased protectionism which will further support this. In our view, we will have to get used to the fact we are living in a more inflationary world than we were.”

All of this, says Bell, means change for both equity investors and the companies they invest in. In a post-global financial crisis (GFC) environment, where the corporate operating cashflows of some of the largest US technology companies and many others rose significantly, corporate excess and a general lack of focus on shareholder returns became more common. In some extreme cases, this led some companies to focus more on devising workplace gimmicks than delivering shareholder value.

Payback time

For Bell, changing market conditions mean it is now payback time for investors, with some investment managers now looking to subject the companies they invest in to much greater scrutiny, demanding more capital discipline and higher dividend pay outs.

“Although corporate margins have improved over time, many companies have given less back to shareholders in the form of dividends than they did historically. In our view, that needs to change. As we go into a different, more challenging economic environment, corporates need to offer more value to shareholders,” says Bell.

“The days when companies could spend as much as they like on whatever they want are behind us and we expect to see them begin to tighten their belts. The age of extravagance is over.”

Bell believes investment managers can play a key role in shifting corporate thinking, influencing management teams and encouraging them to change behaviours in order to generate greater shareholder value.

He says, “Ideally, we want to see more corporate discipline and the return of a healthier blend of corporate reinvestment and dividend pay-outs to shareholders. In fact, companies have not been doing a very good job of giving cash back to shareholders in recent years and, in many cases, we have actually seen pay-out ratios fall.”

Not all sectors are alike. While some US technology giants have a poor track record of rewarding their shareholders in recent years, some pharmaceutical and utilities companies have been far more responsive, with business models that do more to reward investors.

Against this mixed backdrop, Bell stresses the historic and ongoing importance of dividends in a world where slower economic growth can limit returns. The compounding of dividends from income stocks, can fuel a steady accumulation of income within portfolios. This strength of income stocks, he believes, was often overlooked during a long period of low inflation and heavy central bank intervention in markets, post the GFC.

Exciting investments

“The 2020s started with a record low return from dividends, and an environment of zero interest rates and excess fuelled by quantitative easing. Yet when financial bubbles burst dividends, can become a very important factor in building returns,” Bell says.

“It may be that in 2030 we look back on a decade where dividends have been critical to investor returns. The last time inflation was a major problem, in the 1970s and 1980s, strong returns came from dividends and income stocks do tend to outperform during similar periods.

“In inflationary markets, we continue to believe dividends are key and that the compounding of dividends makes select income stocks some of the most exciting investments in the current market.”

For more information on equity investing at BNY Mellon Investment Management, please visit our dedicated Adviser site.

The value of investments can fall. Investors may not get back the amount invested.

For Professional Clients only. This is a financial promotion. Any views and opinions are those of the interviewee, unless otherwise noted. This is not investment research or a research recommendation for regulatory purposes.

For further information visit the BNY Mellon Investment Management website: http://www.bnymellonim.com

1572505 Exp: 05 April 2024

The Scottish Widows Platform is now live for valuations in Dynamic Planner, the UK’s leading risk based financial planning system.

This new integration with the Scottish Widows Platform enables Dynamic Planner users to onboard and value new clients and existing clients in preparation for their client review or cashflow planning, and benefit from the new integration to seamlessly pull in the data at a time they want.

The integration will run alongside the existing Advance by Embark integration while Scottish Widows completes its migration of Advance clients to the Scottish Widows Platform, later this year.

Financial planning firms can now use Scottish Widows’ technology, powered by FNZ, and backed by Lloyds Banking Group, to access over a hundred fund managers, thousands of mutual funds, UK listed equities and Exchange Traded Assets within Dynamic Planner’s one system.

Chris Jones, Proposition Director at Dynamic Planner said: “The Scottish Widows Platform is now live for valuations in Dynamic Planner, and financial planners can begin to onboard and value clients ahead of Advance by Embark Platform closing. For a limited period of time, both integrations can be used. This is yet another example of our commitment to ensuring our users can support their clients throughout and deliver increasing value more efficiently.”

Ross Easton, Head of Platform Propositions at Embark Group said: “We’re pleased to have seamlessly integrated Dynamic Planner with the Scottish Widows Platform. This delivers against our aim to be the most connected platform in the market, Scottish Widows Platform now has bulk valuation coverage with the significant majority of UK CRMs.”

This latest integration is the continuation of Dynamic Planner’s commitment to solving industry wide inefficiencies, a strategy at the heart of the firm’s vision.

Not a Dynamic Planner user? Schedule a free no-obligation demo with a business consultant and experience the full functionality of Dynamic Planner.